Green

Which Countries Are Most Reliant on Coal?

![]() Subscribe to the Elements free mailing list for more like this

Subscribe to the Elements free mailing list for more like this

Which Countries Are Most Reliant on Coal?

This was originally posted on Elements. Sign up to the free mailing list to get beautiful visualizations on real assets and resource megatrends each week.

Global energy policies and discussions in recent years have been focused on the importance of decarbonizing the energy system in the transition to net zero.

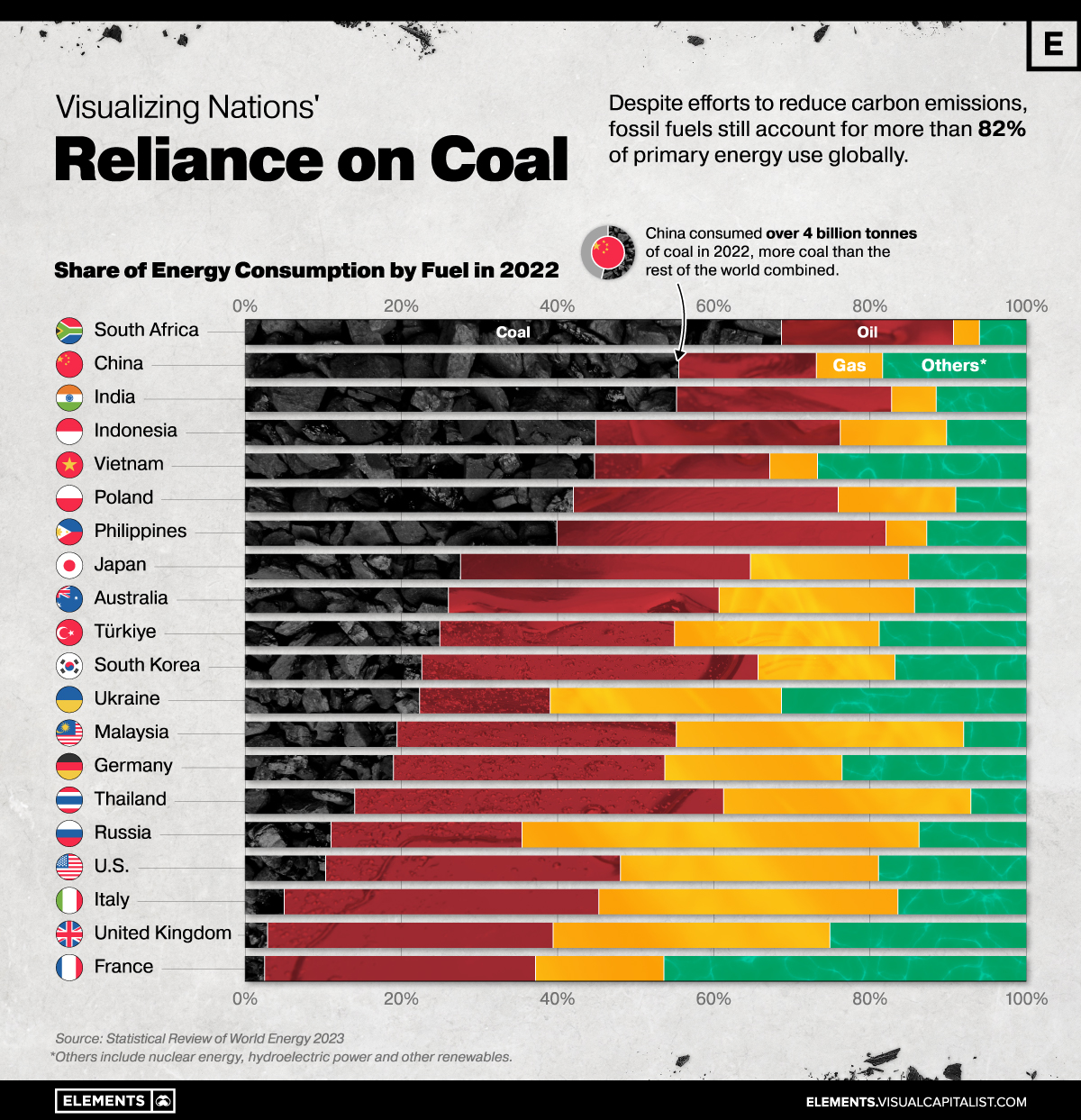

However, despite efforts to reduce carbon emissions, fossil fuels still account for more than 80% of primary energy use globally—and coal, the world’s most affordable energy fuel, is also the largest source of energy-related CO2 emissions.

The graphic above uses data from the Statistical Review of World Energy to show how much select countries rely on fossil fuels, particularly coal.

Coal’s Importance in Emerging Economies

Coal is the largest source of electricity generation and the primary fuel for iron, steel, and cement production, making it central to climate and energy discussions.

The fossil fuel continues to be an affordable and abundant source of energy, particularly in emerging economies where demand is expanding rapidly.

South Africa is the world’s most coal-dependent nation featured in the statistical review, with coal accounting for 69% of its primary energy consumption in 2022.

| Primary energy use, by fuel type (2022) | ||||

|---|---|---|---|---|

| Country | Coal % | Oil % | Gas % | Other % |

| 🇿🇦 South Africa | 69% | 22% | 3% | 6% |

| 🇨🇳 China | 55% | 18% | 8% | 18% |

| 🇮🇳 India | 55% | 27% | 6% | 11% |

| 🇮🇩 Indonesia | 45% | 31% | 14% | 10% |

| 🇻🇳 Vietnam | 45% | 22% | 6% | 27% |

| 🇵🇱 Poland | 42% | 34% | 15% | 9% |

| 🇵🇭 Philippines | 40% | 42% | 5% | 13% |

| 🇯🇵 Japan | 27% | 37% | 20% | 15% |

| 🇦🇺 Australia | 26% | 35% | 25% | 14% |

| 🇹🇷 Türkiye | 25% | 30% | 26% | 19% |

| 🇰🇷 South Korea | 23% | 43% | 17% | 17% |

| 🇺🇦 Ukraine | 22% | 17% | 30% | 31% |

| 🇲🇾 Malaysia | 19% | 36% | 37% | 8% |

| 🇩🇪 Germany | 19% | 35% | 23% | 23% |

| 🇹🇭 Thailand | 14% | 47% | 32% | 7% |

| 🇷🇺 Russia | 11% | 24% | 51% | 14% |

| 🇺🇸 U.S. | 10% | 38% | 33% | 19% |

| 🇮🇹 Italy | 5% | 40% | 38% | 16% |

| 🇬🇧 United Kingdom | 3% | 36% | 35% | 25% |

| 🇫🇷 France | 2% | 35% | 16% | 46% |

Percentages may not add to 100 due to rounding. Select countries shown above.

In 2022, global consumption of coal surpassed 8 billion tonnes in a single year for the first time, with China and India being the two biggest consumers in absolute terms.

China’s power sector alone accounts for one-third of global coal consumption. Meanwhile, with a growth rate of 6% annually, India has doubled its coal consumption since 2007—and is expected to lead the growth in coal consumption for years to come.

Coal Demand in Developed Countries

U.S. consumption of coal has dropped almost 50% compared to the early 2010s.

With initiatives like the Inflation Reduction Act (IRA), which includes nearly $370 billion to accelerate the U.S.’s energy transition, coal consumption is expected to remain on a downward trajectory in the United States.

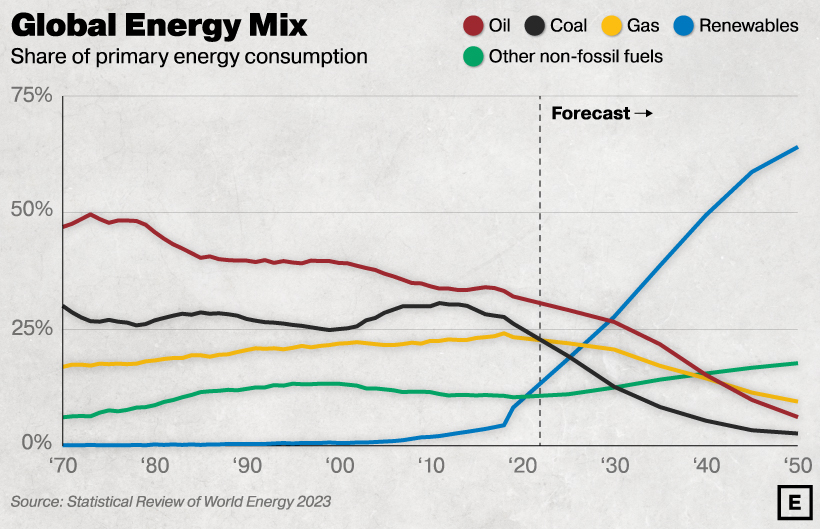

Source: BP Energy Outlook 2023. The forecast is based on BP’s scenario for global net-zero emissions by 2050.

The same movement is seen in the European Union.

France, for example, only has 2.5% of its primary energy consumption coming from coal, a share that is just half of what it was in the early 2000s.

In Germany, Europe’s biggest economy, coal still accounts for 18.9% of total energy consumption (a small increase over 2021, due to the energy crisis). However, a decade ago in 2012, that number stood even higher at 24.9% of primary energy use.

With coal consumption falling in developed nations but remaining steady in emerging economies, the International Energy Agency projects that coal demand will plateau at 2022 levels until 2025 when it will begin to fall.

Automotive

How People Get Around in America, Europe, and Asia

Examining how people get around using cars, public transit, and walking or biking, and the regional differences in usage.

How People Get Around in America, Europe, and Asia

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

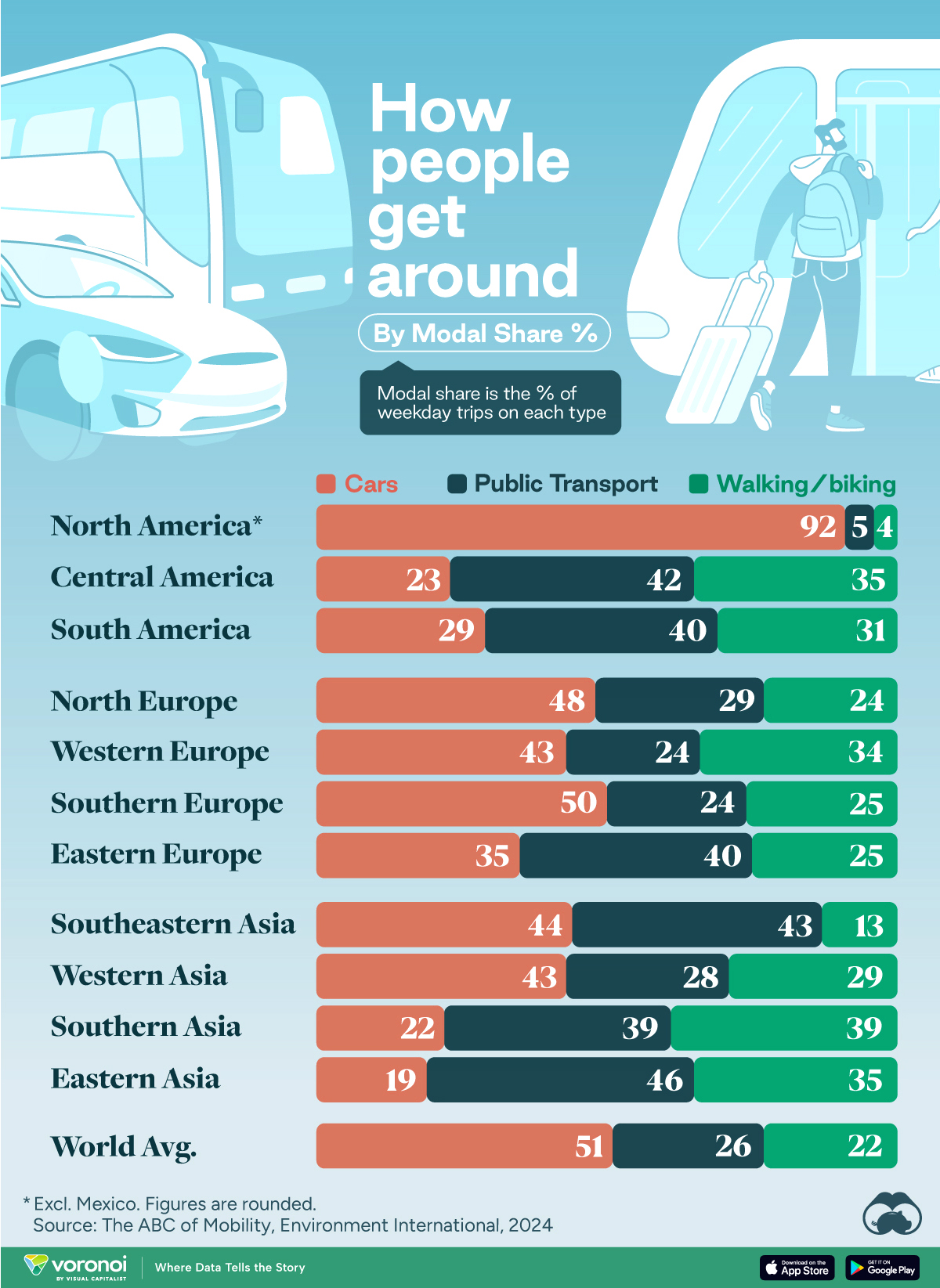

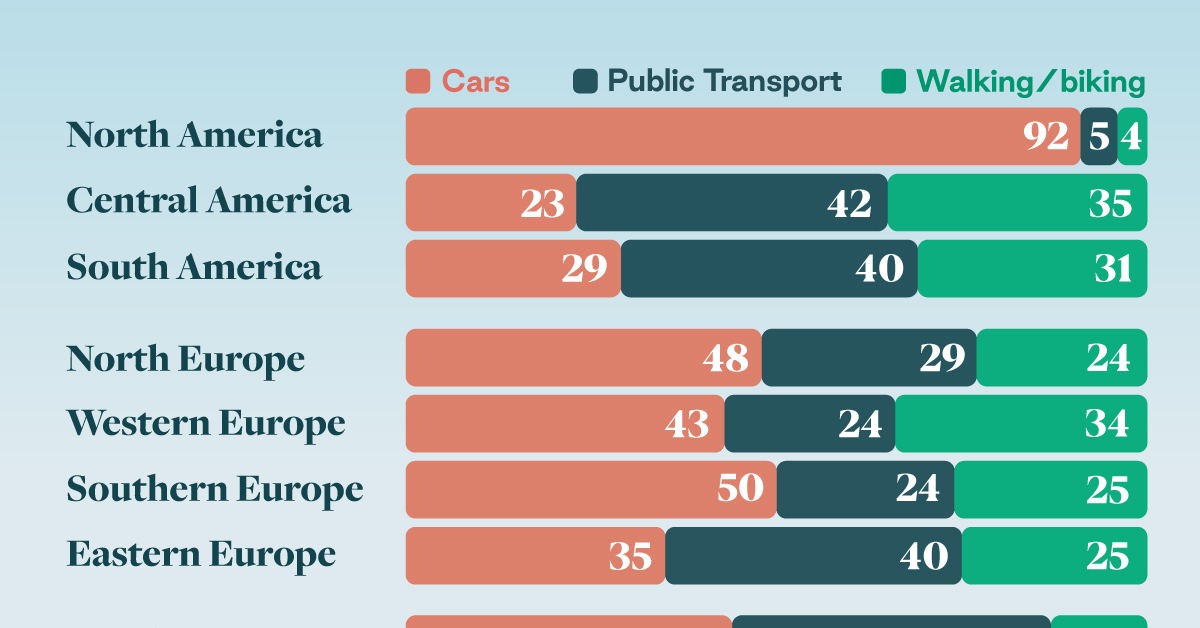

This chart highlights the popularity of different transportation types in the Americas, Europe, and Asia, calculated by modal share.

Data for this article and visualization is sourced from ‘The ABC of Mobility’, a research paper by Rafael Prieto-Curiel (Complexity Science Hub) and Juan P. Ospina (EAFIT University), accessed through ScienceDirect.

The authors gathered their modal share data through travel surveys, which focused on the primary mode of transportation a person employs for each weekday trip. Information from 800 cities across 61 countries was collected for this study.

North American Car Culture Contrasts with the Rest of the World

In the U.S. and Canada, people heavily rely on cars to get around, no matter the size of the city. There are a few exceptions of course, such as New York, Toronto, and smaller college towns across the United States.

| Region | 🚗 Cars | 🚌 Public Transport | 🚶 Walking/Biking |

|---|---|---|---|

| North America* | 92% | 5% | 4% |

| Central America | 23% | 42% | 35% |

| South America | 29% | 40% | 31% |

| Northern Europe | 48% | 29% | 24% |

| Western Europe | 43% | 24% | 34% |

| Southern Europe | 50% | 24% | 25% |

| Eastern Europe | 35% | 40% | 25% |

| Southeastern Asia | 44% | 43% | 13% |

| Western Asia | 43% | 28% | 29% |

| Southern Asia | 22% | 39% | 39% |

| Eastern Asia | 19% | 46% | 35% |

| World | 51% | 26% | 22% |

Note: *Excluding Mexico. Percentages are rounded.

As a result, North America’s share of public transport and active mobility (walking and biking) is the lowest amongst all surveyed regions by a significant amount.

On the other hand, public transport reigns supreme in South and Central America as well as Southern and Eastern Asia. It ties with cars in Southeastern Asia, and is eclipsed by cars in Western Asia.

As outlined in the paper, Europe sees more city-level differences in transport popularity.

For example, Utrecht, Netherlands prefers walking and biking. People in Paris and London like using their extensive transit systems. And in Manchester and Rome, roughly two out of three journeys are by car.

-

Markets5 days ago

Markets5 days agoVisualizing Global Inflation Forecasts (2024-2026)

-

Green2 weeks ago

Green2 weeks agoThe Carbon Footprint of Major Travel Methods

-

United States2 weeks ago

United States2 weeks agoVisualizing the Most Common Pets in the U.S.

-

Culture2 weeks ago

Culture2 weeks agoThe World’s Top Media Franchises by All-Time Revenue

-

voronoi1 week ago

voronoi1 week agoBest Visualizations of April on the Voronoi App

-

Wealth1 week ago

Wealth1 week agoCharted: Which Country Has the Most Billionaires in 2024?

-

Business1 week ago

Business1 week agoThe Top Private Equity Firms by Country

-

Markets1 week ago

Markets1 week agoThe Best U.S. Companies to Work for According to LinkedIn