Cannabis

Visualizing the Boom in the CBD Beverage Market

Visualizing the Boom in the CBD Beverage Market

It’s safe to say that the cascade of cannabis legislation has sent the world into a constant state of flux. We are witnessing a seismic shift in culture, as cannabis steps out of the black market and into unexpected industries—from big pharma, to beauty, and now to beverages.

According to Zenith Global, the U.S. CBD-infused drinks market will reach an estimated $1.4 billion by 2023, making it one of the fastest-growing segments in the overall industry.

Today’s infographic comes to us from Trait Biosciences, and outlines the magnitude of the CBD-infused beverage segment, along with some of the subsequent challenges and opportunities that will shape the future of cannabis.

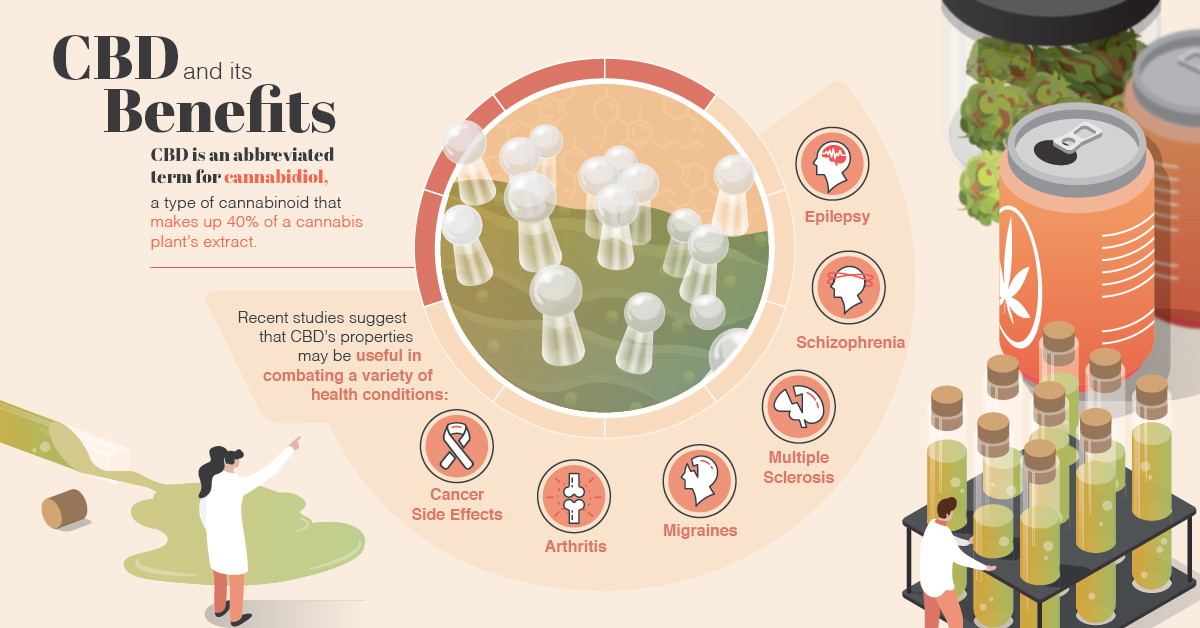

CBD and its Benefits

CBD is an abbreviated term for cannabidiol, a type of cannabinoid that makes up 40% of a cannabis plant’s extract. It has become increasingly popular for relieving pain, promoting relaxation, and lifting mood without the psychoactive properties that come with THC (Tetrahydrocannabinol), the other major cannabinoid.

Recent studies suggest that CBD’s properties may be useful in combating a variety of health conditions such as epilepsy, schizophrenia, multiple sclerosis, migraines, arthritis, and even side effects of cancer.

The New Wave of Beverages

CBD-infused beverages will open the floodgates to new audiences who want to consume cannabis in different formats. They have many benefits, that will rival other methods of ingestion:

- Easy to Administer

Beverages are seen as the healthier way to consume CBD, especially compared to smoking. - More Accessible

They are becoming more easily available in restaurants, bars, supermarkets, and online sites. - Functionality

There is some evidence to suggest that CBD in caffeinated products can curtail the feeling of being on “edge”. - Higher Precision

Dosage is controlled and, much like alcohol, consumers will be able to determine how much CBD content they want. - Changing Consumer Preferences: The decline of alcohol sales globally is evidence of changing consumer tastes. Sales are expected to fall further as more people exchange alcohol for cannabis products.

- Product Innovation: Sustainable packaging, transparency around ingredients, more convenient ready-to-drink solutions, and personalized strains are driving the furious pace of product innovation.

- Big Players and Influencers: Growing knowledge and increasing brand/celebrity endorsements are creating an established CBD industry in mainstream culture. Already, singer Willie Nelson and former NFL star Terrell Davis have put their names to two seperate lines of CBD-infused beverages.

Both alcoholic and non-alcoholic product categories are currently being explored, resulting in some unexpected partnerships, such as Molson Coors—the world’s seventh largest brewer—and Hexo Corp, a Canadian cannabis product company.

Trends Shaping the Future of CBD Beverages

The CBD product landscape is constantly evolving. Demand for CBD-infused beverages will be fueled by three key trends.

As these trends evolve, consumers will benefit from more education around CBD, which could lead to more CBD products, like beverages, entering the mainstream across numerous industries.

What’s Next for the CBD-infused Beverage Market?

CBD purity is a primary focus area of current scientific studies. For consumers, more transparency is needed around ingredients, dosage levels, and product labeling. For example, the state of Indiana now mandates that manufacturers must label CBD products with QR codes that can be scanned to show whether they contain acceptable levels of THC, CBD, pesticides, and other compounds.

Most notably, new methods of CBD infusion will transform the beverages market. Many industry players have used nano-emulsion to infuse CBD. However, these fat-based nanoparticles have been known to accumulate in organs, causing health concerns. That’s why creating water-soluble CBD has been an emerging industry priority.

CBD-infused beverages are poised to become the next big thing and create massive economic growth—despite strict industry regulations. Scientific advancements and changing laws will unlock the potential of the CBD market, potentially disrupting the entire beverage industry.

Politics

Timeline: Cannabis Legislation in the U.S.

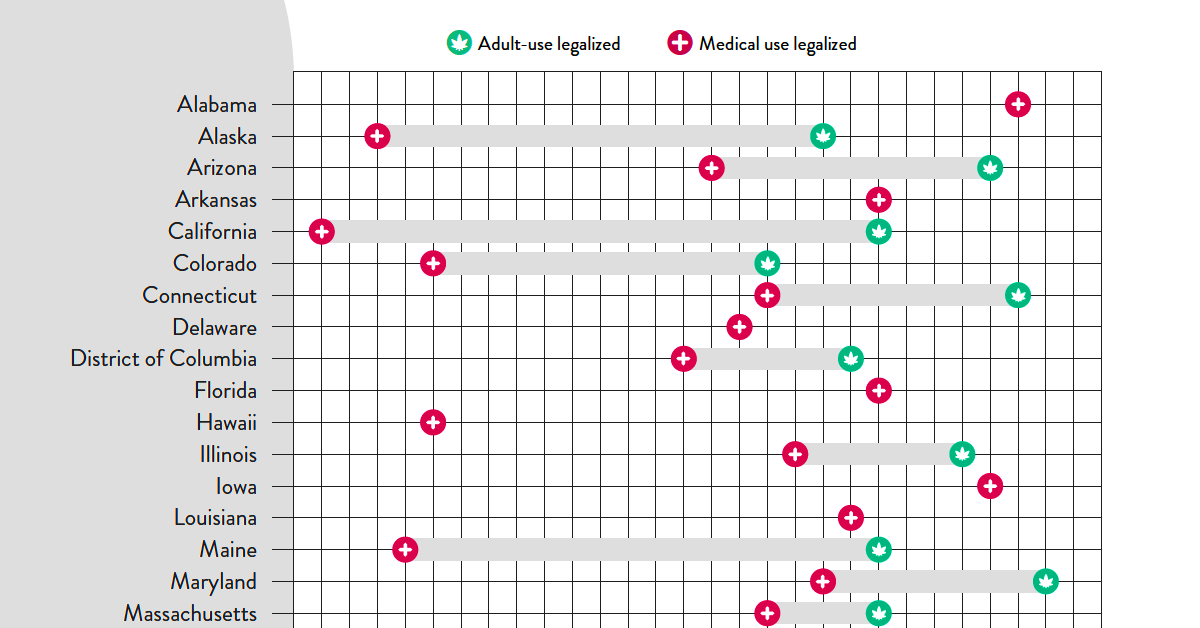

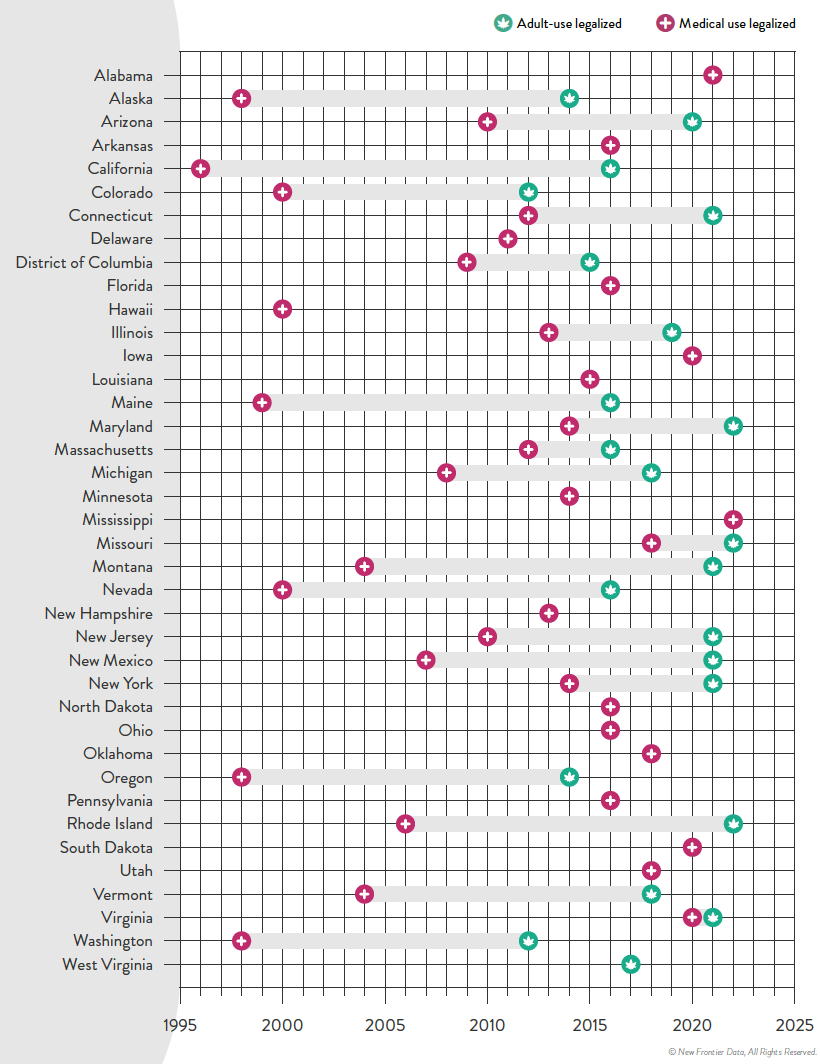

At the federal level, cannabis is illegal, but state laws differ. This graphic looks at the timelines of cannabis legislation in the U.S.

Timeline: Cannabis Legislation in the U.S.

At the federal level, cannabis is still considered an illegal substance. That said, individual states do have the right to determine their own laws around cannabis sales and usage.

This visual from New Frontier Data looks at the status of cannabis in every state and the timeline of when medical and/or recreational use became legal.

Cannabis Through the Years

In the U.S., the oldest legalese concerning cannabis dates back to the 1600s—the colony of Virginia required every farm to grow and produce hemp. Since then, cannabis use was fairly wide open until the 1930s when the Marihuana Tax Act was enforced, prohibiting marijuana federally but still technically allowing medical use.

Jumping ahead, the Controlled Substances Act was passed in 1970, classifying cannabis as Schedule I drug—the same category as heroin. This prohibited any use of the substance.

However, the 1970s also saw a counter movement, wherein many states made the move towards decriminalization. Decriminalization means that although possessing cannabis remained illegal, a person would not be subject to jail time or prosecution for possessing certain amounts.

By the 1990s, some of the first states passed laws to allow the medical usage of cannabis, and by 2012 two states in the U.S.—Washington and Colorado—legalized the recreational use of cannabis.

Cannabis Legislation Today and Beyond

The MORE Act (the Marijuana Opportunity Reinvestment and Expungement Act) was passed in the House early 2022, and if made law, it would decriminalize marijuana federally.

“This bill decriminalizes marijuana. Specifically, it removes marijuana from the list of scheduled substances under the Controlled Substances Act and eliminates criminal penalties for an individual who manufactures, distributes, or possesses marijuana.”– U.S. Congress

Cannabis still remains illegal at the federal level, but at the state levels, cannabis is now fully legal (both for medicinal and recreational purposes) in a total of 22 states.

Over 246 million Americans have legal access to some form of marijuana products with high THC levels. Looking to the future, many new cannabis markets are expected to open up in the next few years:

The earliest states expected to open up next for recreational cannabis sales are Minnesota and Oklahoma. There is always a lag between legalization and actual sales, wherein local regulatory bodies and governments set standards. States like Kentucky, on the other hand, aren’t likely to even legalize medicinal cannabis until 2028.

It’s estimated that by 2030, there will be 69 million cannabis consumers in the country, up 33% from 2022.

Overall, the U.S. cannabis market is likely an important one to watch as legal sales hit $30 billion in 2022. By the end of the decade, that number is expected to be anywhere from $58 billion to as much as $72 billion.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees