Cannabis

How Consumers Are Shaping Cannabis Consumption

How Consumers Are Shaping Cannabis Consumption

The cannabis industry continues to reach new heights, and according to market analysts, global legal spending on cannabis could reach $32 billion by 2022 — a majority of which is thanks to U.S. and Canadian consumers.

What’s driving the evolution of the market?

Cannabis is in the midst of a shakeup, and today’s infographic from Ionic Brands highlights how consumers are significantly shaping the landscape of cannabis.

Cannabis Concentrates: A New Frontier

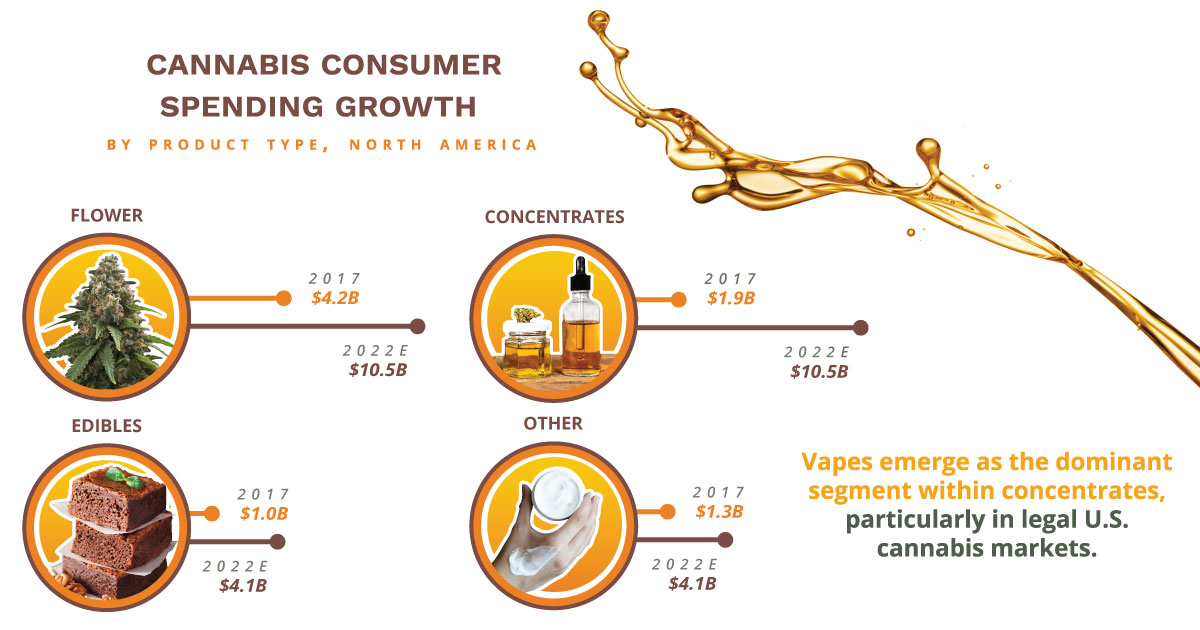

For years, joints and blunts dominated the industry—but sales of traditional flower are swiftly losing ground to new products. Here’s how cannabis consumer spending looks across North America in a few short years:

| Product type | Flower | Edibles | Concentrates | Other |

|---|---|---|---|---|

| 2017 | $4.2B | $1B | $1.9B | $1.3B |

| 2022E | $10.5B | $4.1B | $10.5B | $4.1B |

| % Market Share | ↓ 14pp From 50% to 36% | ↑ 2pp From 12% to 14% | ↑ 13pp From 23% to 36% | ↓ 1pp From 15% to 14% |

| CAGR | 20% | 33% | 41% | 26% |

Cannabis consumers are clearly moving away from simply smoking the product. Concentrates are the fastest growing industry segment, which is not surprising since they’re needed to make all sorts of products, from edibles to topicals and tinctures. Cannabis concentrates are also discreet, convenient, and more potent than other cannabis products, all of which contribute to their consumer appeal.

In fact, these changing preferences are disrupting other mammoth industries. Take JUUL Labs for example: the inconspicuous, smokeless device is chipping away at the tobacco industry, and now accounts for almost 73% of the e-cigarette market. JUUL’s growth is proof that consumers are driving the market, and this trend is also reflected in cannabis.

Among all cannabis concentrate types, vaporizers (vapes) overwhelmingly come out on top in established markets, accounting for 43% of sales in Colorado, 70% in Oregon, and 79% in California.

| Concentrate Sales (2018, Jan-Jun) | Vape | Wax | Shatter | Live Resin | Oils | Others |

|---|---|---|---|---|---|---|

| Colorado | $97M | $17M | $16M | $29M | $12M | $14M |

| Oregon | $60M | - | $10M | $4M | $5M | $8M |

| California | $282M | 14M | $14M | $21M | - | $42M |

Branding is Everything in Cannabis

The cannabis concentrates space is becoming increasingly sophisticated. With more money to be made from less product, concentrates offer higher margins as well. But in a fragmented market, brand recognition is arguably the biggest factor guiding consumer demand.

Returning to JUUL’s example, the company’s branding played a big hand in its accelerated trajectory—and in grabbing the attention of major players like Altria, the corporate parent of Marlboro. Altria made a landmark investment into 35% of JUUL in December 2018, bringing the latter’s value up to $38 billion.

In the nascent cannabis industry, consumers are still wondering who they can trust. A recent survey revealed that 72% of cannabis consumers rated branding as somewhat or very important in assessing a product’s quality and safety. Branded cannabis products are on the rise, but they’re not as established as Starbucks coffee or Apple iPhones quite yet.

When done right, cannabis concentrates brands are able to capture quite a significant chunk of the market:

- California

Top 10 brands: 48.4%

All other: 51.6% - Colorado

Top 10 brands: 46.6%

All other: 53.4% - Oregon

Top 10 brands: 59.7%

All other: 40.3%

In a budding industry, such brand market domination is an impressive feat. However, a few barriers still stand in the way of these brands’ ability to scale on a national level: cannabis and related products aren’t legal in every U.S. state, while diverse state regulations also complicate the process.

Cannabis consumer brands that can spread out into multiple states, and develop consumer trust, will emerge as winners in this new, dynamic market.

Politics

Timeline: Cannabis Legislation in the U.S.

At the federal level, cannabis is illegal, but state laws differ. This graphic looks at the timelines of cannabis legislation in the U.S.

Timeline: Cannabis Legislation in the U.S.

At the federal level, cannabis is still considered an illegal substance. That said, individual states do have the right to determine their own laws around cannabis sales and usage.

This visual from New Frontier Data looks at the status of cannabis in every state and the timeline of when medical and/or recreational use became legal.

Cannabis Through the Years

In the U.S., the oldest legalese concerning cannabis dates back to the 1600s—the colony of Virginia required every farm to grow and produce hemp. Since then, cannabis use was fairly wide open until the 1930s when the Marihuana Tax Act was enforced, prohibiting marijuana federally but still technically allowing medical use.

Jumping ahead, the Controlled Substances Act was passed in 1970, classifying cannabis as Schedule I drug—the same category as heroin. This prohibited any use of the substance.

However, the 1970s also saw a counter movement, wherein many states made the move towards decriminalization. Decriminalization means that although possessing cannabis remained illegal, a person would not be subject to jail time or prosecution for possessing certain amounts.

By the 1990s, some of the first states passed laws to allow the medical usage of cannabis, and by 2012 two states in the U.S.—Washington and Colorado—legalized the recreational use of cannabis.

Cannabis Legislation Today and Beyond

The MORE Act (the Marijuana Opportunity Reinvestment and Expungement Act) was passed in the House early 2022, and if made law, it would decriminalize marijuana federally.

“This bill decriminalizes marijuana. Specifically, it removes marijuana from the list of scheduled substances under the Controlled Substances Act and eliminates criminal penalties for an individual who manufactures, distributes, or possesses marijuana.”– U.S. Congress

Cannabis still remains illegal at the federal level, but at the state levels, cannabis is now fully legal (both for medicinal and recreational purposes) in a total of 22 states.

Over 246 million Americans have legal access to some form of marijuana products with high THC levels. Looking to the future, many new cannabis markets are expected to open up in the next few years:

The earliest states expected to open up next for recreational cannabis sales are Minnesota and Oklahoma. There is always a lag between legalization and actual sales, wherein local regulatory bodies and governments set standards. States like Kentucky, on the other hand, aren’t likely to even legalize medicinal cannabis until 2028.

It’s estimated that by 2030, there will be 69 million cannabis consumers in the country, up 33% from 2022.

Overall, the U.S. cannabis market is likely an important one to watch as legal sales hit $30 billion in 2022. By the end of the decade, that number is expected to be anywhere from $58 billion to as much as $72 billion.

-

Green1 week ago

Green1 week agoRanked: The Countries With the Most Air Pollution in 2023

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Travel2 weeks ago

Travel2 weeks agoRanked: The World’s Top Flight Routes, by Revenue