Money

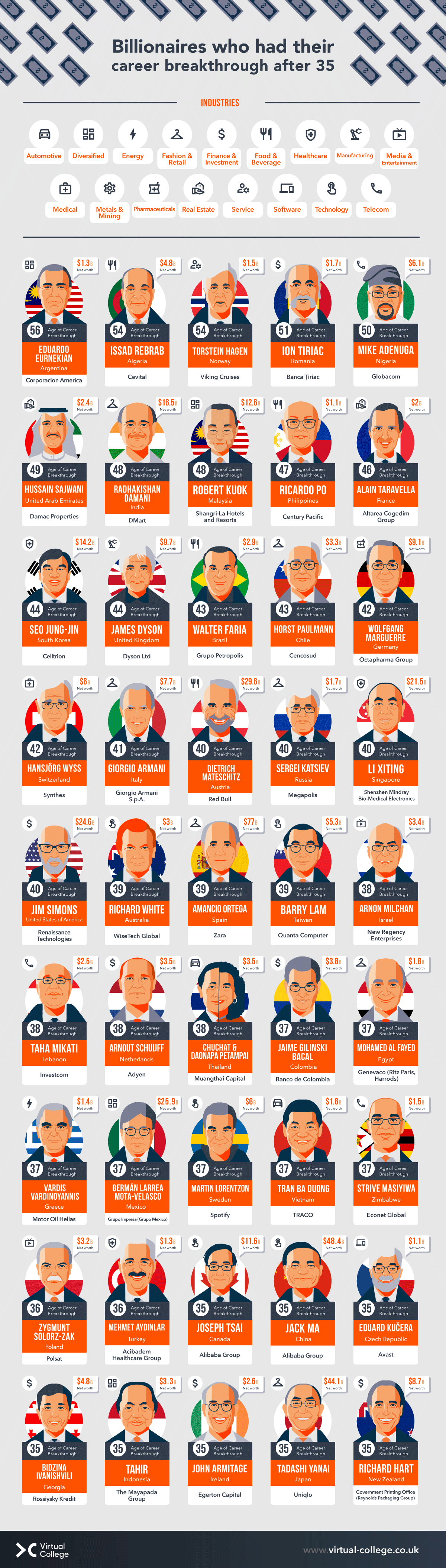

Billionaire Late Bloomers, by Age of Their Breakthrough

Billionaire Late Bloomers, by Age of Breakthrough

More often than not, individuals and media alike focus on the success stories of early bloomers.

These early-age accomplishments of some of the richest people in the world are highlighted as marvels. The early achievements of hoodie-wearing CEOs like Mark Zuckerberg or Evan Spiegel—who became billionaires at ages 23 and 25, respectively—come to mind.

But there’s also the case to be made for the late bloomer. According to the Census Bureau, a 35-year-old is three times more likely to found a successful start-up than someone aged 22.

The infographic above, from Virtual College, highlights 45 billionaires who had their breakthrough later in life, by the age of their respective breakthrough.

Billionaires With Career Breakthroughs at or After Age 35

Though these late successes span many different industries and countries, there are many consistent through lines.

The 45 billionaires highlighted had an average age of 41 and an average net worth of $10 billion.

| Billionaire | Company | Age of Breakthrough | Net Worth ($B) | Nationality |

|---|---|---|---|---|

| Eduardo Eurnekian | Corporacion America | 56 | $1.3 | 🇦🇷 Argentina |

| Issad Rebrab | Cevital | 54 | $4.8 | 🇩🇿 Algeria |

| Torstein Hagen | Viking Cruises | 54 | $1.5 | 🇳🇴 Norway |

| Ion Tiriac | Banca Tiriac | 51 | $1.7 | 🇷🇴 Romania |

| Mike Adenuga | Globacom | 50 | $6.1 | 🇳🇬 Nigeria |

| Hussain Sajwani | Damac Properties | 49 | $2.4 | 🇦🇪 UAE |

| Radhakishan Damani | Dmart | 48 | $16.5 | 🇮🇳 India |

| Robert Kuok | Shangra-La Hotels and Resorts | 48 | $12.6 | 🇲🇾 Malaysia |

| Ricardo Po | Century Pacific | 47 | $1.1 | 🇵🇭 Philippines |

| Alain Tarvella | Altarea Cogedim Group | 46 | $2.0 | 🇫🇷 France |

| Seo Jung-Jin | Celltrion | 44 | $14.2 | 🇰🇷 South Korea |

| James Dyson | Dyson Ltd | 44 | $9.7 | 🇬🇧 UK |

| Walter Faria | Grupo Petropolis | 43 | $2.9 | 🇧🇷 Brazil |

| Horst Paulmann | Cencosud | 43 | $3.3 | 🇨🇱 Chile |

| Wolfgang Marguerre | Octapharma Group | 42 | $9.1 | 🇩🇪 Germany |

| Hansjorg Wyss | Synthes | 42 | $6.0 | 🇨🇭Switzerland |

| Giorgio Armani | Giorgio Armani S.p.A. | 41 | $7.7 | 🇮🇹 Italy |

| Dietrich Mateschitz | Red Bull | 40 | $29.6 | 🇦🇹 Austria |

| Sergei Katsiev | Megapolis | 40 | $1.7 | 🇷🇺 Russia |

| Li Xiting | Shenzhen Mindray Bio-Medical Electronics | 40 | $21.5 | 🇸🇬 Singapore |

| Jim Simmons | Renaissance Technologies | 40 | $24.6 | 🇺🇸 U.S. |

| Richard White | WiseTech Global | 39 | $3.5 | 🇦🇺 Australia |

| Amancio Ortega | Zara | 39 | $77 | 🇪🇸 Spain |

| Barry Lam | Quanta Computer | 39 | $5.3 | 🇹🇼 Taiwan |

| Arnon Milchan | New Regency Enterprises | 38 | $3.4 | 🇮🇱 Israel |

| Taha Mikati | Investcom | 38 | $2.5 | 🇱🇧 Lebanon |

| Arnout Schuijff | Adyen | 38 | $3.5 | 🇳🇱 Netherlands |

| Chuchat & Daonapa Petampai | Muangthai Capital | 38 | $3.5 | 🇹🇭 Thailand |

| Jaime Gilinski Bacal | Banco De Colombia | 37 | $3.8 | 🇨🇴 Colombia |

| Mohamed Al Fayed | Genevaco (Ritz Paris, Harrods) | 37 | $1.8 | 🇪🇬 Egypt |

| Vardis Vardinyannis | Motor Oil Hellas | 37 | $1.4 | 🇬🇷 Greece |

| German Larrea Mota-Velasco | Grupo Mexico | 37 | $25.9 | 🇲🇽 Mexico |

| Martin Lorentzon | Spotify | 37 | $6.0 | 🇸🇪 Sweden |

| Tran Ba Duong | Traco | 37 | $1.6 | 🇻🇳 Vietnam |

| Strive Masiyiwa | Econet Global | 37 | $1.5 | 🇿🇼 Zimbabwe |

| Zygmunt Solorz-Zak | Polsat | 36 | $3.2 | 🇵🇱 Poland |

| Mehmet Aydinlar | Acibadem Healthcare Group | 36 | $1.3 | 🇹🇷 Turkey |

| Joseph Tsai | Alibaba Group | 35 | $11.6 | 🇨🇦 Canada |

| Jack Ma | Alibaba Group | 35 | $48.4 | 🇨🇳 China |

| Eduard Kucera | Avast | 35 | $1.1 | 🇨🇿 Czech Republic |

| Bidzina Ivanishvili | Rossiysky Kredit | 35 | $4.8 | 🇬🇪 Georgia |

| Tahir | The Mayapada Group | 35 | $3.3 | 🇮🇩 Indonesia |

| John Armitage | Egerton Capital | 35 | $2.6 | 🇮🇪 Ireland |

| Tadashi Yanai | Uniqlo | 35 | $44.1 | 🇯🇵 Japan |

| Richard Hart | Raynolds Packaging Group | 35 | $8.7 | 🇳🇿 New Zealand |

Here are just a few highlights of late career breakthroughs:

Jack Ma

Ma is best known for co-founding Alibaba and becoming one of China’s wealthiest people, but his start came rather unexpectedly. After failing to secure jobs as a fresh graduate and starting his own translation company, Ma went on a business trip to the U.S. and discovered the internet (and a lack of Chinese websites). Over time, he connected Chinese companies with American coders to create websites, and soon saw room in the market for a business-to-business marketplace, which became Alibaba. The company secured millions in investment and would go on to become one of China’s leading forces in tech, all without Ma writing a single line of code.

Amancio Ortega

As the former CEO of fashion chain Zara and its parent company Inditex, Ortega is Europe’s third wealthiest person. That success came after opening the first Zara store in 1975 with his then-wife Rosalía Mera, with their store focusing on cheaper versions of high-end fashion. Ortega fine-tuned the design and manufacturing process to produce new trends more quickly, helping to pioneer the concept of “fast fashion,” and soon becoming a fashion powerhouse.

Jim Simons

Simons was once lauded as the world’s greatest investor, largely due to his outlandish returns of over 60% before fees. But he actually started in the academic field, acquiring a PhD in mathematics—he worked in many faculties, and even as a codebreaker for the NSA. Eventually, Simons utilized his mathematical knowledge on Wall Street, where he had his breakthrough in 1982 by starting his model-based hedge fund—Renaissance Technologies, and built a net worth of $24.6 billion.

Dietrich Mateschitz

One of the 60 richest people in the world, Austrian businessman Mateschitz got his start in marketing for Unilever and then cosmetics company Blendax. His breakthrough came on a business trip to Thailand, where the 40-year-old discovered that the local energy drink Krating Daeng helped his jet lag. Mateschitz and the drink’s creator, Chaleo Yoovidhya, each put up $500,000 to turn the drink into an exported energy brand, and Red Bull was born.

James Dyson

Before Dyson was a household name of vacuums, fans, and dryers, The UK’s James Dyson was an industrial engineer with many ideas for inventions. After getting frustrated with the bags of Hoover vacuum cleaners, Dyson had the idea for a bagless cyclone vacuum, and developed one after more than 5,000 prototypes over five years (and supported by his wife’s salary). At first he couldn’t find a manufacturer or success in the UK, so Dyson instead sold his vacuums in Japan and ended up winning the 1991 International Design Fair Prize there. Thirty years later, Dyson’s success led to a royal knighting and becoming the fourth richest person in the UK.

Late Bloomers: The Rule Not The Exception

It’s helpful to remember that these stories might be incredible and successful on a grand scale, but they are not entirely unique.

According to the U.S. Census Bureau, the majority of successful businesses have been founded by middle-aged people and the average age of a company’s founder at the time of founding is 41.9 years. Experience definitely pays dividends, and the saying that “life is a marathon, not a sprint” seems especially true for this list of late breakthrough billionaires.

Economy

Ranked: The Top 20 Countries in Debt to China

The 20 nations featured in this graphic each owe billions in debt to China, posing concerns for their economic future.

Ranked: The Top 20 Countries in Debt to China

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

In this graphic, we ranked the top 20 countries by their amount of debt to China. These figures are as of 2022, and come from the World Bank (accessed via Yahoo Finance).

The data used to make this graphic can be found in the table below.

| Country | Total external debt to China ($B) |

|---|---|

| 🇵🇰 Pakistan | $26.6 |

| 🇦🇴 Angola | $21.0 |

| 🇱🇰 Sri Lanka | $8.9 |

| 🇪🇹 Ethiopia | $6.8 |

| 🇰🇪 Kenya | $6.7 |

| 🇧🇩 Bangladesh | $6.1 |

| 🇿🇲 Zambia | $6.1 |

| 🇱🇦 Laos | $5.3 |

| 🇪🇬 Egypt | $5.2 |

| 🇳🇬 Nigeria | $4.3 |

| 🇪🇨 Ecuador | $4.1 |

| 🇰🇭 Cambodia | $4.0 |

| 🇨🇮 Côte d'Ivoire | $3.9 |

| 🇧🇾 Belarus | $3.9 |

| 🇨🇲 Cameroon | $3.8 |

| 🇧🇷 Brazil | $3.4 |

| 🇨🇬 Republic of the Congo | $3.4 |

| 🇿🇦 South Africa | $3.4 |

| 🇲🇳 Mongolia | $3.0 |

| 🇦🇷 Argentina | $2.9 |

This dataset highlights Pakistan and Angola as having the largest debts to China by a wide margin. Both countries have taken billions in loans from China for various infrastructure and energy projects.

Critically, both countries have also struggled to manage their debt burdens. In February 2024, China extended the maturity of a $2 billion loan to Pakistan.

Soon after in March 2024, Angola negotiated a lower monthly debt payment with its biggest Chinese creditor, China Development Bank (CDB).

Could China be in Trouble?

China has provided developing countries with over $1 trillion in committed funding through its Belt and Road Initiative (BRI), a massive economic development project aimed at enhancing trade between China and countries across Asia, Africa, and Europe.

Many believe that this lending spree could be an issue in the near future.

According to a 2023 report by AidData, 80% of these loans involve countries in financial distress, raising concerns about whether participating nations will ever be able to repay their debts.

While China claims the BRI is a driver of global development, critics in the West have long warned that the BRI employs debt-trap diplomacy, a tactic where one country uses loans to gain influence over another.

Editor’s note: The debt shown in this visualization focuses only on direct external debt, and does not include publicly-traded, liquid, debt securities like bonds. Furthermore, it’s worth noting the World Bank data excludes some countries with data accuracy or reporting issues, such as Venezuela.

Learn More About Debt from Visual Capitalist

If you enjoyed this post, check out our breakdown of $97 trillion in global government debt.

-

Wealth6 days ago

Wealth6 days agoCharted: Which City Has the Most Billionaires in 2024?

-

Mining2 weeks ago

Mining2 weeks agoGold vs. S&P 500: Which Has Grown More Over Five Years?

-

Uranium2 weeks ago

Uranium2 weeks agoThe World’s Biggest Nuclear Energy Producers

-

Education2 weeks ago

Education2 weeks agoHow Hard Is It to Get Into an Ivy League School?

-

Debt2 weeks ago

Debt2 weeks agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Sports2 weeks ago

Sports2 weeks agoThe Highest Earning Athletes in Seven Professional Sports

-

Science2 weeks ago

Science2 weeks agoVisualizing the Average Lifespans of Mammals

-

Brands1 week ago

Brands1 week agoHow Tech Logos Have Evolved Over Time