Datastream

The World’s Top 10 Hedge Fund Managers by Earnings

The Briefing

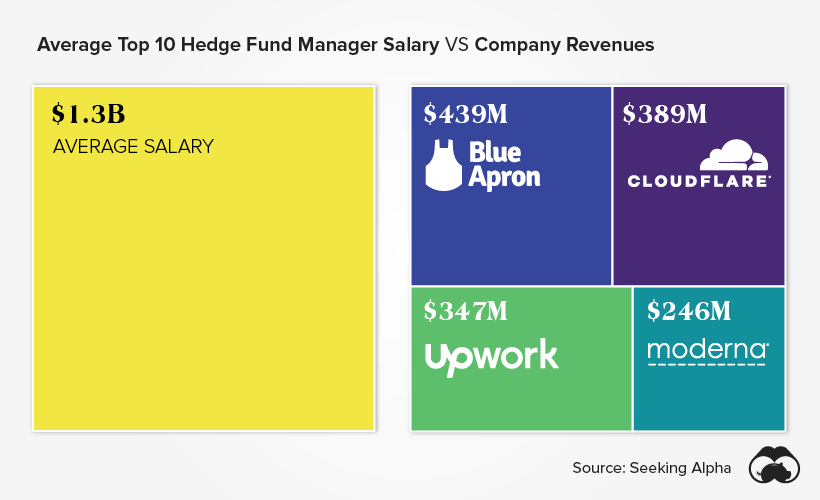

- The top 10 hedge fund managers take home an average of $1.3 billion a year in earnings

- The hedge fund industry manages over $3 trillion in assets

- Hedge funds often have a two-and-twenty fee structure, charging 2% on all assets under management (AUM), and 20% on profits

The Top 10 Hedge Fund Managers by Earnings

The world of hedge funds has recently garnered notoriety during the GameStop/WSB debacle, in which an us-versus-them mentality began to brew for smaller investors.

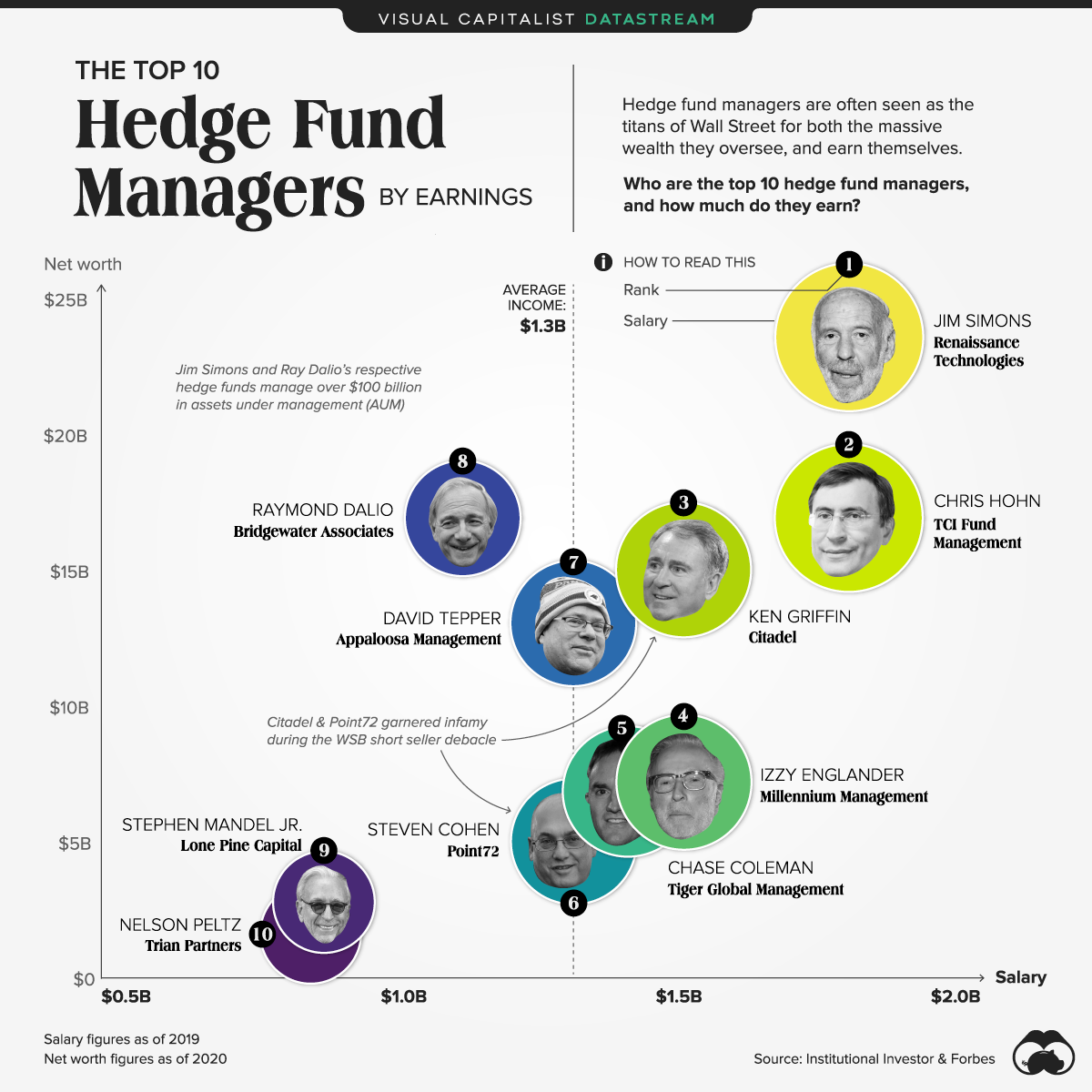

In markets, hedge fund managers are considered the big fish in the pond. Not only do they oversee billions of dollars in capital, they often earn some billions as well. Here’s a look at the earnings of the top 10 managers, where yearly earnings range between a high of $1.8 billion and a low of $835 million.

Entering the World of Billions

Although fees in the wealth management industry have been subject to downward pressure for years, the earnings for the best in the business have been left largely unabated. The historically common fee structure for hedge funds is the two-and-twenty model—that is, 2% of all assets under management (AUM) and 20% of profits based on performance.

This makes out to be a pretty penny when considering hedge fund AUMs go higher than $100 billion, like with Ray Dalio’s Bridgewater Associates. Generous fees charged on an exorbitant value of assets is part in why these 10 managers made it to the Forbes 400 list.

In fact, the top 10 hedge fund managers combine for $108 billion in net worth:

| Manager | Salary Earnings ($M) | Net Worth ($M) | Fund |

|---|---|---|---|

| Jim Simons | $1,800 | $23,500 | Renaissance Technologies |

| Chris Hohn | $1,800 | $16,900 | TCI Fund Management |

| Ken Griffin | $1,500 | $15,000 | Citadel |

| Izzy Englander | $1,500 | $7,200 | Millennium Management |

| Chase Coleman | $1,400 | $6,900 | Tiger Global Management |

| Steven Cohen | $1,300 | $5,000 | Point72 |

| David Tepper | $1,300 | $13,000 | Appaloosa Management |

| Raymond Dalio | $1,100 | $16,900 | Bridgewater Associates |

| Stephen Mandel Jr. | $835 | $2,800 | Lone Pine Capital |

| Nelson Peltz | $835 | $1,700 | Trian Partners |

The top 10 hedge fund managers earn approximately $1.3 billion on average. To put into perspective, this is comparable to the annual revenues of notable companies like Moderna, Cloudflare, Blue Apron, and Upwork.

The World’s Greatest Investors?

Hedge fund managers are not your everyday investors.

They often engage in sophisticated investment strategies like shorting, that would leave most market participants scratching their heads.

Take Jim Simons, who recently retired from the board of Renaissance Technologies, which he founded in 1982. Before being lauded as the world’s greatest investor, he was a codebreaker for the NSA and an award-winning academic.

Simons is also known as the “Quant King”, because Renaissance deploys complex mathematical models and statistical analysis to make its investment decisions. Moreover, their flagship Medallion fund has returned 66% per annum since 1998, before counting his additional billions made in fees of course.

Where does this data come from?

Source: Institutional Investor and Forbes

Notes: Earnings and net worth data was released in March and September of 2020, respectively

Datastream

Can You Calculate Your Daily Carbon Footprint?

Discover how the average person’s carbon footprint impacts the environment and learn how carbon credits can offset your carbon footprint.

The Briefing

- A person’s carbon footprint is substantial, with activities such as food consumption creating as much as 4,500 g of CO₂ emissions daily.

- By purchasing carbon credits from Carbon Streaming Corporation, you can offset your own emissions and fund positive climate action.

Your Everyday Carbon Footprint

While many large businesses and countries have committed to net-zero goals, it is essential to acknowledge that your everyday activities also contribute to global emissions.

In this graphic, sponsored by Carbon Streaming Corporation, we will explore how the choices we make and the products we use have a profound impact on our carbon footprint.

Carbon Emissions by Activity

Here are some of the daily activities and products of the average person and their carbon footprint, according to Clever Carbon.

| Household Activities & Products | CO2 Emissions (g) |

|---|---|

| 💡 Standard Light Bulb (100 watts, four hours) | 172 g |

| 📱 Mobile Phone Use (195 minutes per day)* | 189 g |

| 👕 Washing Machine (0.63 kWh) | 275 g |

| 🔥 Electric Oven (1.56 kWh) | 675 g |

| ♨️ Tumble Dryer (2.5 kWh) | 1,000 g |

| 🧻 Toilet Roll (2 ply) | 1,300 g |

| 🚿 Hot Shower (10 mins) | 2,000 g |

| 🚙 Daily Commute (one hour, by car) | 3,360 g |

| 🍽️ Average Daily Food Consumption (three meals of 600 calories) | 4,500 g |

| *Phone use based on yearly use of 69kg per the source, Reboxed | |

Your choice of transportation plays a crucial role in determining your carbon footprint. For instance, a 15 km daily commute to work on public transport generates an average of 1,464 g of CO₂ emissions. Compared to 3,360 g—twice the volume for a journey the same length by car.

By opting for more sustainable modes of transport, such as cycling, walking, or public transportation, you can significantly reduce your carbon footprint.

Addressing Your Carbon Footprint

One way to compensate for your emissions is by purchasing high-quality carbon credits.

Carbon credits are used to help fund projects that avoid, reduce or remove CO₂ emissions. This includes nature-based solutions such as reforestation and improved forest management, or technology-based solutions such as the production of biochar and carbon capture and storage (CCS).

While carbon credits offer a potential solution for individuals to help reduce global emissions, public awareness remains a significant challenge. A BCG-Patch survey revealed that only 34% of U.S. consumers are familiar with carbon credits, and only 3% have purchased them in the past.

About Carbon Streaming

By financing the creation or expansion of carbon projects, Carbon Streaming Corporation secures the rights to future carbon credits generated by these sustainable projects. You can then purchase these carbon credits to help fund climate solutions around the world and compensate for your own emissions.

Ready to get involved?

>> Learn more about purchasing carbon credits at Carbon Streaming

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023