Markets

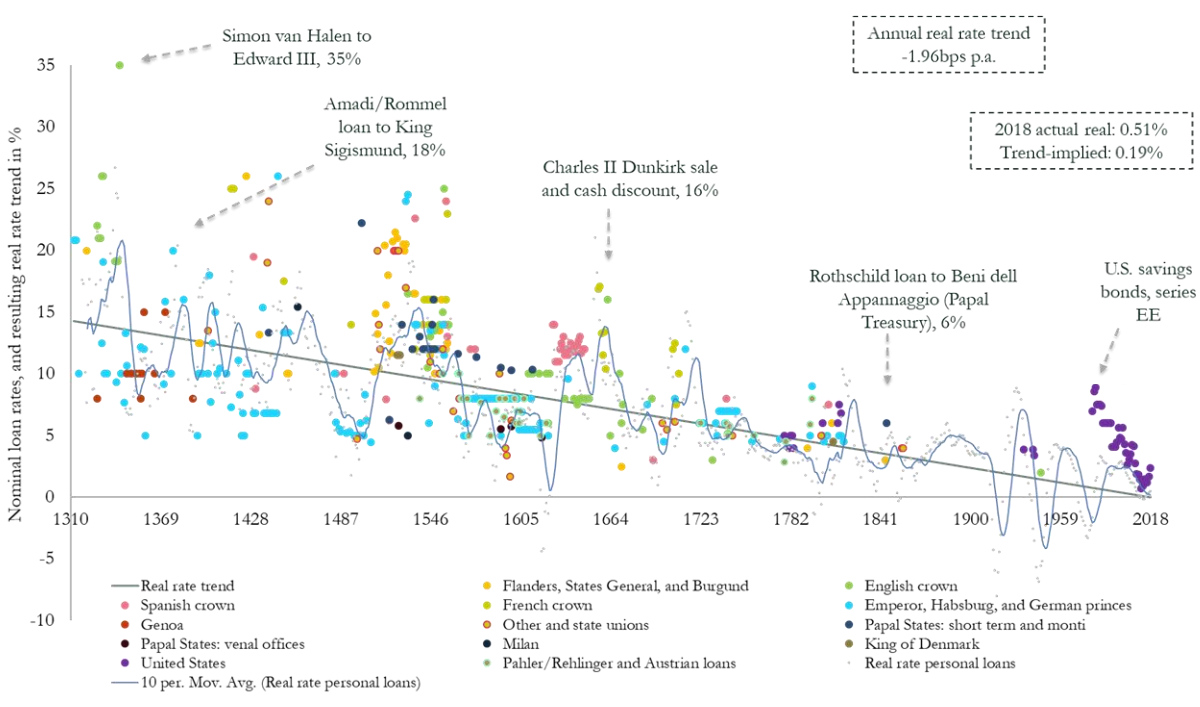

Visualizing the 700-Year Fall of Interest Rates

Visualizing the 700-Year Decline of Interest Rates

How far can interest rates fall?

Currently, many sovereign rates sit in negative territory, and there is an unprecedented $10 trillion in negative-yielding debt. This new interest rate climate has many observers wondering where the bottom truly lies.

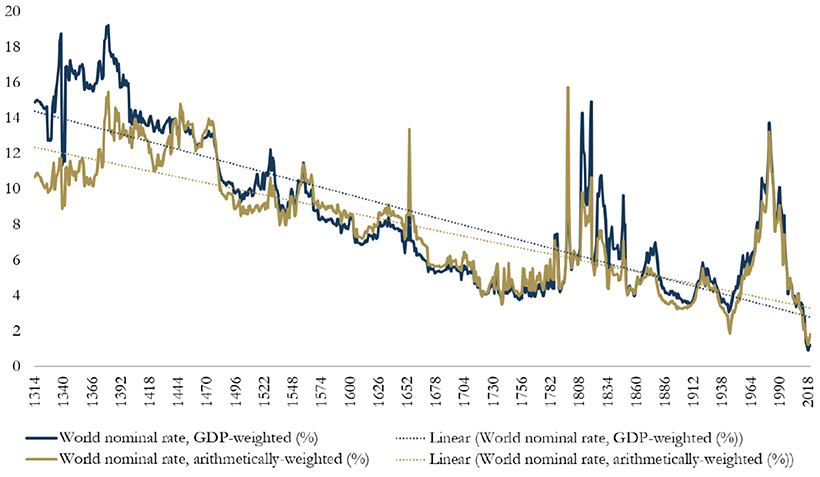

Today’s graphic from Paul Schmelzing, visiting scholar at the Bank of England (BOE), shows how global real interest rates have experienced an average annual decline of -0.0196% (-1.96 basis points) throughout the past eight centuries.

The Evidence on Falling Rates

Collecting data from across 78% of total advanced economy GDP over the time frame, Schmelzing shows that real rates* have witnessed a negative historical slope spanning back to the 1300s.

Displayed across the graph is a series of personal nominal loans made to sovereign establishments, along with their nominal loan rates. Some from the 14th century, for example, had nominal rates of 35%. By contrast, key nominal loan rates had fallen to 6% by the mid 1800s.

Centennial Averages of Real Long-Term “Safe-Asset”† Rates From 1311-2018

| % | 1300s | 1400s | 1500s | 1600s | 1700s | 1800s | 1900s | 2000s |

|---|---|---|---|---|---|---|---|---|

| Nominal rate | 7.3 | 11.2 | 7.8 | 5.4 | 4.1 | 3.5 | 5.0 | 3.5 |

| Inflation | 2.2 | 2.1 | 1.7 | 0.8 | 0.6 | 0.0 | 3.1 | 2.2 |

| Real rate | 5.1 | 9.1 | 6.1 | 4.6 | 3.5 | 3.4 | 2.0 | 1.3 |

*Real rates take inflation into account, and are calculated as follows: nominal rate – inflation = real rate.

†Safe assets are issued from global financial powers

Starting in 1311, data from the report shows how average real rates moved from 5.1% in the 1300s down to an average of 2% in the 1900s.

The average real rate between 2000-2018 stands at 1.3%.

Current Theories

Why have interest rates been trending downward for so long?

Here are the three prevailing theories as to why they’re dropping:

1. Productivity Growth

Since 1970, productivity growth has slowed. A nation’s productive capacity is determined by a number of factors, including labor force participation and economic output.

If total economic output shrinks, real rates will decline too, theory suggests. Lower productivity growth leads to lower wage growth expectations.

In addition, lower productivity growth means less business investment, therefore a lower demand for capital. This in turn causes the lower interest rates.

2. Demographics

Demographics impact interest rates on a number of levels. The aging population—paired with declining fertility levels—result in higher savings rates, longer life expectancies, and lower labor force participation rates.

In the U.S., baby boomers are retiring at a pace of 10,000 people per day, and other advanced economies are also seeing comparable growth in retirees. Theory suggests that this creates downward pressure on real interest rates, as the number of people in the workforce declines.

3. Economic Growth

Dampened economic growth can also have a negative impact on future earnings, pushing down the real interest rate in the process. Since 1961, GDP growth among OECD countries has dropped from 4.3% to 3% in 2018.

Larry Summers referred to this sloping trend since the 1970s as “secular stagnation” during an International Monetary Fund conference in 2013.

Secular stagnation occurs when the economy is faced with persistently lagging economic health. One possible way to address a declining interest rate conundrum, Summers has suggested, is through expansionary government spending.

Bond Yields Declining

According to the report, another trend has coincided with falling interest rates: declining bond yields.

Since the 1300s, global nominal bonds yields have dropped from over 14% to around 2%.

The graph illustrates how real interest rates and bond yields appear to slope across a similar trend line. While it may seem remarkable that interest rates keep falling, this phenomenon shows that a broader trend may be occurring—across centuries, asset classes, and fiscal regimes.

In fact, the historical record would imply that we will see ever new record lows in real rates in future business cycles in the 2020s/30s

-Paul Schmelzing

Although this may be fortunate for debt-seekers, it can create challenges for fixed income investors—who may seek alternatives strategies with higher yield potential instead.

Markets

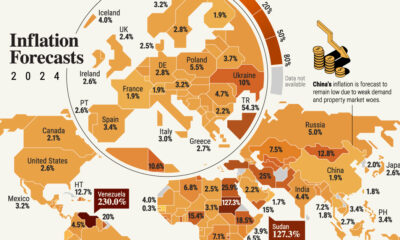

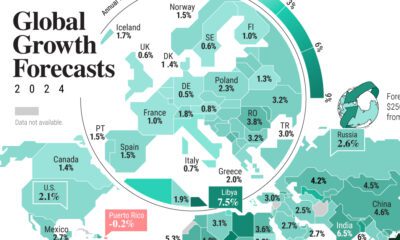

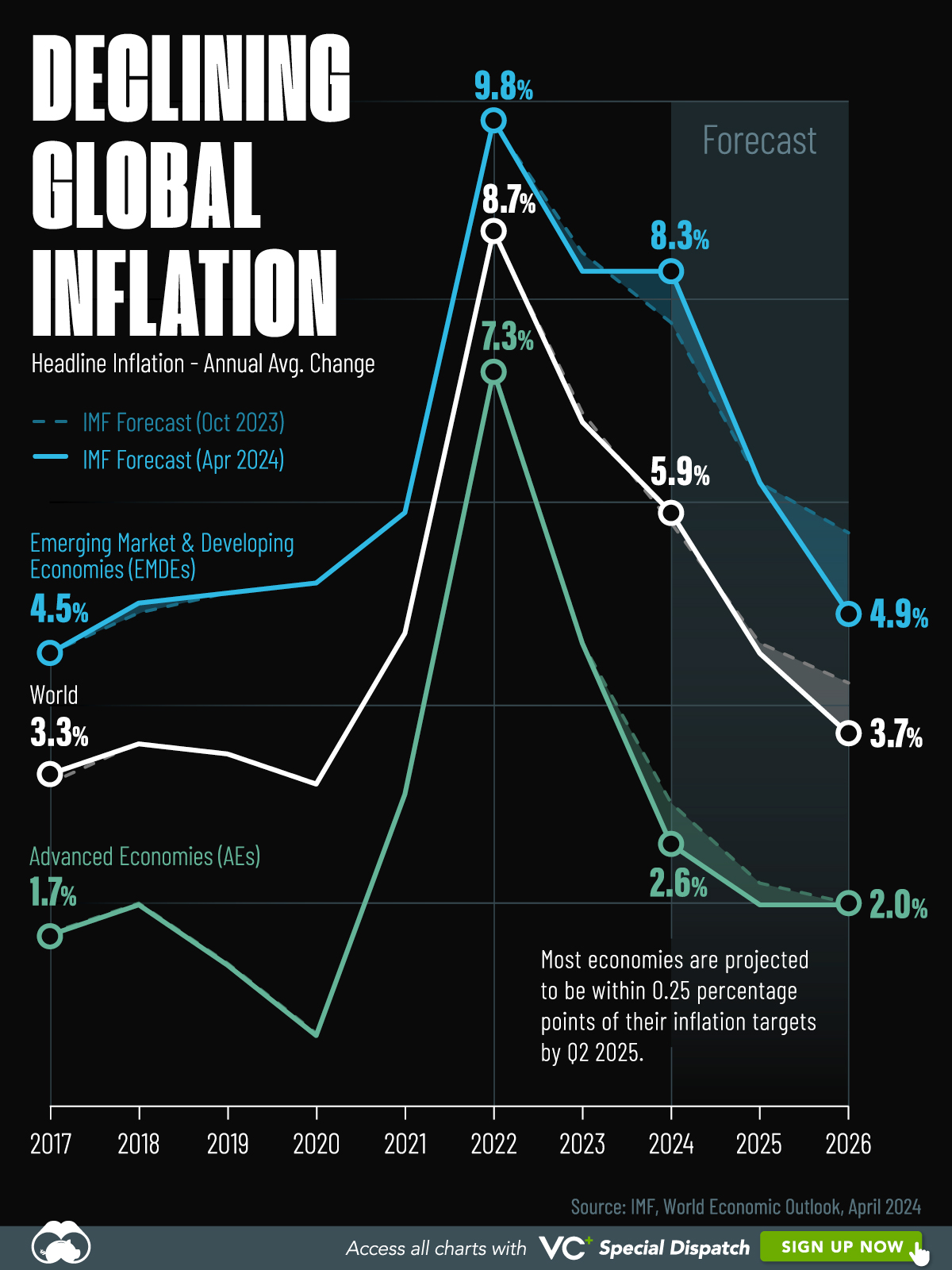

Visualizing Global Inflation Forecasts (2024-2026)

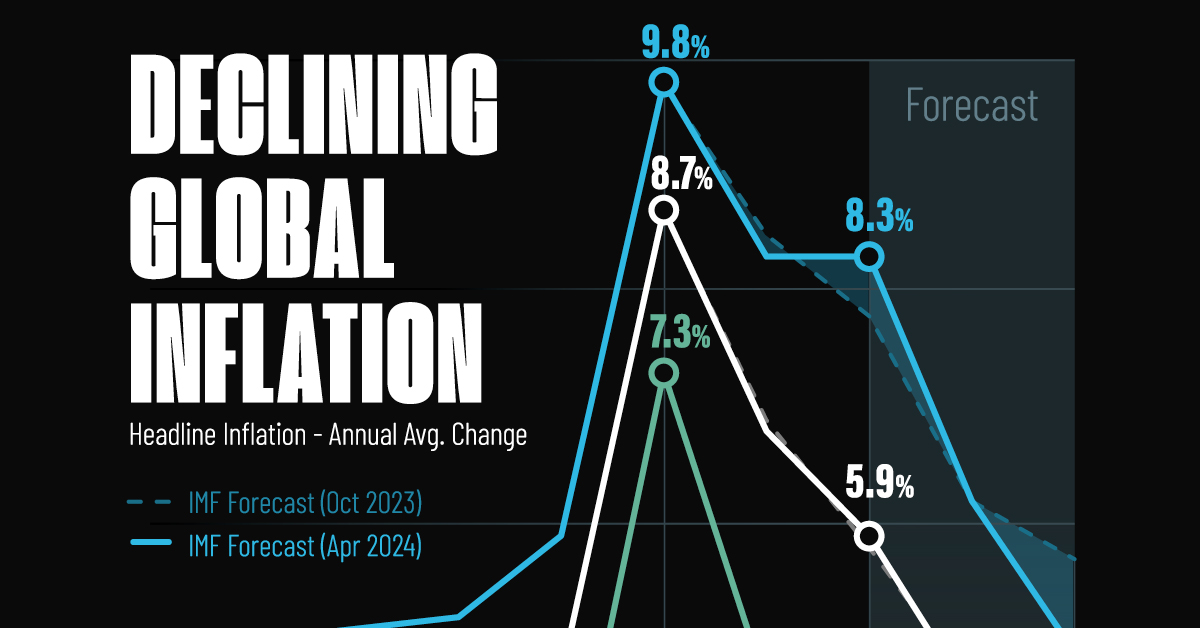

Here are IMF forecasts for global inflation rates up to 2026, highlighting a slow descent of price pressures amid resilient global growth.

Visualizing Global Inflation Forecasts (2024-2026)

Global inflation rates are gradually descending, but progress has been slow.

Today, the big question is if inflation will decline far enough to trigger easing monetary policy. So far, the Federal Reserve has held rates for nine months amid stronger than expected core inflation, which excludes volatile energy and food prices.

Yet looking further ahead, inflation forecasts from the International Monetary Fund (IMF) suggest that inflation will decline as price pressures ease, but the path of disinflation is not without its unknown risks.

This graphic shows global inflation forecasts, based on data from the April 2024 IMF World Economic Outlook.

Get the Key Insights of the IMF’s World Economic Outlook

Want a visual breakdown of the insights from the IMF’s 2024 World Economic Outlook report?

This visual is part of a special dispatch of the key takeaways exclusively for VC+ members.

Get the full dispatch of charts by signing up to VC+.

The IMF’s Inflation Outlook

Below, we show the IMF’s latest projections for global inflation rates through to 2026:

| Year | Global Inflation Rate (%) | Advanced Economies Inflation Rate (%) | Emerging Market and Developing Economies Inflation Rate (%) |

|---|---|---|---|

| 2019 | 3.5 | 1.4 | 5.1 |

| 2020 | 3.2 | 0.7 | 5.2 |

| 2021 | 4.7 | 3.1 | 5.9 |

| 2022 | 8.7 | 7.3 | 9.8 |

| 2023 | 6.8 | 4.6 | 8.3 |

| 2024 | 5.9 | 2.6 | 8.3 |

| 2025 | 4.5 | 2.0 | 6.2 |

| 2026 | 3.7 | 2.0 | 4.9 |

After hitting a peak of 8.7% in 2022, global inflation is projected to fall to 5.9% in 2024, reflecting promising inflation trends amid resilient global growth.

While inflation has largely declined due to falling energy and goods prices, persistently high services inflation poses challenges to mitigating price pressures. In addition, the IMF highlights the potential risk of an escalating conflict in the Middle East, which could lead to energy price shocks and higher shipping costs.

These developments could negatively affect inflation scenarios and prompt central banks to adopt tighter monetary policies. Overall, by 2026, global inflation is anticipated to decline to 3.7%—still notably above the 2% target set by several major economies.

Adding to this, we can see divergences in the path of inflation between advanced and emerging economies. While affluent nations are forecast to see inflation edge closer to the 2% target by 2026, emerging economies are projected to have inflation rates reach 4.9%—falling closer to their pre-pandemic averages.

Get the Full Analysis of the IMF’s Outlook on VC+

This visual is part of an exclusive special dispatch for VC+ members which breaks down the key takeaways from the IMF’s 2024 World Economic Outlook.

For the full set of charts and analysis, sign up for VC+.

-

Markets6 days ago

Markets6 days agoThe Best U.S. Companies to Work for According to LinkedIn

-

VC+2 weeks ago

VC+2 weeks agoVC+: Get Our Key Takeaways From the IMF’s World Economic Outlook

-

Demographics2 weeks ago

Demographics2 weeks agoThe Countries That Have Become Sadder Since 2010

-

Money2 weeks ago

Money2 weeks agoCharted: Who Has Savings in This Economy?

-

Technology2 weeks ago

Technology2 weeks agoVisualizing AI Patents by Country

-

Economy2 weeks ago

Economy2 weeks agoEconomic Growth Forecasts for G7 and BRICS Countries in 2024

-

Wealth1 week ago

Wealth1 week agoCharted: Which City Has the Most Billionaires in 2024?

-

Technology1 week ago

Technology1 week agoAll of the Grants Given by the U.S. CHIPS Act