Green

Visualizing the Global Rise of Sustainable Investing

No matter where you look, climate change is at the centre of every conversation.

With a wide range of global sustainability challenges and complex risks on the rise, investors are starting to re-evaluate traditional portfolio approaches.

The ESG Boom

Today, many investors want their money to align with a higher purpose beyond profit. This infographic from iShares unpacks the prolific rise of sustainable investing, and how its trillion-dollar potential is sweeping across the world.

What is Sustainable Investing?

Sustainable investing considers environmental, social, and governance (ESG) factors that create a lasting, positive impact on the world. As the term ‘ESG’ suggests, its scope goes well beyond environmental concerns alone. Examples include:

- Environmental: Climate risks, resource scarcity, and clean energy

- Social: Diversity, human rights, and cybersecurity

- Governance: Business ethics, transparency, and anti-corruption

Simply put, it’s a force for good.

Although sustainable investing emerged in the 1970s, the movement has gained impressive traction in the last few years.

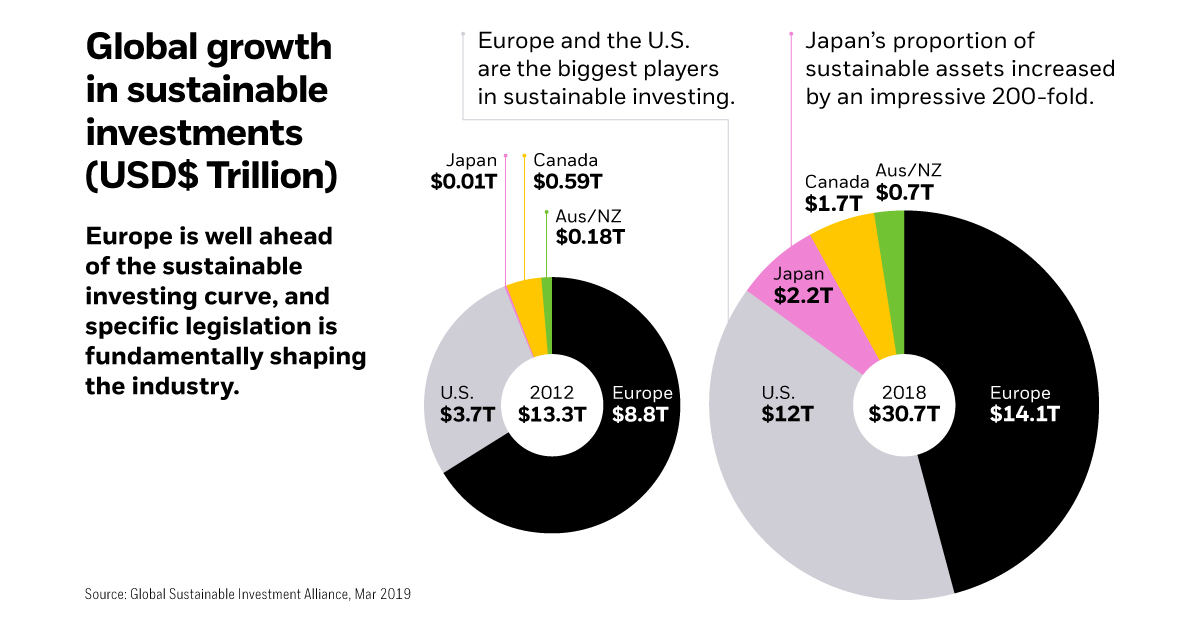

How Global Assets are Growing

Since 2012, total assets in sustainable investing have more than doubled:

| Region | 2012 Assets | 2018 Assets |

|---|---|---|

| Europe | $8.8 trillion | $14.1 trillion |

| U.S. | $3.7 trillion | $12.0 trillion |

| Japan | $0.01 trillion | $2.2 trillion |

| Canada | $0.59 trillion | $1.7 trillion |

| Australia and New Zealand | $0.18 trillion | $0.7 trillion |

| Total | $13.3 trillion | $30.7 trillion |

The U.S. and Europe are major players in this shift. In particular, specific legislation across European countries will continue driving ESG investment for years to come.

The European ESG Landscape

Across major economies in Europe, cultural shifts and new regulations are shaping the landscape of sustainable investing.

- The UK has an ambitious net-zero greenhouse gas emissions target by 2050.

Result: Most sectors will significantly ramp up their decarbonisation efforts to meet this goal. - As per France’s Article 173 (Energy Transition Law), investors must explain how they incorporate ESG factors into their investment strategies.

Result: A majority of French institutional investors now manage their assets with ESG criteria in mind. - Nordic countries consider sustainability and social responsibility a cornerstone of their cultural mindset.

Result: Nordic investors are increasingly integrating all three ESG aspects into their investments.

If Europe’s trajectory is any indication, sustainable investing will soon become second nature in other parts of the world too.

No Industry is Untouched

The rise of sustainable investing is a global phenomenon, and reaches a myriad of industries.

Here is a summary of just a few ESG efforts of some of the world’s most sustainable corporations:

| Company | Industry | Country | ESG Efforts |

|---|---|---|---|

| Chr. Hansen A/S | Bioscience | 🇩🇰 Denmark | • 100% green operations commitment by Apr 2020 • 82% of revenue directly supports UN Global Goals |

| Autodesk | Software | 🇺🇸 U.S. | • 100% renewable energy-run cloud services and offices • 44% women on the Board |

| Banco do Brazil | Finance | 🇧🇷 Brazil | • $51 billion earmarked for green economy spending • 99% adherence to Code of Ethics and Conduct Standards |

| City Developments Ltd | Real Estate | 🇸🇬 Singapore | • S$100 million fully-allocated Green Bond • 59% carbon emissions reduction target by 2030 |

The business world agrees: sustainable investing is smart investing.

How Can Investors Think Sustainably?

Many investment products allow investors to easily access sustainable investing, such as exchange-traded funds (ETFs) and index funds. These provide complete transparency—allowing investors to align their approach with the objectives that matter most to them.

Investors are able to:

- Screen out companies involved in controversial businesses

- Invest in companies with high ESG standards

- Advocate for specific issues like climate change

Not only this, but sustainable investing also has the potential to improve portfolio returns. In a 2015 paper covering ESG investing since the 1970s, 90% of ESG investing matched or overperformed traditional approaches.

The Bottom Line

Investors see a triple bottom line from sustainable investing: strong financial returns, and a lasting impact on both people and the planet.

As sustainable investing goes mainstream, it won’t simply act as a niche in a broader strategy—instead, it’ll be naturally integrated throughout a portfolio.

“With the impact of sustainability on investment returns increasing, we believe that sustainable investing is the strongest foundation for client portfolios going forward.

—Larry Fink, BlackRock Chairman and CEO

Sustainability is a global force that will continue to factor into everyday decisions.

Soon, sustainable investing will simply be considered “investing”.

Green

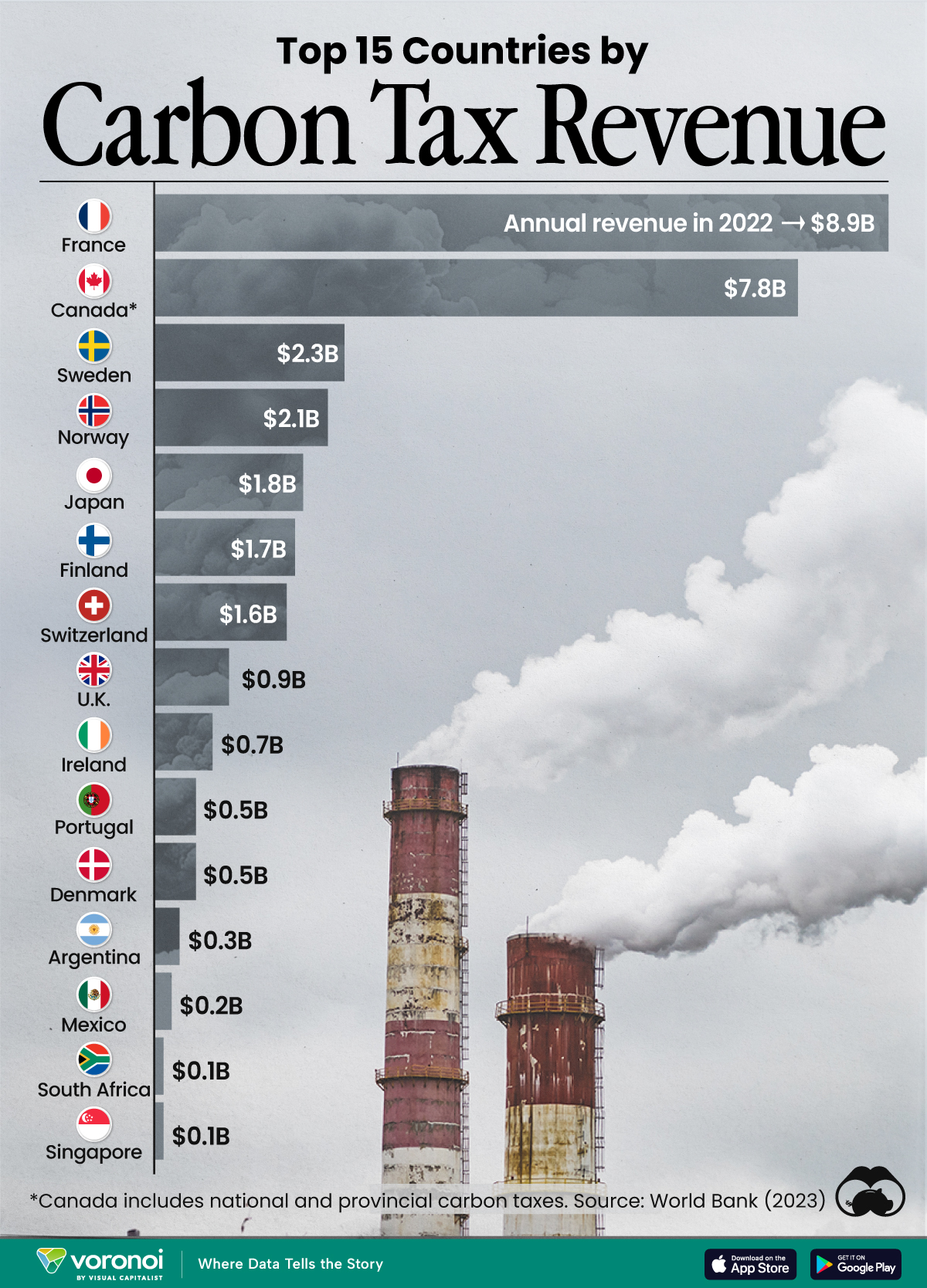

Ranking the Top 15 Countries by Carbon Tax Revenue

This graphic highlights France and Canada as the global leaders when it comes to generating carbon tax revenue.

Top 15 Countries by Carbon Tax Revenue

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Carbon taxes are designed to discourage CO2 emissions by increasing the cost of carbon-intensive activities and incentivizing the adoption of cleaner energy alternatives.

In this graphic we list the top 15 countries by carbon tax revenue as of 2022. The data is from the World Bank’s State and Trends of Carbon Pricing Report, published in April 2023.

France and Canada Lead in Global Carbon Tax Revenue

In 2022, the top 15 countries generated approximately $30 billion in revenue from carbon taxes.

France and Canada lead in this regard, accounting for over half of the total amount. Both countries have implemented comprehensive carbon pricing systems that cover a wide range of sectors, including transportation and industry, and they have set relatively high carbon tax rates.

| Country | Government revenue in 2022 ($ billions) |

|---|---|

| 🇫🇷 France | $8.9 |

| 🇨🇦 Canada | $7.8 |

| 🇸🇪 Sweden | $2.3 |

| 🇳🇴 Norway | $2.1 |

| 🇯🇵 Japan | $1.8 |

| 🇫🇮 Finland | $1.7 |

| 🇨🇭 Switzerland | $1.6 |

| 🇬🇧 United Kingdom | $0.9 |

| 🇮🇪 Ireland | $0.7 |

| 🇩🇰 Denmark | $0.5 |

| 🇵🇹 Portugal | $0.5 |

| 🇦🇷 Argentina | $0.3 |

| 🇲🇽 Mexico | $0.2 |

| 🇸🇬 Singapore | $0.1 |

| 🇿🇦 South Africa | $0.1 |

In Canada, the total carbon tax revenue includes both national and provincial taxes.

While carbon pricing has been recognized internationally as one of the more efficient mechanisms for reducing CO2 emissions, research is divided over what the global average carbon price should be to achieve the goals of the Paris Climate Agreement, which aims to limit global warming to 1.5–2°C by 2100 relative to pre-industrial levels.

A recent study has shown that carbon pricing must be supported by other policy measures and innovations. According to a report from Queen’s University, there is no feasible carbon pricing scenario that is high enough to limit emissions sufficiently to achieve anything below 2.4°C warming on its own.

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Travel1 week ago

Travel1 week agoRanked: The World’s Top Flight Routes, by Revenue

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024