Misc

The 100 Tallest Buildings in New York City

The 100 Tallest Buildings in New York City

If you go to the Big Apple, the city’s signature skyline can make quite an impression.

The fact is, New York City has over 6,000 high-rise buildings in total, 274 of which are skyscrapers standing over 492 ft (150 m) tall. It’s an impressive portfolio of real estate, putting NYC as the number two destination globally for such towers, only behind Hong Kong.

But while some of the buildings have dominated the skyline seemingly forever, it’s also a landscape that is changing fast. New projects coming online will be among the city’s tallest, and they will dramatically alter any view of Midtown of Lower Manhattan for future onlookers.

A List of NYC’s Tallest Buildings

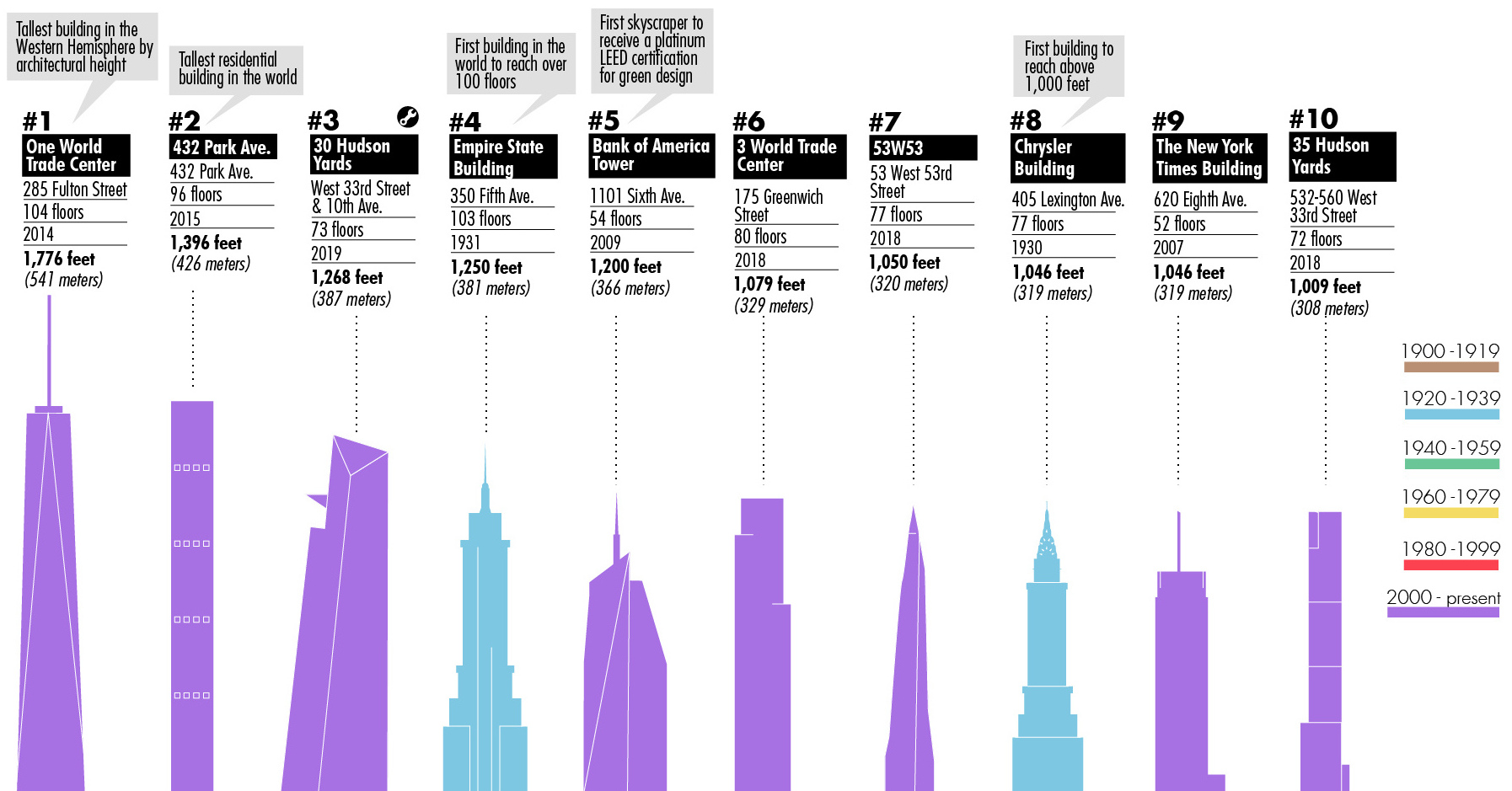

Today’s infographic comes to us from Liberty Cruise, and it shows the tallest buildings in New York City.

Here are the individual profiles of the current top ten:

| Rank | Building Name | Height | Completion Date |

|---|---|---|---|

| #1 | One World Trade Center | 1,776 feet (541 m) | 2014 |

| #2 | 432 Park Avenue | 1,396 feet (426 m) | 2015 |

| #3 | 30 Hudson Yards | 1,268 feet (387 m) | 2019 |

| #4 | Empire State Building | 1,250 feet (381 m) | 1931 |

| #5 | Bank of America Tower | 1,200 feet (366 m) | 2009 |

| #6 | 3 World Trade Center | 1,079 feet (329 m) | 2018 |

| #7 | 53W53 | 1,050 feet (320 m) | 2018 |

| #8 | Chrysler Building | 1,046 feet (319 m) | 1930 |

| #9 | The New York Times Building | 1,046 feet (319 m) | 2007 |

| #10 | 35 Hudson Yards | 1,009 feet (308 m) | 2018 |

Two of the biggest skyscrapers, the Chrysler Building and the Empire State Building, were erected during the Great Depression and still crack the top ten list today.

The Chrysler Building was actually the first skyscraper ever to be built at a height exceeding 1,000 feet. Meanwhile, the Empire State building, which was finished one year later, was the “world’s tallest building” for nearly 40 years.

However, as you can see, the rest of the buildings on the top ten list are more recent builds. It’s a testament to how fast the skyline of New York City has changed even in the last decade.

Towers in the Pipeline

But that’s not all, because the skyscraper boom in NYC hasn’t ended yet. The following megatowers are closing in on completion, and will displace many at the top of the current list:

111 West 57th Street

This building is set to be operational in mid-2019, and it’s already very noticeable on the NYC skyline. With a height of 1,428 feet (435 m), it will be the “skinniest” skyscraper in the world when completed, with a width-to-height ratio of 1:23.

Central Park Tower

This building, which was designed by the same people who did the Burj Khalifa in Dubai, will be the tallest building in the country by roof-height when done in 2020. It will clock in at 1,550 feet (472 m), making it the most sky-high residential building in the world.

45 Broad Street

With a height of 1,200 feet (366 m), this new building in Lower Manhattan is expected to be completed by 2021. If it were finished today, it would tie the Bank of America Tower for the fifth spot on a list of tallest buildings in the city.

One Vanderbilt

This massive building will be the fourth tallest in the city when completed in 2021. Standing at 1,401 feet (427 m), it will have a highly anticipated observation deck set 1,000 feet above the ground.

Want to visualize more data about the Big Apple?

Check out this animation, which shows the population pulse of a Manhattan workday.

Misc

The Evolution of U.S. Beer Logos

In this graphic, we analyze the evolution of popular U.S. beer logos like Budweiser, Coors Light, Bud Light, and more.

The Evolution of U.S. Beer Logos

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Despite selling a popular product, beer companies have to be creative to stand out in a competitive market.

In this graphic, we analyze the evolution of some U.S. beer logos based on various sources. We chose brands based on a mixture of criteria, including popularity (based on YouGov surveys), availability of logo assets, and those with interesting developments.

Bud Light Back to the ’80s

Despite recent backlash and calls for a boycott after sending a commemorative can to transgender influencer Dylan Mulvaney, Bud Light remains one of America’s best-selling beers.

The brand of light beer, owned by the Anheuser-Busch company, has switched from its more circular logo with italic letters adopted in the 1990s back to the Bud Light badge of the 1980s. It is composed of heavy uppercase lettering, written in two levels in a shade of blue with the inscription placed on a solid white background and enclosed in a thin rectangular frame.

Miller Lite Goes Old School

After following a similar approach to Bud Light’s branding throughout the 2000s, Miller Lite decided to undergo a major rebranding in 2014.

The company returned to its 1970s roots, once again combining a white can with its original blue, gold, and red logo. The redesign was largely considered a success, given that Miller Lite sales immediately increased following the change.

A Symbol of American Brewing

The oldest brand on our U.S. beer list, the Budweiser logo, has undergone more than 15 changes over the years.

The design of two connected triangles represents a red bow tie, as a symbol of American brewing.

The colors of the Budweiser logo include a vibrant red, which helps the logo stand out and be easily recognizable from a distance. Studies also suggest that the color red stimulates appetite. Meanwhile, the white inscription symbolizes purity and cleanliness.

Curious to learn more about the beer market? Check out this graphic about global beer consumption.

-

Markets6 days ago

Markets6 days agoVisualized: Interest Rate Forecasts for Advanced Economies

-

Economy2 weeks ago

Economy2 weeks agoEconomic Growth Forecasts for G7 and BRICS Countries in 2024

-

Wealth2 weeks ago

Wealth2 weeks agoCharted: Which City Has the Most Billionaires in 2024?

-

Technology2 weeks ago

Technology2 weeks agoAll of the Grants Given by the U.S. CHIPS Act

-

Green2 weeks ago

Green2 weeks agoThe Carbon Footprint of Major Travel Methods

-

United States1 week ago

United States1 week agoVisualizing the Most Common Pets in the U.S.

-

Culture1 week ago

Culture1 week agoThe World’s Top Media Franchises by All-Time Revenue

-

voronoi1 week ago

voronoi1 week agoBest Visualizations of April on the Voronoi App