Cities

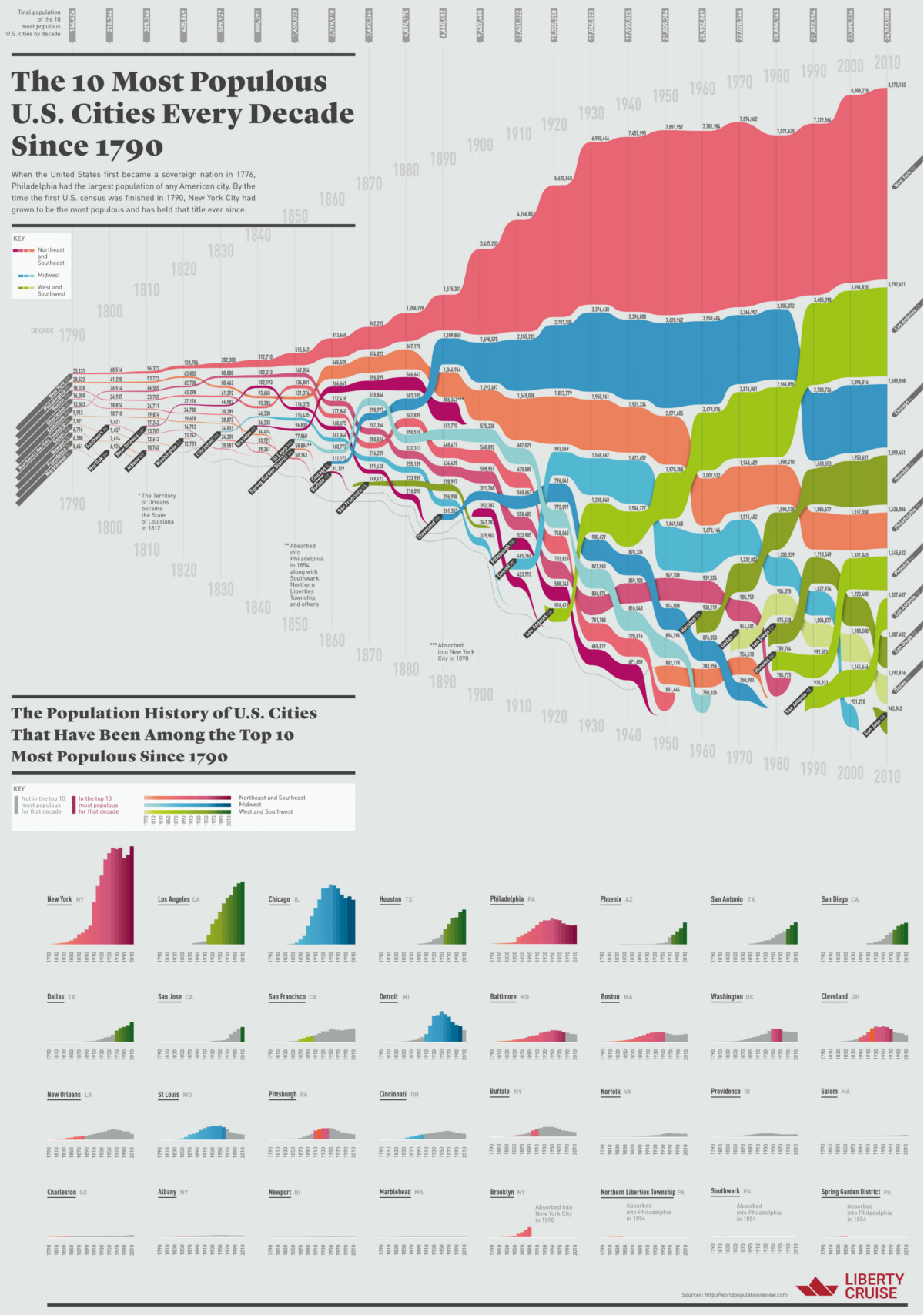

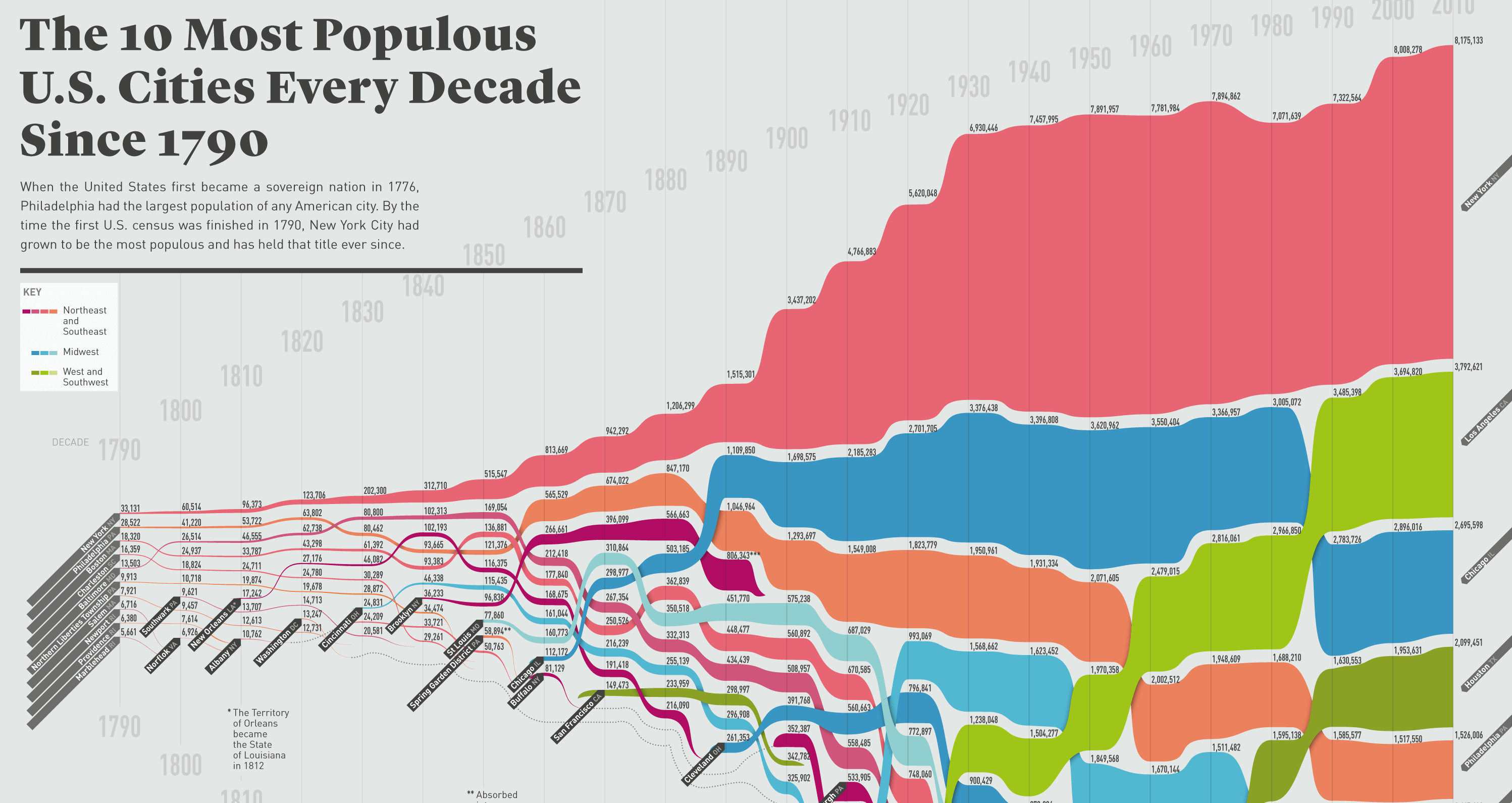

The 10 Most Populous U.S. Cities, Every Decade Since 1790

View the full-size version of this infographic

The 10 Most Populous U.S. Cities, Every Decade Since 1790

View the high resolution version of today’s infographic by clicking here

There are only two cities that have had the distinction of being named the most populous city in the United States.

The first city to hold the title was Philadelphia, as the City of Brotherly Love was estimated to be the biggest city in the country at the time of the signing of the Declaration of Independence.

However, by the time of the first U.S. Census in 1790, New York City had surpassed Philadelphia by a few thousand residents – and the Big Apple has stayed the largest in the country ever since.

From Then to Now

Today’s infographic comes to us from Liberty Cruise, and it ranks the 10 most populous cities in the United States for every decade since 1790.

To start, let’s take a look at what the list looked just after the first U.S. Census in 1790:

| Rank | City | Population (1790) |

|---|---|---|

| #1 | New York City, NY | 33,131 |

| #2 | Philadelphia, PA | 28,522 |

| #3 | Boston, MA | 18,320 |

| #4 | Charleston, SC | 16,359 |

| #5 | Baltimore, MD | 13,503 |

| #6 | Northern Liberties Township, PA | 9,913 |

| #7 | Salem, MA | 7,921 |

| #8 | Newport, RI | 6,716 |

| #9 | Providence, RI | 6,380 |

| #10 | Marblehead, MA | 5,661 |

It’s pretty surreal to think that some of the biggest cities in the late 18th century hosted no more than 6,000 residents.

It also may be a surprise to many that Rhode Island – a state that ranks 50th in size and 44th in population today – held two of the largest towns in the nation at the time: Newport and Providence.

The Modern List

Jump forward over 200 years, and New York City has not lost its top spot.

It helped that NYC was able to absorb Brooklyn – one of the country’s other largest cities – into its boundaries in 1898. Other major cities saw similar merges happen over the years, with Philadelphia absorbing Northern Liberties Township, for example.

Here is a list of the most populous U.S. cities in 2017 (est.):

| Rank | City | Population (Est. 2017) | Population (2010 Census) | Change |

|---|---|---|---|---|

| #1 | New York City, NY | 8,622,698 | 8,175,133 | +5.47% |

| #2 | Los Angeles, CA | 3,999,759 | 3,792,621 | +5.46% |

| #3 | Chicago, IL | 2,716,450 | 2,695,598 | +0.77% |

| #4 | Houston, TX | 2,312,717 | 2,100,263 | +10.12% |

| #5 | Phoenix, AZ | 1,626,078 | 1,445,632 | +12.48% |

| #6 | Philadelphia, PA | 1,580,863 | 1,526,006 | +3.59% |

| #7 | San Antonio, TX | 1,511,946 | 1,327,407 | +13.90% |

| #8 | San Diego, CA | 1,419,516 | 1,307,402 | +8.58% |

| #9 | Dallas TX | 1,341,075 | 1,197,816 | +11.96% |

| #10 | San Jose, CA | 1,035,317 | 945,942 | +9.45% |

In contrast to the NYC of today, the 1790 population looks more like a Long Island suburb.

This rapid urbanization is mainly thanks to Industrial Revolution, which triggered a massive migration to cities, allowing New York to grow 26,000% in total population.

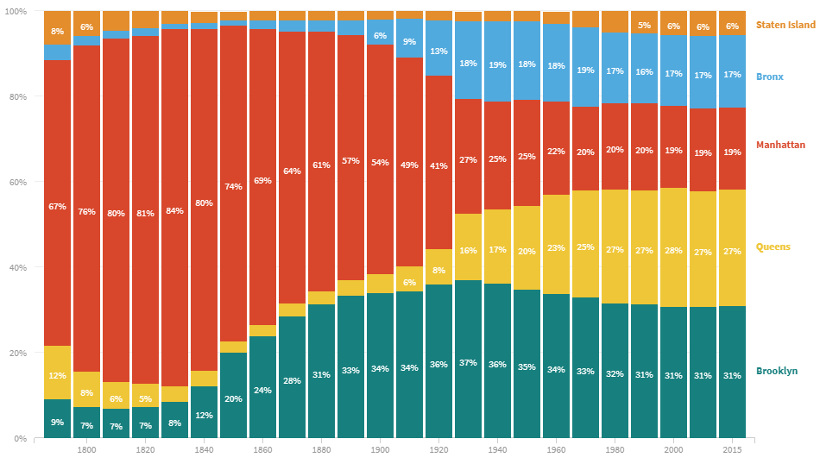

Here’s how the population distribution of New York City’s five boroughs has changed over time:

Interested in learning more about the country’s largest cities?

See the electrifying pulse of a Manhattan workday or view a 3d map that shows how much U.S. metro areas contribute to economic growth.

Markets

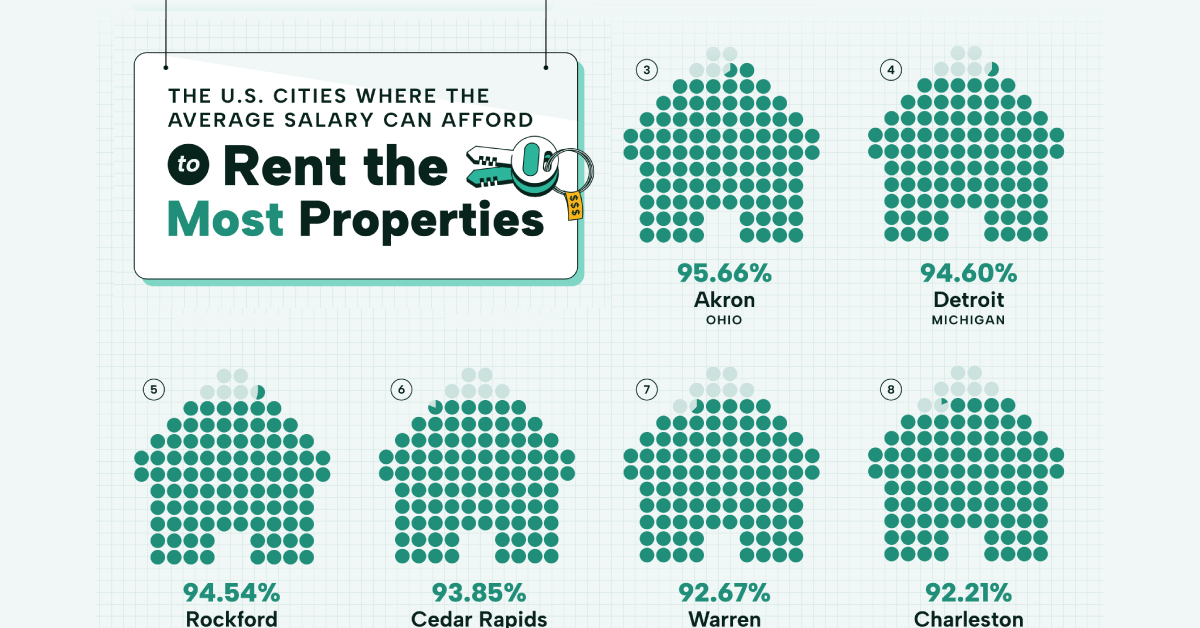

The Most Affordable U.S. Cities for Rent on an Average Salary

Visualizing the most affordable U.S. cities for renters by the percentage of affordable rentals available on an average salary.

The Most Affordable U.S. Cities for Rent on an Average Salary

In 2023, 34% of the 131 million households in the U.S. lived in rented homes.

But which U.S. cities are the most affordable to rent in? The question isn’t just about cost, but about the average salary in each city, and some cities in expensive-seeming states turn out to be relatively affordable.

To answer the question, CashNetUSA found rental price data (as of August 2023) from Zillow.com and compared it to city salary data to calculate the percentage of properties available to rent for 30% or less of the local average income.

Ranked: Most Affordable American Cities for Renters

Ranked first, nearly 97% of the available rentals in Hartford can be rented for an affordable rate, based on average income.

This might be a surprising statistic. Connecticut was the richest U.S. state (by per capita income) for nearly three decades till 2019, and has one of the highest costs of living in the U.S.

However, it’s important to note that this data deals with averages instead of medians. For example, according to data from the Bureau of Labor Statistics, the average hourly wage for a Hartford resident—across all occupations—is slightly more than $33/hour, or close to $70,000 a year. Its median wage is almost $8/hour lower, which comes in at $53,000 a year.

Richer residents, with higher incomes might be skewing the apparent affordability of available rentals.

Note: Data current as of August, 2023.

Toledo and Akron, ranked second and third, have similar rates of affordability, with 95% of their available rentals falling within 30% of the city’s average wage. In fact Ohio has the most number of cities in the top 20, with Waterbury ranked 17th.

Detroit and Rockford round out the top five most affordable cities in the U.S. for renters. Both cities have affordable housing markets, after the Great Recession caused the local economies to tank, in turn causing an increase in crime and decline in population. Post-pandemic, however, both cities are on the rebound with an influx of industries, jobs, and people.

Where Does This Data Come From?

Source: CashNetUSA

Methodology: CashNetUSA sourced the average base salary of U.S. cities focusing on the 100 most populated cities in the country, plus the five most populated cities from each state. Using Zillow.com, they then counted how many rental properties per city were listed at a monthly price equivalent to 30% or less of a city’s monthly gross salary. The number of rental properties available per city was converted into a percentage score per city. Data for this research is accurate as of August 2023.

-

Mining1 week ago

Mining1 week agoGold vs. S&P 500: Which Has Grown More Over Five Years?

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

Creator Program

Creator Program