Mining

The Yukon: Where Mineral Potential is Coming of Age

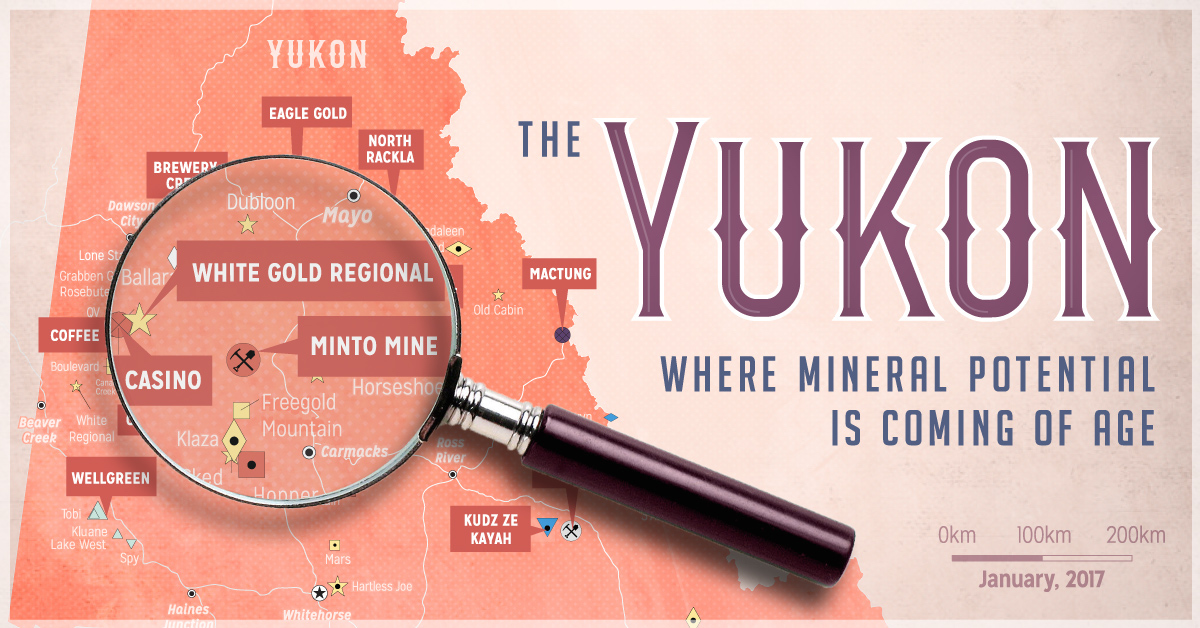

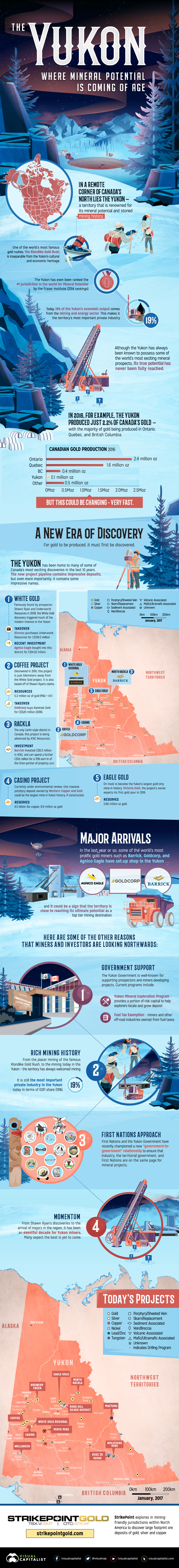

In a remote corner of Canada’s north lies the Yukon – a territory that is renowned for both its legendary mineral potential and its storied mining history.

But while the Yukon only produced 2.2% of Canada’s gold in 2016, the territory’s considerable potential may finally be getting realized in a big way. In the last few years, globally significant discoveries have been made, and now mining giants such as Barrick, Goldcorp, and Agnico Eagle are making their move into the Yukon to get in on the action.

A Coming of Age Story

Today’s infographic comes from Strikepoint Gold, and it showcases some of the reasons on why the most important chapter in the Yukon’s mining story may just be beginning.

Although the Yukon has been known to possess incredible mineral potential for a long time, it is only in the last few years that signs have been pointing towards this being realized in the form of globally significant discoveries, investment from major players, and mines being built.

A New Era in the Yukon

For gold to be produced, it must first be discovered.

The Yukon has been home to many of some of Canada’s most exciting discoveries in the last 10 years. The new project pipeline contains impressive deposits, but even more importantly – it contains some impressive names.

White Gold

Famously found by prospector Shawn Ryan and Underworld Resources in 2008, the White Gold discovery triggered much of the modern interest in the Yukon. Kinross purchased Underworld Resources for C$139.2 million at the height of the gold market. More recently, major Agnico Eagle has bought into the district for C$14.52 million.

Coffee Project

Discovered in 2010, this project is just kilometers away from the White Gold project. It too is based off of Shawn Ryan’s claims. Most recently, Goldcorp bought the project for C$520 million through its acquisition of Kaminak Gold. It currently has 5.2 million oz of gold (M&I + Inf.) in resources.

Casino Project

Currently under environmental review, this massive porphyry deposit owned by Western Copper and Gold could be the largest mine in Yukon history, if constructed. Right now, the deposit has reserves of 4.5 billion lbs of copper, and 8.9 million oz of gold.

Rackla

The only Carlin-style district in Canada, this project is being advanced by ATAC Resources. Recently, ATAC Resources generated headlines with an investment from major Barrick Gold, who put in C$8.3 million while also committing up to a further C$55 million to earn-in 70% of the property’s Orion project.

Eagle Gold

Eagle Gold is on track to become the Yukon’s largest gold-only mine in history. Victoria Gold, the project’s owner, expects its first gold pour in 2019. Currently the mine has 2.66 million oz of gold in reserves.

Major Arrivals

In the last year or so, some of the world’s most prolific gold miners such as Barrick, Goldcorp, and Agnico Eagle have set up shop in the Yukon – and it could be a sign that the territory is close to reaching its ultimate potential as a top tier mining destination.

Here are some of the other reasons that miners and investors are looking northwards:

1. Government Support

The Yukon Government is well-known for supporting prospectors and miners developing projects. Current programs include the Yukon Mineral Exploration Program, which provides a portion of risk capital to help explorers locate and grow deposits, as well as the Fuel Tax Exemption, which makes miners and other off-road industries exempt from fuel taxes.

2. A Rich Mining History

From the placer mining of the famous Klondike Gold Rush, to the mining today in the Yukon – the territory has always welcomed mining. In fact, mining is still the most important private industry today in the Yukon by GDP share (19%).

3. First Nations Approach

First Nations and the Yukon Government have recently championed a new “government-to-government” relationship to ensure that industry, the territorial government, and First Nations are on the same page for mineral projects.

4. Momentum

From Shawn Ryan’s discoveries to the arrival of majors in the region, it has been an eventful decade for Yukon miners. Many expect the best is yet to come.

Lithium

Ranked: The Top 10 EV Battery Manufacturers in 2023

Asia dominates this ranking of the world’s largest EV battery manufacturers in 2023.

The Top 10 EV Battery Manufacturers in 2023

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Despite efforts from the U.S. and EU to secure local domestic supply, all major EV battery manufacturers remain based in Asia.

In this graphic we rank the top 10 EV battery manufacturers by total battery deployment (measured in megawatt-hours) in 2023. The data is from EV Volumes.

Chinese Dominance

Contemporary Amperex Technology Co. Limited (CATL) has swiftly risen in less than a decade to claim the title of the largest global battery group.

The Chinese company now has a 34% share of the market and supplies batteries to a range of made-in-China vehicles, including the Tesla Model Y, SAIC’s MG4/Mulan, and various Li Auto models.

| Company | Country | 2023 Production (megawatt-hour) | Share of Total Production |

|---|---|---|---|

| CATL | 🇨🇳 China | 242,700 | 34% |

| BYD | 🇨🇳 China | 115,917 | 16% |

| LG Energy Solution | 🇰🇷 Korea | 108,487 | 15% |

| Panasonic | 🇯🇵 Japan | 56,560 | 8% |

| SK On | 🇰🇷 Korea | 40,711 | 6% |

| Samsung SDI | 🇰🇷 Korea | 35,703 | 5% |

| CALB | 🇨🇳 China | 23,493 | 3% |

| Farasis Energy | 🇨🇳 China | 16,527 | 2% |

| Envision AESC | 🇨🇳 China | 8,342 | 1% |

| Sunwoda | 🇨🇳 China | 6,979 | 1% |

| Other | - | 56,040 | 8% |

In 2023, BYD surpassed LG Energy Solution to claim second place. This was driven by demand from its own models and growth in third-party deals, including providing batteries for the made-in-Germany Tesla Model Y, Toyota bZ3, Changan UNI-V, Venucia V-Online, as well as several Haval and FAW models.

The top three battery makers (CATL, BYD, LG) collectively account for two-thirds (66%) of total battery deployment.

Once a leader in the EV battery business, Panasonic now holds the fourth position with an 8% market share, down from 9% last year. With its main client, Tesla, now sourcing batteries from multiple suppliers, the Japanese battery maker seems to be losing its competitive edge in the industry.

Overall, the global EV battery market size is projected to grow from $49 billion in 2022 to $98 billion by 2029, according to Fortune Business Insights.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees