Money

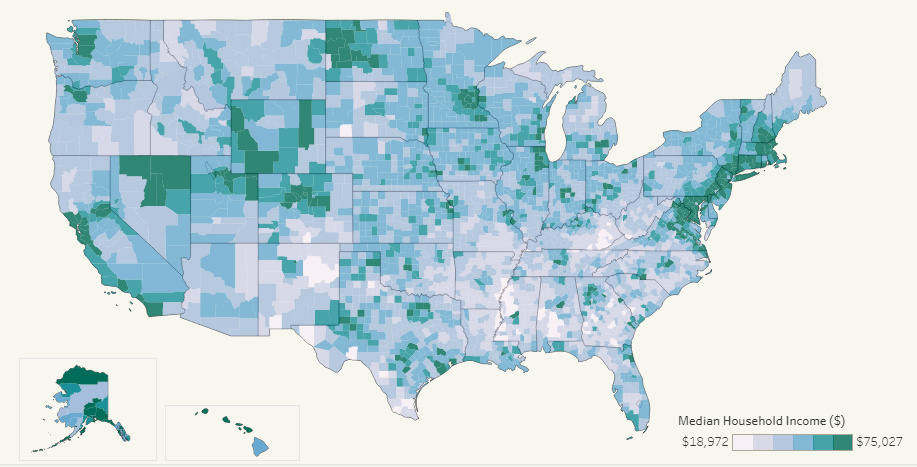

Interactive: U.S. Counties by Household Income

Interactive: U.S. Counties by Household Income

With over 3,000 counties in the United States, variance is to be expected.

Geographically speaking, for example, there a wide spectrum of differences between counties. Some are situated in gorgeous mountain settings, while others may be almost entirely flat. There are urban counties that are major population centers, and others that don’t have a skyscraper within 500 miles of them.

Just like with geography, individual counties can also be quite unique when it comes to looking at socioeconomic measurements, such as median household income.

Median Income by County

Today’s interactive infographic comes to us from Overflow Data, and it helps give a sense of the household income spectrum by visualizing data from all U.S. counties.

Some counties, like Loudoun County (Virginia) have sky-high median incomes – in this case, $125,672 per household.

Meanwhile, other places are stuck in much rougher circumstances. For example, just a few hundred miles away is McDowell County (West Virginia), which has a median household income of $25,206.

Highs and Lows

The level of wealth found in a particular county is dependent on a large quantity of factors, including nearby industries, natural resources, demographics, tax rates, education, and available jobs and careers.

As you can see on the map, the most common range for median household income is from $45,000 to $70,000. Simultaneously, however, there are outliers that fall way outside that range for various reasons.

Highest Median Incomes

Here are the five counties with the highest median household incomes in the U.S.:

| Rank | County | Median household income | Population |

|---|---|---|---|

| #1 | Loudoun, Virginia | $125,672 | 362,435 |

| #2 | Fairfax, Virginia | $114,329 | 1,132,887 |

| #3 | Howard, Maryland | $113,800 | 308,447 |

| #4 | Arlington, Virginia | $108,706 | 226,092 |

| #5 | Hunterdon, NJ | $108,177 | 125,708 |

Not surprisingly, four of these five counties are clustered around Washington, D.C., and the other is just over an hour away from Manhattan.

Lowest Median Incomes

Finally, here are the five counties with the lowest median incomes in the country:

| Rank | County | Median household income | Population |

|---|---|---|---|

| #1 | McCreary, Kentucky | $18,972 | 17,850 |

| #2 | Sumter, Alabama | $20,428 | 13,285 |

| #3 | Holmes, Mississippi | $20,800 | 18,547 |

| #4 | Stewart, Georgia | $20,882 | 5,791 |

| #5 | Lee, Kentucky | $21,185 | 6,896 |

All of these are located in the Southeast, although just missing the top five was Mora County in New Mexico ($21,190). As you can see by the population numbers, these are all very rural places as well.

Want to see more on median household income? See it visualized at the state level.

Wealth

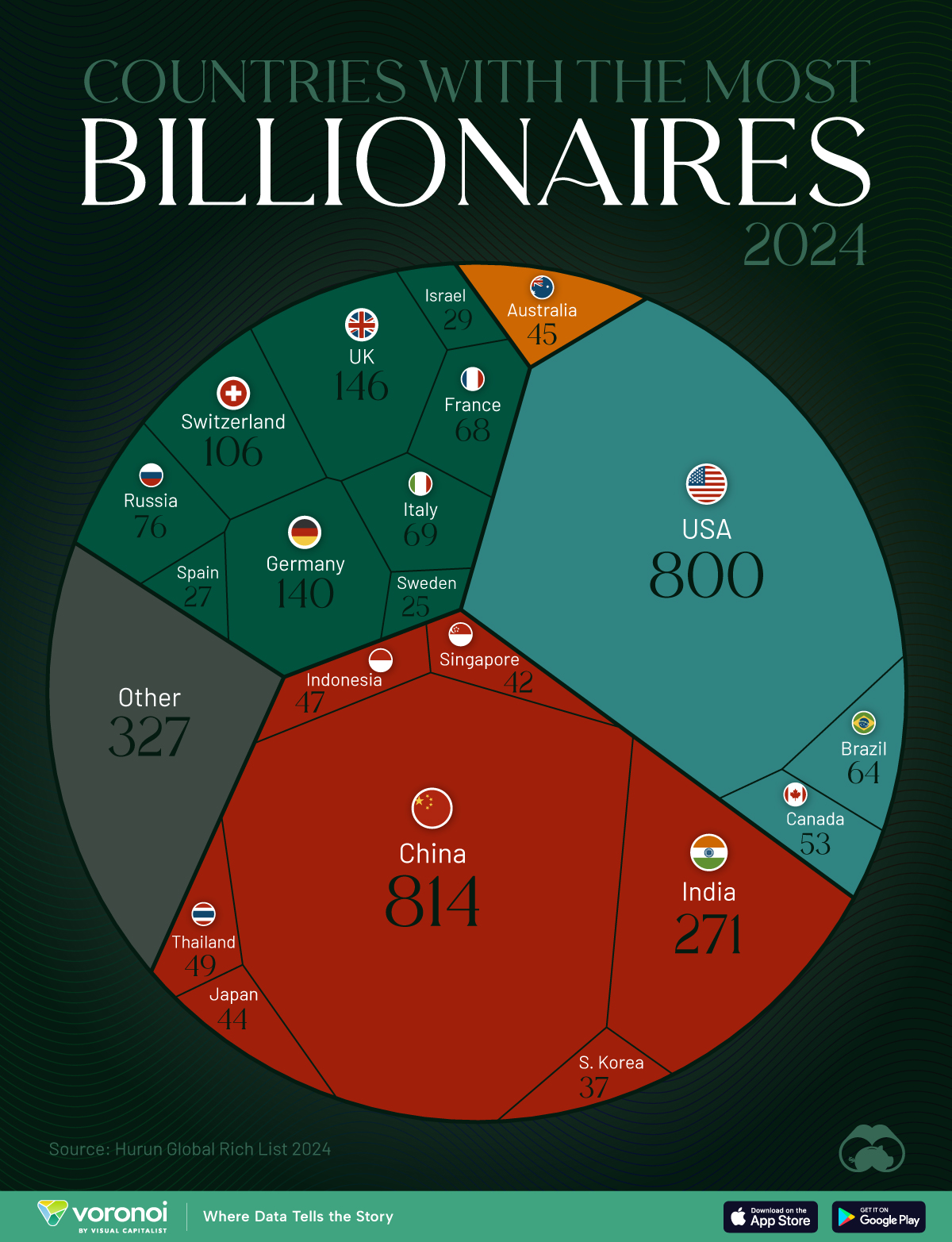

Charted: Which Country Has the Most Billionaires in 2024?

According to the annual Hurun Global Rich List, the U.S. and China are home to nearly half of the world’s 3,279 billionaires in 2024.

Charted: Which Country Has the Most Billionaires in 2024?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

The world has always had people with incredible wealth: from Roman emperors to John D. Rockefeller who became the world’s first billionaire in measurable dollars. But where do the very wealthiest people live right now?

We visualize the countries with the most billionaires in 2024, sourced from the annual Hurun Global Rich list. A country and city aggregate is also available here.

A caveat to this data. Total wealth estimates are notoriously difficult to get right, and different sources can vary in their billionaire data. For example, Forbes, switches ranks for the U.S. and China, though the overall top three remain the same.

Forbes also has Bernard Arnault as the current richest individual, while Hurun places Elon Musk atop the ranks. Nevertheless, their overall top 10 is similar with a few ranking differences.

Ranked: Countries with the Most Billionaires in 2024

China has 814 billionaires, the most in the world, according to the Hurun Global Rich List 2024. Despite holding on to the top spot, China lost 155 billionaires year-over-year, while the U.S. gained 109. The gap between the two countries has now reduced to just 14 billionaires.

| Rank | Country | Billionaires | Change YoY |

|---|---|---|---|

| 1 | 🇨🇳 China | 814 | -155 |

| 2 | 🇺🇸 U.S. | 800 | +109 |

| 3 | 🇮🇳 India | 271 | +84 |

| 4 | 🇬🇧 UK | 146 | +12 |

| 5 | 🇩🇪 Germany | 140 | -4 |

| 6 | 🇨🇭 Switzerland | 106 | +6 |

| 7 | 🇷🇺 Russia | 76 | +6 |

| 8 | 🇮🇹 Italy | 69 | +11 |

| 9 | 🇫🇷 France | 68 | -4 |

| 10 | 🇧🇷 Brazil | 64 | +13 |

| 11 | 🇨🇦 Canada | 53 | +8 |

| 12 | 🇹🇭 Thailand | 49 | +3 |

| 13 | 🇮🇩 Indonesia | 47 | +12 |

| 14 | 🇦🇺 Australia | 45 | 0 |

| 15 | 🇯🇵 Japan | 44 | +12 |

| 16 | 🇸🇬 Singapore | 42 | +5 |

| 17 | 🇰🇷 South Korea | 37 | +4 |

| 18 | 🇮🇱 Israel | 29 | +9 |

| 19 | 🇪🇸 Spain | 27 | +1 |

| 20 | 🇸🇪 Sweden | 25 | -2 |

| N/A | 🌍 Other | 327 | N/A |

Together, the U.S. and China account for nearly half of the 3,279 billionaires globally, leagues ahead of closest peers, #3 India (271) and #4 UK (146).

Collectively however, European countries account for six of the top 10 and eight of the top 20 countries with the most billionaires.

Naturally, the world’s largest economies tend to be overrepresented on billionaire counts, as they provide more opportunities for wealth creation.

Switzerland, Singapore, and Sweden are outliers in this regard, with only one of them making the top 20 economies by total gross domestic product.

All three countries are perceived to have high tax rates, generally not conducive to amassing wealth. But perceptions can be misleading. Sweden, for example, has no inheritance tax, a flat rate on capital gains, and a corporate tax rate at 21%.

-

Lithium7 days ago

Lithium7 days agoRanked: The Top 10 EV Battery Manufacturers in 2023

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023

-

Green2 weeks ago

Green2 weeks agoRanking the Top 15 Countries by Carbon Tax Revenue

-

Markets2 weeks ago

Markets2 weeks agoU.S. Debt Interest Payments Reach $1 Trillion

-

Mining2 weeks ago

Mining2 weeks agoGold vs. S&P 500: Which Has Grown More Over Five Years?