Technology

There’s Big Money to Be Made in Asteroid Mining

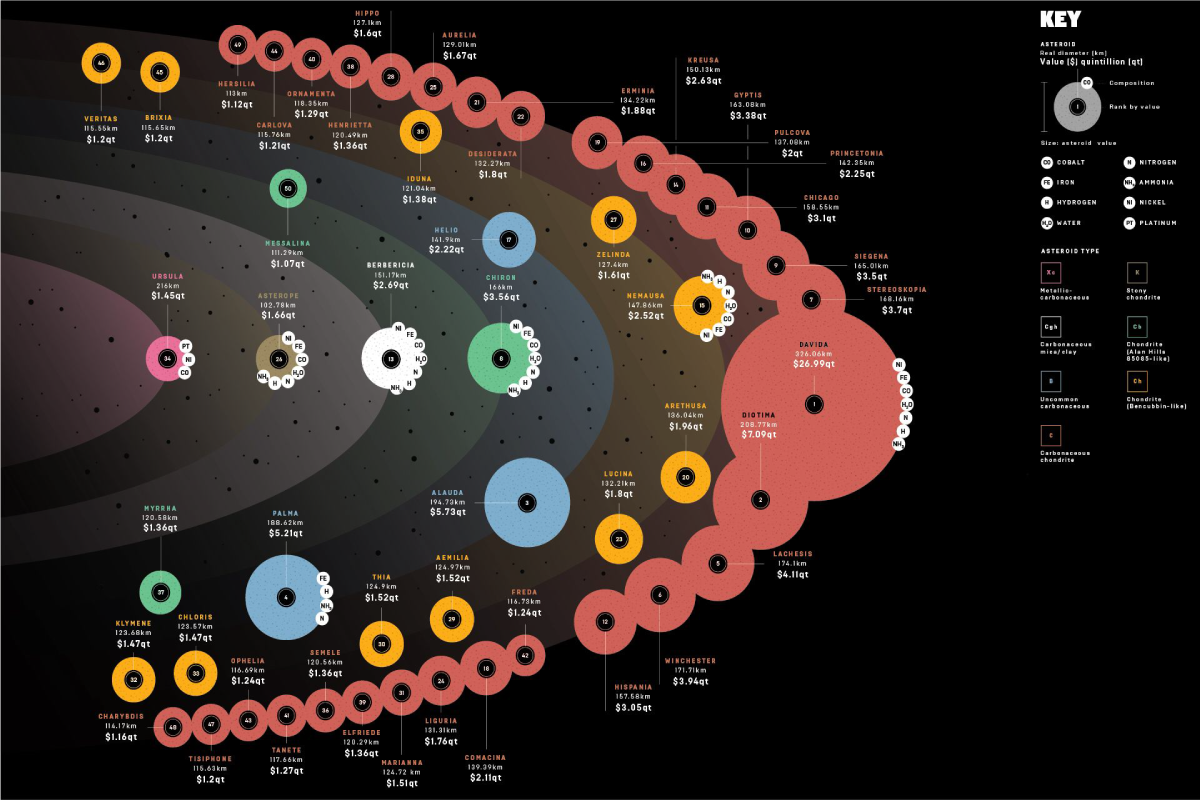

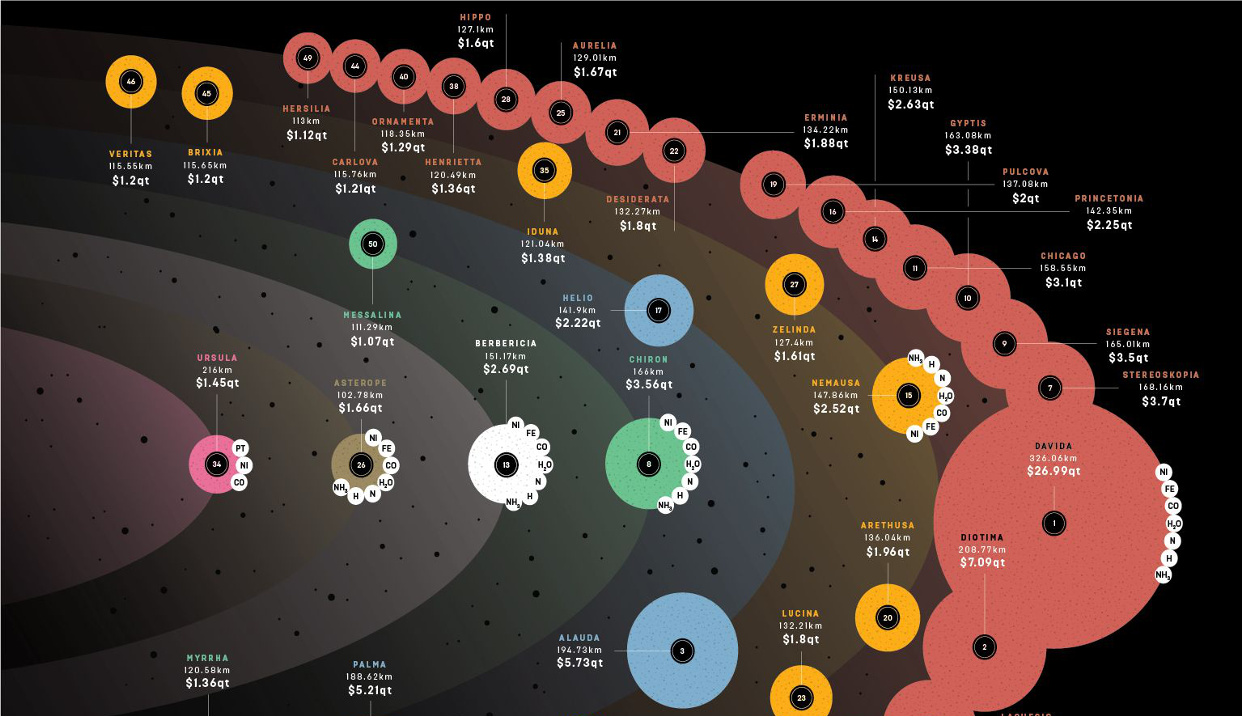

Click below to expand to the full version of the infographic

Image courtesy of: Wired

There’s Big Money to Be Made in Asteroid Mining

See the full version of the infographic.

If humans were ever able to get their hands on just one asteroid, it would be a game-changer.

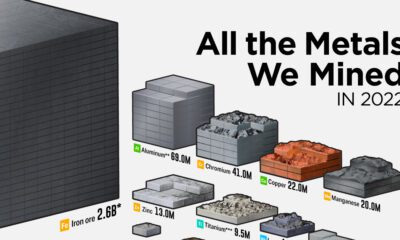

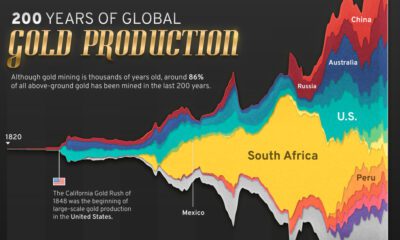

That’s because the value of many asteroids are measured in the quintillions of dollars, which makes the market for Earth’s annual production of raw metals – about $660 billion per year – look paltry in comparison.

The reality is that the Earth’s crust is saddled with uneconomic materials, while certain types of asteroids are almost pure metal. X-type asteroids, for example, are thought to be the remnants of large asteroids that were pulverized in collisions in which their dense, metallic cores got separated from the mantle.

There is one such X-type asteroid near earth that is believed to hold more platinum than ever mined in human history.

Near-Earth Mining Targets

Asteroid mining companies such as Planetary Resources and Deep Space Industries are the first-movers in the sector, and they’ve already started to identify prospective targets to boldly mine where no man has mined before.

Both companies are looking specifically at near-Earth asteroids in the near-term, which are the easiest ones to get to. So far, roughly 15,000 such objects have been discovered, and their orbits all come in close proximity to Earth.

Planetary Resources has identified eight of these as potential targets and has listed them publicly, while Deep Space Industries has claimed to have “half a dozen very, very attractive targets”.

While these will be important for verifying the feasibility of asteroid mining, the reality is that near-Earth asteroids are just tiny minnows in an ocean of big fish. Their main advantage is that they are relatively easy to access, but most targets identified so far are less than 1,000 ft (300 m) in diameter – meaning the potential economic payoff of a mission is still unclear.

Where the Money is Made

The exciting part of asteroid mining is the asteroid belt itself, which lies between Mars and Jupiter. It is there that over 1 million asteroids exist, including about 200 that are over 60 miles (100 km) in diameter.

NASA estimates this belt to hold $700 quintillion of bounty. That’s about $100 billion for each person on Earth.

There are obviously many technical challenges that must be overcome to make mining these possible. As it stands, NASA aims to bring back a grab sample from the surface of asteroid Bennu that is 2 and 70 ounces (about 60 to 2,000 grams) in size. The cost of the mission? Approximately $1 billion.

To do anything like that on a large scale will require robots, spacecraft, and other technologies that simply do not exist yet. Further, missions like this could cost trillions of dollars – a huge risk and burden in the case that a mission is unsuccessful.

Until then, the near-Earth asteroids are the fertile testing ground for aspirational asteroid miners – and we look forward to seeing what is possible in the future.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Environment2 weeks ago

Environment2 weeks agoTop Countries By Forest Growth Since 2001