Mining

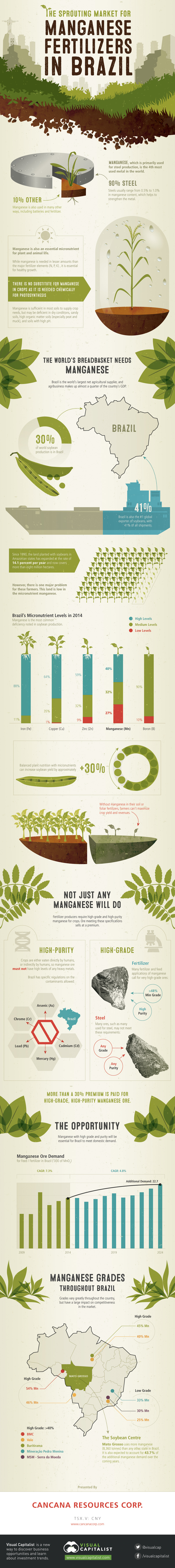

The Sprouting Market for Manganese Fertilizers in Brazil

The Sprouting Market for Manganese Fertilizers in Brazil

Manganese fertilizer infographic presented by: Cancana

Manganese is primarily known for its uses in steel production, which makes up about 90% of the metal’s demand. However, it is less known for its important uses in batteries and particularly fertilizers.

Manganese is an essential micronutrient that is needed for plant and animal life. While it is needed in lesser amounts than the major fertilizer elements (N, P, K), the metal is essential for healthy growth of plants. There is no substitute for manganese in crops as it is needed chemically for photosynthesis.

Manganese is sufficient in most soils to supply crop needs, but may be deficient in dry conditions, sandy soils, high organic matter soils (especially peat and muck), and soils with high pH.

As the world’s largest net agricultural supplier, Brazil is the world’s breadbasket and agribusiness makes up almost a quarter of the country’s GDP.

Brazil, The World’s Breadbasket

Brazil produces 30% of the world’s soybeans and is also the crop’s #1 exporter with 41% of all shipments. Growth in soybean production is not stopping, and it continues to expand by 14.1% per year in Amazonian states, covering over eight million hectares.

However, there is a major problem for these farmers. This soil tends to be low in manganese micronutrients. Balanced plant nutrition with micronutrients can increase soybean yield by approximately 30%, yet manganese is the most common deficiency noted in soybean production in Brazil. Without it, farmers cannot maximize crop yield or revenues.

Purity and Grade

Not just any type of manganese will do. It has to be both high-purity and high-grade. Crops are eaten directly or indirectly by humans, so manganese must not have significant levels of heavy metals such as arsenic, cadmium, mercury, lead, or chromium. Brazil has specific regulations on the level of contaminants allowed, and therefore high-purity manganese is needed.

Manganese also has to be high-grade. Many fertilizer and feed applications call for high-grade ores with a minimum grade of 48%. As a result, more than a 30% premium is paid for high-grade, high-purity manganese ore.

Mato Grosso

Of particular interest is Mato Grosso, which uses more manganese than any other state in Brazil. This state is expected to account for 43.7% of the additional fertilizer and feed demand of manganese over the coming years, and high-grade sources of ore in this area will be particularly strategic.

Mining

Visualizing Global Gold Production in 2023

Gold production in 2023 was led by China, Australia, and Russia, with each outputting over 300 tonnes.

Visualizing Global Gold Production in 2023

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Over 3,000 tonnes of gold were produced globally in 2023.

In this graphic, we list the world’s leading countries in terms of gold production. These figures come from the latest USGS publication on gold statistics (published January 2024).

China, Australia, and Russia Produced the Most Gold in 2023

China was the top producer in 2023, responsible for over 12% of total global production, followed by Australia and Russia.

| Country | Region | 2023E Production (tonnes) |

|---|---|---|

| 🇨🇳 China | Asia | 370 |

| 🇦🇺 Australia | Oceania | 310 |

| 🇷🇺 Russia | Europe | 310 |

| 🇨🇦 Canada | North America | 200 |

| 🇺🇸 United States | North America | 170 |

| 🇰🇿 Kazakhstan | Asia | 130 |

| 🇲🇽 Mexico | North America | 120 |

| 🇮🇩 Indonesia | Asia | 110 |

| 🇿🇦 South Africa | Africa | 100 |

| 🇺🇿 Uzbekistan | Asia | 100 |

| 🇬🇭 Ghana | Africa | 90 |

| 🇵🇪 Peru | South America | 90 |

| 🇧🇷 Brazil | South America | 60 |

| 🇧🇫 Burkina Faso | Africa | 60 |

| 🇲🇱 Mali | Africa | 60 |

| 🇹🇿 Tanzania | Africa | 60 |

| 🌍 Rest of World | - | 700 |

Gold mines in China are primarily concentrated in eastern provinces such as Shandong, Henan, Fujian, and Liaoning. As of January 2024, China’s gold mine reserves stand at an estimated 3,000 tonnes, representing around 5% of the global total of 59,000 tonnes.

In addition to being the top producer, China emerged as the largest buyer of the yellow metal for the year. In fact, the country’s central bank alone bought 225 tonnes of gold in 2023, according the World Gold Council.

Estimated Global Gold Consumption

Most of the gold produced in 2023 was used in jewelry production, while another significant portion was sold as a store of value, such as in gold bars or coins.

- Jewelry: 46%

- Central Banks and Institutions: 23%

- Physical Bars: 16%

- Official Coins, Medals, and Imitation Coins: 9%

- Electrical and Electronics: 5%

- Other: 1%

According to Fitch Solutions, over the medium term (2023-2032), global gold mine production is expected to grow 15%, as high prices encourage investment and output.

-

Technology7 days ago

Technology7 days agoAll of the Grants Given by the U.S. CHIPS Act

-

Misc2 weeks ago

Misc2 weeks agoHow Hard Is It to Get Into an Ivy League School?

-

Debt2 weeks ago

Debt2 weeks agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Sports2 weeks ago

Sports2 weeks agoThe Highest Earning Athletes in Seven Professional Sports

-

Science2 weeks ago

Science2 weeks agoVisualizing the Average Lifespans of Mammals

-

Brands1 week ago

Brands1 week agoHow Tech Logos Have Evolved Over Time

-

Energy1 week ago

Energy1 week agoRanked: The Top 10 EV Battery Manufacturers in 2023

-

Demographics1 week ago

Demographics1 week agoCountries With the Largest Happiness Gains Since 2010