Energy

Fusion: Will Humanity Ever Harness Star Power?

Fusion is the epitome of “high risk, high reward” scientific research.

If we were to ever successfully harness the forces that power the stars, mankind could have access to power that is almost literally too cheap to meter. However, reaching that goal will be a very expensive, long-term commitment – and it’s also very possible that we may never achieve a commercially viable method of fusion power generation.

Today’s video, by the talented team at Kurzgesagt, explains how fusion works, what experiments are ongoing, and the pros and cons of pursuing fusion power generation.

How Fusion Works

Fusion involves heating nuclei of atoms – usually isotopes of hydrogen – to temperatures in the millions of degrees. At extreme temperatures, atoms are stripped of their electrons and nuclei move so quickly that they overcome their “mutual repulsion”, joining together to form a heavier nucleus. This process gives off massive amounts of energy that investors and researchers hope will propel mankind into an era of cheap and abundant electricity, but without the downsides of many other forms of energy.

I would like nuclear fusion to become a practical power source. It would provide an inexhaustible supply of energy, without pollution or global warming.

– Stephen Hawking, award-winning theoretical physicist

Stars are so large that fusion occurs naturally in their cores – but here on Earth, we’re trying a number of complex methods in the hopes of replicating that process to achieve positive net energy.

The Cost of Bottling a Star

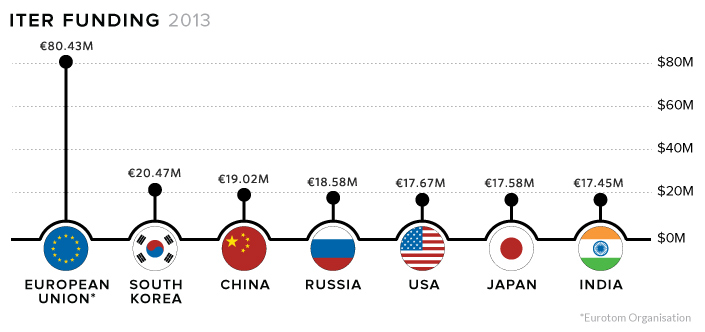

The International Thermonuclear Experimental Reactor (ITER), an experimental reactor currently being built in the south of France, will house the world’s largest ever tokamak – a doughnut-shaped reactor that uses a powerful magnetic field to confine plasma. Construction of the facility began in 2013 and is expected to cost €20 billion upon completion in 2021.

Research organizations see ITER as a crucial step in realizing fusion. Though the facility is not designed to generate electricity, it would pave the way for functional reactors.

Competition is Heating Up

There are some who claim that the bureaucracy of government-funded labs is hampering the process. As a result, there is a pack of private companies, fueled by high-profile investors, looking to make commercially-viable fusion into a reality.

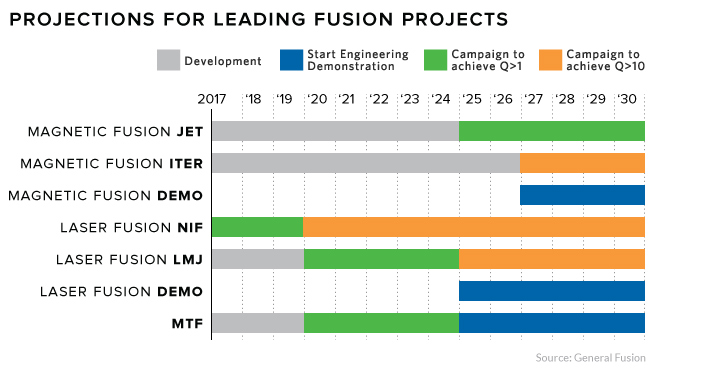

Tri Alpha, a company in southern California, is hoping their method of spinning magnetized plasma inside a containment vessel will be a lower-cost method of power generation than ITER. In 2015, they held super-heated hydrogen plasma in a stable state for 5 milliseconds, which is a huge deal in the world of fusion research. The company has attracted over $500 million in investment in the past 20 years, and has the backing of Microsoft co-founder, Paul Allen.

Helion Energy, located in Redmond, Washington, believes they are only a few years away from creating nuclear fusion that can be used as a source for electricity. Their reaction is created by colliding two plasma balls made of hydrogen atom cores at one million miles per hour. Helion Energy’s ongoing research is funded in part by the U.S. Department of Energy’s ARPA-E program, which the Trump administration slated for elimination. Thankfully, Helion still counts Peter Thiel’s Mithril Capital and Y Combinator as supporters.

General Fusion, located in Burnaby, B.C., is taking a different approach. Their piston-based reactor is designed to create energy bursts lasting thousandths of seconds, rather than a sustained plasma reaction. Heat recovered bursts would be used to generate electricity much like nuclear power plants, minus the long-term radioactive waste. General Fusion has attracted millions of dollars in funding, including investment from Bezos Expeditions and the Business Development Bank of Canada.

Time Horizon

Though commercially viable fusion is still a long way off, each new technological breakthrough brings us one step closer. With such a massive payoff for success, research will likely only increase as we get closer to bottling a star here on Earth.

Energy

Charted: 4 Reasons Why Lithium Could Be the Next Gold Rush

Visual Capitalist has partnered with EnergyX to show why drops in prices and growing demand may make now the right time to invest in lithium.

4 Reasons Why You Should Invest in Lithium

Lithium’s importance in powering EVs makes it a linchpin of the clean energy transition and one of the world’s most precious minerals.

In this graphic, Visual Capitalist partnered with EnergyX to explore why now may be the time to invest in lithium.

1. Lithium Prices Have Dropped

One of the most critical aspects of evaluating an investment is ensuring that the asset’s value is higher than its price would indicate. Lithium is integral to powering EVs, and, prices have fallen fast over the last year:

| Date | LiOH·H₂O* | Li₂CO₃** |

|---|---|---|

| Feb 2023 | $76 | $71 |

| March 2023 | $71 | $61 |

| Apr 2023 | $43 | $33 |

| May 2023 | $43 | $33 |

| June 2023 | $47 | $45 |

| July 2023 | $44 | $40 |

| Aug 2023 | $35 | $35 |

| Sept 2023 | $28 | $27 |

| Oct 2023 | $24 | $23 |

| Nov 2023 | $21 | $21 |

| Dec 2023 | $17 | $16 |

| Jan 2024 | $14 | $15 |

| Feb 2024 | $13 | $14 |

Note: Monthly spot prices were taken as close to the 14th of each month as possible.

*Lithium hydroxide monohydrate MB-LI-0033

**Lithium carbonate MB-LI-0029

2. Lithium-Ion Battery Prices Are Also Falling

The drop in lithium prices is just one reason to invest in the metal. Increasing economies of scale, coupled with low commodity prices, have caused the cost of lithium-ion batteries to drop significantly as well.

In fact, BNEF reports that between 2013 and 2023, the price of a Li-ion battery dropped by 82%.

| Year | Price per KWh |

|---|---|

| 2023 | $139 |

| 2022 | $161 |

| 2021 | $150 |

| 2020 | $160 |

| 2019 | $183 |

| 2018 | $211 |

| 2017 | $258 |

| 2016 | $345 |

| 2015 | $448 |

| 2014 | $692 |

| 2013 | $780 |

3. EV Adoption is Sustainable

One of the best reasons to invest in lithium is that EVs, one of the main drivers behind the demand for lithium, have reached a price point similar to that of traditional vehicle.

According to the Kelly Blue Book, Tesla’s average transaction price dropped by 25% between 2022 and 2023, bringing it in line with many other major manufacturers and showing that EVs are a realistic transport option from a consumer price perspective.

| Manufacturer | September 2022 | September 2023 |

|---|---|---|

| BMW | $69,000 | $72,000 |

| Ford | $54,000 | $56,000 |

| Volkswagon | $54,000 | $56,000 |

| General Motors | $52,000 | $53,000 |

| Tesla | $68,000 | $51,000 |

4. Electricity Demand in Transport is Growing

As EVs become an accessible transport option, there’s an investment opportunity in lithium. But possibly the best reason to invest in lithium is that the IEA reports global demand for the electricity in transport could grow dramatically by 2030:

| Transport Type | 2022 | 2025 | 2030 |

|---|---|---|---|

| Buses 🚌 | 23,000 GWh | 50,000 GWh | 130,000 GWh |

| Cars 🚙 | 65,000 GWh | 200,000 GWh | 570,000 GWh |

| Trucks 🛻 | 4,000 GWh | 15,000 GWh | 94,000 GWh |

| Vans 🚐 | 6,000 GWh | 16,000 GWh | 72,000 GWh |

The Lithium Investment Opportunity

Lithium presents a potentially classic investment opportunity. Lithium and battery prices have dropped significantly, and recently, EVs have reached a price point similar to other vehicles. By 2030, the demand for clean energy, especially in transport, will grow dramatically.

With prices dropping and demand skyrocketing, now is the time to invest in lithium.

EnergyX is poised to exploit lithium demand with cutting-edge lithium extraction technology capable of extracting 300% more lithium than current processes.

-

Lithium4 days ago

Lithium4 days agoRanked: The Top 10 EV Battery Manufacturers in 2023

Asia dominates this ranking of the world’s largest EV battery manufacturers in 2023.

-

Energy1 week ago

Energy1 week agoThe World’s Biggest Nuclear Energy Producers

China has grown its nuclear capacity over the last decade, now ranking second on the list of top nuclear energy producers.

-

Energy1 month ago

Energy1 month agoThe World’s Biggest Oil Producers in 2023

Just three countries accounted for 40% of global oil production last year.

-

Energy1 month ago

Energy1 month agoHow Much Does the U.S. Depend on Russian Uranium?

Currently, Russia is the largest foreign supplier of nuclear power fuel to the U.S.

-

Uranium2 months ago

Uranium2 months agoCharted: Global Uranium Reserves, by Country

We visualize the distribution of the world’s uranium reserves by country, with 3 countries accounting for more than half of total reserves.

-

Energy3 months ago

Energy3 months agoVisualizing the Rise of the U.S. as Top Crude Oil Producer

Over the last decade, the United States has established itself as the world’s top producer of crude oil, surpassing Saudi Arabia and Russia.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees