Technology

How Amazon Prime Day Compares to Other Shopping Bonanzas

How Amazon Prime Day Compares to Other Shopping Bonanzas

The Chart of the Week is a weekly Visual Capitalist feature on Fridays.

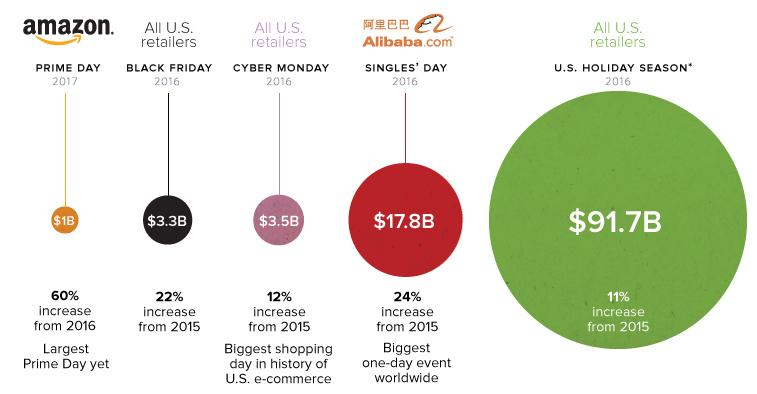

Earlier this week, products were flying off their figurative shelves at a pace that is pretty unusual for the summer. That’s because July 11, 2017 was the third-ever Amazon Prime Day – and in just a 30-hour period, the online retailer was able to offload close to $1 billion of merchandise.

The biggest seller of the day was the Amazon Echo Dot, an entry-level product that allows customers to access the company’s personal voice assistant, Amazon Alexa. With a 30% discount, it outsold thousands of other heavily discounted items, propelling Amazon to a 60% increase in revenue over the previous Prime Day in 2016.

At triple the sales of a normal day, it’s fair to say Amazon Prime Day is big – but just how big, exactly?

How Does Amazon Prime Day Compare?

Set up to reward Amazon’s roughly 80 million Prime subscribers once a year, the $1 billion number is pretty impressive even on a grander scale.

Here are the e-commerce numbers for Black Friday and Cyber Monday for all U.S. retailers in 2016:

| Shopping Day | Retailer | E-commerce sales | % Increase (from prev. year) |

|---|---|---|---|

| Amazon Prime Day (2017) | Amazon | $1 billion (est.) | 60% |

| Black Friday (2016) | All U.S. Retailers | $3.3 billion | 22% |

| Cyber Monday (2016) | All U.S. Retailers | $3.5 billion | 12% |

The fact that Prime Day revenue comes from only one retailer makes it quite impressive – especially considering the day falls in the heat of summer, rather than the holiday shopping season. The 60% growth figure is compelling as well, showing that Prime Day could eventually be the biggest U.S. shopping day of the year.

Singled Out by Alibaba

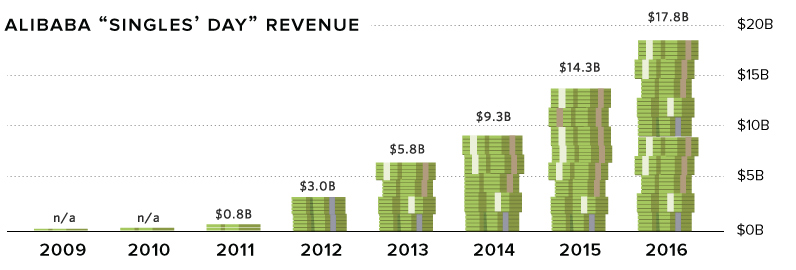

While Amazon Prime Day favors comparably in the U.S. market, it doesn’t even close when looking at single-day events abroad. That’s because since 2009, Chinese e-commerce leader Alibaba has used the Singles’ Day “holiday” to promote sales during the slow period leading up to the Lunar New Year season.

In 2016, Alibaba raked in a whopping $17.8 billion of revenue from Singles’ Day alone.

See the steady growth of the event below:

The concept of setting a global record for e-commerce sales on Singles’ Day sounds a bit strange to us Westerners, but the hype around Singles’ Day is no joke.

The holiday is now a full-on festival in China, with star-studded ceremonies kicking off the 24-hour sales period. For last year’s event, even Kobe Bryant, David and Victoria Beckham, and band OneRepublic made appearances to help ring it in.

A Prime Opportunity

During just the first five minutes of Singles’ Day in 2016, shoppers spent as much money ($1 billion) as Amazon’s entire 30-hour event in 2017.

While that may seem daunting to match, Jeff Bezos has built his tech empire from taking advantage of big opportunities such as this. As a result, it’s likely that Bezos and Amazon both see Singles’ Day as something to emulate – a full-blown festival that could ring in over $10 billion in revenue in one day for Amazon.

After all, it’s already been done once by Jack Ma, so why can’t it be done again in North America?

Brands

How Tech Logos Have Evolved Over Time

From complete overhauls to more subtle tweaks, these tech logos have had quite a journey. Featuring: Google, Apple, and more.

How Tech Logos Have Evolved Over Time

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

One would be hard-pressed to find a company that has never changed its logo. Granted, some brands—like Rolex, IBM, and Coca-Cola—tend to just have more minimalistic updates. But other companies undergo an entire identity change, thus necessitating a full overhaul.

In this graphic, we visualized the evolution of prominent tech companies’ logos over time. All of these brands ranked highly in a Q1 2024 YouGov study of America’s most famous tech brands. The logo changes are sourced from 1000logos.net.

How Many Times Has Google Changed Its Logo?

Google and Facebook share a 98% fame rating according to YouGov. But while Facebook’s rise was captured in The Social Network (2010), Google’s history tends to be a little less lionized in popular culture.

For example, Google was initially called “Backrub” because it analyzed “back links” to understand how important a website was. Since its founding, Google has undergone eight logo changes, finally settling on its current one in 2015.

| Company | Number of Logo Changes |

|---|---|

| 8 | |

| HP | 8 |

| Amazon | 6 |

| Microsoft | 6 |

| Samsung | 6 |

| Apple | 5* |

Note: *Includes color changes. Source: 1000Logos.net

Another fun origin story is Microsoft, which started off as Traf-O-Data, a traffic counter reading company that generated reports for traffic engineers. By 1975, the company was renamed. But it wasn’t until 2012 that Microsoft put the iconic Windows logo—still the most popular desktop operating system—alongside its name.

And then there’s Samsung, which started as a grocery trading store in 1938. Its pivot to electronics started in the 1970s with black and white television sets. For 55 years, the company kept some form of stars from its first logo, until 1993, when the iconic encircled blue Samsung logo debuted.

Finally, Apple’s first logo in 1976 featured Isaac Newton reading under a tree—moments before an apple fell on his head. Two years later, the iconic bitten apple logo would be designed at Steve Jobs’ behest, and it would take another two decades for it to go monochrome.

-

Green1 week ago

Green1 week agoRanked: The Countries With the Most Air Pollution in 2023

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Travel2 weeks ago

Travel2 weeks agoRanked: The World’s Top Flight Routes, by Revenue