Visualizing the Global Electric Vehicle Market

The following content is sponsored by Scotch Creek Ventures.

Visualizing the Global Electric Vehicle Market

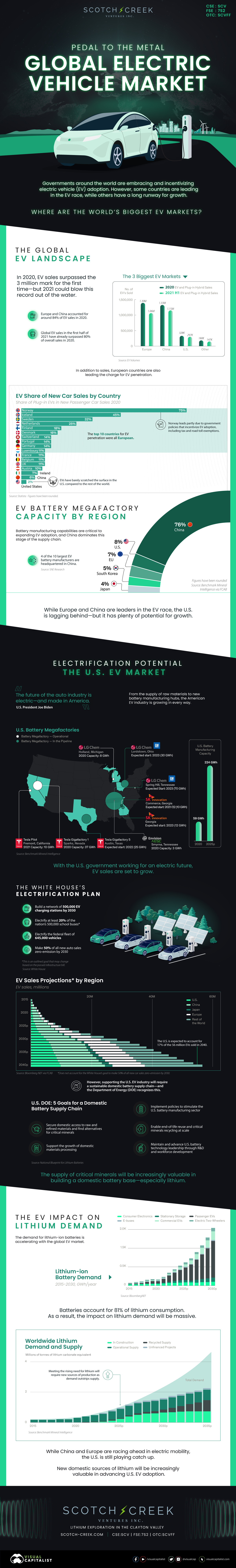

Electric vehicles (EVs) are a key piece of the net-zero carbon future puzzle, and the electric vehicle market is growing exponentially.

Countries and governments around the world are recognizing the importance of these zero-emission vehicles and consequently including them in their decarbonization plans. But some countries are far ahead in the EV race, while others are yet to fully embrace EV adoption.

This infographic from our sponsor Scotch Creek Ventures provides an overview of the global EV market and the potential for growth in the United States.

The World’s Largest EV Markets

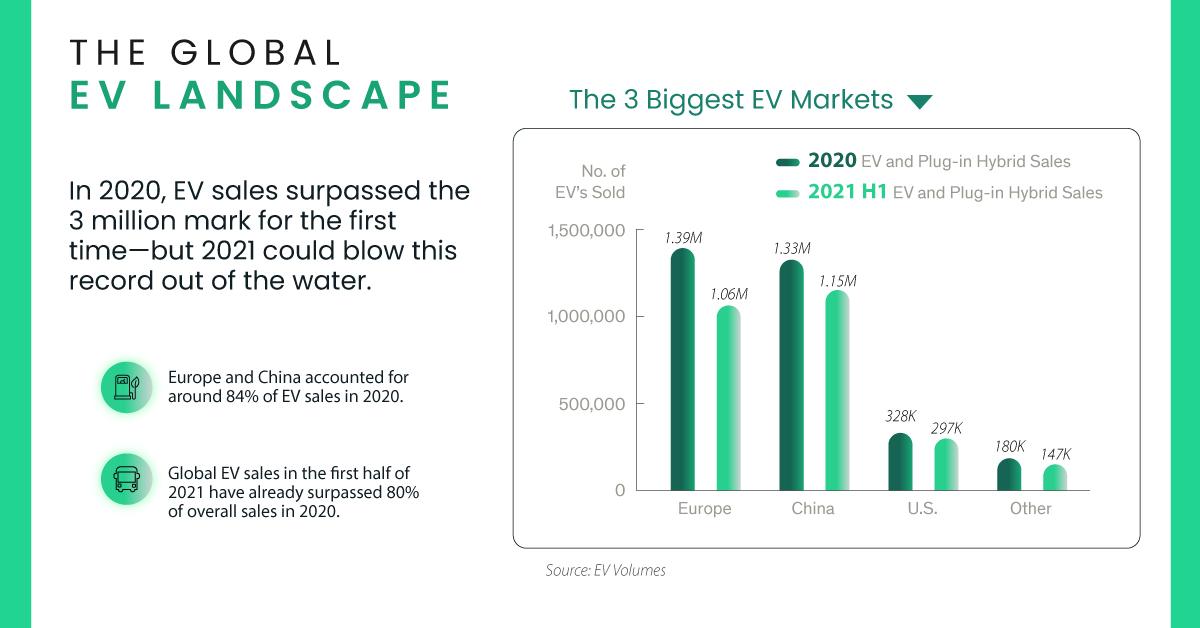

In 2020, global EV and plug-in hybrid sales crossed the 3 million mark for the first time, and data from the first half of 2021 suggests that we may be in for another year of record-high sales.

Europe and China have been the leading EV markets in both years, with over 80% of plug-in hybrid and battery electric vehicle (BEV) sales occurring in these two regions.

| Country/Region | 2020 sales | 2020 H1 sales |

|---|---|---|

| Europe 🇪🇺 | 1,390,000 | 1,060,000 |

| China 🇨🇳 | 1,330,000 | 1,149,000 |

| U.S. 🇺🇸 | 328,000 | 297,000 |

| Rest of the World 🌎 | 180,000 | 147,000 |

| Total | 3,228,000 | 2,653,000 |

Although country populations are the driver of absolute sales potential, government incentives have played a key role in expanding EV adoption in the interim. For example, several European countries offer tax benefits for purchasing and owning EVs, in addition to incentives like road toll exemptions. Similarly, China’s EV subsidies reimburse buyers different amounts depending on the range of the vehicle purchased.

European countries also dominate the leaderboard for EV penetration rates, which represent the share of EVs in new passenger car sales. The top 10 countries for EV penetration in 2020 were all European, with Norway taking the top spot.

While the U.S. is the world’s third-largest market for EVs, its sales are only a fraction of those made in Europe and China, and its EV penetration rate sits at just 2%. However, the American EV market is growing rapidly, with plenty of potential for expansion.

Electrification Potential: The U.S. EV Market

Both automakers and the government are supporting America’s shift toward EVs.

The country is home to one of the world’s largest battery megafactories in Tesla’s Giga Nevada, which has the capacity to produce 37 gigawatt-hours (GWh) worth of batteries annually. Other battery makers have announced plans to build larger factories in the coming years.

Consequently, battery manufacturing capacity in the U.S. is expected to reach 224 GWh by 2025, up from 59 GWh in 2020. Here are some of the operational and planned battery factories in the country:

| Factory/Company | Capacity | Location |

|---|---|---|

| LG Chem and GM* | 70 GWh | Spring Hill, Tennessee |

| Tesla Gigafactory 1 | 37 GWh | Sparks, Nevada |

| LG Chem and GM* | 30 GWh | Lordstown, Ohio |

| Tesla Gigafactory 5* | 25 GWh | Austin, Texas |

| SK Innovation* | 12 GWh | Commerce, Georgia |

| SK Innovation* | 10 GWh | Commerce, Georgia |

| Tesla Pilot | 10 GWh | Fremont, California |

| LG Chem | 8 GWh | Holland, Michigan |

| Envision AESC | 3 GWh | Smyrna, Tennessee |

*Represents planned, announced, or under-construction factories.

The government is also doing its part to support EV adoption. The recently-passed trillion-dollar infrastructure bill supports the White House’s electrification plan, with $7.5 billion allocated to building a network of EV charging stations, and another $5 billion for low and zero-emission buses. Earlier this year, President Biden signed an executive order that aims to make 50% of all new vehicle sales electric by 2030, providing another catalyst for the switch to EVs.

As a result, EV sales are set to grow in the United States. However, more EVs require more batteries, and more batteries need more raw materials—especially lithium.

The Impact on Lithium Demand

Batteries accounted for 81% of lithium consumption in 2020, and they are in increasing demand.

According to Bloomberg, the world could require 2,000 GWh of lithium-ion batteries annually by 2030, up from 223 GWh in 2020. Given that lithium is a key ingredient in these batteries, the impact on lithium demand will be massive.

In fact, global lithium demand is expected to outstrip supply in 2025. Furthermore, with 200 battery megafactories in the pipeline to 2030, the world could require 3 million tonnes of lithium annually, which is roughly 37 times current production.

Meeting the rising need for lithium will require new sources of production as the global electric vehicle market expands. This is especially true for the United States, which strives to build a domestic battery supply chain but hosts only one lithium-producing mine.

Scotch Creek Ventures is developing two lithium mining projects in Clayton Valley, Nevada, to supply lithium for the green future.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology...

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.