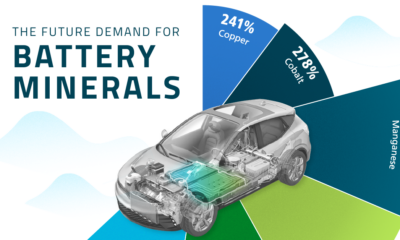

In this graphic, our sponsor Sprott examines the growth in demand for battery metals, as well as potential supply constraints.

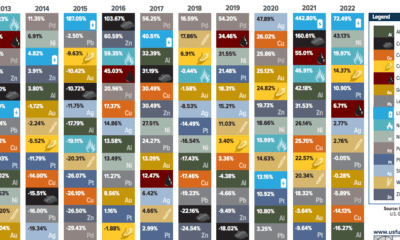

This table shows the fluctuating returns for various commodities over the past decade, from energy fuels to industrial and precious metals.

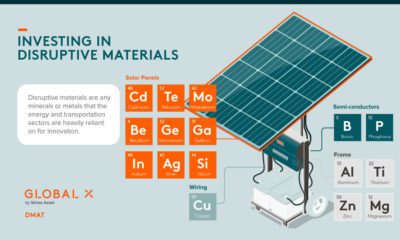

Disruptive materials are experiencing a demand supercycle. See how these materials are helping revolutionize next generation technologies.

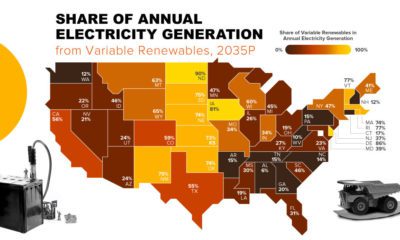

As the U.S. transitions to clean energy, investing in battery metals like lithium and cobalt can help secure an energy-independent future.

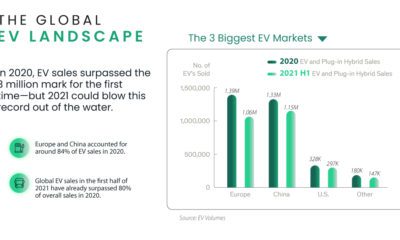

The global electric vehicle market crossed 3 million units in sales for the first time in 2020. Here's a snapshot of the largest EV markets.

How do you price lithium? Benchmark Mineral Intelligence has the method to price lithium for a new era in energy.

The tech sector has dominated the stock market for years - but battery metals and cannabis could give tech a run for its money.