Visualizing the Future Demand for Battery Minerals

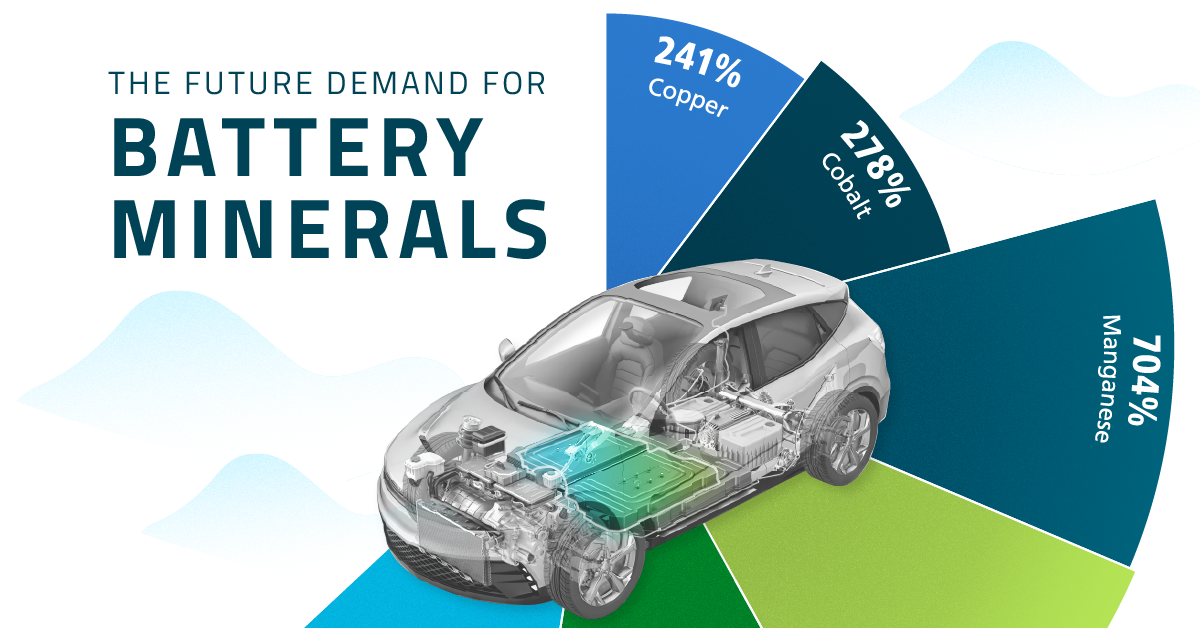

The Future Demand For Battery Minerals

Battery minerals are vital for the clean energy transition. They power cost-effective, on-demand energy systems and are at the core of decarbonizing transportation.

In this graphic, our sponsor Sprott examines the growth in demand for battery metals, as well as potential supply constraints.

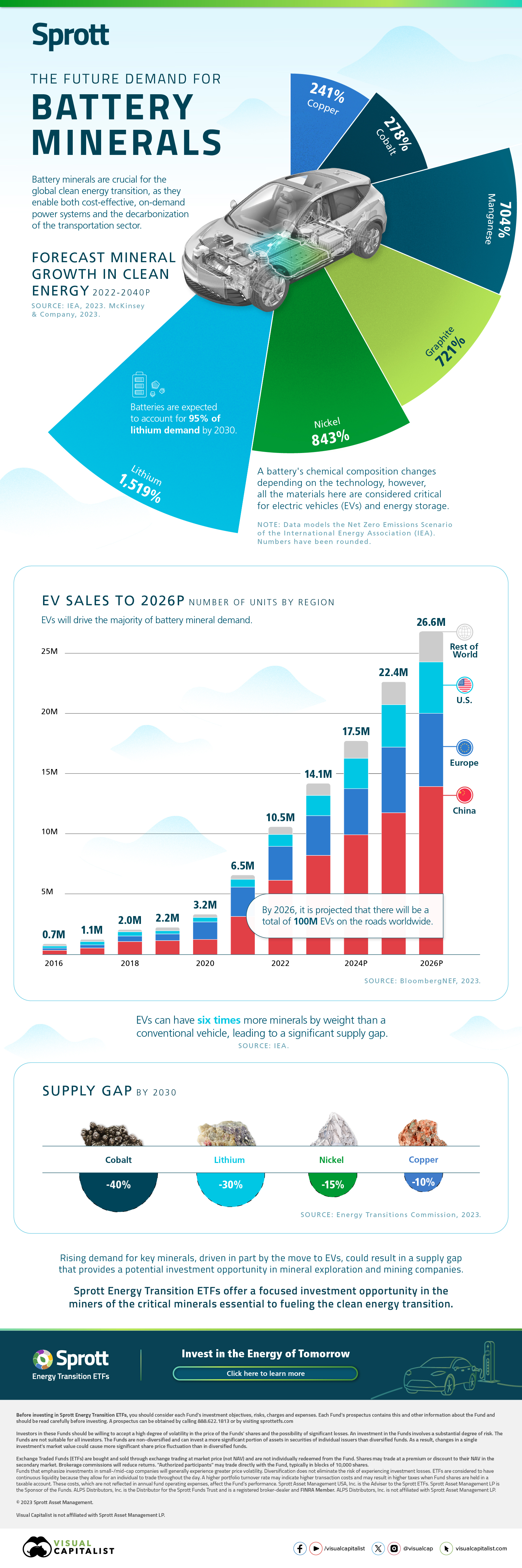

Exploring Mineral Growth to 2040

Demand for battery metals is set to skyrocket in the coming years. Let’s break down the expected growth between current usage and the projected demand in 2040, based on a Net Zero Emissions Scenario (NZE):

| Mineral Demand (kilotonnes) | 2022 | 2040P (NZE) |

|---|---|---|

| Copper | 6,062.6 kt | 20,677.8 kt |

| Cobalt | 68.3 kt | 258.5 kt |

| Lithium | 73.3 kt | 1,187.5 kt |

| Nickel | 460.6 kt | 4,344.8 kt |

| Graphite | 552.8 kt | 4,540.4 kt |

| Manganese | 187.4 kt | 1,507.3 kt |

The raw materials that batteries use can differ depending on their chemical compositions. However, these metals are considered critical for EVs and energy storage.

For example, the cells in the average battery with a 60 kilowatt-hour (kWh) capacity—the same size that’s used in a Chevy Bolt—contained roughly 185 kilograms of minerals.

Supply Gap in 2030

The growing demand for these battery metals is raising concerns over supply. Predicted shortages are expected to emerge by or before 2030, according to Energy Transitions Commission:

| Mineral | Supply gap in 2030P |

|---|---|

| Copper | -10% |

| Nickel | -15% |

| Lithium | -30% |

| Cobalt | -40% |

The rising demand for key minerals, driven in part by the move to EVs, could result in a supply gap that provides a potential investment opportunity in mineral exploration and mining companies. Interested in learning more?

Invest in the energy of tomorrow. Sprott Energy Transition ETFs offer a focused investment opportunity in the miners of the critical minerals essential to fueling the clean energy transition.

-

Lithium4 days ago

Lithium4 days agoRanked: The Top 10 EV Battery Manufacturers in 2023

Asia dominates this ranking of the world’s largest EV battery manufacturers in 2023.

-

Mining1 week ago

Mining1 week agoGold vs. S&P 500: Which Has Grown More Over Five Years?

The price of gold has set record highs in 2024, but how has this precious metal performed relative to the S&P 500?

-

Mining3 weeks ago

Mining3 weeks agoCharted: The Value Gap Between the Gold Price and Gold Miners

While the price of gold has reached new record highs in 2024, gold mining stocks are still far from their 2011 peaks.

-

Uranium2 months ago

Uranium2 months agoCharted: Global Uranium Reserves, by Country

We visualize the distribution of the world’s uranium reserves by country, with 3 countries accounting for more than half of total reserves.

-

Energy4 months ago

Energy4 months agoThe Periodic Table of Commodity Returns (2014-2023)

Commodity returns in 2023 took a hit. This graphic shows the performance of commodities like gold, oil, nickel, and corn over the last decade.

-

Mining4 months ago

Mining4 months agoChina Dominates the Supply of U.S. Critical Minerals List

The U.S. Geological Survey estimates that in 2022, China was the world’s leading producer of 30 out of 50 entries on the U.S. critical minerals list.