Should You Invest in Disruptive Materials?

Should You Invest in Disruptive Materials?

New technologies are having a transformative impact on the transportation and energy sectors. As these technologies develop, it is becoming clear that a small selection of materials, metals, and minerals—known collectively as disruptive materials—are critical components required to innovate.

This graphic from Global X ETFs takes a closer look at the disruptive materials that are key to fueling climate technologies. With a growing global effort to decarbonize, disruptive materials may enter a demand supercycle, characterized as a structural decades-long period of rising demand and rising prices.

Building Blocks Of the Future

There are 10 categories of disruptive materials in particular that are expected to see demand growth as part of their role within emerging technologies.

| Disruptive Material | Applicability |

|---|---|

| Zinc | Protects metal surfaces from rusting through a process called galvanization. This is essential to wind energy. |

| Palladium & Platinum | Often used in catalytic converters, thus playing a major role in hydrogen fuel cell technology. |

| Nickel | A corrosion-resistant metal used to make other metals more durable. |

| Manganese | An important mineral needed for battery and steel production. |

| Lithium | The foundational component of lithium-ion batteries. |

| Graphene | The thinnest known material which is also 100x stronger than steel. Used in sensors and transistors. |

| Rare Earth Materials | A broader category including 15 lanthanide series elements, plus yttrium. These metals are found in all types of electronics. |

| Copper | A reliable conductor of electricity. It can also kill bacteria, making it useful during pandemics. |

| Cobalt | An important ingredient for rechargeable lithium batteries, found only in specific regions of the world. |

| Carbon Fiber & Carbon Materials | Strong and lightweight materials with applications in aerospace and the automotive industry. |

While these 10 categories do not make up the entire disruptive material universe, all are essential to securing a climate and technologically advanced future.

How The Green Revolution Is Transforming the Materials Market

The data on rising global temperatures and extreme weather events is jarring and has governments and organizations from all over the world ramping up efforts to combat its effects through new budgets and policies.

Take the soaring total number of U.S. climate disasters for instance. Most recently in 2021, the quantity of weather disasters stood at 20 whereas in 1980 it stood as a much smaller figure of three. In addition, total disaster costs have risen above $100 billion per year.

Globally, the top 10 most extreme weather events in 2021 racked up $170 billion in costs.

| Rank | Climate Event | Cost ($B) |

|---|---|---|

| #1 | Hurricane Ida | $65.0B |

| #2 | European floods | $43.0B |

| #3 | Texas winter storm | $23.0B |

| #4 | Henan floods | $17.6B |

| #5 | British Columbia floods | $7.5B |

| #6 | France’s “cold wave” | $5.6B |

| #7 | Cyclone Yaas | $3.0B |

| #8 | Australian floods | $2.1B |

| #9 | Typhoon In-fa | $2.0B |

| #10 | Cyclone Tauktae | $1.5B |

What’s more, some research estimates that these rising costs are far from coming to a halt. By 2050 the annual cost of weather disasters could surge past $1 trillion a year. In an effort to slow rising temperatures, governments are dramatically increasing their climate spending. For example, the U.S. is set to spend $80 billion annually over the next five years.

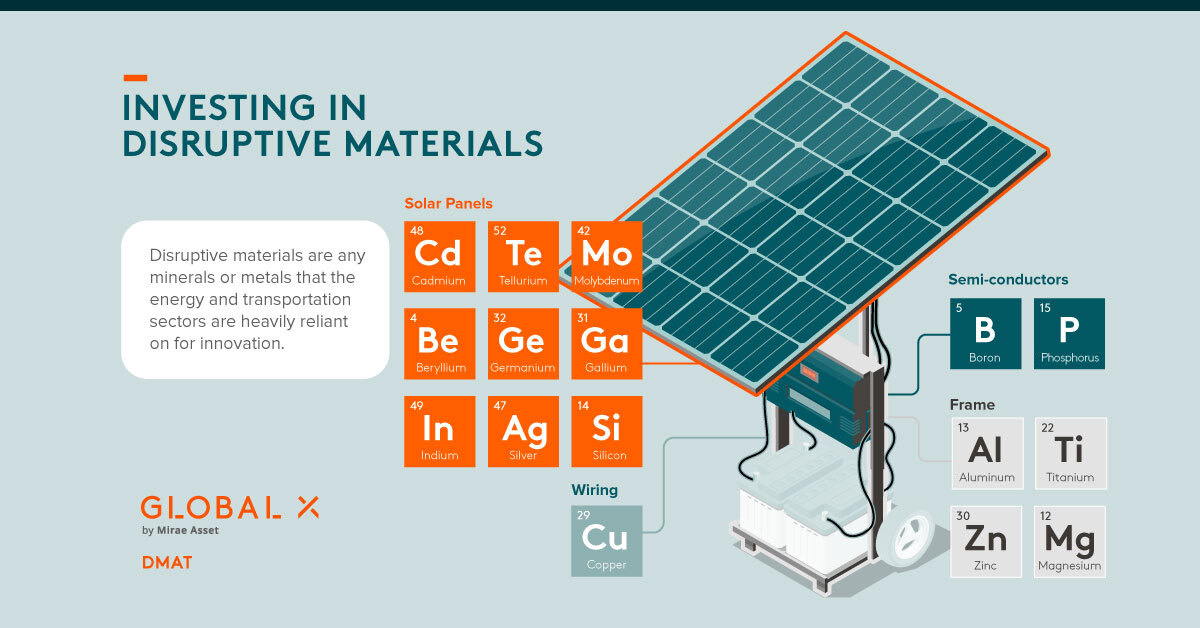

To see how climate spending impacts the materials market, consider the complexity behind a typical solar panel which requires almost 20 different materials including copper for wiring, boron and phosphorus for semiconductors, as well as zinc and magnesium for its frame.

Overall, these materials are essential to the expansion of a variety of emerging technologies like lithium batteries, solar panels, wind turbines, fuel cells, robotics, and 3D printers. And therefore, are translating to higher levels of demand for the disruptive materials that make combating climate change possible.

Estimated Disruptive Material Growth by 2040

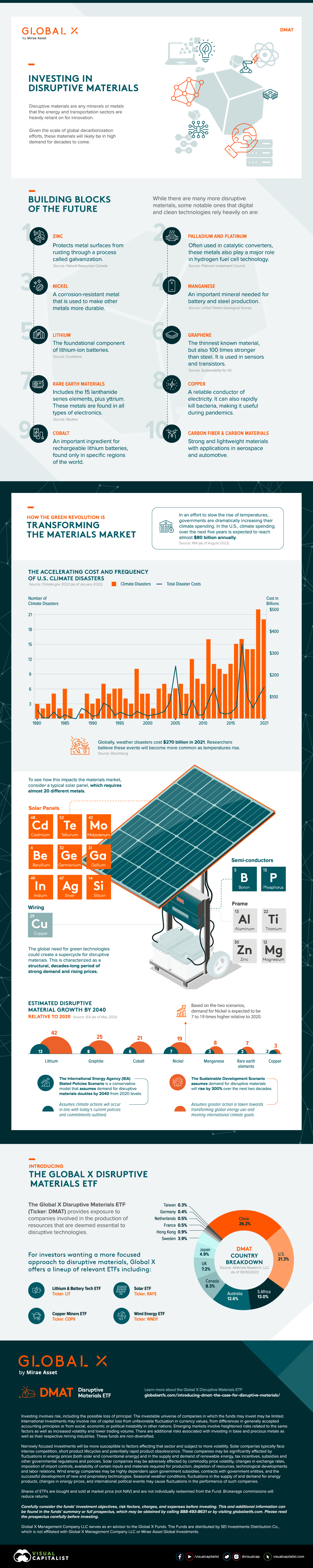

A societal shift in how we address climate change is forecasted to lead to a demand supercycle for disruptive materials and acts as a massive tailwind.

But just how large is this expected level of demand to be? To answer this, we use two scenarios created by The International Energy Agency (IEA). The first is the Stated Policies Scenario, a more conservative model that assumes demand for material will double by 2040 relative to 2020 levels. Under this scenario, it’s assumed that society takes climate action in line with current and existing policies and commitments.

Then there is the Sustainable Development Scenario, which assumes more drastic action will take place to transform global energy use and meet international climate goals. Under this scenario, the demand for disruptive materials could rise as high as 300% relative to 2020 levels.

However, under both scenarios there’s still significant demand for each type of material.

| Disruptive Material | Stated Policies Scenario Demand Relative to 2020 | Sustainable Development Scenario Demand Relative to 2020 |

|---|---|---|

| Lithium | 13X | 42X |

| Graphite | 8X | 25X |

| Cobalt | 6X | 21X |

| Nickel | 7X | 19X |

| Manganese | 3X | 8X |

| Rare earth elements | 3X | 7X |

| Copper | 2X | 3X |

Overall, lithium is expected to see the most explosive surge in demand, as it could reach anywhere from 13 to 42 times the level of demand seen in 2020, based on the above scenarios.

Introducing the Global X Disruptive Materials ETF

The Global X Disruptive Materials ETF (Ticker: DMAT) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Disruptive Materials Index.

Investors can use this passively managed solution to gain exposure to the rising demand for disruptive materials and climate technologies.

The Global X Disruptive Materials ETF is a passively managed solution that can be used to gain exposure to the rising demand for disruptive materials. Click the link to learn more.

-

Mining2 days ago

Mining2 days agoGold vs. S&P 500: Which Has Grown More Over Five Years?

The price of gold has set record highs in 2024, but how has this precious metal performed relative to the S&P 500?

-

Mining2 weeks ago

Mining2 weeks agoCharted: The Value Gap Between the Gold Price and Gold Miners

While the price of gold has reached new record highs in 2024, gold mining stocks are still far from their 2011 peaks.

-

Uranium2 months ago

Uranium2 months agoCharted: Global Uranium Reserves, by Country

We visualize the distribution of the world’s uranium reserves by country, with 3 countries accounting for more than half of total reserves.

-

Markets3 months ago

Markets3 months agoThe Periodic Table of Commodity Returns (2014-2023)

Commodity returns in 2023 took a hit. This graphic shows the performance of commodities like gold, oil, nickel, and corn over the last decade.

-

Strategic Metals3 months ago

Strategic Metals3 months agoChina Dominates the Supply of U.S. Critical Minerals List

The U.S. Geological Survey estimates that in 2022, China was the world’s leading producer of 30 out of 50 entries on the U.S. critical minerals list.

-

Mining5 months ago

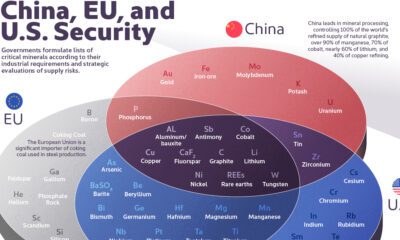

Mining5 months agoThe Critical Minerals to China, EU, and U.S. National Security

Ten materials, including cobalt, lithium, graphite, and rare earths, are deemed critical by all three.