Mining

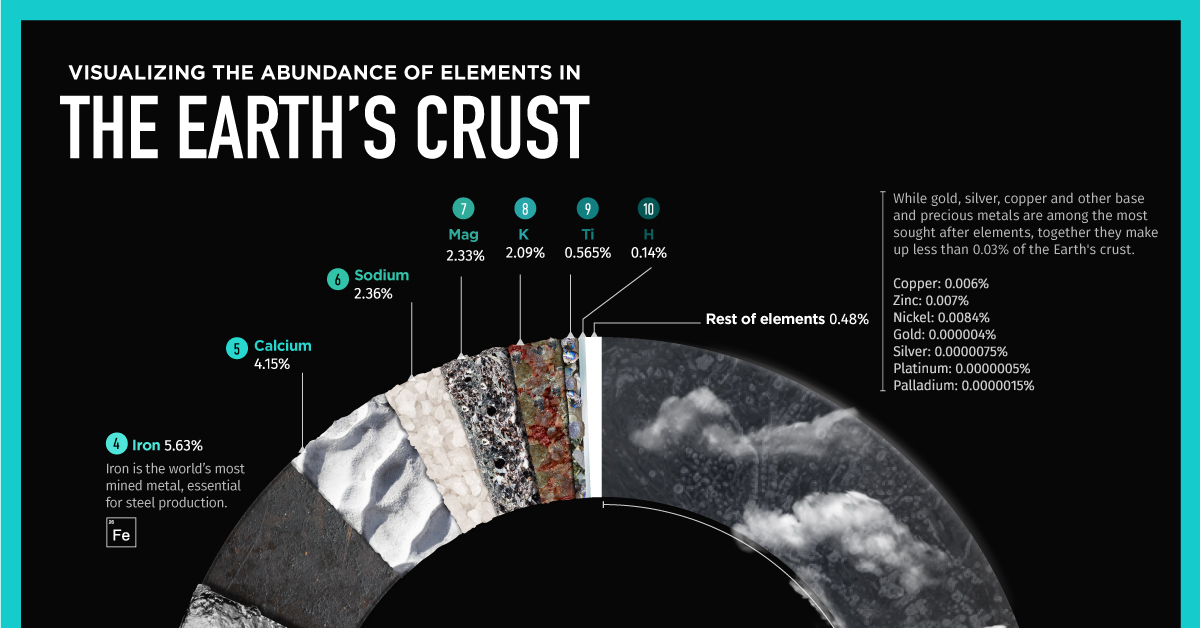

Visualizing the Abundance of Elements in the Earth’s Crust

![]() Subscribe to the Elements free mailing list for more like this

Subscribe to the Elements free mailing list for more like this

Visualizing the Abundance of Elements in the Earth’s Crust

This was originally posted on Elements. Sign up to the free mailing list to get beautiful visualizations on natural resource megatrends in your email every week.

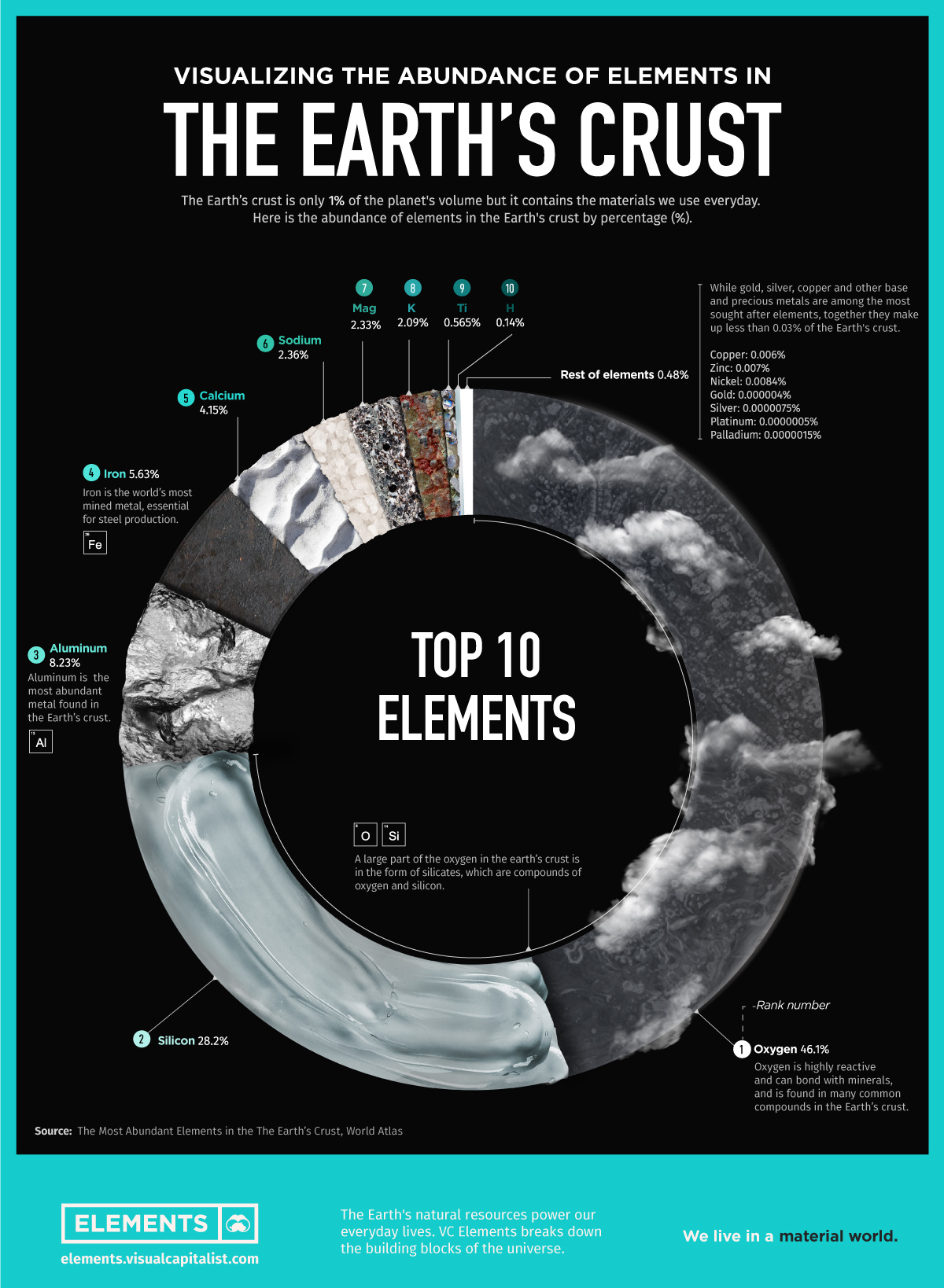

Elements in the Earth’s crust provide all the basic building blocks for mankind.

But even though the crust is the source of everything we find, mine, refine, and build, it really is just scratching the surface of our planet.

After all, the innermost layer of the Earth, the core, represents 15% of the planet’s volume, whereas the mantle occupies 84%. Representing the remaining 1% is the crust, a thin layer that ranges in depth from approximately 5-70 km (~3-44 miles).

This infographic takes a look at what elements make up this 1%, based on data from WorldAtlas.

Earth’s Crust Elements

The crust is a rigid surface containing both the oceans and landmasses. Most elements are found in only trace amounts within the Earth’s crust, but several are abundant.

The Earth’s crust comprises about 95% igneous and metamorphic rocks, 4% shale, 0.75% sandstone, and 0.25% limestone.

Oxygen, silicon, aluminum, and iron account for 88.1% of the mass of the Earth’s crust, while another 90 elements make up the remaining 11.9%.

| Rank | Element | % of Earth's Crust |

|---|---|---|

| 1 | Oxygen (O) | 46.1% |

| 2 | Silicon (Si) | 28.2% |

| 3 | Aluminum (Al) | 8.2% |

| 4 | Iron (Fe) | 5.6% |

| 5 | Calcium (Ca) | 4.1% |

| 6 | Sodium (Na) | 2.3% |

| 7 | Magnesium (Mg) | 2.3% |

| 8 | Potassium (K) | 2.0% |

| 9 | Titanium (Ti) | 0.5% |

| 10 | Hydrogen (H) | 0.1% |

| Other elements | 0.5% | |

| Total | 100.0% |

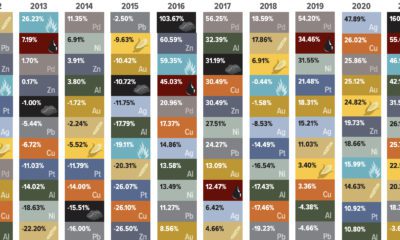

While gold, silver, copper and other base and precious metals are among the most sought after elements, together they make up less than 0.03% of the Earth’s crust by mass.

#1: Oxygen

Oxygen is by far the most abundant element in the Earth’s crust, making up 46% of mass—coming up just short of half of the total.

Oxygen is a highly reactive element that combines with other elements, forming oxides. Some examples of common oxides are minerals such as granite and quartz (oxides of silicon), rust (oxides of iron), and limestone (oxide of calcium and carbon).

#2: Silicon

More than 90% of the Earth’s crust is composed of silicate minerals, making silicon the second most abundant element in the Earth’s crust.

Silicon links up with oxygen to form the most common minerals on Earth. For example, in most places, sand primarily consists of silica (silicon dioxide) usually in the form of quartz. Silicon is an essential semiconductor, used in manufacturing electronics and computer chips.

#3: Aluminum

Aluminum is the third most common element in the Earth’s crust.

Because of its strong affinity for oxygen, aluminum is rarely found in its elemental state. Aluminum oxide (Al2O3), aluminum hydroxide (Al(OH)3) and potassium aluminum sulphate (KAl(SO4)2) are common aluminum compounds.

Aluminum and aluminum alloys have a variety of uses, from kitchen foil to rocket manufacturing.

#4: Iron

The fourth most common element in the Earth’s crust is iron, accounting for over 5% of the mass of the Earth’s crust.

Iron is obtained chiefly from the minerals hematite and magnetite. Of all the metals we mine, over 90% is iron, mainly to make steel, an alloy of carbon and iron. Iron is also an essential nutrient in the human body.

#5: Calcium

Calcium makes up about 4.2% of the planet’s crust by weight.

In its pure elemental state, calcium is a soft, silvery-white alkaline earth metal. It is never found in its isolated state in nature but exists instead in compounds. Calcium compounds can be found in a variety of minerals, including limestone (calcium carbonate), gypsum (calcium sulphate) and fluorite (calcium fluoride).

Calcium compounds are widely used in the food and pharmaceutical industries for supplementation. They are also used as bleaches in the paper industry, as components in cement and electrical insulators, and in manufacturing soaps.

Digging the Earth’s Crust

Despite Jules Verne’s novel, no one has ever journeyed to the center of Earth.

In fact, the deepest hole ever dug by humanity reaches approximately 12 km (7.5 miles) below the Earth’s surface, about one-third of the way to the Earth’s mantle. This incredible depth took about 20 years to reach.

Although mankind is constantly making new discoveries and reaching for the stars, there is still a lot to explore about the Earth we stand on.

Mining

Visualizing Global Gold Production in 2023

Gold production in 2023 was led by China, Australia, and Russia, with each outputting over 300 tonnes.

Visualizing Global Gold Production in 2023

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Over 3,000 tonnes of gold were produced globally in 2023.

In this graphic, we list the world’s leading countries in terms of gold production. These figures come from the latest USGS publication on gold statistics (published January 2024).

China, Australia, and Russia Produced the Most Gold in 2023

China was the top producer in 2023, responsible for over 12% of total global production, followed by Australia and Russia.

| Country | Region | 2023E Production (tonnes) |

|---|---|---|

| 🇨🇳 China | Asia | 370 |

| 🇦🇺 Australia | Oceania | 310 |

| 🇷🇺 Russia | Europe | 310 |

| 🇨🇦 Canada | North America | 200 |

| 🇺🇸 United States | North America | 170 |

| 🇰🇿 Kazakhstan | Asia | 130 |

| 🇲🇽 Mexico | North America | 120 |

| 🇮🇩 Indonesia | Asia | 110 |

| 🇿🇦 South Africa | Africa | 100 |

| 🇺🇿 Uzbekistan | Asia | 100 |

| 🇬🇭 Ghana | Africa | 90 |

| 🇵🇪 Peru | South America | 90 |

| 🇧🇷 Brazil | South America | 60 |

| 🇧🇫 Burkina Faso | Africa | 60 |

| 🇲🇱 Mali | Africa | 60 |

| 🇹🇿 Tanzania | Africa | 60 |

| 🌍 Rest of World | - | 700 |

Gold mines in China are primarily concentrated in eastern provinces such as Shandong, Henan, Fujian, and Liaoning. As of January 2024, China’s gold mine reserves stand at an estimated 3,000 tonnes, representing around 5% of the global total of 59,000 tonnes.

In addition to being the top producer, China emerged as the largest buyer of the yellow metal for the year. In fact, the country’s central bank alone bought 225 tonnes of gold in 2023, according the World Gold Council.

Estimated Global Gold Consumption

Most of the gold produced in 2023 was used in jewelry production, while another significant portion was sold as a store of value, such as in gold bars or coins.

- Jewelry: 46%

- Central Banks and Institutions: 23%

- Physical Bars: 16%

- Official Coins, Medals, and Imitation Coins: 9%

- Electrical and Electronics: 5%

- Other: 1%

According to Fitch Solutions, over the medium term (2023-2032), global gold mine production is expected to grow 15%, as high prices encourage investment and output.

-

Wealth6 days ago

Wealth6 days agoCharted: Which City Has the Most Billionaires in 2024?

-

Mining2 weeks ago

Mining2 weeks agoGold vs. S&P 500: Which Has Grown More Over Five Years?

-

Uranium2 weeks ago

Uranium2 weeks agoThe World’s Biggest Nuclear Energy Producers

-

Education2 weeks ago

Education2 weeks agoHow Hard Is It to Get Into an Ivy League School?

-

Debt2 weeks ago

Debt2 weeks agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Sports2 weeks ago

Sports2 weeks agoThe Highest Earning Athletes in Seven Professional Sports

-

Science2 weeks ago

Science2 weeks agoVisualizing the Average Lifespans of Mammals

-

Brands1 week ago

Brands1 week agoHow Tech Logos Have Evolved Over Time