Datastream

Visualizing Net Worth by Age in America

The Briefing

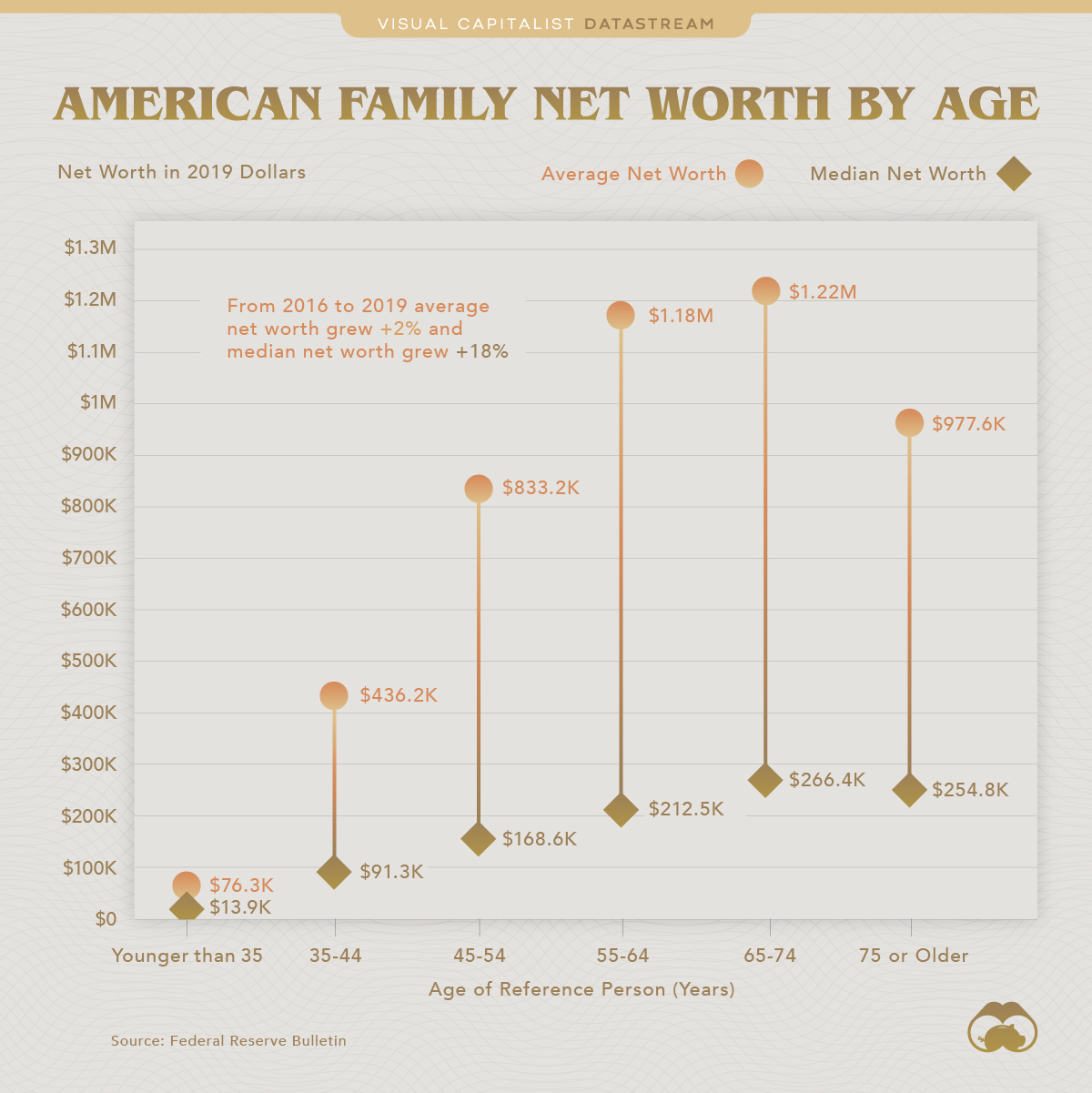

- The age group with the highest average net worth in the U.S. is the 65-74 group, with $1.22 million in 2019 dollars.

- There is a significant gap between median and mean (average) net worth in nearly every age category, suggesting that mean values are skewed upwards by outliers.

Visualizing Net Worth by Age in America

Calculating the net worth of individuals often seems like the kind of math reserved only for the richest people in the world like Elon Musk or Jack Ma. But as the proverbial pie gets bigger, the net worth of the average American household gets bigger as well.

This chart uses data from the U.S. Federal Reserve Bulletin to reveal median and average household net worth across different age categories in 2019.

Average vs. Median Net Worth

A person’s net worth is a sum of their assets and liabilities. Here’s a closer look at net worth by age in the U.S.

| Age | Median Net Worth 2019 | Average Net Worth 2019 | Difference |

|---|---|---|---|

| Younger than 35 | $13,900 | $76,300 | >5x |

| 35-44 | $91,300 | $436,200 | >4.5x |

| 45-54 | $168,600 | $833,200 | >4.5x |

| 55-64 | $212,500 | $1,175,900 | >5.5x |

| 65-74 | $266,400 | $1,217,700 | >4.5x |

| 75 or Older | $254,800 | $977,600 | >3.5x |

The age group with the highest net worth is those aged 65-74, sitting at around $1.22 million. Coming in at a close second, are 55-64 year olds, at $1.18 million. However, these are the numbers using the average, while median net worth is quite different.

Median net worth at 65-74, for example, is $266,000, a difference of over $950,000 compared to the average. This reveals that there are likely high net worth individuals skewing the average towards over a million dollars in the same age category.

Both average and median net worth appear to increase throughout one’s life, trailing off slightly around the 75+ age range.

Trends in Net Worth

With the economic impacts of COVID-19, it’s possible that median net worth growth could taper off across nearly every age category, as people lose jobs, income, and assets such as houses.

Average net worth, on the other hand, may not drop as significantly, as a handful of American billionaires have actually increased their net worth during the pandemic.

Overall, wealth has been generally increasing in America with a consistent rise in average and median net worth occurring over the three years leading up to the pandemic. And while this steady increase has likely been slightly derailed, the general trends in asset ownership and income increases over time, bode well for Americans.

Where does this data come from?

Source: U.S. Federal Reserve Bulletin.

Details: Data is in 2019 U.S. dollars.

Datastream

Can You Calculate Your Daily Carbon Footprint?

Discover how the average person’s carbon footprint impacts the environment and learn how carbon credits can offset your carbon footprint.

The Briefing

- A person’s carbon footprint is substantial, with activities such as food consumption creating as much as 4,500 g of CO₂ emissions daily.

- By purchasing carbon credits from Carbon Streaming Corporation, you can offset your own emissions and fund positive climate action.

Your Everyday Carbon Footprint

While many large businesses and countries have committed to net-zero goals, it is essential to acknowledge that your everyday activities also contribute to global emissions.

In this graphic, sponsored by Carbon Streaming Corporation, we will explore how the choices we make and the products we use have a profound impact on our carbon footprint.

Carbon Emissions by Activity

Here are some of the daily activities and products of the average person and their carbon footprint, according to Clever Carbon.

| Household Activities & Products | CO2 Emissions (g) |

|---|---|

| 💡 Standard Light Bulb (100 watts, four hours) | 172 g |

| 📱 Mobile Phone Use (195 minutes per day)* | 189 g |

| 👕 Washing Machine (0.63 kWh) | 275 g |

| 🔥 Electric Oven (1.56 kWh) | 675 g |

| ♨️ Tumble Dryer (2.5 kWh) | 1,000 g |

| 🧻 Toilet Roll (2 ply) | 1,300 g |

| 🚿 Hot Shower (10 mins) | 2,000 g |

| 🚙 Daily Commute (one hour, by car) | 3,360 g |

| 🍽️ Average Daily Food Consumption (three meals of 600 calories) | 4,500 g |

| *Phone use based on yearly use of 69kg per the source, Reboxed | |

Your choice of transportation plays a crucial role in determining your carbon footprint. For instance, a 15 km daily commute to work on public transport generates an average of 1,464 g of CO₂ emissions. Compared to 3,360 g—twice the volume for a journey the same length by car.

By opting for more sustainable modes of transport, such as cycling, walking, or public transportation, you can significantly reduce your carbon footprint.

Addressing Your Carbon Footprint

One way to compensate for your emissions is by purchasing high-quality carbon credits.

Carbon credits are used to help fund projects that avoid, reduce or remove CO₂ emissions. This includes nature-based solutions such as reforestation and improved forest management, or technology-based solutions such as the production of biochar and carbon capture and storage (CCS).

While carbon credits offer a potential solution for individuals to help reduce global emissions, public awareness remains a significant challenge. A BCG-Patch survey revealed that only 34% of U.S. consumers are familiar with carbon credits, and only 3% have purchased them in the past.

About Carbon Streaming

By financing the creation or expansion of carbon projects, Carbon Streaming Corporation secures the rights to future carbon credits generated by these sustainable projects. You can then purchase these carbon credits to help fund climate solutions around the world and compensate for your own emissions.

Ready to get involved?

>> Learn more about purchasing carbon credits at Carbon Streaming

-

Mining1 week ago

Mining1 week agoGold vs. S&P 500: Which Has Grown More Over Five Years?

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries