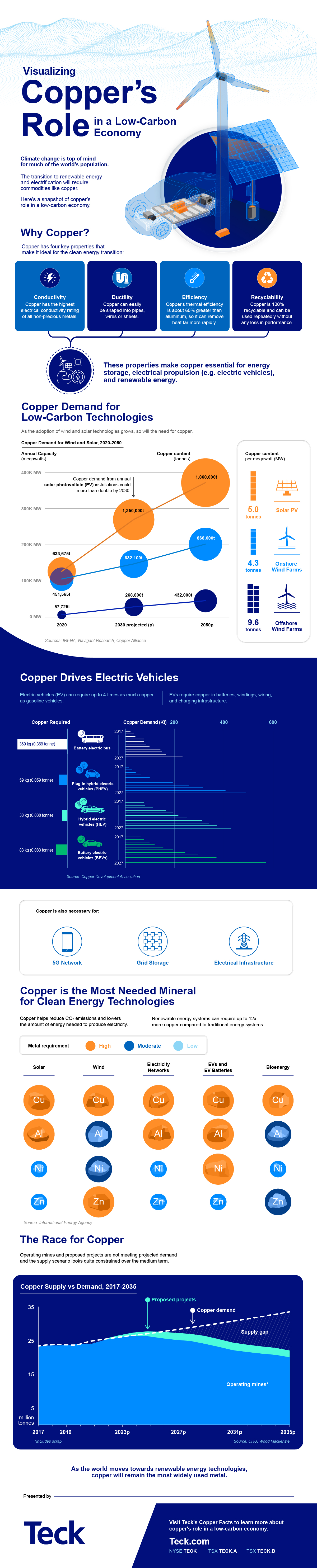

Visualizing Copper’s Role in a Low-Carbon Economy

The following content is sponsored by Teck

Visualizing Copper’s Role in a Low-Carbon Economy

Climate change is top of mind for much of the world’s population.

The transition to renewable energy and electrification will require tons of metals, and copper is considered the most essential.

The above infographic from Teck outlines copper’s role in low-carbon technologies, highlighting why the red metal is essential for a low-carbon future.

Why Copper?

Copper has been an essential material to man since prehistoric times. In fact, it is the oldest metal known, dating back more than 10,000 years and one of the most used because of its versatility.

The metal has four key properties that make it ideal for energy storage, propulsion for electrical vehicles (EVs), and renewable energy:

- Conductivity: Copper has the highest electrical conductivity rating of all non-precious metals.

- Ductility: Copper can easily be shaped into pipes, wires or sheets.

- Efficiency: Copper’s thermal efficiency is about 60% greater than aluminum, so it can remove heat far more rapidly.

- Recyclability: Copper is 100% recyclable and can be used repeatedly without any loss of performance.

In addition to its unique properties, copper remains relatively affordable, making it a key part of the energy transition.

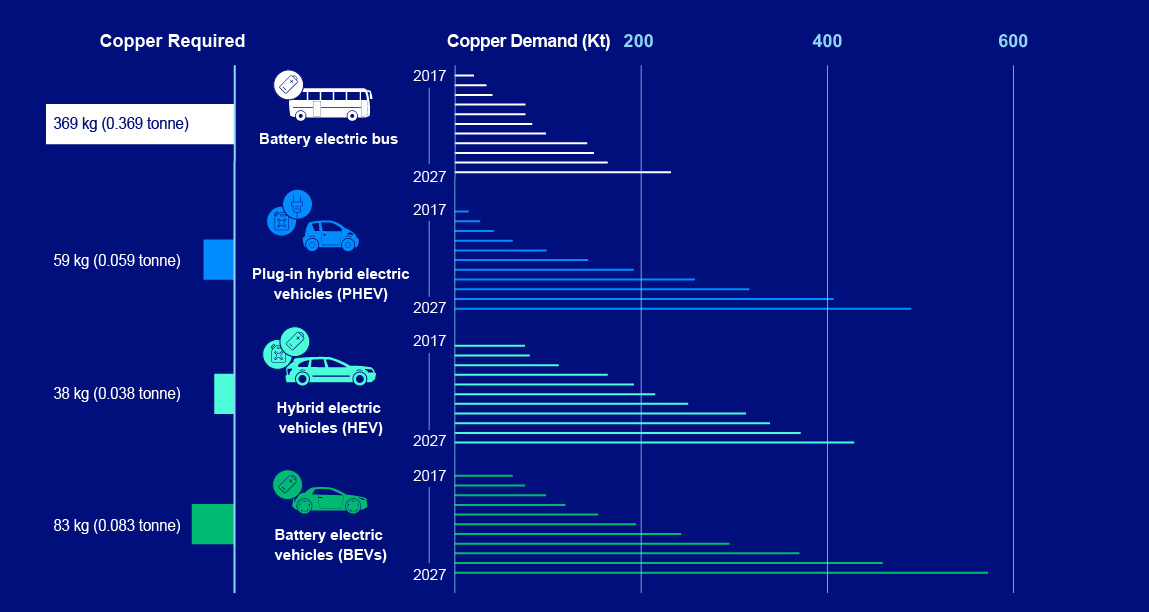

A Cornerstone of the EV Revolution

EVs can use up to four times as much copper when compared to an internal combustion engine (ICE) passenger car. The amount goes up as the size of the vehicle increases: a fully electric bus uses between 11 and 18 times more copper than an ICE passenger vehicle.

Copper is used in every major EV component, from the motor to the inverter and the electrical wiring. In fact, a fully electric vehicle can use up to a mile of copper wiring.

Currently, there are few alternatives to copper. Aluminum is the closest one, but despite it being lighter and almost three times cheaper, aluminum cables require double the size of any copper equivalent to conduct the same amount of electricity.

The Most Essential Metal for Renewable Energy

Copper is an essential element for almost all electricity-related technologies. According to the Copper Alliance, renewable energy systems can require up to 12x more copper compared to traditional energy systems.

Technology 2020 Installed Capacity (megawatts) Copper Content (2020, tonnes) 2050p Installed Capacity (megawatts) Copper Content (2050p, tonnes)

Solar PV 126,735 MW 633,675 372,000 MW 1,860,000

Onshore Wind 105,015 MW 451,565 202,000 MW 868,600

Offshore Wind 6,013 MW 57,725 45,000 MW 432,000

By 2050, annual copper demand from wind and solar technologies could exceed 3 million tonnes or around 15% of 2020 global copper production.

The Race for Copper

Goldman Sachs predicts copper demand for low-carbon technologies will grow to 5.4 million tonnes by 2030, up from around 1 million tonnes in 2021.

Meanwhile, the number of operating mines and proposed projects are not meeting projected demand and the supply scenario looks quite constrained over the medium term.

“We have deficits over the course of 2021 and next year. Inventories will be run down to very low levels, we believe, by the middle of 2022.”

—Nick Snowdon, Commodities Strategist, Goldman Sachs

As the transition to renewable energy and electrification speeds up, so will the pressure for new copper projects in the pipeline.

Teck is one of Canada’s leading mining companies committed to responsibly producing copper needed for a low-carbon future.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology...

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.