Markets

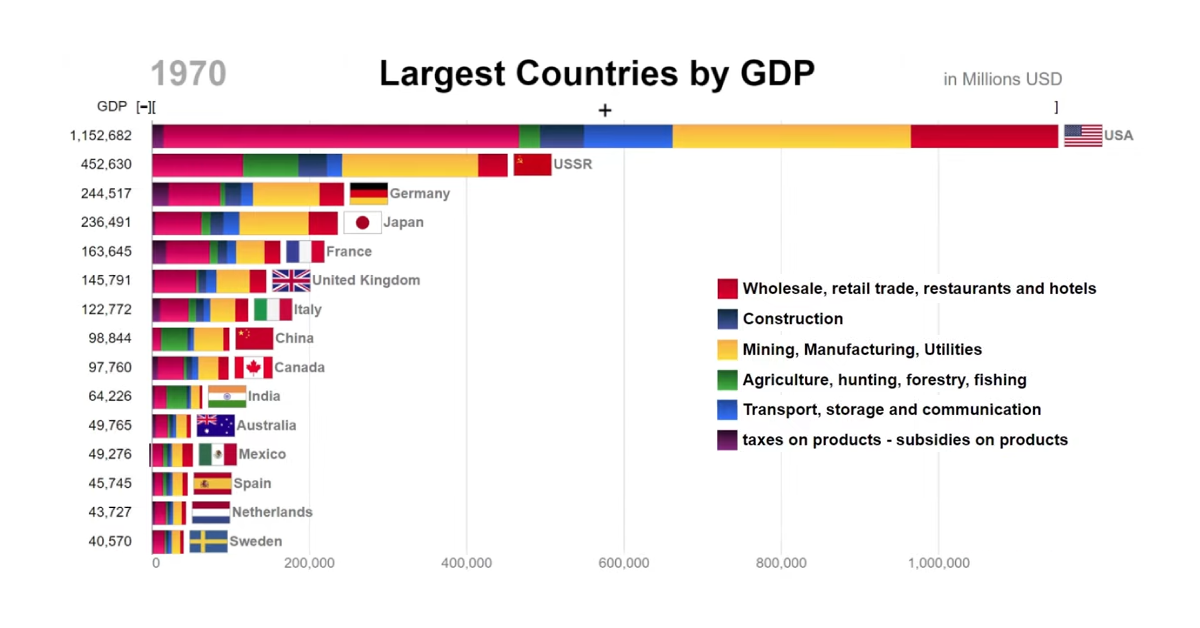

Top Countries by GDP and Economic Components (1970-2017)

Countries by GDP and Economic Components (1970-2017)

While looking at the top countries by GDP is a useful big picture measure, it can also be informative to look at the components that make up an economy as well.

Examining a country’s economic building blocks can tell us a lot about what stage of development the country is in, and where competitive advantages may exist.

Analyzing GDP by Sector

Today’s “horse race” bar chart, by Number Story, is an entertaining historical look at the ranking of top countries by GDP, including the parts that make up the whole.

Here is the latest data as of 2018, as well as the largest sector according to data from the United Nations’ industry classification database:

| Rank | Country | GDP (2018) | Top Sector (% of total) | 2nd Largest Sector (% of total) |

|---|---|---|---|---|

| 1 | 🇺🇸 United States | $20.6T | Other (55%) | Mining/Manufacturing/Utilities (15%) |

| 2 | 🇨🇳 China | $13.6T | Other (36%) | Mining/Manufacturing/Utilities (33%) |

| 3 | 🇯🇵 Japan | $4.9T | Other (43%) | Mining/Manufacturing/Utilities (23%) |

| 4 | 🇩🇪 Germany | $3.6T | Other (48%) | Mining/Manufacturing/Utilities (25%) |

| 5 | 🇬🇧 UK | $2.5T | Other (55%) | Retail/Restaurant/Hotels (14%) |

| 6 | 🇮🇳 India | $2.5T | Other (36%) | Mining/Manufacturing/Utilities (22%) |

| 7 | 🇫🇷 France | $2.5T | Other (56%) | Mining/Manufacturing/Utilities (13%) |

| 8 | 🇮🇹 Italy | $1.9T | Other (49%) | Mining/Manufacturing/Utilities (20%) |

| 9 | 🇧🇷 Brazil | $1.6T | Other (50%) | Mining/Manufacturing/Utilities (16%) |

| 10 | 🇨🇦 Canada | $1.6T | Other (52%) | Mining/Manufacturing/Utilities (18%) |

| 11 | 🇰🇷 South Korea | $1.6T | Other (42%) | Mining/Manufacturing/Utilities (31%) |

| 12 | 🇷🇺 Russia | $1.5T | Other (36%) | Mining/Manufacturing/Utilities (28%) |

| 13 | 🇦🇺 Australia | $1.4T | Other (53%) | Mining/Manufacturing/Utilities (17%) |

| 14 | 🇪🇸 Spain | $1.3T | Other (47%) | Retail/Restaurant/Hotels (19%) |

| 15 | 🇲🇽 Mexico | $1.2T | Other (34%) | Mining/Manufacturing/Utilities (24%) |

Why are “Other Activities” so dominant in this breakdown?

It’s because of the way GDP that components are classified as data in the UN industry classification system, which is laid out below:

- Agriculture, hunting, forestry, fishing (ISIC A-B)

- Mining, manufacturing, utilities (ISIC C-E)

- Construction (ISIC F)

- Wholesale, retail trade, restaurants and hotels (ISIC G-H)

- Transport, storage and communication (ISIC I)

- Other activities, such as finance, healthcare, real estate, and tech (ISIC J-P)

Although agriculture, construction, or manufacturing have been a bedrock for economies in the past, developed countries skew towards adding economic value in different ways today.

Given that finance, government spending (healthcare, education, defense, etc.) and technology — all important modern industries — are included in “Other”, this makes the possibly outdated classification the biggest (and least useful) category to examine here.

Nevertheless, there is still information we can glean from this animated breakdown of GDP, spanning a period of almost 50 years.

A More Granular Look at GDP

In the past, we’ve shown you high level visualizations that break down the world’s $86 trillion GDP by country, or even projections on the largest countries by GDP in 2030 in PPP terms.

However, the animated bar chart shows something more granular that is compelling in its own right. By observing the evolution of countries’ economic components over time, some interesting observations emerge that would normally be lost in the big picture.

Japan’s Manufacturing Boom

At points during Japan’s heyday of growth during the 1980’s, manufacturing comprised nearly 30% of economic activity. By the mid-90s, this single segment of Japan’s economy was so valuable that, on its own, it would’ve placed fifth in the global ranking.

America Leading the Pack

While other countries switch positions, reordering as economies boom and bust, the U.S. has handily remained in top position.

Japan was the country that narrowed the gap between the first and second spot the most, though the country’s Lost Decade in the 1990s cut that ascension short.

During the years between 1970 and 2017, the United States was at its most dominant in 2006 when its GDP was triple the size of Japan’s. Of course, in recent years China has narrowed the gap considerably.

A Star Rising in the East

As one would expect, the building blocks of China’s economy looked very different in the 1970s than today.

The communist systems of the USSR and China are both easy to spot in the visualization. Agriculture played an outsized role, and industries like finance, real estate, and retail were understated compared to the profiles of countries that operated under a capitalist system.

In 1980, as the first Special Economic Zones were being created, three-quarters of China’s economy was based on agriculture, resource extraction, and manufacturing. Even as recently as the early ’90s, China wasn’t in the top 10 despite being the world’s most populous country.

Of course, that situation changed drastically over the next two decades. By the dawn of the 21st century, China ranked fifth in the world, and a decade later, China surpassed Japan to become the second largest economy globally.

Markets

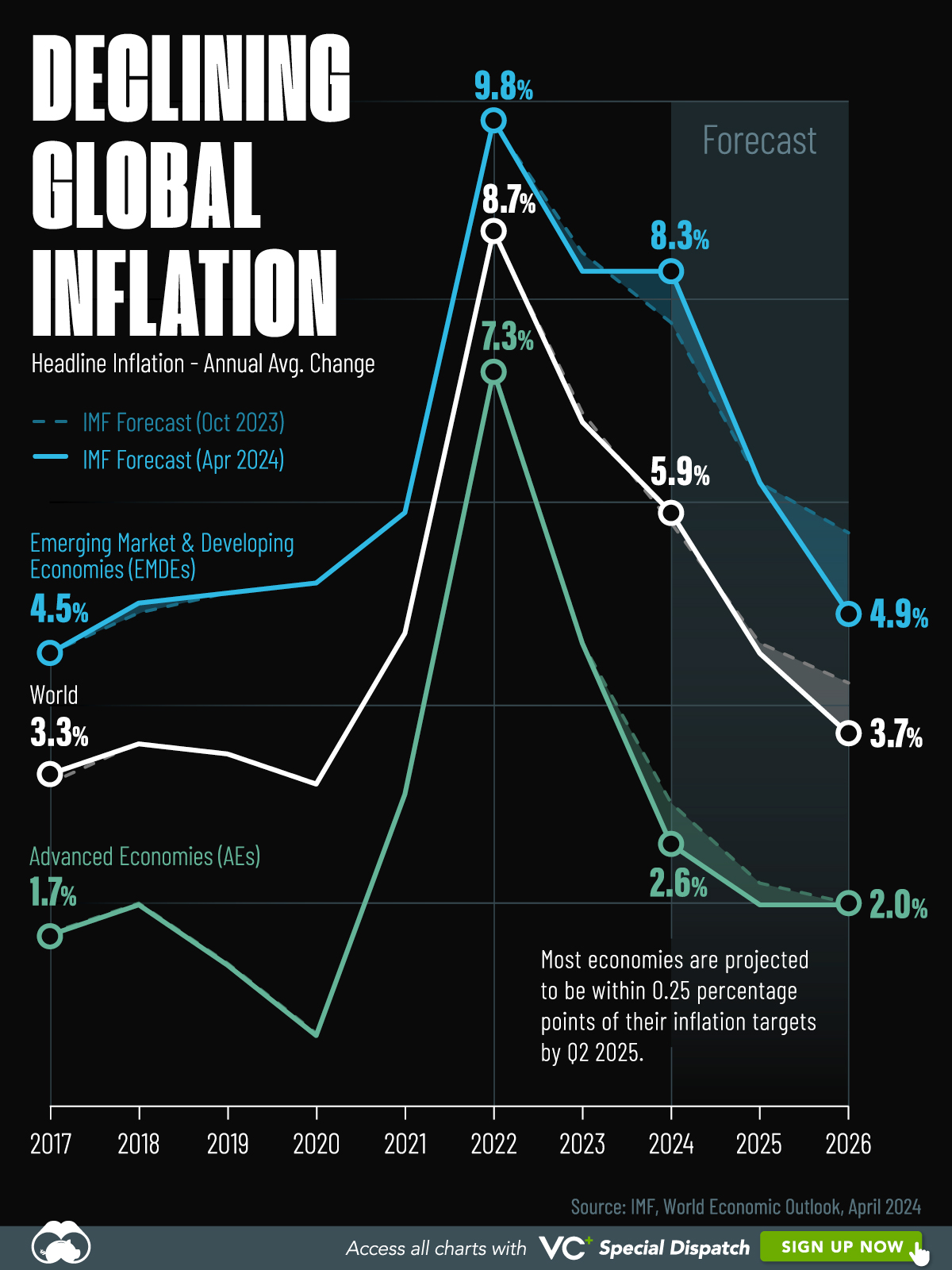

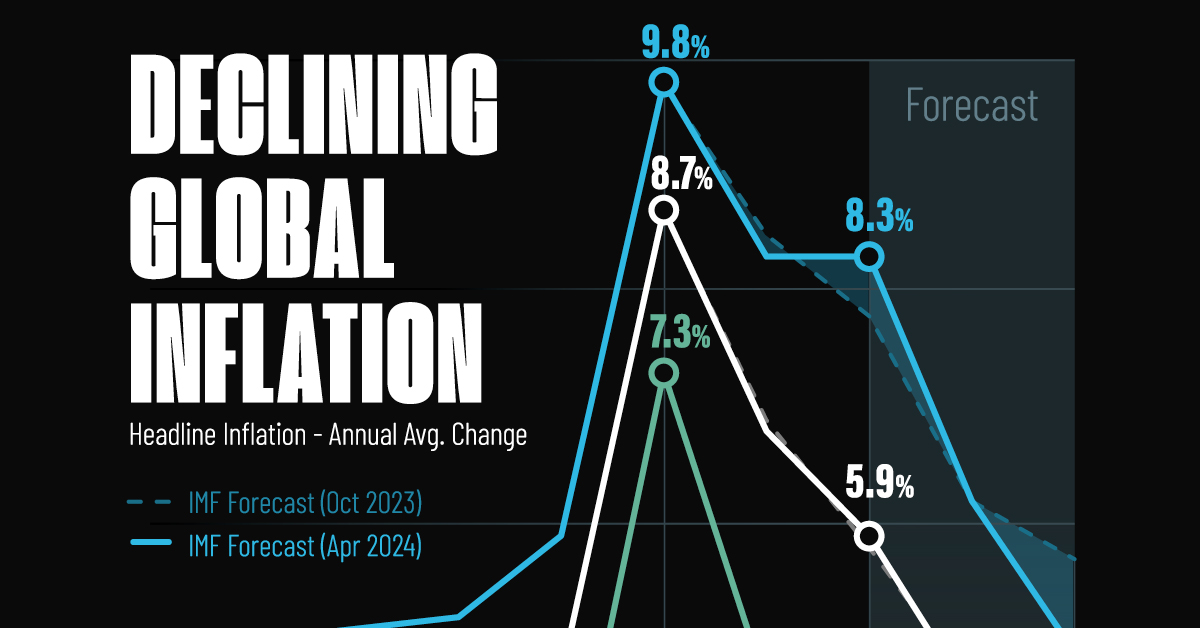

Visualizing Global Inflation Forecasts (2024-2026)

Here are IMF forecasts for global inflation rates up to 2026, highlighting a slow descent of price pressures amid resilient global growth.

Visualizing Global Inflation Forecasts (2024-2026)

Global inflation rates are gradually descending, but progress has been slow.

Today, the big question is if inflation will decline far enough to trigger easing monetary policy. So far, the Federal Reserve has held rates for nine months amid stronger than expected core inflation, which excludes volatile energy and food prices.

Yet looking further ahead, inflation forecasts from the International Monetary Fund (IMF) suggest that inflation will decline as price pressures ease, but the path of disinflation is not without its unknown risks.

This graphic shows global inflation forecasts, based on data from the April 2024 IMF World Economic Outlook.

Get the Key Insights of the IMF’s World Economic Outlook

Want a visual breakdown of the insights from the IMF’s 2024 World Economic Outlook report?

This visual is part of a special dispatch of the key takeaways exclusively for VC+ members.

Get the full dispatch of charts by signing up to VC+.

The IMF’s Inflation Outlook

Below, we show the IMF’s latest projections for global inflation rates through to 2026:

| Year | Global Inflation Rate (%) | Advanced Economies Inflation Rate (%) | Emerging Market and Developing Economies Inflation Rate (%) |

|---|---|---|---|

| 2019 | 3.5 | 1.4 | 5.1 |

| 2020 | 3.2 | 0.7 | 5.2 |

| 2021 | 4.7 | 3.1 | 5.9 |

| 2022 | 8.7 | 7.3 | 9.8 |

| 2023 | 6.8 | 4.6 | 8.3 |

| 2024 | 5.9 | 2.6 | 8.3 |

| 2025 | 4.5 | 2.0 | 6.2 |

| 2026 | 3.7 | 2.0 | 4.9 |

After hitting a peak of 8.7% in 2022, global inflation is projected to fall to 5.9% in 2024, reflecting promising inflation trends amid resilient global growth.

While inflation has largely declined due to falling energy and goods prices, persistently high services inflation poses challenges to mitigating price pressures. In addition, the IMF highlights the potential risk of an escalating conflict in the Middle East, which could lead to energy price shocks and higher shipping costs.

These developments could negatively affect inflation scenarios and prompt central banks to adopt tighter monetary policies. Overall, by 2026, global inflation is anticipated to decline to 3.7%—still notably above the 2% target set by several major economies.

Adding to this, we can see divergences in the path of inflation between advanced and emerging economies. While affluent nations are forecast to see inflation edge closer to the 2% target by 2026, emerging economies are projected to have inflation rates reach 4.9%—falling closer to their pre-pandemic averages.

Get the Full Analysis of the IMF’s Outlook on VC+

This visual is part of an exclusive special dispatch for VC+ members which breaks down the key takeaways from the IMF’s 2024 World Economic Outlook.

For the full set of charts and analysis, sign up for VC+.

-

Markets6 days ago

Markets6 days agoThe Best U.S. Companies to Work for According to LinkedIn

-

VC+2 weeks ago

VC+2 weeks agoVC+: Get Our Key Takeaways From the IMF’s World Economic Outlook

-

Demographics2 weeks ago

Demographics2 weeks agoThe Countries That Have Become Sadder Since 2010

-

Money2 weeks ago

Money2 weeks agoCharted: Who Has Savings in This Economy?

-

Technology2 weeks ago

Technology2 weeks agoVisualizing AI Patents by Country

-

Economy2 weeks ago

Economy2 weeks agoEconomic Growth Forecasts for G7 and BRICS Countries in 2024

-

Wealth1 week ago

Wealth1 week agoCharted: Which City Has the Most Billionaires in 2024?

-

Technology1 week ago

Technology1 week agoAll of the Grants Given by the U.S. CHIPS Act