Space Sustainability: Preserving the Usability of Outer Space

The following content is sponsored by Secure World Foundation.

Space Sustainability: Preserving the Usability of Outer Space

Humanity is yet to explore the limits of our universe, but outer space is already becoming an increasingly important resource for the Earth.

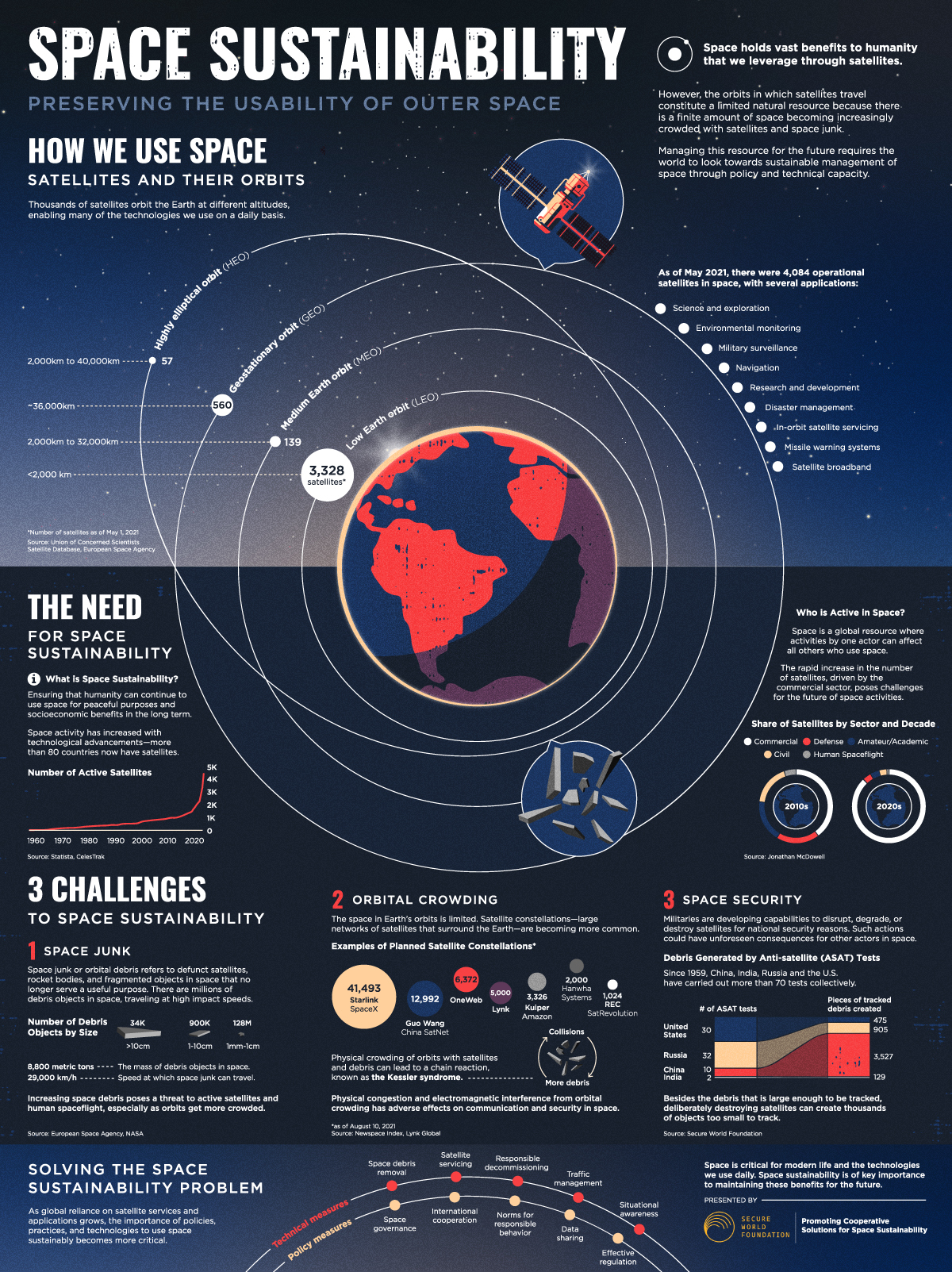

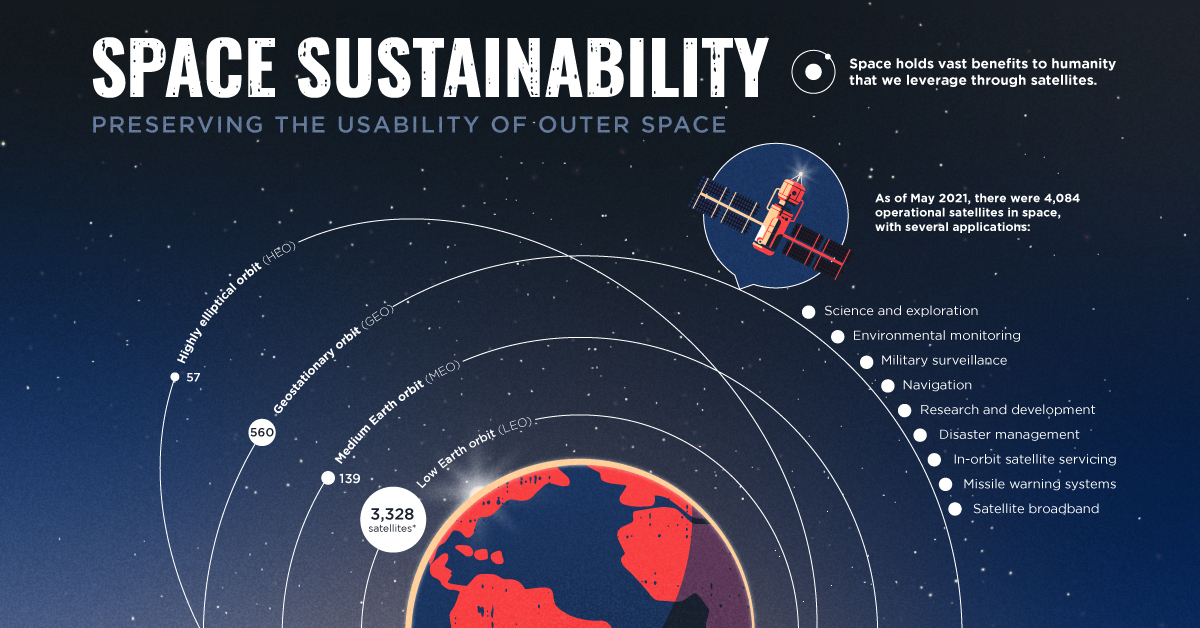

The Earth’s orbits support various satellite applications that enable the technologies we use on a daily basis. While space might seem infinite, the orbits in which satellites travel constitute a limited natural resource with a finite amount of physical space. These orbits are becoming more and more crowded with satellites and space junk—and managing this resource sustainably is critical to the future of activities in space.

The above infographic from our sponsor Secure World Foundation highlights the challenges facing space sustainability and the potential solutions that can help manage this resource for the future.

The Need to Preserve Outer Space

Thousands of satellites orbit the Earth at different altitudes, providing social, scientific, and economic benefits to people across the globe. While some satellites are helping advance science and exploration in space, others are monitoring the Earth’s environment and aiding disaster management on the ground.

However, space is a global resource, where the presence and actions of one actor can affect all the others in orbit. In 1990, there were less than 500 active satellites orbiting the Earth. Today, there are more than 4,000 active satellites in space. Furthermore, with companies like SpaceX launching expansive satellite networks, the majority of active satellites today are for commercial purposes, with a smaller portion serving government, military, civil, and academic needs.

The rapid increase in the number of satellites, driven by the commercial sector, poses challenges to the future of space activity and sustainability.

Three Challenges to Space Sustainability

Space sustainability is ensuring that all humanity can continue to use outer space for peaceful purposes and socioeconomic benefits now and in the long term. This will require international cooperation, discussion, and agreements designed to ensure that outer space is safe, secure, and peaceful.

There are several challenges facing space sustainability, but three important issues stand out.

Challenge #1:

Space Junk

As the term suggests, space junk or orbital debris refers to defunct satellites, old rocket bodies, and fragmented objects in space that no longer serve a useful purpose.

According to the European Space Agency (ESA), the mass of all debris objects in space summed up to 8,800 tonnes as of December 2020. This includes:

- 34,000 objects greater than 10cm in size

- 900,000 objects between 1cm and 10cm

- 128 million objects between 1mm and 1cm

Although these objects seem small in size, they can travel at speeds up to 29,000 km/h or roughly 8 km/s. As a result, even collisions with small pieces of debris can have dangerous consequences for those in space.

The increasing amount of space junk brings up another issue—the physical congestion in Earth’s orbits.

Challenge #2:

Orbital Crowding

The Earth’s orbits have a limited amount of physical space. Today, these orbits host thousands of satellites of different sizes, in addition to the debris and objects that are floating around.

Physical crowding of orbits with satellites and debris can lead to a chain reaction known as the Kessler syndrome. This refers to a scenario where the density of objects in the Low Earth Orbit (LEO) is high enough that collisions between objects can create a cascading effect where each collision generates debris that increases the probability of further collisions.

Moreover, satellite constellations—large networks of satellites—are becoming more common. Here are some examples of planned satellite constellations as of August 10, 2021:

| Company | Constellation Name | Number of Satellites |

|---|---|---|

| SpaceX | Starlink | 41,493 |

| China SatNet | Guo Wang | 12,992 |

| OneWeb | N/A | 6,372 |

| Lynk Global | N/A | 5,000 |

| Amazon | Kuiper | 3,326 |

| Hanwha Systems | N/A | 2,000 |

| SatRevolution | REC | 1,024 |

Orbital crowding with satellites and space junk can cause both physical congestion and electromagnetic interference, hindering communication and security in space.

Challenge #3:

Space Security

Militaries use space to support operations with communications, intelligence, navigation, and surveillance satellites, which play an important role in both national and international security.

However, with more nations integrating space into their security measures, there is an increased risk of conflict in case of any satellite interference. As a result, militaries are developing capabilities to disrupt, degrade, or destroy satellites for national security reasons.

Since 1959, China, India, Russia, and the U.S. have carried out more than 70 anti-satellite (ASAT) tests collectively. These tests generated over 5,000 pieces of debris that are currently being tracked, in addition to the thousands of smaller objects that are too small to track.

Managing Space: A Resource for the Future

Space junk, orbital crowding, and space security are challenges that call for policies, practices, and technologies to use space sustainably.

Potential solutions to these issues range from technical measures like removing space debris, managing orbital traffic, and improving situational awareness, to policy measures like space governance, data-sharing, and implementing effective regulations.

While some of these initiatives are already underway, such as the world’s first debris removal mission launching in 2025, ensuring space sustainability on a global level will require policy and technical measures on a global scale.

Secure World Foundation promotes cooperative solutions for space sustainability and the peaceful uses of outer space.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology...

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.