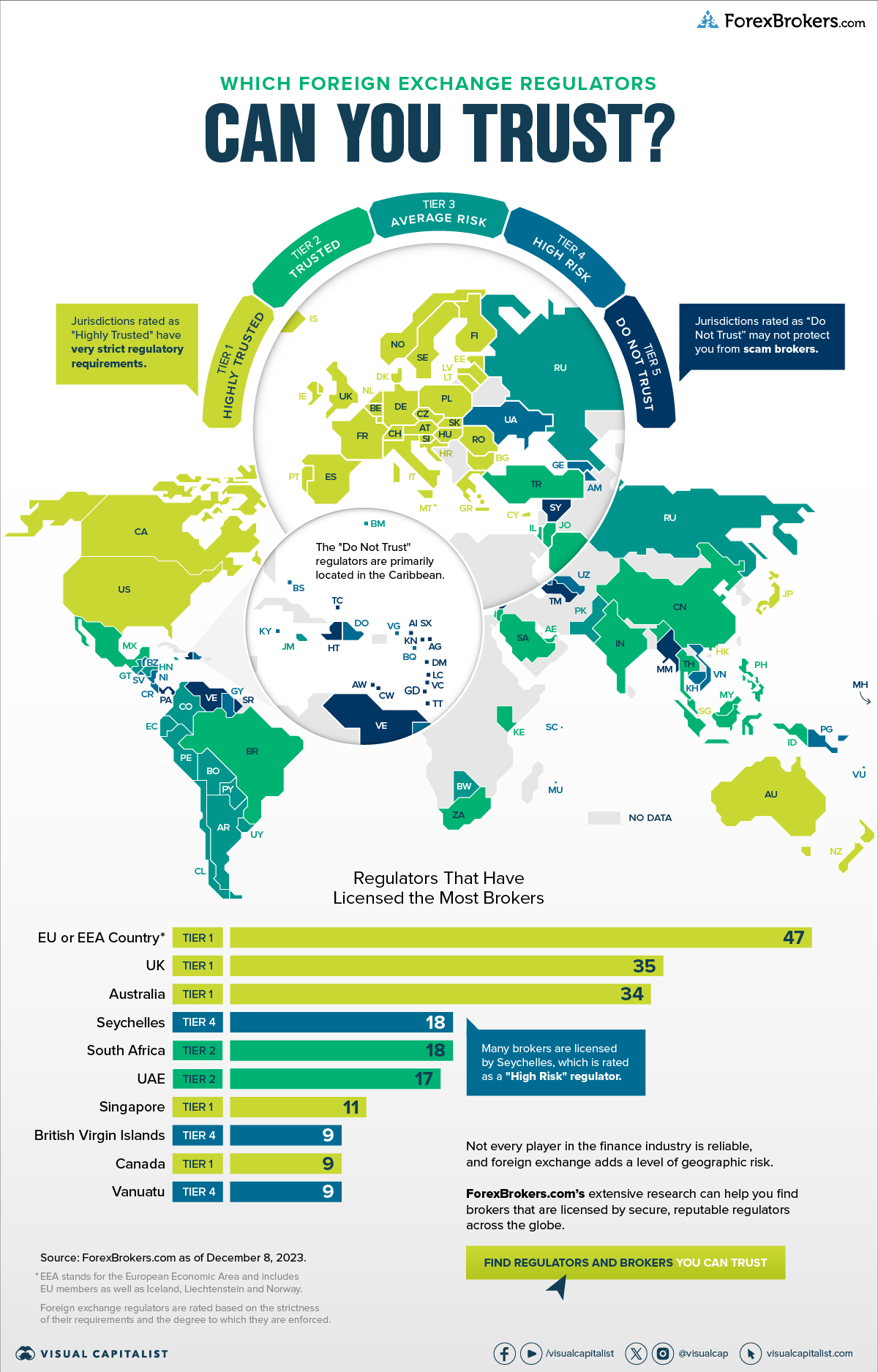

Mapped: Which Foreign Exchange Regulators Can You Trust?

Which Foreign Exchange Regulators Can You Trust?

Global trading volumes in foreign exchange (forex) markets reached $7.5 trillion per day in April 2022. Notably, this was 30 times greater than daily global GDP. With so much money at stake, it’s important that investors know which regulators they can trust.

In this graphic from ForexBrokers.com, we look at the trustworthiness of forex regulators around the world.

The Trust Tiers of Forex Regulators

ForexBrokers.com sorts regulatory jurisdictions into five trust tiers:

- Highly Trusted

- Trusted

- Average Risk

- High Risk

- Do Not Trust

Tier 1 regulators have the most strict and efficient regulations in place. They also typically carry out periodic audits to ensure that brokers are meeting compliance obligations. On the other hand, lower-tier jurisdictions have less stringent regulations—or no regulations whatsoever. They may also not respond to or resolve complaints quickly.

Below, we show how more than 100 regulatory jurisdictions around the world stack up.

| Tier | Country/Jurisdiction |

|---|---|

| Tier 1: Highly Trusted | 🇦🇹 Austria |

| Tier 1: Highly Trusted | 🇦🇺 Australia |

| Tier 1: Highly Trusted | 🇧🇪 Belgium |

| Tier 1: Highly Trusted | 🇧🇬 Bulgaria |

| Tier 1: Highly Trusted | 🇨🇦 Canada |

| Tier 1: Highly Trusted | 🇨🇭 Switzerland |

| Tier 1: Highly Trusted | 🇨🇾 Cyprus |

| Tier 1: Highly Trusted | 🇨🇿 Czechia |

| Tier 1: Highly Trusted | 🇩🇪 Germany |

| Tier 1: Highly Trusted | 🇩🇰 Denmark |

| Tier 1: Highly Trusted | 🇪🇪 Estonia |

| Tier 1: Highly Trusted | 🇪🇸 Spain |

| Tier 1: Highly Trusted | 🇫🇮 Finland |

| Tier 1: Highly Trusted | 🇫🇷 France |

| Tier 1: Highly Trusted | 🇬🇧 UK |

| Tier 1: Highly Trusted | 🇬🇷 Greece |

| Tier 1: Highly Trusted | 🇭🇰 Hong Kong |

| Tier 1: Highly Trusted | 🇭🇷 Croatia |

| Tier 1: Highly Trusted | 🇭🇺 Hungary |

| Tier 1: Highly Trusted | 🇮🇪 Ireland |

| Tier 1: Highly Trusted | 🇮🇸 Iceland |

| Tier 1: Highly Trusted | 🇮🇹 Italy |

| Tier 1: Highly Trusted | 🇯🇵 Japan |

| Tier 1: Highly Trusted | 🇱🇮 Lichtenstein |

| Tier 1: Highly Trusted | 🇱🇹 Lithuania |

| Tier 1: Highly Trusted | 🇱🇺 Luxembourg |

| Tier 1: Highly Trusted | 🇱🇻 Latvia |

| Tier 1: Highly Trusted | 🇲🇹 Malta |

| Tier 1: Highly Trusted | 🇳🇱 Netherlands |

| Tier 1: Highly Trusted | 🇳🇴 Norway |

| Tier 1: Highly Trusted | 🇳🇿 New Zealand |

| Tier 1: Highly Trusted | 🇵🇱 Poland |

| Tier 1: Highly Trusted | 🇵🇹 Portugal |

| Tier 1: Highly Trusted | 🇷🇴 Romania |

| Tier 1: Highly Trusted | 🇸🇪 Sweden |

| Tier 1: Highly Trusted | 🇸🇬 Singapore |

| Tier 1: Highly Trusted | 🇸🇮 Slovenia |

| Tier 1: Highly Trusted | 🇸🇰 Slovakia |

| Tier 1: Highly Trusted | 🇺🇸 United States |

| Tier 2: Trusted | 🇧🇷 Brazil |

| Tier 2: Trusted | 🇨🇳 China |

| Tier 2: Trusted | 🇮🇳 India |

| Tier 2: Trusted | 🇮🇩 Indonesia |

| Tier 2: Trusted | 🇮🇱 Israel |

| Tier 2: Trusted | 🇯🇴 Jordan |

| Tier 2: Trusted | 🇰🇪 Kenya |

| Tier 2: Trusted | 🇲🇾 Malaysia |

| Tier 2: Trusted | 🇲🇽 Mexico |

| Tier 2: Trusted | 🇵🇭 Philippines |

| Tier 2: Trusted | 🇸🇦 Saudi Arabia |

| Tier 2: Trusted | 🇿🇦 South Africa |

| Tier 2: Trusted | 🇹🇭 Thailand |

| Tier 2: Trusted | 🇹🇷 Türkiye |

| Tier 2: Trusted | 🇦🇪 United Arab Emirates |

| Tier 3: Average Risk | 🇦🇷 Argentina |

| Tier 3: Average Risk | 🇧🇲 Bermuda |

| Tier 3: Average Risk | 🇧🇴 Bolivia |

| Tier 3: Average Risk | 🇧🇼 Botswana |

| Tier 3: Average Risk | 🇨🇱 Chile |

| Tier 3: Average Risk | 🇨🇴 Columbia |

| Tier 3: Average Risk | 🇪🇨 Ecuador |

| Tier 3: Average Risk | 🇬🇹 Guatemala |

| Tier 3: Average Risk | 🇭🇳 Honduras |

| Tier 3: Average Risk | 🇯🇲 Jamaica |

| Tier 3: Average Risk | 🇵🇰 Pakistan |

| Tier 3: Average Risk | 🇵🇾 Paraguay |

| Tier 3: Average Risk | 🇵🇪 Peru |

| Tier 3: Average Risk | 🇷🇺 Russia |

| Tier 3: Average Risk | 🇺🇾 Uruguay |

| Tier 4: High Risk | 🇦🇲 Armenia |

| Tier 4: High Risk | 🇧🇸 Bahamas |

| Tier 4: High Risk | 🇧🇿 Belize |

| Tier 4: High Risk | 🇧🇶 BES Islands (Bonaire, Sint Eustatius, Saba) |

| Tier 4: High Risk | 🇻🇬 British Virgin Islands |

| Tier 4: High Risk | 🇰🇭 Cambodia |

| Tier 4: High Risk | 🇰🇾 Cayman Islands |

| Tier 4: High Risk | 🇨🇷 Costa Rica |

| Tier 4: High Risk | 🇩🇴 Dominican Republic |

| Tier 4: High Risk | 🇸🇻 El Salvador |

| Tier 4: High Risk | 🇬🇪 Georgia |

| Tier 4: High Risk | 🇬🇾 Guyana |

| Tier 4: High Risk | 🇲🇺 Mauritius |

| Tier 4: High Risk | 🇳🇮 Nicaragua |

| Tier 4: High Risk | 🇵🇬 Papua New Guinea |

| Tier 4: High Risk | 🇸🇨 Seychelles |

| Tier 4: High Risk | 🇺🇦 Ukraine |

| Tier 4: High Risk | 🇺🇿 Uzbekistan |

| Tier 4: High Risk | 🇻🇺 Vanuatu |

| Tier 4: High Risk | 🇻🇳 Vietnam |

| Tier 5: Do Not Trust | 🇦🇮 Anguilla |

| Tier 5: Do Not Trust | 🇦🇬 Antigua and Barbuda |

| Tier 5: Do Not Trust | 🇦🇼 Aruba |

| Tier 5: Do Not Trust | 🇨🇼 Curaçao and Sint Maarten |

| Tier 5: Do Not Trust | 🇩🇲 Commonwealth of Dominica |

| Tier 5: Do Not Trust | 🇬🇩 Grenada |

| Tier 5: Do Not Trust | 🇭🇹 Haiti |

| Tier 5: Do Not Trust | 🇲🇭 Marshall Islands |

| Tier 5: Do Not Trust | 🇲🇲 Myanmar |

| Tier 5: Do Not Trust | 🇳🇨 Nevis |

| Tier 5: Do Not Trust | 🇵🇦 Panama |

| Tier 5: Do Not Trust | 🇱🇨 Saint Lucia |

| Tier 5: Do Not Trust | 🇻🇨 Saint Vincent & The Grenadines |

| Tier 5: Do Not Trust | 🇸🇷 Suriname |

| Tier 5: Do Not Trust | 🇸🇾 Syria |

| Tier 5: Do Not Trust | 🇹🇹 Trinidad and Tobago |

| Tier 5: Do Not Trust | 🇹🇲 Turkmenistan |

| Tier 5: Do Not Trust | 🇹🇨 Turks and Caicos Islands |

| Tier 5: Do Not Trust | 🇻🇪 Venezuela |

Source: ForexBrokers.com as of December 8, 2023.

Mature markets tend to have tighter regulations. For instance, the U.S. is one of 39 jurisdictions on this list that ForexBrokers.com rates as highly trusted.

The country has implemented a number of regulations to provide a more stable and secure trading environment. In 2010, the Commodity Futures Trading Commission mandated that forex brokers must keep at least $20 million in regulatory capital and lowered the amount of leverage (borrowed funds) brokers could legally offer.

Conversely, regulators in the lowest “Do Not Trust” tier are primarily located in the Caribbean. Many of these small island nations do not have a fully developed infrastructure to regulate financial markets.

While some countries such as Mauritius and Seychelles are developing a regulatory framework, others such as the Marshall Islands or St. Vincent and the Grenadines have virtually nonexistent rules. However, brokers can still register entities in these tier 5 jurisdictions without any properly established client protections.

Finding a Broker for Forex Trading

To trade currencies, you’ll want to find a forex broker that is licensed by secure, reputable regulators. ForexBrokers.com analyzed 62 companies and found that brokers use some regulators much more often than others.

Here are the 10 regulatory jurisdictions that have licensed the most brokers.

| Country/Jurisdiction | Trust Tier | Number of Brokers Licensed |

|---|---|---|

| 🇪🇺 EU or EEA Country* | Tier 1: Highly Trusted | 47 |

| 🇬🇧 UK | Tier 1: Highly Trusted | 35 |

| 🇦🇺 Australia | Tier 1: Highly Trusted | 34 |

| 🇸🇨 Seychelles | Tier 4: High Risk | 18 |

| 🇿🇦 South Africa | Tier 2: Trusted | 18 |

| 🇦🇪 UAE | Tier 2: Trusted | 17 |

| 🇸🇬 Singapore | Tier 1: Highly Trusted | 11 |

| 🇻🇬 British Virgin Islands | Tier 4: High Risk | 9 |

| 🇨🇦 Canada | Tier 1: Highly Trusted | 9 |

| 🇻🇺 Vanuatu | Tier 4: High Risk | 9 |

Source: ForexBrokers.com as of December 8, 2023. *EEA stands for the European Economic area and includes EU members as well as Iceland, Liechtenstein, and Norway.

It’s most common for brokers to be licensed by a country within the EU or EEA, which is a highly trusted jurisdiction. However, many brokers get a license from Seychelles, which is rated as a high risk regulator.

A broker can be licensed in a number of different regulatory jurisdictions. It’s also worth noting that if a forex broker accepts customers from your country, it does not necessarily mean they are licensed in your country.

To help investors find brokers they can trust, ForexBrokers.com has developed a proprietary Trust Score. The score produces an individual numerical rating for each broker based on a variety of factors, including the number and quality of regulatory licenses the broker holds.

Explore Trust Scores from ForexBrokers.com to find reliable regulators and brokers.

-

Misc3 years ago

Misc3 years agoMapped: The World’s Biggest Private Tax Havens

What countries or territories do the ultra-wealthy use as tax havens?

-

Politics3 years ago

Politics3 years agoVisualizing the UK and EU Trade Relationship

The UK and the EU have recently laid out new terms for their relationship. So how important is the UK’s trade with the EU?

-

Precious Metals3 years ago

Precious Metals3 years agoHow Every Asset Class, Currency, and S&P 500 Sector Performed in 2020

The markets were volatile but offered great opportunity in 2020. See how every asset class, currency, and S&P 500 sector performed over the year.

-

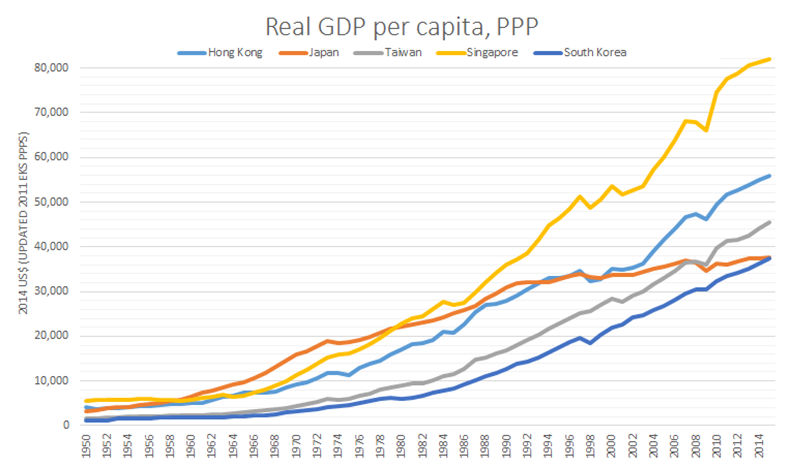

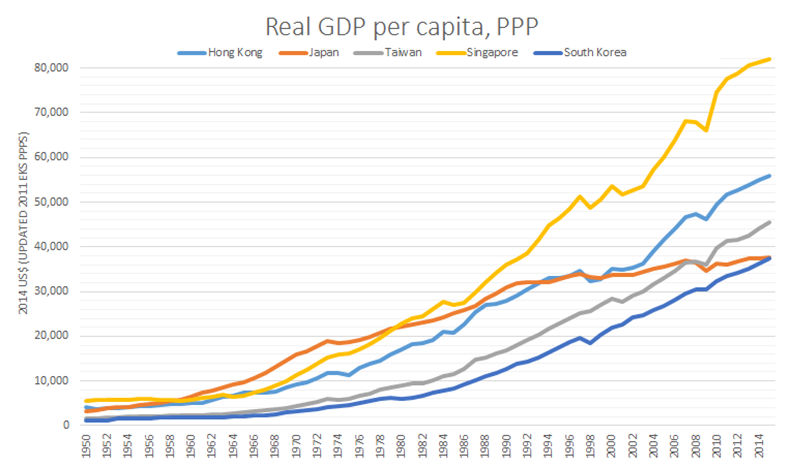

Markets8 years ago

Markets8 years agoJapan Officially Gets Leapfrogged by the Four Asian Tigers

After 25 years of economic stagnation, Japan has finally been leapfrogged by all four so-called Asian Tigers: Hong Kong, Singapore, S. Korea, and Taiwan.

-

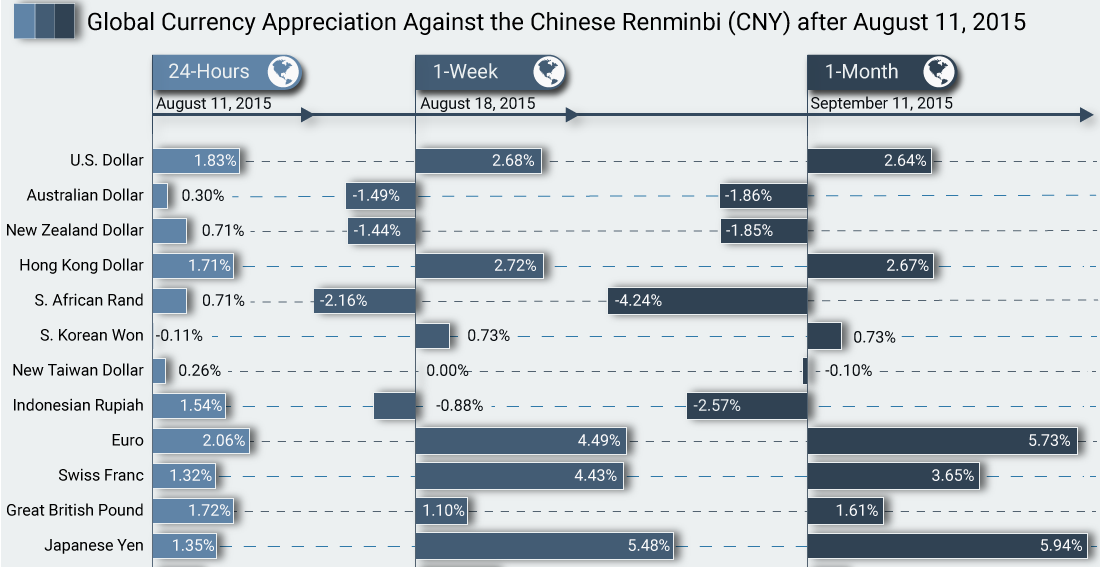

Markets9 years ago

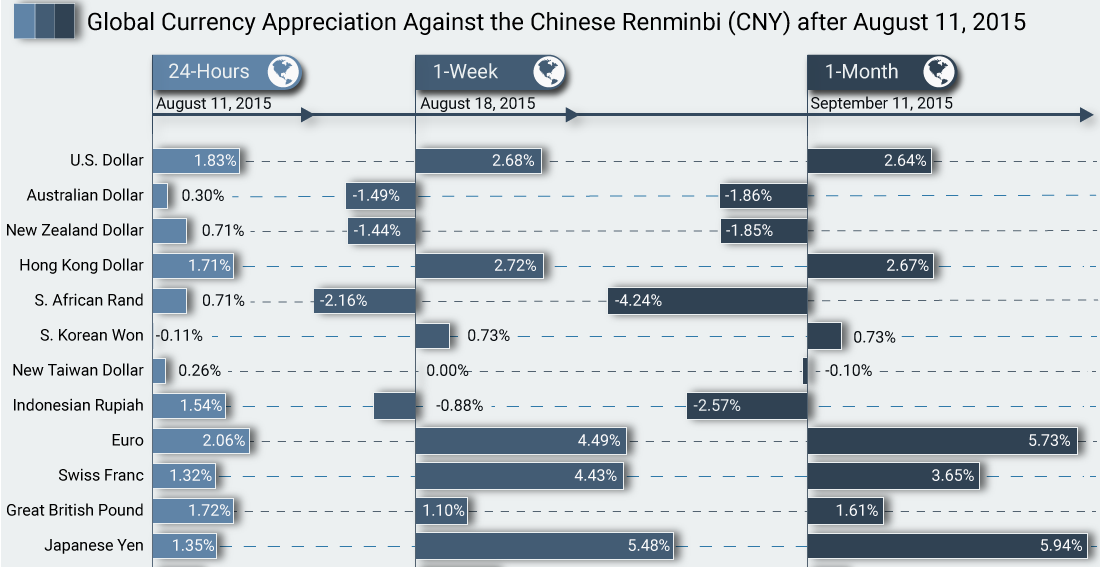

Markets9 years agoNumber Crunching: The Impact of China’s Currency Devaluation

On August 11, China’s central banks shocked markets by devaluating the yuan in the biggest move in 20 years. Over one month later, here is the…

-

Energy9 years ago

Energy9 years agoThe Petrostate Hex: How Plunging Oil Prices Affect Currencies

Plunging oil prices have profound effects on major importers and exporters of oil. In this case, we look at how currencies of net exporters are impacted.