Markets

Japan Officially Gets Leapfrogged by the Four Asian Tigers

Japan Officially Gets Leapfrogged by the Four Asian Tigers

Throughout the decades in the 1950s and 1960s, the Japanese economy was envied for its unrelenting growth.

Dubbed the “Post-War Miracle”, this period of time saw Japan become a global center of manufacturing and exports. Japanese brands such as Toyota, Sony, Honda, Mitsubishi, Panasonic, and Canon would become household names worldwide. By the 1960s, Japan catapulted to become the second largest economy in the world.

Today, Japan has the third largest economy in terms of total nominal GDP, and the fourth largest by GDP adjusted for Purchasing Power Parity (PPP). This doesn’t seem so bad on paper, but Japan also has nearly 130 million people.

What do those amounts look like per capita? It turns out to be not so good.

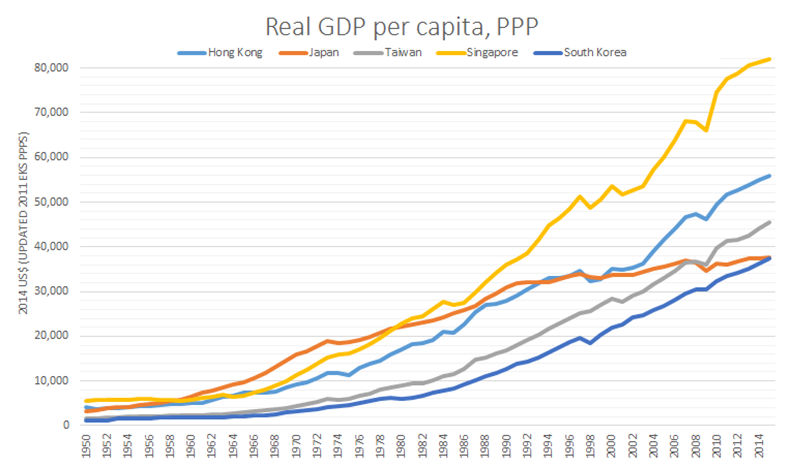

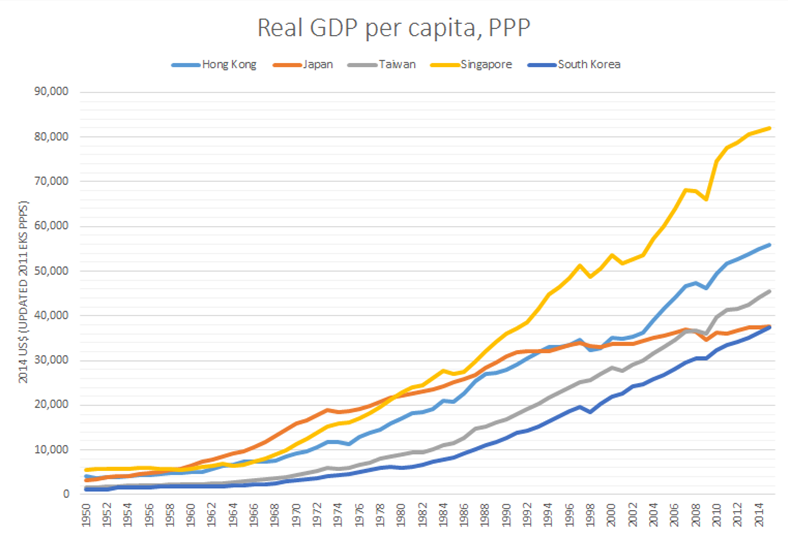

After over two decades of economic stagnation, the most recent GDP per capita (PPP) numbers for 2014 by the IMF had the Japanese economy in 29th place globally. As you saw in the opening chart, even more recent projections from another source show that all four Asian Tigers have now all officially leapfrogged Japan in terms of GDP per capita (PPP).

The “Four Asian Tigers”, a term used to reference the highly free-market and developed economies of Hong Kong, Singapore, South Korea, and Taiwan, have continued to grow despite Japan’s struggles. Singapore, a significant Asian banking center, passed Japan in GDP per capita (PPP) back in 1979. Hong Kong would be the next to do so in 1993, and Taiwan would jump ahead during the Financial Crisis. The last of the leapfrogging happened when South Korea passed Japan this year.

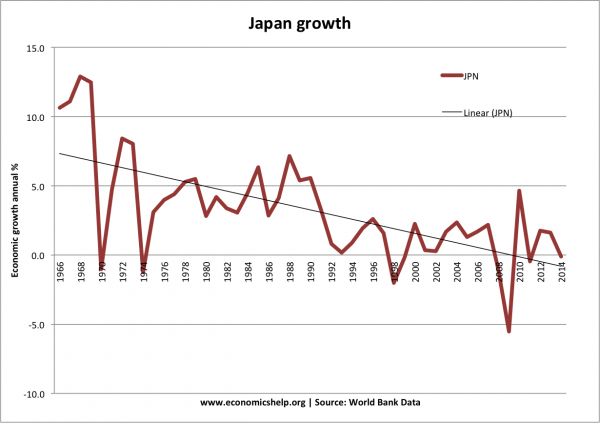

This shouldn’t be too surprising, as the struggles of Japan over the last 25 years have been well-documented. However, a point of interest may be the context of how these challenges began.

In the mid-80s, the yen had basically doubled in value against the dollar. For a manufacturing and exporting nation (similar to how China is today), this was less than ideal. While this was happening, the Bank of Japan intervened with five sessions of monetary easing starting in January 1986 to weaken the yen, cutting interest rates from 5.0% to 2.5% in just one year.

During this time, monetary growth was much quicker than anticipated. More-than-sufficient liquidity and ultra low interest rates fueled speculation, which helped lead to inflate a classic asset bubble. In the early 90s, the BOJ hiked rates to counter speculation and curb inflation.

The asset bubble popped, and Japan’s economy would be sent into the “Lost Decade” – a “decade” which has lasted 25 years.

You can see the drastic increase in money supply leading up to the crisis here:

Japan now has the world’s highest debt-to-GDP ratio of 243% as well as the world’s highest debt-to-revenue ratio.

Despite this, they’ve started an even more potentially dangerous experiment known as Abenomics, which is the three-headed beast of unprecedented quantitative easing, monetary stimulus, and reforms.

Original graphics by: Utopia – You’re Standing In It (blog), Trading Economics

Markets

U.S. Debt Interest Payments Reach $1 Trillion

U.S. debt interest payments have surged past the $1 trillion dollar mark, amid high interest rates and an ever-expanding debt burden.

U.S. Debt Interest Payments Reach $1 Trillion

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

The cost of paying for America’s national debt crossed the $1 trillion dollar mark in 2023, driven by high interest rates and a record $34 trillion mountain of debt.

Over the last decade, U.S. debt interest payments have more than doubled amid vast government spending during the pandemic crisis. As debt payments continue to soar, the Congressional Budget Office (CBO) reported that debt servicing costs surpassed defense spending for the first time ever this year.

This graphic shows the sharp rise in U.S. debt payments, based on data from the Federal Reserve.

A $1 Trillion Interest Bill, and Growing

Below, we show how U.S. debt interest payments have risen at a faster pace than at another time in modern history:

| Date | Interest Payments | U.S. National Debt |

|---|---|---|

| 2023 | $1.0T | $34.0T |

| 2022 | $830B | $31.4T |

| 2021 | $612B | $29.6T |

| 2020 | $518B | $27.7T |

| 2019 | $564B | $23.2T |

| 2018 | $571B | $22.0T |

| 2017 | $493B | $20.5T |

| 2016 | $460B | $20.0T |

| 2015 | $435B | $18.9T |

| 2014 | $442B | $18.1T |

| 2013 | $425B | $17.2T |

| 2012 | $417B | $16.4T |

| 2011 | $433B | $15.2T |

| 2010 | $400B | $14.0T |

| 2009 | $354B | $12.3T |

| 2008 | $380B | $10.7T |

| 2007 | $414B | $9.2T |

| 2006 | $387B | $8.7T |

| 2005 | $355B | $8.2T |

| 2004 | $318B | $7.6T |

| 2003 | $294B | $7.0T |

| 2002 | $298B | $6.4T |

| 2001 | $318B | $5.9T |

| 2000 | $353B | $5.7T |

| 1999 | $353B | $5.8T |

| 1998 | $360B | $5.6T |

| 1997 | $368B | $5.5T |

| 1996 | $362B | $5.3T |

| 1995 | $357B | $5.0T |

| 1994 | $334B | $4.8T |

| 1993 | $311B | $4.5T |

| 1992 | $306B | $4.2T |

| 1991 | $308B | $3.8T |

| 1990 | $298B | $3.4T |

| 1989 | $275B | $3.0T |

| 1988 | $254B | $2.7T |

| 1987 | $240B | $2.4T |

| 1986 | $225B | $2.2T |

| 1985 | $219B | $1.9T |

| 1984 | $205B | $1.7T |

| 1983 | $176B | $1.4T |

| 1982 | $157B | $1.2T |

| 1981 | $142B | $1.0T |

| 1980 | $113B | $930.2B |

| 1979 | $96B | $845.1B |

| 1978 | $84B | $789.2B |

| 1977 | $69B | $718.9B |

| 1976 | $61B | $653.5B |

| 1975 | $55B | $576.6B |

| 1974 | $50B | $492.7B |

| 1973 | $45B | $469.1B |

| 1972 | $39B | $448.5B |

| 1971 | $36B | $424.1B |

| 1970 | $35B | $389.2B |

| 1969 | $30B | $368.2B |

| 1968 | $25B | $358.0B |

| 1967 | $23B | $344.7B |

| 1966 | $21B | $329.3B |

Interest payments represent seasonally adjusted annual rate at the end of Q4.

At current rates, the U.S. national debt is growing by a remarkable $1 trillion about every 100 days, equal to roughly $3.6 trillion per year.

As the national debt has ballooned, debt payments even exceeded Medicaid outlays in 2023—one of the government’s largest expenditures. On average, the U.S. spent more than $2 billion per day on interest costs last year. Going further, the U.S. government is projected to spend a historic $12.4 trillion on interest payments over the next decade, averaging about $37,100 per American.

Exacerbating matters is that the U.S. is running a steep deficit, which stood at $1.1 trillion for the first six months of fiscal 2024. This has accelerated due to the 43% increase in debt servicing costs along with a $31 billion dollar increase in defense spending from a year earlier. Additionally, a $30 billion increase in funding for the Federal Deposit Insurance Corporation in light of the regional banking crisis last year was a major contributor to the deficit increase.

Overall, the CBO forecasts that roughly 75% of the federal deficit’s increase will be due to interest costs by 2034.

-

Green1 week ago

Green1 week agoRanked: The Countries With the Most Air Pollution in 2023

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Travel2 weeks ago

Travel2 weeks agoRanked: The World’s Top Flight Routes, by Revenue