Technology

Visualized: A Snapshot of the Global Personal Tech Market

A Snapshot of the Global Personal Tech Market

For many, it’s become difficult to function in day-to-day life without the use of a mobile phone. The average American checks their phone 96 times a day—that’s once every 10 minutes.

But it’s not just mobile phones that have become increasingly intertwined with our everyday lives. A plethora of accessories and devices, known as smartphone multipliers, have surged in popularity—this market is set to generate $459 billion in revenue by the end of 2020.

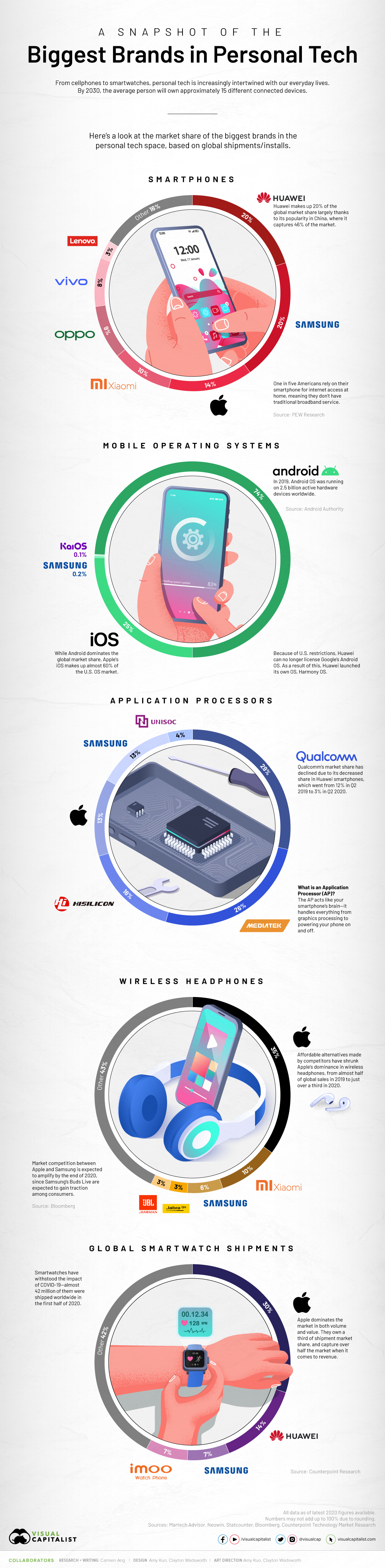

Which brands are capitalizing on this lucrative market? Today’s graphic provides a snapshot of the leading tech brands currently dominating the personal tech space, based on the most recent global market share data on shipments and installs.

How the Brands Stack Up, by Personal Tech Device

Though far from exhaustive, we’ve selected a few popular devices to hone in on, providing key insights on some of the top players in the personal tech space as of 2020.

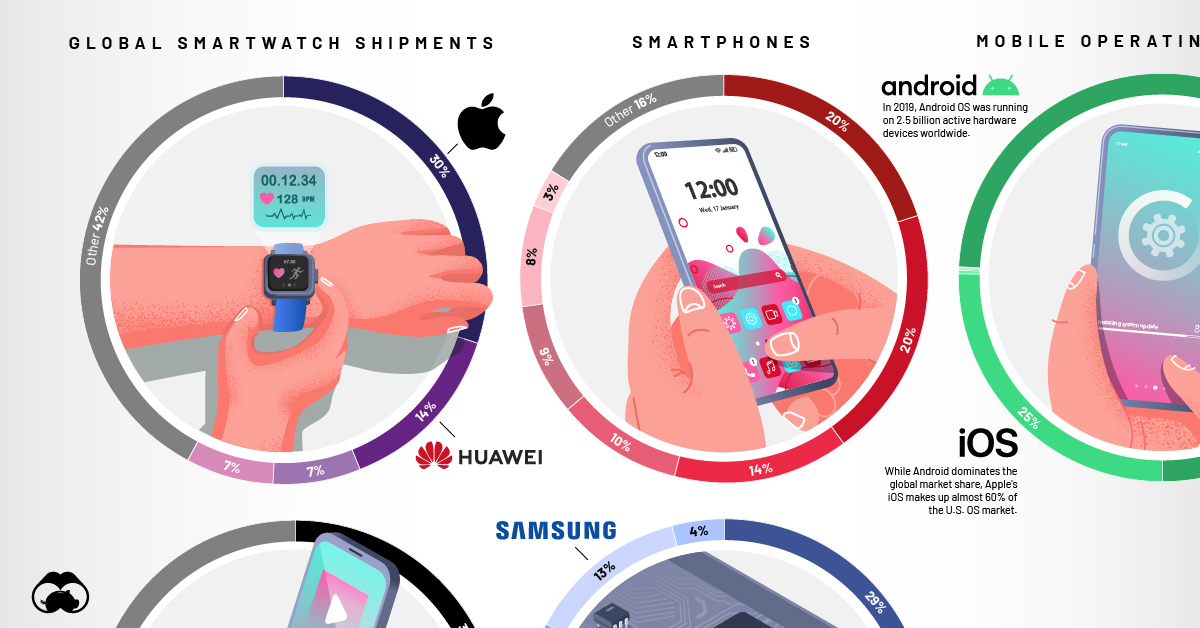

Smartphones

Smartphones are an essential part of the personal tech conversation—by 2025, there will be an estimated 5.8 billion smartphone users worldwide, or roughly 70% of the global population.

| Brand | Global Smartphone Shipments Market Share |

|---|---|

| Huawei | 20% |

| Samsung | 20% |

| Apple | 14% |

| Xiaomi | 10% |

| Oppo | 9% |

| Vivo | 8% |

| Lenovo | 3% |

| Other | 16% |

Currently, Huawei and Samsung hold the largest share of the global market, at 20% each. Chinese company Huawei’s dominance is concentrated in its home country, where it captures almost half of smartphone sales. Like Huawei, Samsung’s market dominance is amplified in its home country South Korea, where it makes up 67% of the market.

While Apple lags slightly behind Huawei and Samsung in global sales, the company rules in the U.S., where it captures 46% of market share.

Why isn’t Apple as successful in other parts of the world? A big factor is price. For instance, 90% of smartphones in India cost around $300, while iPhones start at $999.

Smartphone Operating Systems

Of course, smartphones are useless without an operating system (OS). Each smartphone OS essentially acts as your phone’s nervous system, running all applications and programs, as well as managing network and WiFi connectivity.

| Brand | Global Market Share (by units) |

|---|---|

| Android | 74.3% |

| iOS | 25.2% |

| Samsung | 0.2% |

| KaiOS | 0.1% |

| Unknown | 0.1% |

When it comes to the OS market, Google-owned Android dominates by a landslide, making up 74% of global market share. This makes sense, considering that both the leading smartphone companies, Huawei and Samsung, use Android OS on a number of their devices.

However, it’s important to note that newer Huawei phones won’t operate on Android. When the Chinese tech giant was blacklisted in the U.S., it was no longer able to license Android’s OS. As a result, Huawei launched its own HarmonyOS to fill the gap.

Smartphone Application Processors

If a smartphone’s OS acts like its nervous system, then the application processor (AP) functions like a brain. APs handle everything from image processing and graphics to powering your phone on and off.

| Brand | Global Market Share (by units) |

|---|---|

| Qualcomm | 29% |

| MediaTek | 26% |

| HiSilicon | 16% |

| Apple | 13% |

| Samsung | 13% |

| Unisoc | 4% |

Qualcomm is currently the largest provider of application processors, capturing almost 30% of the global market share. While it currently holds the top spot, its market share has declined since 2019, largely due to a decrease in usage in Huawei products.

After being banned in the U.S., Huawei shifted suppliers for this crucial part. Instead of buying from Qualcomm—an American company—it now relies on HiSilicon, which is based in China.

Wireless Headphones

The wireless headphone market is growing fast—in 2019, it was valued at $2.5 billion. Between 2020 to 2027, it’s set to increase at a compound annual growth rate (CAGR) of 20.3%.

| Brand | Global Sales Units Market Share |

|---|---|

| Apple | 35% |

| Xiaomi | 10% |

| Samsung | 6% |

| Jabra | 3% |

| JBL | 3% |

| Other | 43% |

Apple currently dominates the wireless headphone space, making up over a third of global market share. The company is expected to sell 82 million units by the end of 2020.

Despite this, it’s important to note that Apple’s dominance has decreased significantly in 2020 compared to 2019, when it captured over 50% of the global market. Apple’s decline is likely due to the emergence of cheaper alternatives from companies like Lypertek Tevi or 1More, which offer comparable products at about half the cost of Apple’s AirPods.

Smartwatches

Health and wellness have been top priorities among consumers recently, which has had a positive impact on the global smartwatch market—in the first half of 2020, it’s shown a 20% growth in revenue, compared to a year prior.

| Brand | Global Smartwatch Shipments Market Share |

|---|---|

| Apple | 30% |

| Huawei | 14% |

| Samsung | 7% |

| imoo | 7% |

| Other | 42% |

Like wireless headphones, Apple dominates the smartwatch market, in both volume and value. When looking at global shipments in Q2 2020, the company makes up 30% of the market share—however, in terms of revenue, Apple’s piece of the pie rises to 50%.

The Only Constant is Change

It’s clear that no matter who leads the list for each type of personal tech, these spots are never static—there’s always room for disruption.

How long will Apple hold its top spot in the wireless headphone market? Will Qualcomm’s dominance of the AP market continue to shrink?

Things are certain to change—the only question is, how?

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Energy1 week ago

Energy1 week agoThe World’s Biggest Nuclear Energy Producers

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024