Countries

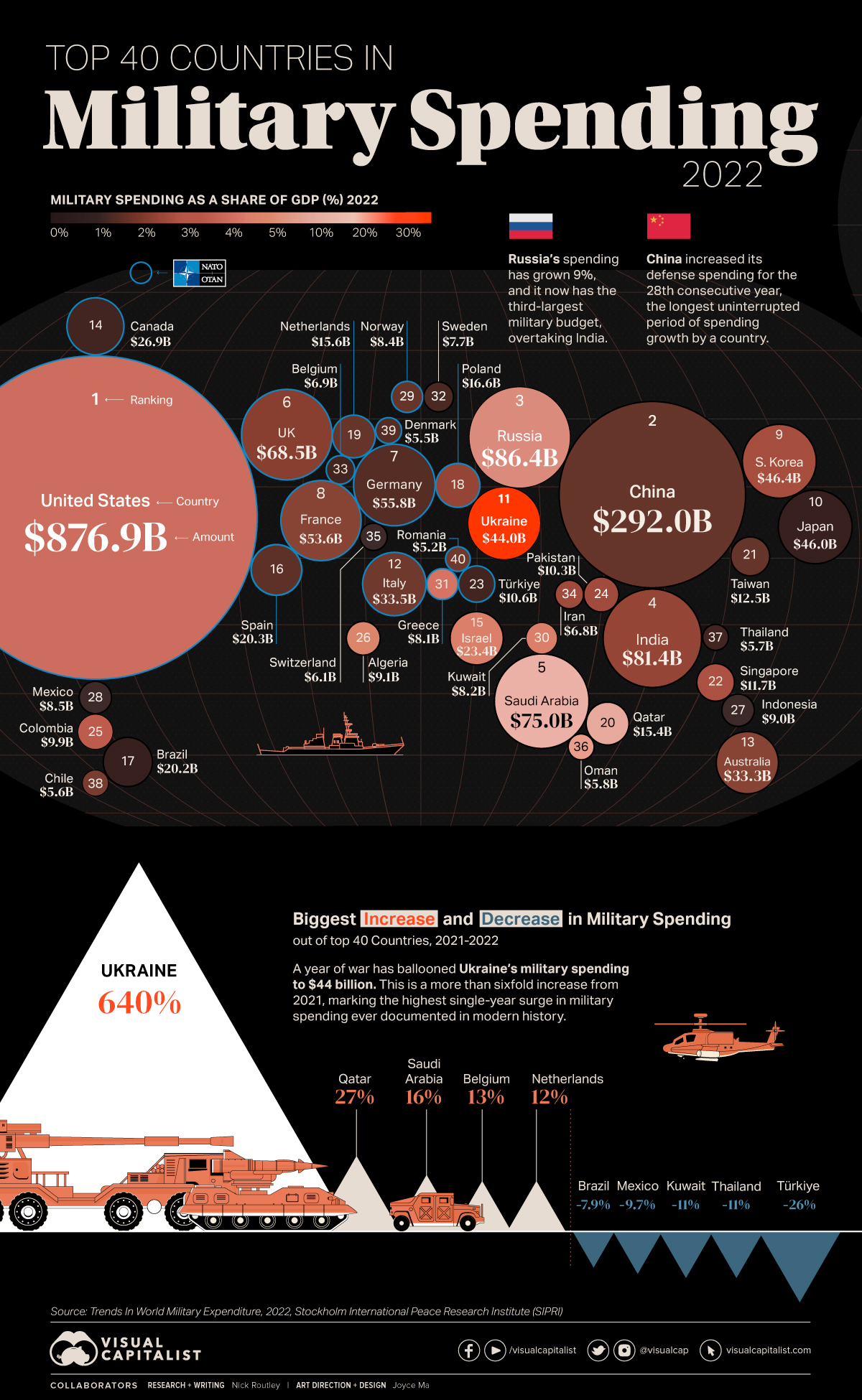

Mapped: World’s Top 40 Largest Military Budgets

Mapped: World’s Top 40 Largest Military Budgets

In the final year of World War II, the U.S. spent about 38% of its GDP on its military. When adjusted for inflation, the military budget over those four years of war came to a staggering $4.1 trillion in 2020 dollars.

Almost 80 years later, modern day military spending isn’t much of a far cry from World War II budgets. The top spenders have continued to increase their military capabilities, while war in Ukraine has caused countries in the region to re-evaluate their budgets as well.

In 2022, global military budgets hit an all-time high of $2.2 trillion, according to data released by Stockholm International Peace Research Institute (SIPRI), the eighth consecutive year of increase. This post looks at the top 40 largest military budgets in the world.

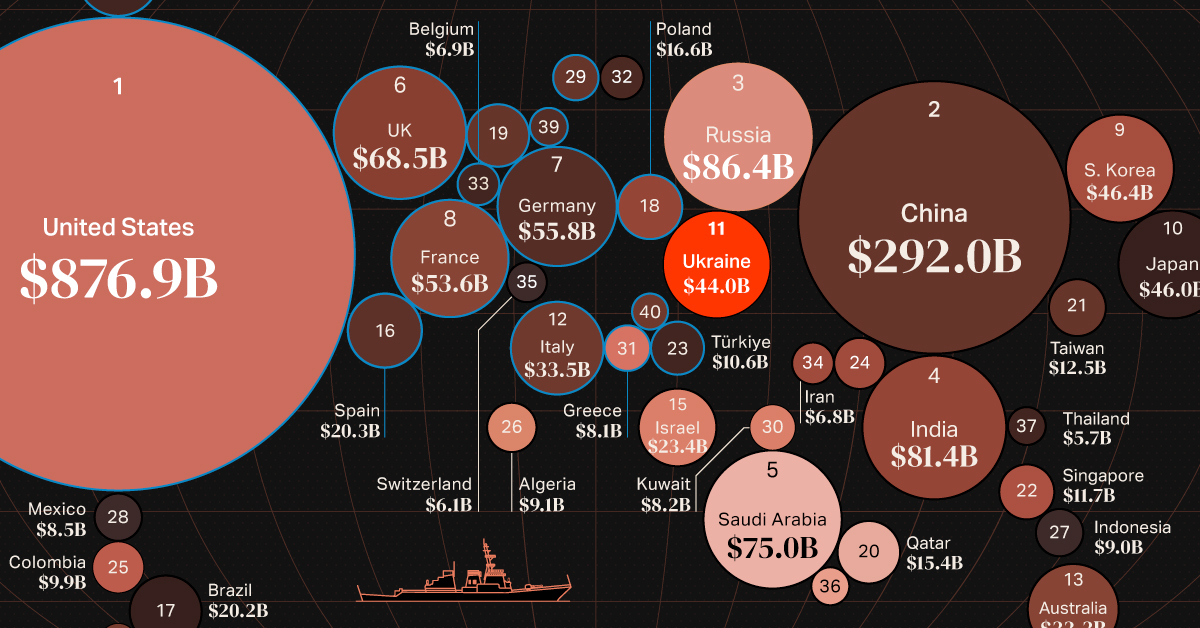

The Largest Military Budgets in 2022

The United States accounts for almost 40% of global military expenditures, with its 2022 spend coming to $877 billion.

Here are the top 40 largest military budgets in the world for 2022 in U.S. dollars:

| Rank | Country | Military Budget (Billions) | % of World Military Spend |

|---|---|---|---|

| 1 | 🇺🇸 U.S. | $876.9 | 39.0% |

| 2 | 🇨🇳 China | $292.0 | 13.0% |

| 3 | 🇷🇺 Russia | $86.4 | 3.9% |

| 4 | 🇮🇳 India | $81.4 | 3.6% |

| 5 | 🇸🇦 Saudi Arabia | $75.0 | 3.3% |

| 6 | 🇬🇧 UK | $68.5 | 3.1% |

| 7 | 🇩🇪 Germany | $55.8 | 2.5% |

| 8 | 🇫🇷 France | $53.6 | 2.4% |

| 9 | 🇰🇷 South Korea | $46.4 | 2.1% |

| 10 | 🇯🇵 Japan | $46.0 | 2.1% |

| 11 | 🇺🇦 Ukraine | $44.0 | 2.0% |

| 12 | 🇮🇹 Italy | $33.5 | 1.5% |

| 13 | 🇦🇺 Australia | $32.3 | 1.4% |

| 14 | 🇨🇦 Canada | $26.9 | 1.2% |

| 15 | 🇮🇱 Israel | $23.4 | 1.0% |

| 16 | 🇪🇸 Spain | $20.3 | 0.9% |

| 17 | 🇧🇷 Brazil | $20.2 | 0.9% |

| 18 | 🇵🇱 Poland | $16.6 | 0.7% |

| 19 | 🇳🇱 Netherlands | $15.6 | 0.7% |

| 20 | 🇶🇦 Qatar | $15.4 | 0.7% |

| 21 | 🇹🇼 Taiwan | $12.5 | 0.6% |

| 22 | 🇸🇬 Singapore | $11.7 | 0.5% |

| 23 | 🇹🇷 Türkiye | $10.6 | 0.5% |

| 24 | 🇵🇰 Pakistan | $10.3 | 0.5% |

| 25 | 🇨🇴 Colombia | $9.9 | 0.4% |

| 26 | 🇩🇿 Algeria | $9.1 | 0.4% |

| 27 | 🇮🇩 Indonesia | $9.0 | 0.4% |

| 28 | 🇲🇽 Mexico | $8.5 | 0.4% |

| 29 | 🇳🇴 Norway | $8.4 | 0.4% |

| 30 | 🇰🇼 Kuwait | $8.2 | 0.4% |

| 31 | 🇬🇷 Greece | $8.1 | 0.4% |

| 32 | 🇸🇪 Sweden | $7.7 | 0.3% |

| 33 | 🇧🇪 Belgium | $6.9 | 0.3% |

| 34 | 🇮🇷 Iran | $6.8 | 0.3% |

| 35 | 🇨🇭 Switzerland | $6.1 | 0.3% |

| 36 | 🇴🇲 Oman | $5.8 | 0.3% |

| 37 | 🇹🇭 Thailand | $5.7 | 0.3% |

| 38 | 🇨🇱 Chile | $5.6 | 0.2% |

| 39 | 🇩🇰 Denmark | $5.5 | 0.2% |

| 40 | 🇷🇴 Romania | $5.2 | 0.2% |

China, ranked second in absolute terms, accounts for another 13% of world military expenditure at $292 billion.

Russia, India and Saudi Arabia round out the top five biggest military budgets in 2022. Add in the UK to the mix (#6 rank), and these countries all had military expenditures that made up at least 3% of global spend.

Comparatively, the lowest budgets on the top 40 ranged include Romania at $5.2 billion, Denmark at $5.5 billion, and Chile at $5.6 billion. They each account for just 0.2% of the world’s military budgets in 2022, and of course there are many countries with even smaller spends.

Largest Military Budget Increases in 2022

Russia’s position as the third-largest military spender is a recent development, as the country’s military spend had a 9% increase between 2021 and 2022, according to SIPRI estimates.

On the other side of Russia’s invasion, Ukraine was the top 40 military budget with the largest annual increase in 2022, surging nearly six and a half times above its 2021 expenditures.

| Country | % Change (2021-2022) | Rank Change (2021-2022) |

|---|---|---|

| 🇺🇦 Ukraine | 640% | +25 |

| 🇶🇦 Qatar | 27% | +2 |

| 🇸🇦 Saudi Arabia | 16% | +3 |

| 🇧🇪 Belgium | 13% | 0 |

| 🇳🇱 Netherlands | 12% | 0 |

| 🇸🇪 Sweden | 12% | -1 |

| 🇵🇱 Poland | 11% | 0 |

| 🇷🇺 Russia | 9.2% | +2 |

| 🇩🇰 Denmark | 8.8% | +3 |

| 🇪🇸 Spain | 7.3% | -1 |

| 🇳🇴 Norway | 6.2% | 0 |

| 🇮🇳 India | 6.0% | -1 |

| 🇯🇵 Japan | 5.9% | -1 |

| 🇮🇷 Iran | 4.6% | +5 |

| 🇨🇳 China | 4.2% | 0 |

| 🇬🇧 UK | 3.7% | -2 |

| 🇨🇦 Canada | 3.0% | -1 |

| 🇸🇬 Singapore | 2.8% | +1 |

| 🇩🇪 Germany | 2.3% | 0 |

| 🇮🇩 Indonesia | 1.3% | 0 |

| 🇨🇴 Colombia | 1.1% | -1 |

| 🇺🇸 U.S. | 0.7% | 0 |

| 🇫🇷 France | 0.6% | -2 |

| 🇬🇷 Greece | 0.6% | -1 |

| 🇨🇭 Switzerland | 0.4% | -1 |

| 🇹🇼 Taiwan | 0.4% | -1 |

| 🇦🇺 Australia | 0.3% | -1 |

| 🇵🇰 Pakistan | -2.0% | -3 |

| 🇰🇷 South Korea | -2.5% | +1 |

| 🇷🇴 Romania | -2.6% | +1 |

| 🇴🇲 Oman | -3.0% | +1 |

| 🇩🇿 Algeria | -3.7% | -1 |

| 🇮🇱 Israel | -4.2% | -1 |

| 🇮🇹 Italy | -4.5% | -1 |

| 🇨🇱 Chile | -6.2% | -3 |

| 🇧🇷 Brazil | -7.9% | -1 |

| 🇲🇽 Mexico | -9.7% | 0 |

| 🇰🇼 Kuwait | -11% | -4 |

| 🇹🇭 Thailand | -11% | -5 |

| 🇹🇷 Türkiye | -26% | -6 |

Ukraine’s dramatic increase represents the highest single-year jump ever recorded by SIPRI, painting a vivid before-and-after picture of a nation engaged in conflict.

Although no other country comes close in matching Ukraine’s surge in defense spending, Qatar saw a substantial increase of 27% over the last year, marking a continuing trend over the last decade of significantly bolstering its military.

Additionally, Saudi Arabia, along with four European nations (Belgium, the Netherlands, Sweden, and Poland), have registered year-over-year changes of over 10%.

On the flipside, 13 of the nations with the largest military budgets decreased spend from 2021, including top 15 spenders such as South Korea, Italy, and Israel.

The largest drop was seen by Türkiye, with an estimated 26% reduction in military budget. This drop may be linked to Türkiye’s inflation problem, which saw prices rise 72.3% in 2022—effectively decreasing the purchasing power of their currency in relative terms to other nations.

The Specter of War in Europe

With an ongoing conflict in the region and large financial powerhouses, its no surprise that eight of the top 10 countries with the most significant increases in military spending are located in Europe.

Consequently, European military budgets have reached levels not witnessed since the end of the Cold War.

And amid escalating geopolitical concerns, countries in Asia such as India, Japan, and China have also ramped up their defense spending. This is an indication of simmering global flashpoints such as India and China’s border skirmishes, the longstanding South China Sea territorial conflict, and concerns surrounding Taiwan’s sovereignty.

Source: Stockholm International Peace Research Institute (SIPRI).

Data note: SIPRI’s military expenditure data collection began in 1949, thus its records do not account for all expenditure that occurred during both World Wars.

Please see SIPRI’s methodologies page for more details on how they collect their data and create estimates.

Countries

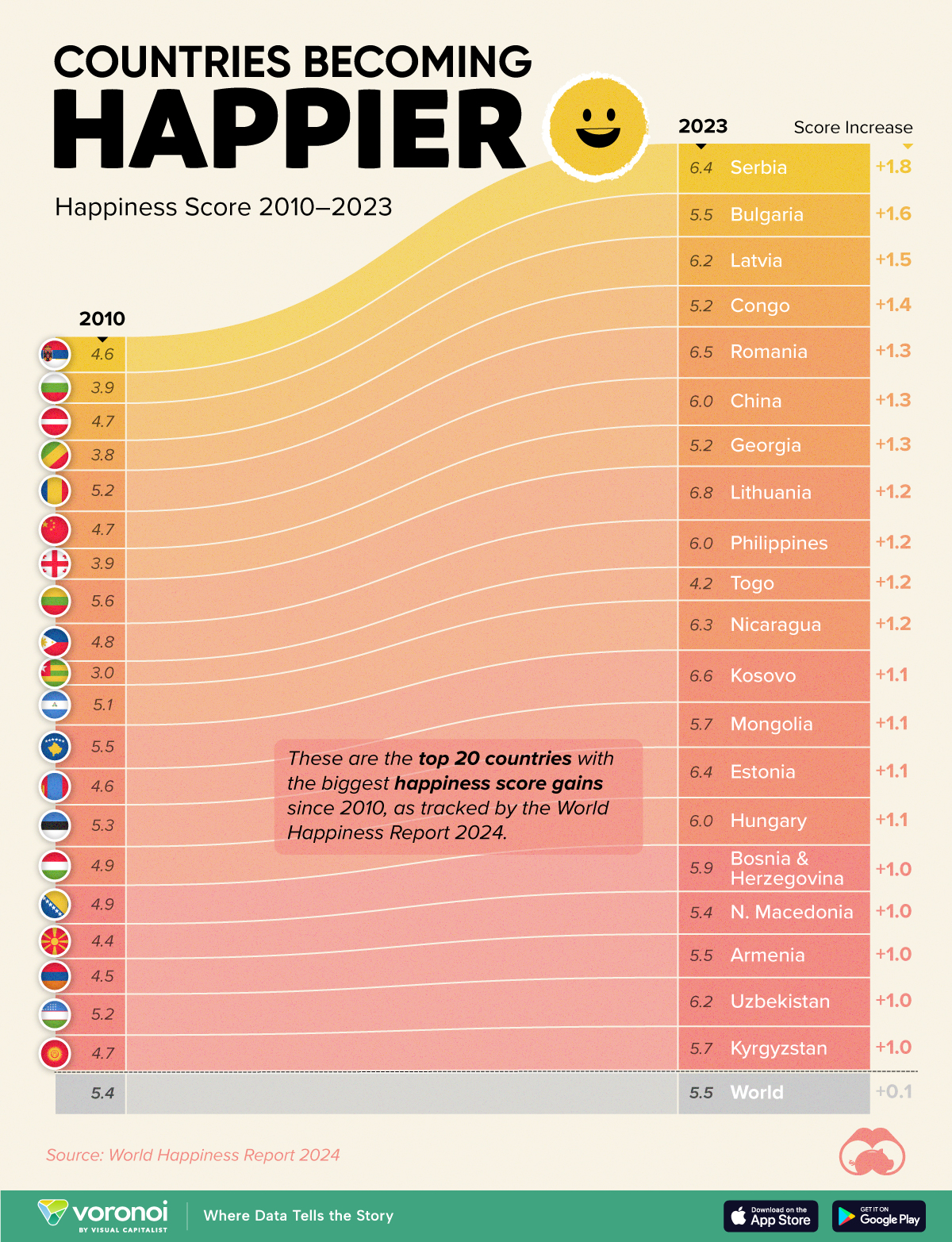

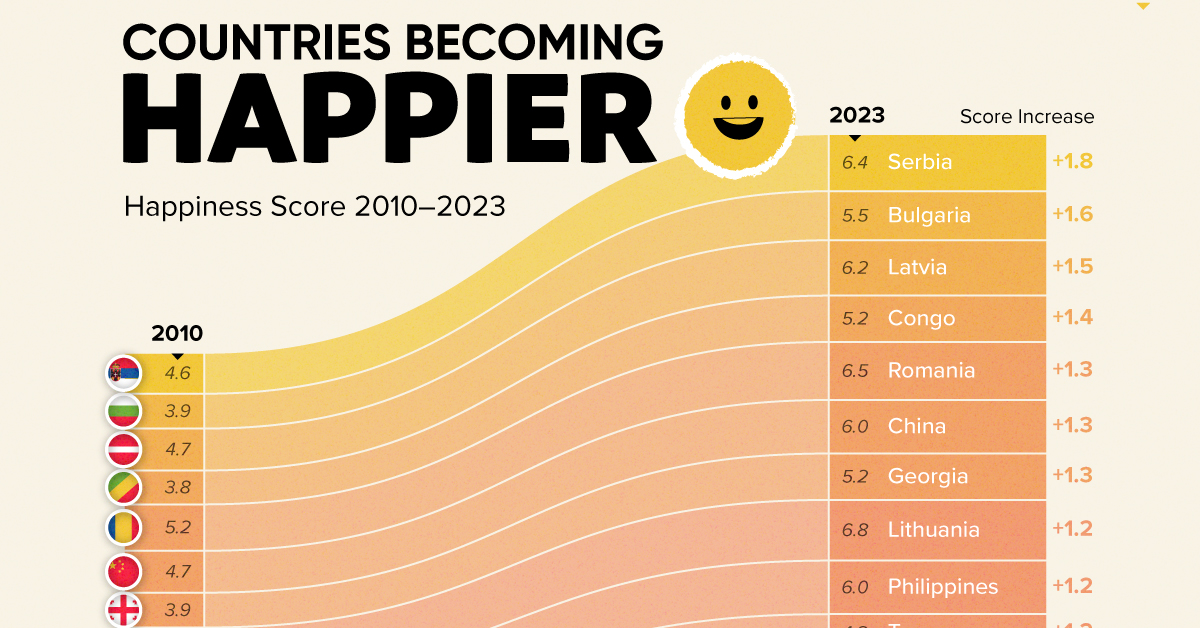

Countries With the Largest Happiness Gains Since 2010

Tracking Gallup survey data for more than a decade reveals insights into the regions seeing happiness gains.

Countries With the Largest Happiness Gains Since 2010

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

In 2011, Bhutan sponsored a UN resolution that invited governments to prioritize happiness and well-being as a way to measure social and economic development.

And thus, the World Happiness Report was born.

In 2012, the first report released, examining Gallup poll data from 2006–2010 that asked respondents in nearly every country to evaluate their life on a 0–10 scale. From this they extrapolated a single “happiness score” out of 10 to compare how happy countries are.

More than a decade later, the 2024 World Happiness Report continues the mission to quantify, measure, and compare well-being. Its latest findings also include how countries have become happier in the intervening years.

We visualize these findings in the above chart, which shows the 20 countries that have seen their happiness scores grow the most since 2010.

Which Countries Have Become Happier Since 2010?

Serbia leads a list of 12 Eastern European nations whose average happiness score has improved more than 20% in the last decade.

In the same time period, the Serbian economy has doubled to $80 billion, and its per capita GDP has nearly doubled to $9,538 in current dollar terms.

| Rank | Country | Happiness Score Gains (2010–2024) | 2024 Happiness Score (out of 10) |

|---|---|---|---|

| 1 | 🇷🇸 Serbia | +1.8 | 6.4 |

| 2 | 🇧🇬 Bulgaria | +1.6 | 5.5 |

| 3 | 🇱🇻 Latvia | +1.5 | 6.2 |

| 4 | 🇨🇬 Congo | +1.4 | 5.2 |

| 5 | 🇷🇴 Romania | +1.3 | 6.5 |

| 6 | 🇨🇳 China | +1.3 | 6.0 |

| 7 | 🇬🇪 Georgia | +1.3 | 5.2 |

| 8 | 🇱🇹 Lithuania | +1.2 | 6.8 |

| 9 | 🇵🇭 Philippines | +1.2 | 6.0 |

| 10 | 🇹🇬 Togo | +1.2 | 4.2 |

| 11 | 🇳🇮 Nicaragua | +1.2 | 6.3 |

| 12 | 🇽🇰 Kosovo | +1.1 | 6.6 |

| 13 | 🇲🇳 Mongolia | +1.1 | 5.7 |

| 14 | 🇪🇪 Estonia | +1.1 | 6.4 |

| 15 | 🇭🇺 Hungary | +1.1 | 6.0 |

| 16 | 🇧🇦 Bosnia & Herzegovina | +1.0 | 5.9 |

| 17 | 🇲🇰 North Macedonia | +1.0 | 5.4 |

| 18 | 🇦🇲 Armenia | +1.0 | 5.5 |

| 19 | 🇺🇿 Uzbekistan | +1.0 | 6.2 |

| 20 | 🇰🇬 Kyrgyzstan | +1.0 | 5.7 |

| N/A | 🌍 World | +0.1 | 5.5 |

Since the first report, Western Europe has on average been happier than Eastern Europe. But as seen with these happiness gains, Eastern Europe is now seeing their happiness levels converge closer to their Western counterparts. In fact, when looking at those under the age of 30, the most recent happiness scores are nearly the same across the continent.

All in all, 20 countries have increased their happiness score by a full point or more since 2010, on the 0–10 scale.

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Environment2 weeks ago

Environment2 weeks agoTop Countries By Forest Growth Since 2001