Technology

The Most Valuable Brand in Each Country in 2018

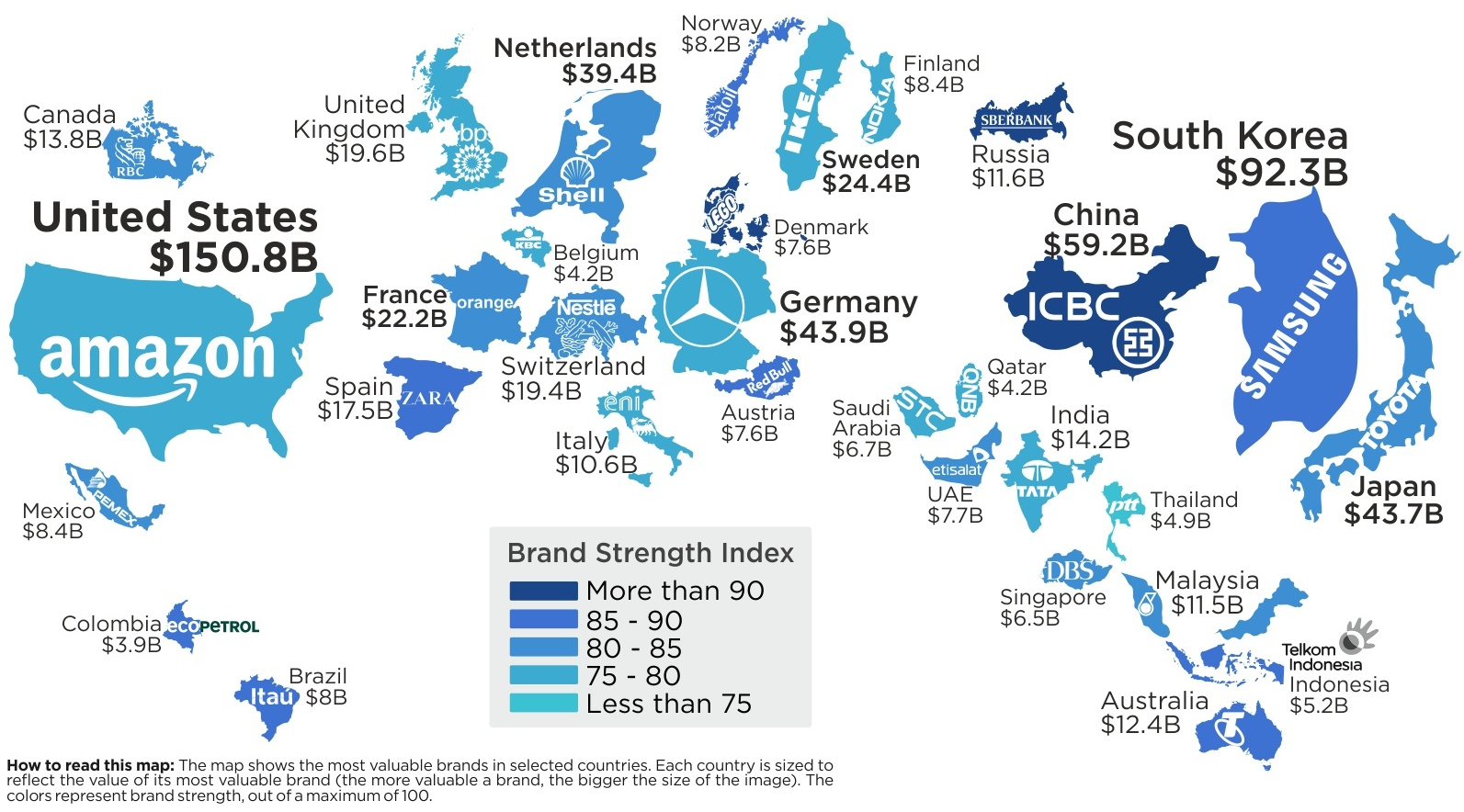

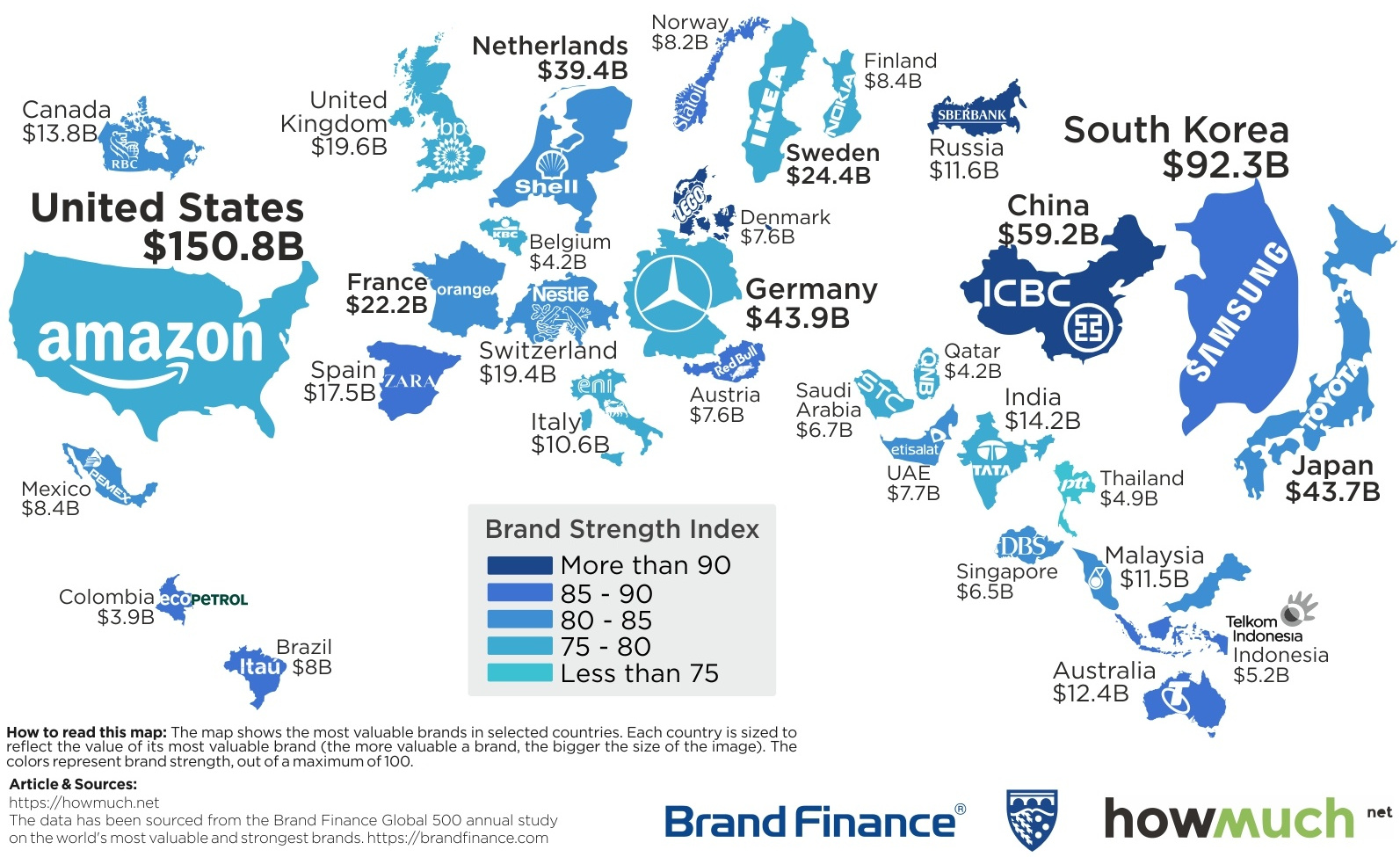

Map: The Most Valuable Brand in Each Country in 2018

Last year, we covered the world’s top brands based on the measure of brand value, and one thing stood out.

The top of the list was dominated by U.S. brands like Google, Amazon, Facebook, Visa, AT&T, and McDonald’s, but only one non-American brand (China’s Tencent) was able to crack the top 10 list.

Today’s infographic comes to us from HowMuch.net, and it helps to make the international brand value picture a lot clearer. Using updated rankings from Brand Finance’s Global 500 Report, it shows the top brand for each country in 2018.

It’s worth noting, however, that there are many countries that are not represented here, as they do not have a brand large enough to make the top 500 list.

A Steep Dropoff

Keeping the aforementioned U.S. dominance of brands in mind, there is a pretty steep drop from the U.S. to other countries on the map. After retail giant Amazon, which ranks as the world’s top brand at $150.8 billion, the next biggest brand in any other country is Samsung (South Korea) at $92.3 billion.

From there, it’s another big fall to get to the next tier, which includes China’s ICBC ($59.2 billion), Germany’s Mercedes-Benz ($43.9 billion), Japan’s Toyota ($43.7 billion), and Royal Dutch Shell ($39.4 billion).

After that, the remaining brands on the list are in the $4 billion to $25 billion range, including well-known names like Nestlé ($19.4 billion), Zara ($17.5 billion), and RBC ($13.8 billion). While small compared to Amazon, these are still mostly large international or national brands.

Why is Amazon so Dominant?

As Amazon continues to rapidly scale its revenue, and as the Jeff Bezos Empire expands, we are all now very familiar with the online retailer’s dominance.

That said, while Amazon appears massive on the map, it actually only just edged out Apple as the most dominant brand overall. Further, because Apple is also based in the U.S., the iconic tech company doesn’t have its logo appear on the map itself.

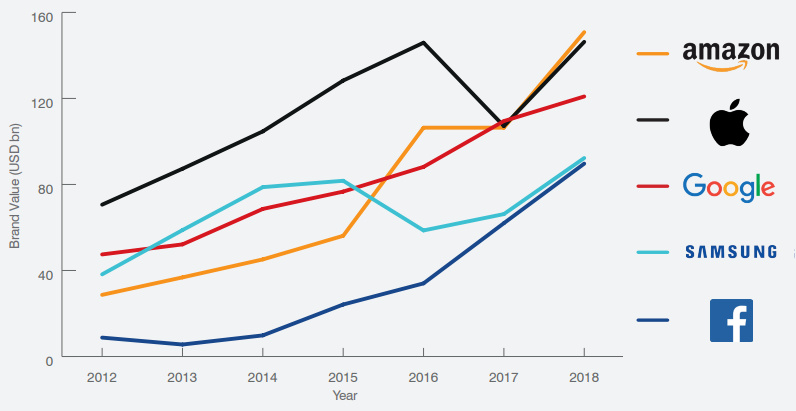

Here’s a look at how brand value for the top five brands has changed over time:

Courtesy: Brand Finance

According to Brand Finance, the value of Amazon’s brand increased by 42% between 2017 and 2018. Here’s what Brand Finance CEO, David Haigh, had to say about the future of Amazon’s brand:

The strength and value of the Amazon brand gives it stakeholder permission to extend relentlessly into new sectors and geographies. All evidence suggests that the amazing Amazon brand is going to continue growing indefinitely and exponentially.

– David Haigh, CEO of Brand Finance

Interestingly, the report authors also offer up reasons for Apple and Google getting “left behind”.

For Apple, an over-dependency on the iPhone limits the brand’s growth opportunities, while Google’s investments outside of search are unable to offer the scale, impact, or audacity demonstrated by Amazon’s ventures.

A Note on Brand Value

Understandably, there is often some confusion behind the definition of “brand value”.

Not to be confused with market capitalization or enterprise value, brand value is defined as a marketing-related intangible asset that generates economic benefits for a brand within a company. In other words, this is the value of the image of the brand itself, as represented in the minds of stakeholders.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001