Markets

How Every Asset Class, Currency, and S&P 500 Sector Performed in 2021

How Every Market Performed in 2021

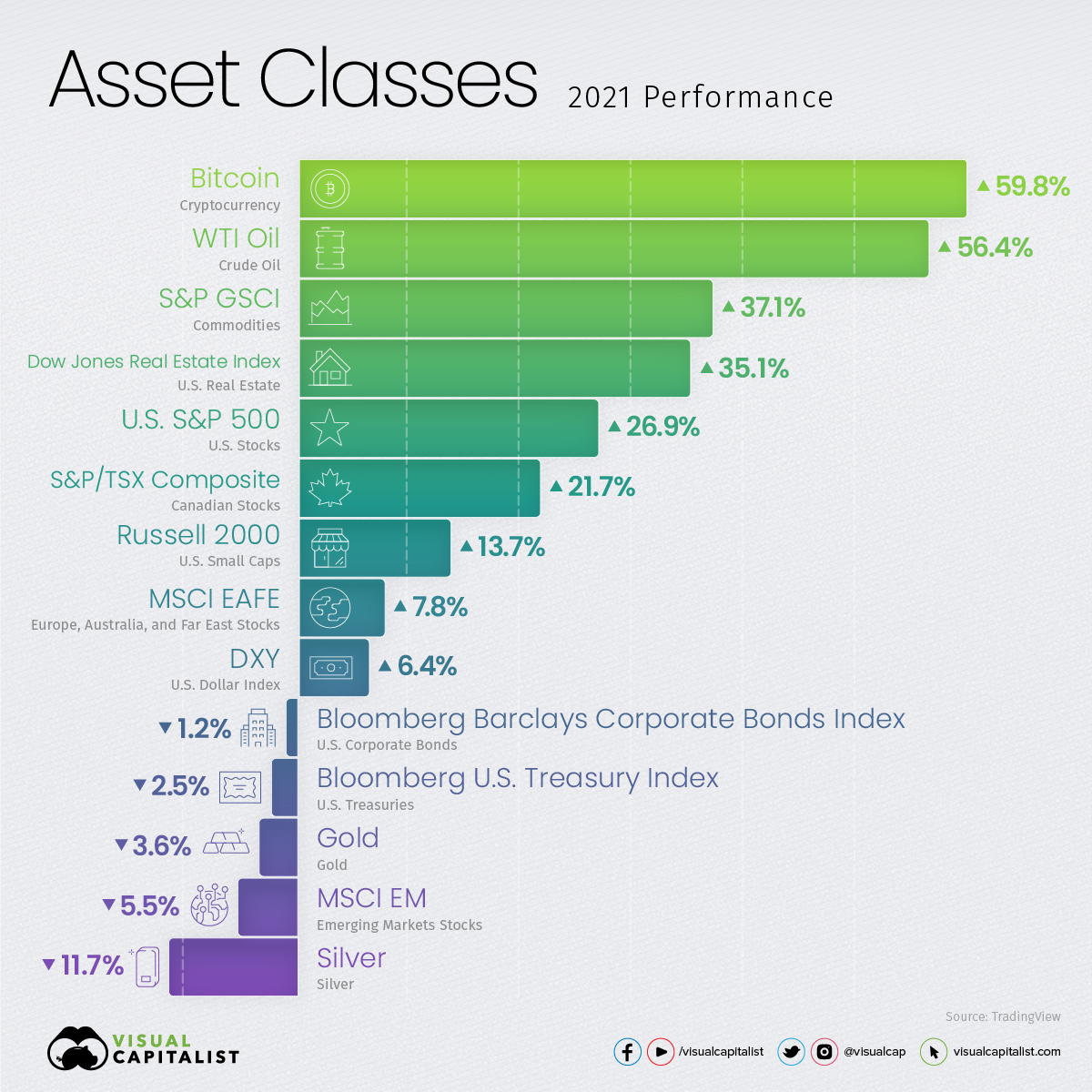

After the roller coaster of volatility in 2020, the majority of asset classes in 2021 saw positive returns as the world reopened for business.

The Federal Reserve’s accommodative monetary policy, supply chain struggles, and high demand for fuels and raw materials for the clean energy transition largely shaped the markets.

Alongside the rise in inflation, commodities and cryptocurrency outperformed as broad equity indices saw double-digit returns, with the S&P 500 rising by 26.9% in 2021.

Markets Roundup for 2021

Speculation and the energy fuels for the world’s reopening were two of the main themes for markets in 2021, reflected in Bitcoin (59.8%) and crude oil (56.4%) being the top two performing assets in that time frame.

The S&P GSCI commodity index (37.1%) was another top performer, as agricultural and livestock food prices rose alongside the Dow Jones Real Estate Index (35.1%).

| Asset Class | 2021 Return | Asset Type |

|---|---|---|

| Bitcoin | 59.8% | Cryptocurrency |

| WTI Crude Oil | 56.4% | Commodity |

| S&P GSCI | 37.1% | Commodity |

| Dow Jones Real Estate Index | 35.1% | Real Estate |

| S&P 500 | 26.9% | Equities |

| S&P/TSX Composite | 21.7% | Equities |

| Russell 2000 | 13.7% | Equities |

| MSCI EAFE | 7.8% | Equities |

| U.S. Dollar | 6.4% | Currency |

| Bloomberg Barclays Corporate Bonds Index | -1.2% | Bonds |

| Bloomberg U.S. Treasury Index | -2.5% | Bonds |

| Gold | -3.6% | Commodity |

| MSCI Emerging Markets | -5.5% | Equities |

| Silver | -11.7% | Commodity |

Source: TradingView

Despite most physical and digital commodities seeing price gains, precious metals such as gold (-3.6%) and silver (-11.7%) struggled to hold onto their value, while industrial and battery metals like lithium (477.4%) and cobalt (207.7%) surged.

Large cap equity indices like the S&P 500 (26.9%) almost doubled the returns of small caps (Russell 2000, 13.7%), with emerging markets failing to keep up as they fell 5.5%.

How the S&P 500 Sectors Performed

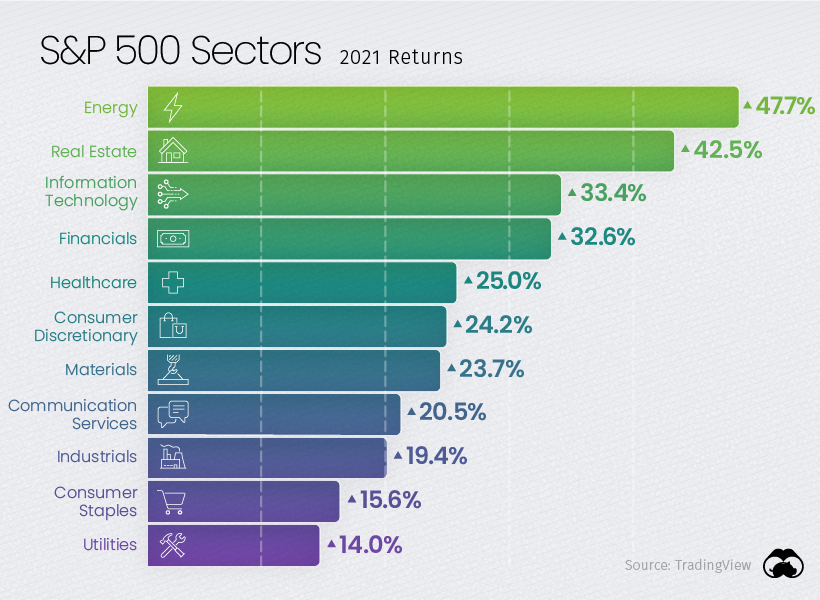

After last year’s poor performance as the worst-performing S&P 500 sector, energy (47.7%) was 2021’s best performing sector alongside the rise in crude oil and other energy commodities.

Two other negative performers last year, real estate (42.5%) and financials (32.6%), also turned it around and were among the top performing sectors this year.

Despite many value equities performing well, growth equities still managed to keep a strong pace. Information technology (33.4%) continued to provide strong returns with Microsoft (51.2%) outperforming many of the other tech giants.

As Amazon (2.38%) and Netflix lagged behind (11.4%), Apple (33.8%) capped off its strong 2021 returns by becoming the first U.S. company to reach a $3T market cap at the start of 2022.

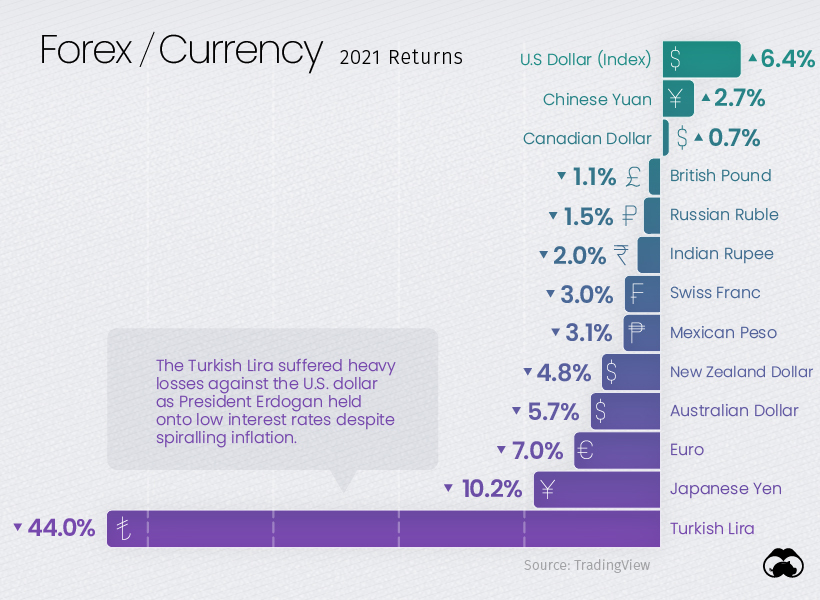

Foreign Exchange and Currency Returns in 2021

While the U.S. dollar struggled last year with most currencies outperforming it, 2021 saw the dollar index rise by 6.4%, outperforming most other currencies.

The Chinese yuan (2.7%) and Canadian dollar (0.7%) were the only major currencies that managed positive returns against the U.S. dollar, while the Australian dollar (-5.7%), Euro (-7.0%), and Japanese Yen (-10.2%) were among the worst performers.

The Turkish lira was the standout loser in foreign exchange, and the turmoil was punctuated by turnover in the country’s finance minister position. While most other emerging economies raised interest rates to fight against inflation, Turkey has continued cutting rates and looks set to default on its $446 million of external debt.

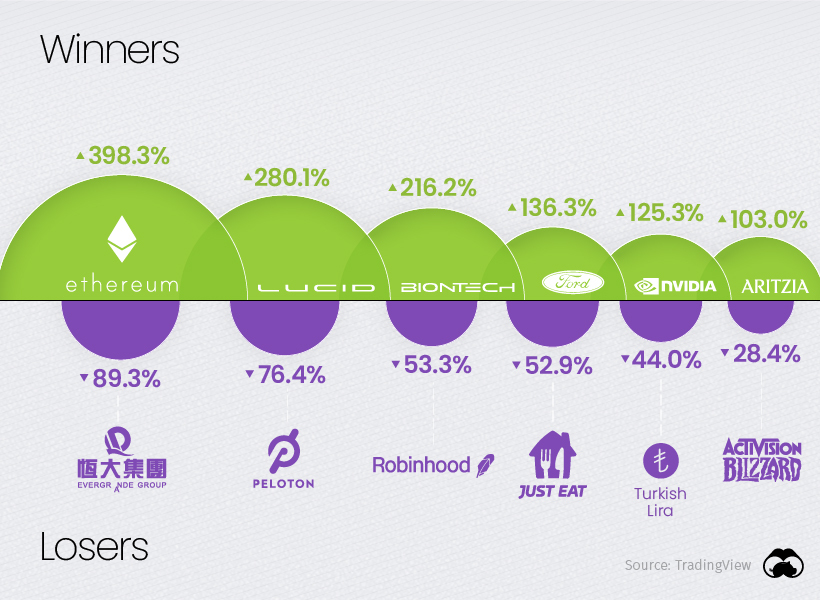

The Winners and Losers of 2021

As the COVID-19 pandemic defined many of the winners and losers in 2020, the gradual reopening of international travel and business shaped the over and underperformers of 2021.

Cryptocurrencies had a standout year beyond Bitcoin (59.8%), which was greatly outpaced by many other cryptocurrencies and smart contract platforms like Ethereum (398.3%), Solana (11,177.8%), Avalanche (3,334.8%), and Luna (12,967.3%).

While Tesla (49.8%) had another strong year, Lucid and Ford Motors greatly outperformed Elon Musk’s company and the rest of the auto industry with their EV efforts. Demand was so great that Ford had to halt reservations for its F-150 Lightning pickup trucks at the end of 2021.

The pain of Evergrande Group (89.3%) shareholders is set to end soon, with the company starting 2022 by halting shares in Hong Kong as its $300 billion in liabilities remain in limbo.

Peloton (-76.4%) was another big loser in 2021 as it gave back nearly all of its gains from last year, proving lockdown speculation fueled most of its former valuation. Just Eat (-52.9%) was similarly hit hard as restaurants reopened in 2021.

Robinhood’s (53.3%) weak performance since its IPO puts a bow on 2021’s retail “stonk” frenzy kicked off by the Wall Street Bets subreddit.

With 2021 being a breakout year for retail traders and investors online, we’ll see if 2022 remains risk-on as the Fed begins tapering, or if markets are due for a change in direction.

Markets

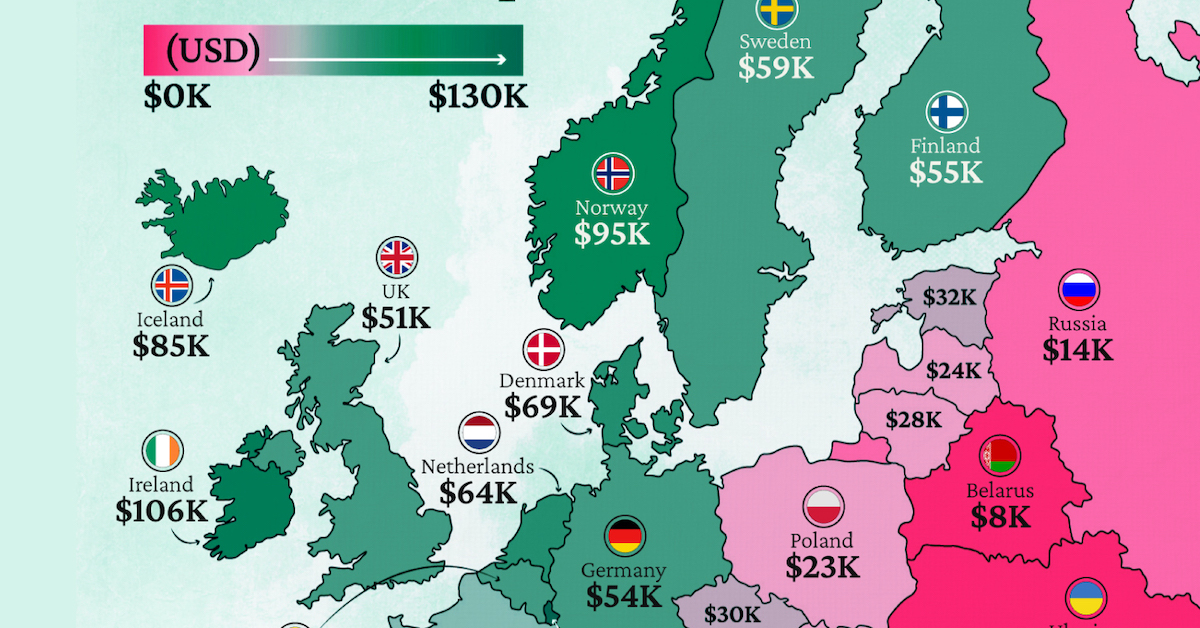

Mapped: Europe’s GDP Per Capita, by Country

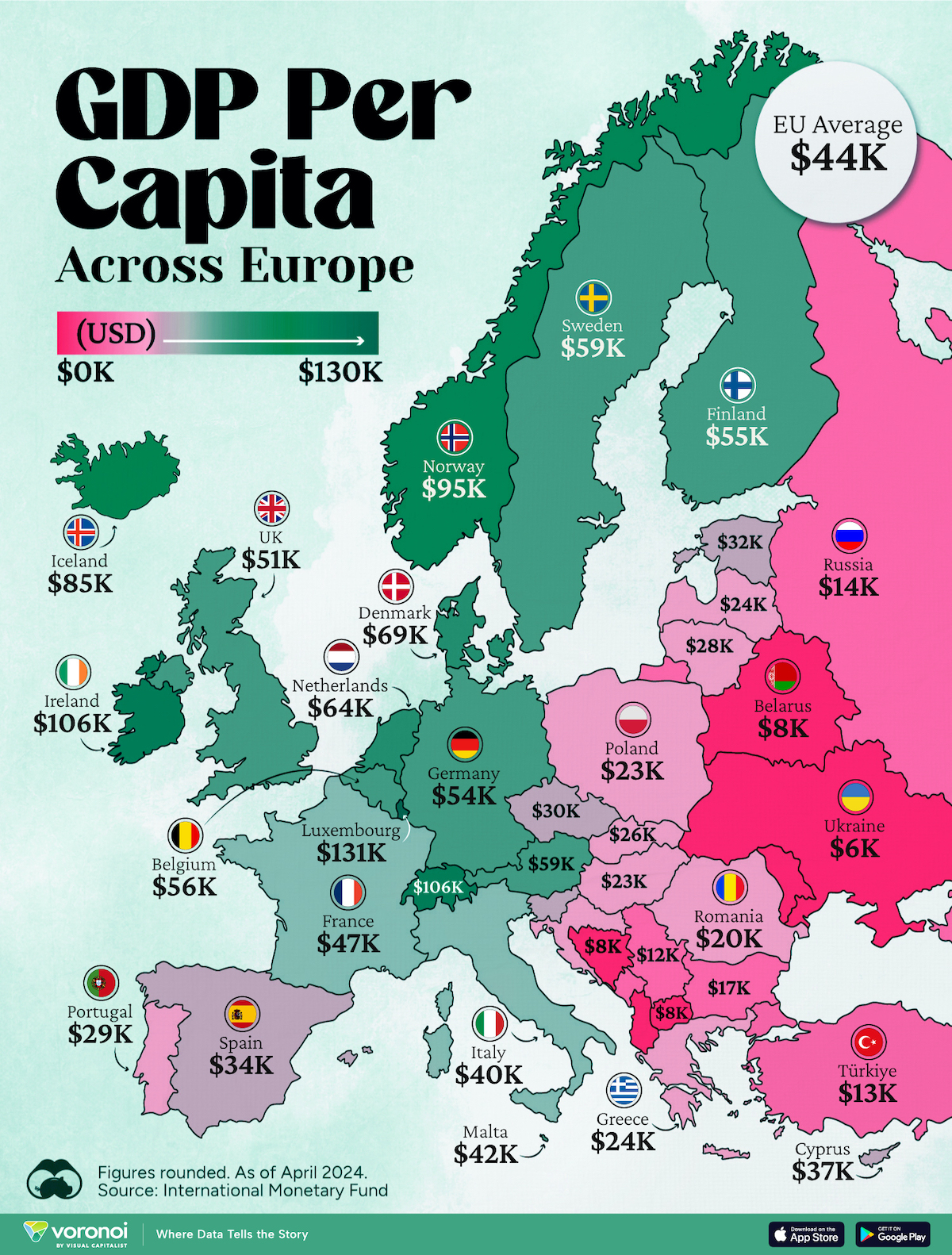

Which European economies are richest on a GDP per capita basis? This map shows the results for 44 countries across the continent.

Mapped: Europe’s GDP Per Capita, by Country (2024)

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Europe is home to some of the largest and most sophisticated economies in the world. But how do countries in the region compare with each other on a per capita productivity basis?

In this map, we show Europe’s GDP per capita levels across 44 nations in current U.S. dollars. Data for this visualization and article is sourced from the International Monetary Fund (IMF) via their DataMapper tool, updated April 2024.

Europe’s Richest and Poorest Nations, By GDP Per Capita

Luxembourg, Ireland, and Switzerland, lead the list of Europe’s richest nations by GDP per capita, all above $100,000.

| Rank | Country | GDP Per Capita (2024) |

|---|---|---|

| 1 | 🇱🇺 Luxembourg | $131,380 |

| 2 | 🇮🇪 Ireland | $106,060 |

| 3 | 🇨🇭 Switzerland | $105,670 |

| 4 | 🇳🇴 Norway | $94,660 |

| 5 | 🇮🇸 Iceland | $84,590 |

| 6 | 🇩🇰 Denmark | $68,900 |

| 7 | 🇳🇱 Netherlands | $63,750 |

| 8 | 🇸🇲 San Marino | $59,410 |

| 9 | 🇦🇹 Austria | $59,230 |

| 10 | 🇸🇪 Sweden | $58,530 |

| 11 | 🇧🇪 Belgium | $55,540 |

| 12 | 🇫🇮 Finland | $55,130 |

| 13 | 🇩🇪 Germany | $54,290 |

| 14 | 🇬🇧 UK | $51,070 |

| 15 | 🇫🇷 France | $47,360 |

| 16 | 🇦🇩 Andorra | $44,900 |

| 17 | 🇲🇹 Malta | $41,740 |

| 18 | 🇮🇹 Italy | $39,580 |

| 19 | 🇨🇾 Cyprus | $37,150 |

| 20 | 🇪🇸 Spain | $34,050 |

| 21 | 🇸🇮 Slovenia | $34,030 |

| 22 | 🇪🇪 Estonia | $31,850 |

| 23 | 🇨🇿 Czech Republic | $29,800 |

| 24 | 🇵🇹 Portugal | $28,970 |

| 25 | 🇱🇹 Lithuania | $28,410 |

| 26 | 🇸🇰 Slovakia | $25,930 |

| 27 | 🇱🇻 Latvia | $24,190 |

| 28 | 🇬🇷 Greece | $23,970 |

| 29 | 🇭🇺 Hungary | $23,320 |

| 30 | 🇵🇱 Poland | $23,010 |

| 31 | 🇭🇷 Croatia | $22,970 |

| 32 | 🇷🇴 Romania | $19,530 |

| 33 | 🇧🇬 Bulgaria | $16,940 |

| 34 | 🇷🇺 Russia | $14,390 |

| 35 | 🇹🇷 Türkiye | $12,760 |

| 36 | 🇲🇪 Montenegro | $12,650 |

| 37 | 🇷🇸 Serbia | $12,380 |

| 38 | 🇦🇱 Albania | $8,920 |

| 39 | 🇧🇦 Bosnia & Herzegovina | $8,420 |

| 40 | 🇲🇰 North Macedonia | $7,690 |

| 41 | 🇧🇾 Belarus | $7,560 |

| 42 | 🇲🇩 Moldova | $7,490 |

| 43 | 🇽🇰 Kosovo | $6,390 |

| 44 | 🇺🇦 Ukraine | $5,660 |

| N/A | 🇪🇺 EU Average | $44,200 |

Note: Figures are rounded.

Three Nordic countries (Norway, Iceland, Denmark) also place highly, between $70,000-90,000. Other Nordic peers, Sweden and Finland rank just outside the top 10, between $55,000-60,000.

Meanwhile, Europe’s biggest economies in absolute terms, Germany, UK, and France, rank closer to the middle of the top 20, with GDP per capitas around $50,000.

Finally, at the end of the scale, Eastern Europe as a whole tends to have much lower per capita GDPs. In that group, Ukraine ranks last, at $5,660.

A Closer Look at Ukraine

For a broader comparison, Ukraine’s per capita GDP is similar to Iran ($5,310), El Salvador ($5,540), and Guatemala ($5,680).

According to experts, Ukraine’s economy has historically underperformed to expectations. After the fall of the Berlin Wall, the economy contracted for five straight years. Its transition to a Western, liberalized economic structure was overshadowed by widespread corruption, a limited taxpool, and few revenue sources.

Politically, its transformation from authoritarian regime to civil democracy has proved difficult, especially when it comes to institution building.

Finally, after the 2022 invasion of the country, Ukraine’s GDP contracted by 30% in a single year—the largest loss since independence. Large scale emigration—to the tune of six million refugees—is also playing a role.

Despite these challenges, the country’s economic growth has somewhat stabilized while fighting continues.

-

Markets6 days ago

Markets6 days agoThe Most Valuable Companies in Major EU Economies

-

Wealth2 weeks ago

Wealth2 weeks agoCharted: Which City Has the Most Billionaires in 2024?

-

Technology2 weeks ago

Technology2 weeks agoAll of the Grants Given by the U.S. CHIPS Act

-

Green2 weeks ago

Green2 weeks agoThe Carbon Footprint of Major Travel Methods

-

United States1 week ago

United States1 week agoVisualizing the Most Common Pets in the U.S.

-

Culture1 week ago

Culture1 week agoThe World’s Top Media Franchises by All-Time Revenue

-

voronoi1 week ago

voronoi1 week agoBest Visualizations of April on the Voronoi App

-

Wealth1 week ago

Wealth1 week agoCharted: Which Country Has the Most Billionaires in 2024?