Markets

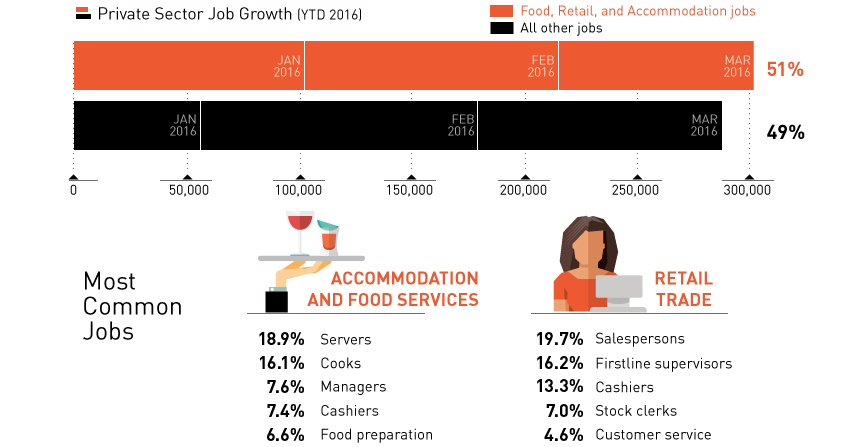

Do You Want Fries With That? [Chart]

![Do You Want Fries With That? [Chart]](https://www.visualcapitalist.com/wp-content/uploads/2016/04/retail-food-service-jobs-chart.png)

Do You Want Fries With That? [Chart]

Over half of U.S. jobs created this year are in Food or Retail

The Chart of the Week is a weekly Visual Capitalist feature on Fridays.

Every month, the Bureau of Labor Statistics releases its Employment Situation report, summing up the most recent government figures on employment in the United States. Investors use this information to gauge the health of the domestic economy, paying close attention to the unemployment rate, nonfarm payrolls, labor force participation, and wage growth.

While this report gets dissected to death each month, we thought we’d take a more nuanced view by profiling the two sectors that have supplied the lion’s share of job growth in 2016 so far.

Numbers in Q1

In the first three months of 2016, a total of 589,000 private sector jobs were created.

A variety of sectors contributed to this growth, including industries such as construction and healthcare. In particular, however, it was the “Accommodation and Food Services” and “Retail Trade” segments that added the most new workers. In combination, these sectors are the source for 51% of all new U.S. jobs in 2016 to date.

While there’s absolutely nothing wrong with job growth in these sectors, an important point from an investment perspective must be made. Typically speaking, these are jobs that pay on the lower end of the spectrum, and they do little to move the needle on making the overall economy richer and more diversified.

Sector Comparison

To get an idea of the jobs that are being created, here are the five most popular positions in each segment:

Accommodation and Food Services

- Waiters and waitresses (18.9%)

- Cooks (16.1%)

- Food service managers (7.6%)

- Cashiers (7.4%)

- Food preparation (6.6%)

Retail Trade

- Retail salespersons (19.7%)

- Firstline supervisors (16.2%)

- Cashiers (13.3%)

- Stock clerks (7.0%)

- Customer service (4.6%)

Here’s also the salary and age profile of each segment, as well as a comparison to the Manufacturing sector, which lost 29,000 jobs in March.

Accommodation and Food Services

- Average age: 32.7

- Average salary: $20,495

- Share making <$20k per year: 63.8%

Retail Trade

- Average age: 38.5

- Average salary: $31,460

- Share making <$20k per year: 46.6%

Manufacturing

- Average age: 43.7

- Average salary: $56,264

- Share making <$20k per year: 15.8%

Data in this section comes from DataUSA, using information from the Bureau of Labor Statistics and Census Bureau for 2014.

Markets

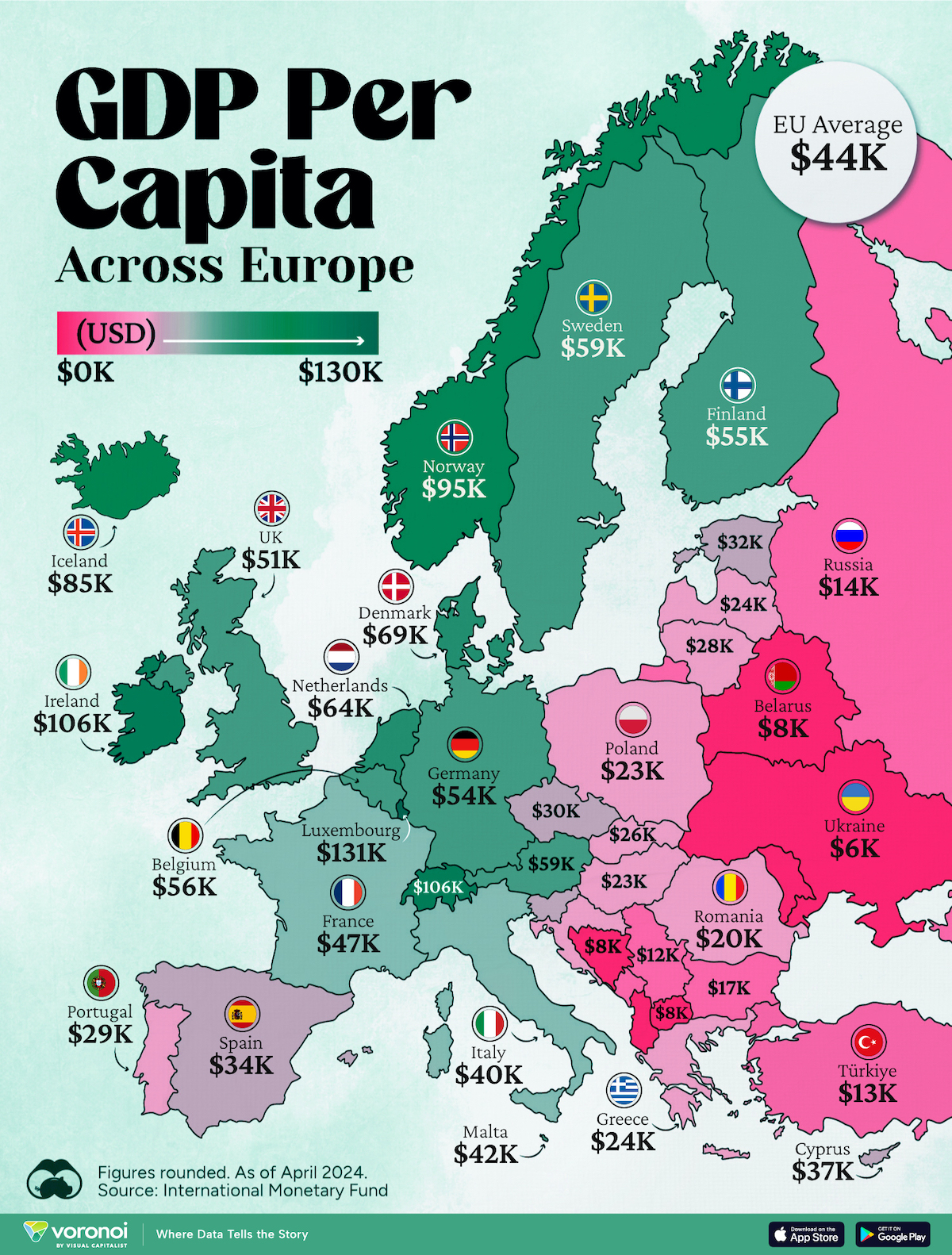

Mapped: Europe’s GDP Per Capita, by Country

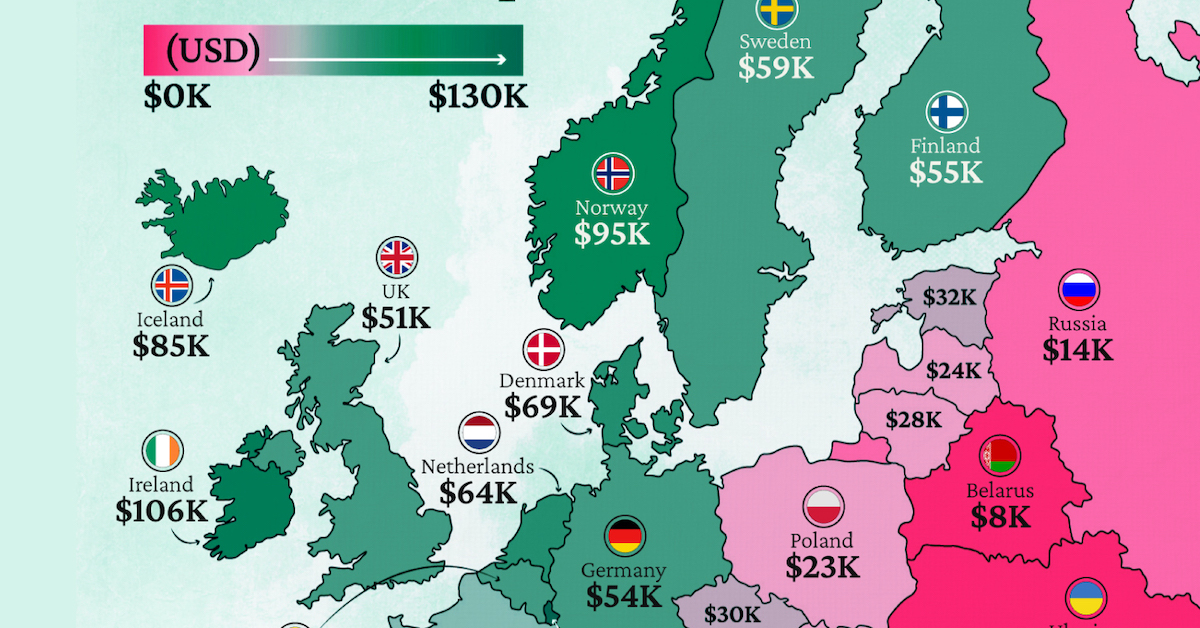

Which European economies are richest on a GDP per capita basis? This map shows the results for 44 countries across the continent.

Mapped: Europe’s GDP Per Capita, by Country (2024)

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Europe is home to some of the largest and most sophisticated economies in the world. But how do countries in the region compare with each other on a per capita productivity basis?

In this map, we show Europe’s GDP per capita levels across 44 nations in current U.S. dollars. Data for this visualization and article is sourced from the International Monetary Fund (IMF) via their DataMapper tool, updated April 2024.

Europe’s Richest and Poorest Nations, By GDP Per Capita

Luxembourg, Ireland, and Switzerland, lead the list of Europe’s richest nations by GDP per capita, all above $100,000.

| Rank | Country | GDP Per Capita (2024) |

|---|---|---|

| 1 | 🇱🇺 Luxembourg | $131,380 |

| 2 | 🇮🇪 Ireland | $106,060 |

| 3 | 🇨🇭 Switzerland | $105,670 |

| 4 | 🇳🇴 Norway | $94,660 |

| 5 | 🇮🇸 Iceland | $84,590 |

| 6 | 🇩🇰 Denmark | $68,900 |

| 7 | 🇳🇱 Netherlands | $63,750 |

| 8 | 🇸🇲 San Marino | $59,410 |

| 9 | 🇦🇹 Austria | $59,230 |

| 10 | 🇸🇪 Sweden | $58,530 |

| 11 | 🇧🇪 Belgium | $55,540 |

| 12 | 🇫🇮 Finland | $55,130 |

| 13 | 🇩🇪 Germany | $54,290 |

| 14 | 🇬🇧 UK | $51,070 |

| 15 | 🇫🇷 France | $47,360 |

| 16 | 🇦🇩 Andorra | $44,900 |

| 17 | 🇲🇹 Malta | $41,740 |

| 18 | 🇮🇹 Italy | $39,580 |

| 19 | 🇨🇾 Cyprus | $37,150 |

| 20 | 🇪🇸 Spain | $34,050 |

| 21 | 🇸🇮 Slovenia | $34,030 |

| 22 | 🇪🇪 Estonia | $31,850 |

| 23 | 🇨🇿 Czech Republic | $29,800 |

| 24 | 🇵🇹 Portugal | $28,970 |

| 25 | 🇱🇹 Lithuania | $28,410 |

| 26 | 🇸🇰 Slovakia | $25,930 |

| 27 | 🇱🇻 Latvia | $24,190 |

| 28 | 🇬🇷 Greece | $23,970 |

| 29 | 🇭🇺 Hungary | $23,320 |

| 30 | 🇵🇱 Poland | $23,010 |

| 31 | 🇭🇷 Croatia | $22,970 |

| 32 | 🇷🇴 Romania | $19,530 |

| 33 | 🇧🇬 Bulgaria | $16,940 |

| 34 | 🇷🇺 Russia | $14,390 |

| 35 | 🇹🇷 Türkiye | $12,760 |

| 36 | 🇲🇪 Montenegro | $12,650 |

| 37 | 🇷🇸 Serbia | $12,380 |

| 38 | 🇦🇱 Albania | $8,920 |

| 39 | 🇧🇦 Bosnia & Herzegovina | $8,420 |

| 40 | 🇲🇰 North Macedonia | $7,690 |

| 41 | 🇧🇾 Belarus | $7,560 |

| 42 | 🇲🇩 Moldova | $7,490 |

| 43 | 🇽🇰 Kosovo | $6,390 |

| 44 | 🇺🇦 Ukraine | $5,660 |

| N/A | 🇪🇺 EU Average | $44,200 |

Note: Figures are rounded.

Three Nordic countries (Norway, Iceland, Denmark) also place highly, between $70,000-90,000. Other Nordic peers, Sweden and Finland rank just outside the top 10, between $55,000-60,000.

Meanwhile, Europe’s biggest economies in absolute terms, Germany, UK, and France, rank closer to the middle of the top 20, with GDP per capitas around $50,000.

Finally, at the end of the scale, Eastern Europe as a whole tends to have much lower per capita GDPs. In that group, Ukraine ranks last, at $5,660.

A Closer Look at Ukraine

For a broader comparison, Ukraine’s per capita GDP is similar to Iran ($5,310), El Salvador ($5,540), and Guatemala ($5,680).

According to experts, Ukraine’s economy has historically underperformed to expectations. After the fall of the Berlin Wall, the economy contracted for five straight years. Its transition to a Western, liberalized economic structure was overshadowed by widespread corruption, a limited taxpool, and few revenue sources.

Politically, its transformation from authoritarian regime to civil democracy has proved difficult, especially when it comes to institution building.

Finally, after the 2022 invasion of the country, Ukraine’s GDP contracted by 30% in a single year—the largest loss since independence. Large scale emigration—to the tune of six million refugees—is also playing a role.

Despite these challenges, the country’s economic growth has somewhat stabilized while fighting continues.

-

Markets5 days ago

Markets5 days agoVisualizing Global Inflation Forecasts (2024-2026)

-

Green2 weeks ago

Green2 weeks agoThe Carbon Footprint of Major Travel Methods

-

United States2 weeks ago

United States2 weeks agoVisualizing the Most Common Pets in the U.S.

-

Culture2 weeks ago

Culture2 weeks agoThe World’s Top Media Franchises by All-Time Revenue

-

Visual Capitalist1 week ago

Visual Capitalist1 week agoBest Visualizations of April on the Voronoi App

-

Wealth1 week ago

Wealth1 week agoCharted: Which Country Has the Most Billionaires in 2024?

-

Markets1 week ago

Markets1 week agoThe Top Private Equity Firms by Country

-

Markets1 week ago

Markets1 week agoThe Best U.S. Companies to Work for According to LinkedIn