Real Estate

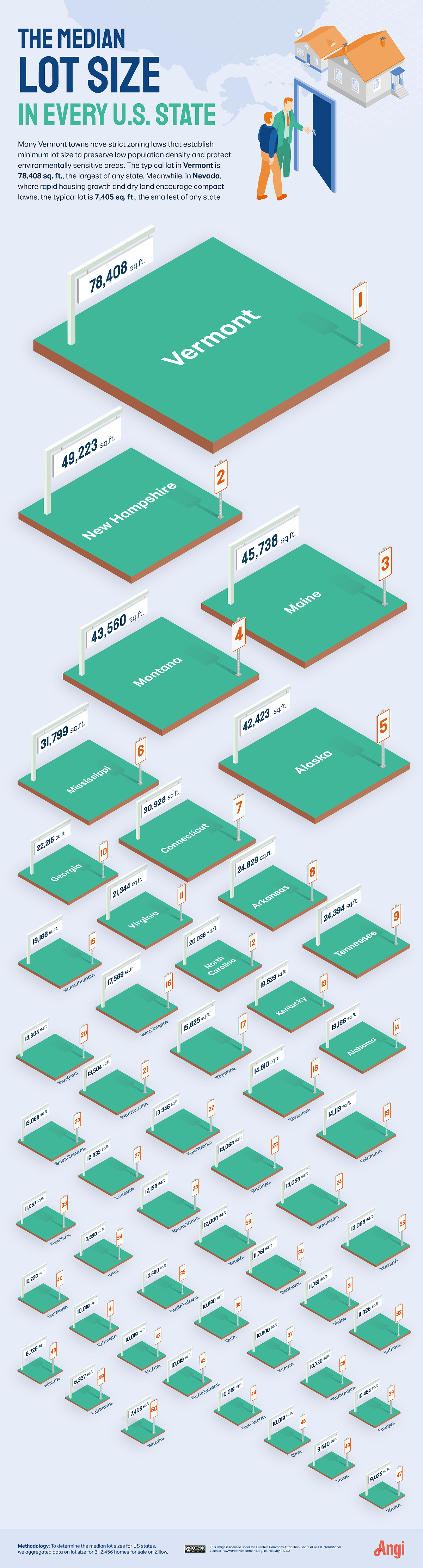

The Median Lot Size in Every U.S. State in 2022

The Median Lot Size in Every U.S. State in 2022

The “American Dream” is often associated with imagery of spacious estates adorned with white picket fences, wrap-around porches, and sprawling green lawns that seem to go on forever.

But in reality, modern American life has become much more compact. Over the last few decades, the typical lot size in the U.S. has decreased significantly—from 18,760 square feet in 1978 to 13,896 in 2020.

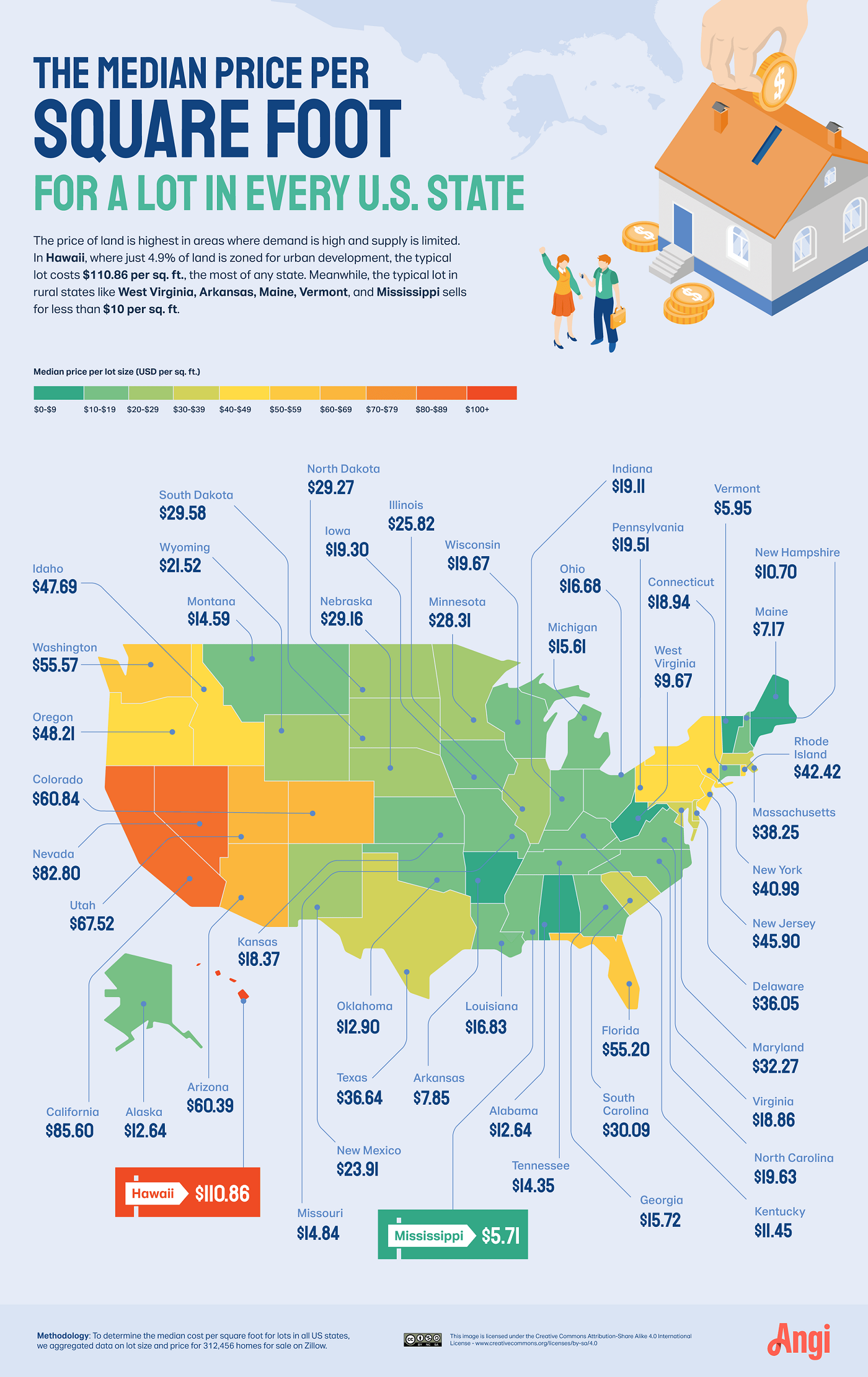

While lot sizes are getting smaller overall, there are still large discrepancies in lot sizes from state to state. This graphic by Angi uses data from the 2022 U.S. Lot Size Index to show the median lot size in every U.S. State, using data from 312,456 Zillow listings as of May 2022.

Largest and Smallest Median Lot Sizes by State

When it comes to the states with the largest plots of land, New England dominates the ranking, with Vermont, New Hampshire, and Maine at the top of the list.

| Rank | State | Median lot size (sq.ft.) |

|---|---|---|

| 1 | Vermont | 78,408 |

| 2 | New Hampshire | 49,223 |

| 3 | Maine | 45,738 |

| 4 | Montana | 43,560 |

| 5 | Alaska | 42,423 |

| 6 | Mississippi | 31,799 |

| 7 | Connecticut | 30,928 |

| 8 | Arkansas | 24,829 |

| 9 | Tennessee | 24,394 |

| 10 | Georgia | 22,215 |

New England was one of the first regions settled by the Europeans in Colonial America. This long history, along with a large rural population, could explain why the area has strict zoning policies that limit density and require large minimum lot sizes for new builds.

On the opposite end of the spectrum, Nevada ranks as the state with the smallest median lot size:

| Rank | State | Median lot size (sq.ft.) |

|---|---|---|

| 1 | Nevada | 7,405 |

| 2 | California | 8,327 |

| 3 | Arizona | 8,726 |

| 4 | Illinois | 9,025 |

| 5 | Texas | 9,540 |

| 6 | Colorado | 10,019 |

| 7 | Florida | 10,019 |

| 8 | North Dakota | 10,019 |

| 9 | New Jersey | 10,019 |

| 10 | Ohio | 10,019 |

One possible explanation is that Nevada’s population boom—and subsequent development—is relatively recent. Newer homes listed in the dataset tend to have smaller lot sizes, and in Nevada, 34.6% of homes included in the research were built in 2000 or later.

Comparing Lot Size to Land Price

Generally speaking, the states with the biggest lots also tend to have the cheapest land when broken down per square foot. For instance, in Vermont, properties sold for a median $5.95 per square foot.

View the full-size infographic

On the flip side, in Nevada, land sold for a median $82.80 per square foot—that’s the third most expensive of any state.

Of course, other factors are at play here when it comes to the cost of land. Like anything else that’s for sale, the price of a lot is governed largely by the laws of supply and demand.

For example, housing supply is scarce in Hawaii, where only 4.9% of the land is zoned for residential development, and the median home size is much smaller than in other parts of the country. Not surprisingly, the median plot of land in Hawaii costs $110.86 per square foot, the most expensive on the list.

The Future of Housing in America

Lot sizes remain relatively large in some states for now, but as the U.S. population continues to become more urbanized, living conditions in America could get even tighter.

Will America hold onto its spacious way of living, or could life in the U.S. start to resemble more densely populated regions in the future?

This article was published as a part of Visual Capitalist's Creator Program, which features data-driven visuals from some of our favorite Creators around the world.

Markets

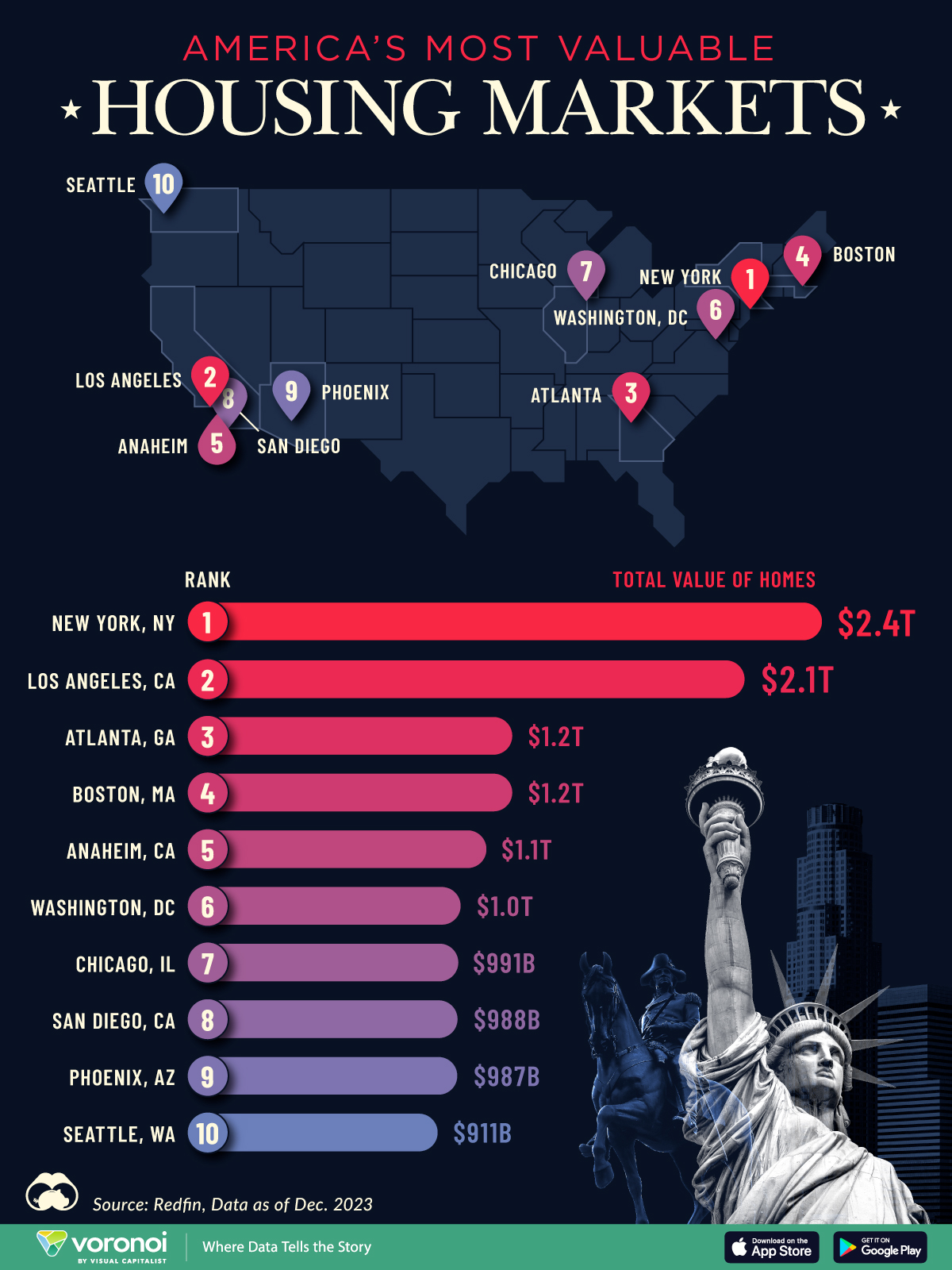

Ranked: The Most Valuable Housing Markets in America

The U.S. residential real estate market is worth a staggering $47.5 trillion. Here are the most valuable housing markets in the country.

The Most Valuable Housing Markets in America

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

The residential real estate market in the U.S. stands as one of the largest asset classes in the country, worth $47.5 trillion in 2023.

Despite a slowdown in home sales, the total value of homes increased $2.4 trillion last year as low inventory levels pushed up prices. Affordable metropolitan areas saw steady price growth, while expensive metros experienced slower price appreciation.

This graphic shows America’s most valuable housing markets, using data from Redfin.

Top U.S. Residential Real Estate Markets

To calculate the largest U.S. housing markets, Redfin analyzed 90 million properties covering single-family homes, townhouses, condos, and two-to four-unit multifamily properties.

Below, we show the most valuable residential markets as of December 2023:

| Rank | U.S. Metro | Total Value of Homes | Total Value of Homes YoY Change |

|---|---|---|---|

| 1 | New York, NY | $2.4T | -1.0% |

| 2 | Los Angeles, CA | $2.1T | +4.3% |

| 3 | Atlanta, GA | $1.2T | +6.2% |

| 4 | Boston, MA | $1.2T | +8.3% |

| 5 | Anaheim, CA | $1.1T | +8.0% |

| 6 | Washington, DC | $1.0T | +6.2% |

| 7 | Chicago, IL | $991B | +7.4% |

| 8 | San Diego, CA | $988B | +9.4% |

| 9 | Phoenix, AZ | $987B | +4.2% |

| 10 | Seattle, WA | $911B | +4.6% |

With a housing market worth $2.4 trillion, New York, NY tops the list.

Unlike the majority of large U.S. cities, the aggregate value of homes declined as buyers became increasingly priced out of the market. At the same time, homeowners hesitated to sell in order to lock in low mortgage rates. In fact, more than 80% of mortgage holders in New York City have interest rates that are 5% or lower.

Los Angeles, CA falls in second, with a residential real estate market worth $2.0 trillion. Last year, existing home sales tumbled 24.8%, falling to the lowest point since 2007. However, the housing shortage led prices to increase amid high demand. The median sale price climbed to $975,000 in February 2024, a 5.9% jump compared to the same time last year.

Atlanta, GA ranks third and is the most overpriced housing market in the country according to one countrywide analysis. Homes have been selling for 41.7% more than their worth as of the February 2024 data update.

People are flocking to the city for many reasons. General housing affordability is a major driver, along with its thriving tech center. Along with this, state tax credits have increasingly made it a hub for the TV and film industries, earning it the moniker “Y’allywood”. Another factor in Atlanta’s inflating housing market are large investment firms, which own a huge footprint of homes in the city.

Editor’s note: For those wondering about the Bay Area, the data groups cities like San Francisco ($657 billion), San Jose ($821 billion), and Oakland ($881 billion) as individual entities, which puts them outside the cutoff. See the Redfin data for the full list of cities.

-

Mining1 week ago

Mining1 week agoGold vs. S&P 500: Which Has Grown More Over Five Years?

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries