Markets

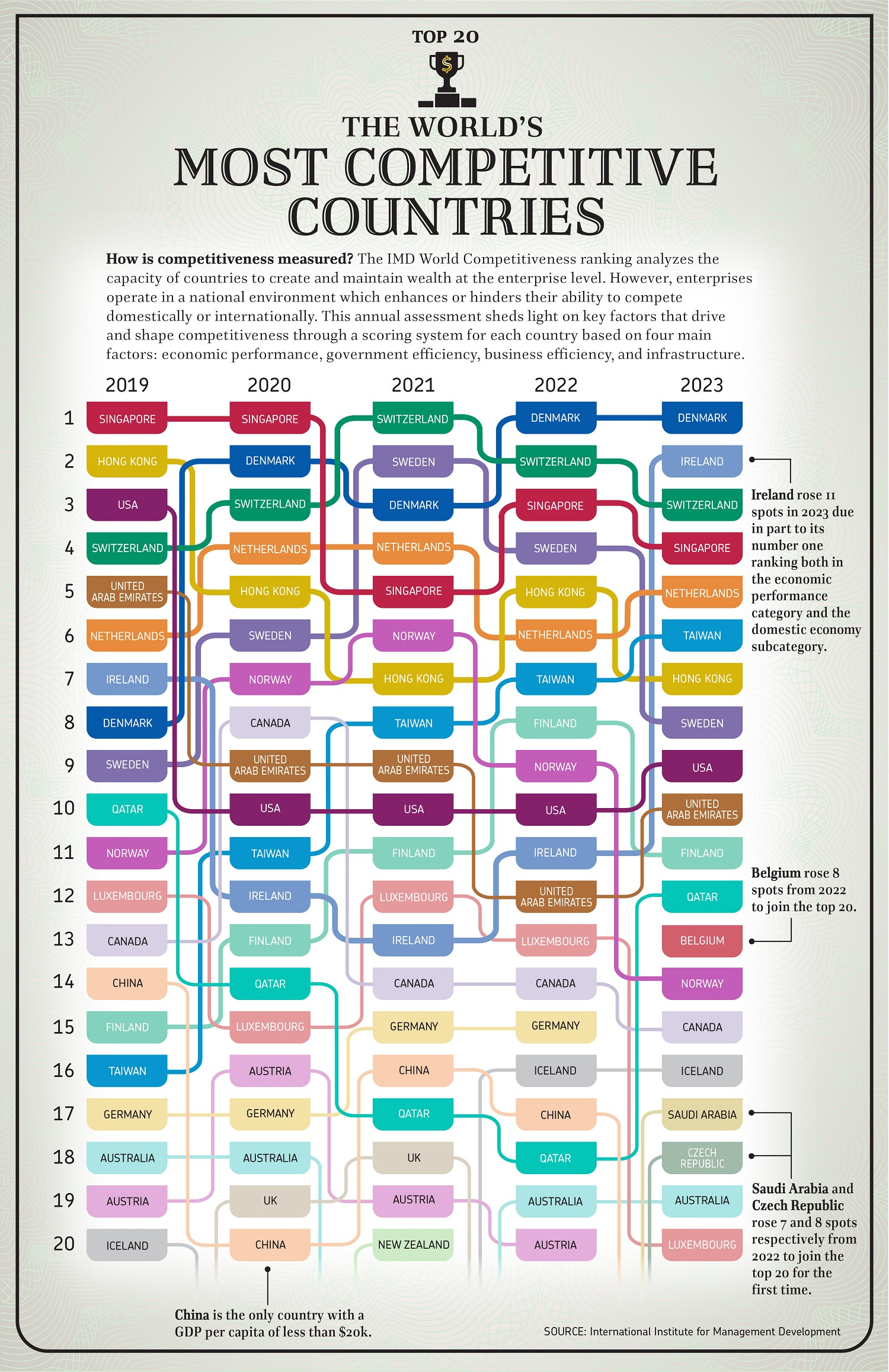

Ranked: The World’s Most Competitive Countries (2019-2023)

Ranking the Most Competitive Countries Around the World

Just as a well-made ship needs fair weather for a smooth voyage, businesses need a supportive ecosystem to start and stay successful.

Rankings for the most competitive countries attempt to quantify this support directly, seeing which economies have the best frameworks for business to thrive. Examining how the rankings change over time can also tell us a lot about how countries are progressing relative to others.

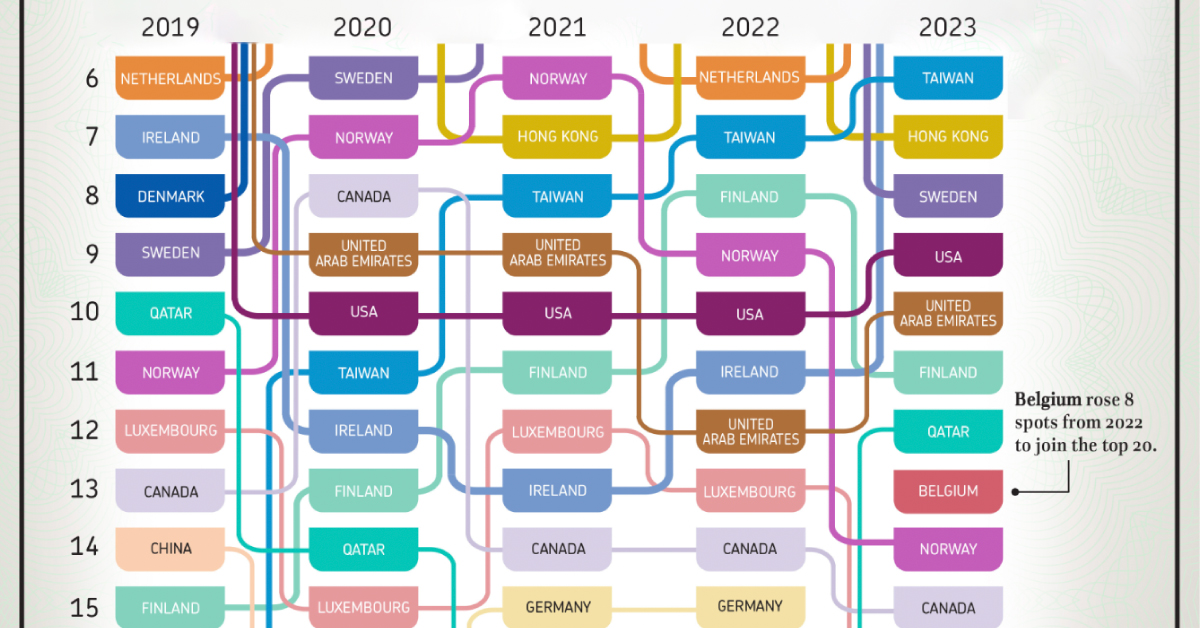

In the above graphic, Julie Peasley uses the World Competitiveness Ranking report by the International Institute for Management Development (IMD) to chart the top 20 most competitive countries between 2019 and 2023.

How is Business Competitiveness Measured?

IMD examines countries on the basis of four metrics across multiple sub-factors:

- Economic performance:

Domestic economy, international trade, international investment, employment, prices - Government efficiency:

Public finance, tax policy, institutional framework, business legislation, societal framework - Business efficiency:

Productivity & efficiency, labor market, finance, management practices, attitudes & values - Infrastructure:

Basic infrastructure, technological infrastructure, scientific infrastructure, health & environment, education

These metrics are scored on a mix of hard statistics, surveys from partner institutes, and supplementary data.

Which Countries are the Best and Worst for Business?

Denmark holds on to the top spot as the most business-friendly country in 2023, after it ranked number one for the first time in 2022. The Scandinavian country has been a perennial top 10 performer since 2018 but really began its ascent to the summit in the last four years.

The country excels in the categories of business efficiency, government efficiency, and infrastructure metrics, despite comparatively average economic performance next to some of its geographic peers.

| Rank (2023) | Country | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| 1 | 🇩🇰 Denmark | 8 | 2 | 3 | 1 |

| 2 | 🇮🇪 Ireland | 7 | 12 | 13 | 11 |

| 3 | 🇨🇭 Switzerland | 4 | 3 | 1 | 2 |

| 4 | 🇸🇬 Singapore | 1 | 1 | 5 | 3 |

| 5 | 🇳🇱 Netherlands | 6 | 4 | 4 | 6 |

| 6 | 🇹🇼 Taiwan | 16 | 11 | 8 | 7 |

| 7 | 🇭🇰 Hong Kong | 2 | 5 | 7 | 5 |

| 8 | 🇸🇪 Sweden | 9 | 6 | 2 | 4 |

| 9 | 🇺🇸 U.S. | 3 | 10 | 10 | 10 |

| 10 | 🇦🇪 UAE | 5 | 9 | 9 | 12 |

| 11 | 🇫🇮 Finland | 15 | 13 | 11 | 8 |

| 12 | 🇶🇦 Qatar | 10 | 14 | 17 | 18 |

| 13 | 🇧🇪 Belgium | 27 | 25 | 24 | 21 |

| 14 | 🇳🇴 Norway | 11 | 7 | 6 | 9 |

| 15 | 🇨🇦 Canada | 13 | 8 | 14 | 14 |

| 16 | 🇮🇸 Iceland | 20 | 21 | 21 | 16 |

| 17 | 🇸🇦 Saudi Arabia | 26 | 24 | 32 | 24 |

| 18 | 🇨🇿 Czech Republic | 33 | 33 | 34 | 26 |

| 19 | 🇦🇺 Australia | 18 | 18 | 22 | 19 |

| 20 | 🇱🇺 Luxembourg | 12 | 15 | 12 | 13 |

| 21 | 🇨🇳 China | 14 | 20 | 16 | 17 |

| 22 | 🇩🇪 Germany | 17 | 17 | 15 | 15 |

| 23 | 🇮🇱 Israel | 24 | 26 | 27 | 25 |

| 24 | 🇦🇹 Austria | 19 | 16 | 19 | 20 |

| 25 | 🇧🇭 Bahrain | N/A | N/A | N/A | 30 |

| 26 | 🇪🇪 Estonia | 35 | 28 | 26 | 22 |

| 27 | 🇲🇾 Malaysia | 22 | 27 | 25 | 32 |

| 28 | 🇰🇷 South Korea | 28 | 23 | 23 | 27 |

| 29 | 🇬🇧 UK | 23 | 19 | 18 | 23 |

| 30 | 🇹🇭 Thailand | 25 | 29 | 28 | 33 |

| 31 | 🇳🇿 New Zealand | 21 | 22 | 20 | 31 |

| 32 | 🇱🇹 Lithuania | 29 | 31 | 30 | 29 |

| 33 | 🇫🇷 France | 31 | 32 | 29 | 28 |

| 34 | 🇮🇩 Indonesia | 32 | 40 | 37 | 44 |

| 35 | 🇯🇵 Japan | 30 | 34 | 31 | 34 |

| 36 | 🇪🇸 Spain | 36 | 36 | 39 | 36 |

| 37 | 🇰🇿 Kazakhstan | 34 | 42 | 35 | 43 |

| 38 | 🇰🇼 Kuwait | N/A | N/A | N/A | N/A |

| 39 | 🇵🇹 Portugal | 39 | 37 | 36 | 42 |

| 40 | 🇮🇳 India | 43 | 43 | 43 | 37 |

| 41 | 🇮🇹 Italy | 44 | 44 | 41 | 41 |

| 42 | 🇸🇮 Slovenia | 37 | 35 | 40 | 38 |

| 43 | 🇵🇱 Poland | 38 | 39 | 47 | 50 |

| 44 | 🇨🇱 Chile | 42 | 38 | 44 | 45 |

| 45 | 🇨🇾 Cyprus | 41 | 30 | 33 | 40 |

| 46 | 🇭🇺 Hungary | 47 | 47 | 42 | 39 |

| 47 | 🇹🇷 Türkiye | 51 | 46 | 51 | 52 |

| 48 | 🇷🇴 Romania | 49 | 51 | 48 | 51 |

| 49 | 🇬🇷 Greece | 58 | 49 | 46 | 47 |

| 50 | 🇭🇷 Croatia | 60 | 60 | 59 | 46 |

| 51 | 🇱🇻 Latvia | 40 | 41 | 38 | 35 |

| 52 | 🇵🇭 Philippines | 46 | 45 | 52 | 48 |

| 53 | 🇸🇰 Slovak Republic | 53 | 57 | 50 | 49 |

| 54 | 🇯🇴 Jordan | 57 | 58 | 49 | 56 |

| 55 | 🇵🇪 Peru | 55 | 52 | 58 | 54 |

| 56 | 🇲🇽 Mexico | 50 | 53 | 55 | 55 |

| 57 | 🇧🇬 Bulgaria | 48 | 48 | 53 | 53 |

| 58 | 🇨🇴 Colombia | 52 | 54 | 56 | 57 |

| 59 | 🇧🇼 Botswana | N/A | N/A | 61 | 58 |

| 60 | 🇧🇷 Brazil | 59 | 56 | 57 | 59 |

| 61 | 🇿🇦 South Africa | 56 | 59 | 62 | 60 |

| 62 | 🇲🇳 Mongolia | 62 | 61 | 60 | 61 |

| 63 | 🇦🇷 Argentina | 61 | 62 | 63 | 62 |

| 64 | 🇻🇪 Venezuela | 63 | 63 | 64 | 63 |

Close behind in second place is Ireland, jumping five spots since 2019. The country’s strong economic performance helped it break into the upper echelon after bouncing around the top-15 rankings in the last few years.

Ranked third is Switzerland which has been in the top five since 2018, and reached first place in 2021. While the country scores well on several key indicators, it loses points on subfactors like the lack of business development and IPO offerings.

Singapore, which also was previously ranked as the most competitive country in 2019 and 2020, secured fourth place in 2023. In contrast to Denmark and Switzerland, the Asian financial heavyweight scores well on economic performance but loses ground on government efficiency.

At the bottom of the list, Venezuela, Argentina, and Mongolia face significant challenges in business competitiveness in 2023. These countries suffer from a trifecta of poor economic performance, low business and government efficiency, and substandard infrastructure, hindering business growth and development. Macro developments also play a key factor in their fortunes. For example, Mongolia has suffered in the aftermath of sanctions on Russia, a key trade partner.

Changing Rankings for the Most Competitive Countries

Though some countries have placed consistently in the rankings of the most competitive countries, there are also countries that have seen more noteworthy fluctuations.

China and Germany were both in the top 20 rankings pretty consistently until 2022, but both fell just short of that benchmark in the 2023 rankings.

And the U.S. is still in the top 10 but has dropped six spots compared to other economies in the last five years. The country’s economic might is unimpeachable, but rankings slipped in the business landscape and government efficiency metrics.

Here are the five-year changes in rankings for all countries scored in the IMD report, sorted from biggest increase to largest decrease:

| Country | Change (2019-2023) | Rank (2023) |

|---|---|---|

| 🇨🇿 Czech Republic | +15 | 18 |

| 🇧🇪 Belgium | +14 | 13 |

| 🇹🇼 Taiwan | +10 | 6 |

| 🇭🇷 Croatia | +10 | 50 |

| 🇸🇦 Saudi Arabia | +9 | 17 |

| 🇪🇪 Estonia | +9 | 26 |

| 🇬🇷 Greece | +9 | 49 |

| 🇩🇰 Denmark | +7 | 1 |

| 🇮🇪 Ireland | +5 | 2 |

| 🇫🇮 Finland | +4 | 11 |

| 🇮🇸 Iceland | +4 | 16 |

| 🇹🇷 Türkiye | 4 | 47 |

| 🇮🇳 India | 3 | 40 |

| 🇮🇹 Italy | 3 | 41 |

| 🇯🇴 Jordan | 3 | 54 |

| 🇨🇭 Switzerland | +1 | 3 |

| 🇳🇱 Netherlands | +1 | 5 |

| 🇸🇪 Sweden | +1 | 8 |

| 🇮🇱 Israel | +1 | 23 |

| 🇭🇺 Hungary | +1 | 46 |

| 🇷🇴 Romania | +1 | 48 |

| 🇰🇷 South Korea | 0 | 28 |

| 🇪🇸 Spain | 0 | 36 |

| 🇵🇹 Portugal | 0 | 39 |

| 🇸🇰 Slovak Republic | 0 | 53 |

| 🇵🇪 Peru | 0 | 55 |

| 🇲🇳 Mongolia | 0 | 62 |

| 🇦🇺 Australia | -1 | 19 |

| 🇧🇷 Brazil | -1 | 60 |

| 🇻🇪 Venezuela | -1 | 64 |

| 🇶🇦 Qatar | -2 | 12 |

| 🇨🇦 Canada | -2 | 15 |

| 🇫🇷 France | -2 | 33 |

| 🇮🇩 Indonesia | -2 | 34 |

| 🇨🇱 Chile | -2 | 44 |

| 🇦🇷 Argentina | -2 | 63 |

| 🇸🇬 Singapore | -3 | 4 |

| 🇳🇴 Norway | -3 | 14 |

| 🇱🇹 Lithuania | -3 | 32 |

| 🇰🇿 Kazakhstan | -3 | 37 |

| 🇨🇾 Cyprus | -4 | 45 |

| 🇭🇰 Hong Kong | -5 | 7 |

| 🇦🇪 UAE | -5 | 10 |

| 🇩🇪 Germany | -5 | 22 |

| 🇦🇹 Austria | -5 | 24 |

| 🇲🇾 Malaysia | -5 | 27 |

| 🇹🇭 Thailand | -5 | 30 |

| 🇯🇵 Japan | -5 | 35 |

| 🇸🇮 Slovenia | -5 | 42 |

| 🇵🇱 Poland | -5 | 43 |

| 🇿🇦 South Africa | -5 | 61 |

| 🇺🇸 U.S. | -6 | 9 |

| 🇬🇧 UK | -6 | 29 |

| 🇵🇭 Philippines | -6 | 52 |

| 🇲🇽 Mexico | -6 | 56 |

| 🇨🇴 Colombia | -6 | 58 |

| 🇨🇳 China | -7 | 21 |

| 🇱🇺 Luxembourg | -8 | 20 |

| 🇧🇬 Bulgaria | -9 | 57 |

| 🇳🇿 New Zealand | -10 | 31 |

| 🇱🇻 Latvia | -11 | 51 |

| 🇧🇭 Bahrain | N/A | 25 |

| 🇰🇼 Kuwait | N/A | 38 |

| 🇧🇼 Botswana | N/A | 59 |

The Czech Republic and Belgium have made huge strides in improving their business environments since 2019, moving up 15 and 14 spots in the rankings over the last half a decade, respectively.

Saudi Arabia has also been making steady gains thanks to a series of pro-business reforms in recent years. Together with the Czech Republic, 2023 marked the first year both countries cracked the top 20 list for the most competitive countries.

On the other hand, Latvia and New Zealand have slipped the most in competitiveness, dropping 11 and 10 spots respectively. Latvia and its Baltic neighbors are dealing with a tough geopolitical environment and risk of a recession with instability in the region, while New Zealand was noted as dealing with both a brain drain and a lack of resiliency to climate change.

An Examination of Business Competitiveness

Business competitiveness is one of many measurements for country performance, including gross domestic product (GDP), income, livability, and even happiness rankings.

And as with other measurements, it is important to consider the nuances and disparities among countries when applying a one-size-fits-all ranking system.

For instance, the most populous countries rank comparatively poorer. The U.S. ranks #2 when only considering countries with a population greater than 20 million, and China is the most competitive country with a GDP per capita of less than $20,000.

And while criticisms about the subjectivity of these rankings may be valid, looking at these kinds of breakdowns can bring unique insights to broad sociological questions, and be used as a tool to help policymakers.

Where Does This Data Come From?

Source: The International Institute for Management Development’s World Competitiveness Booklet 2023.

This article was published as a part of Visual Capitalist's Creator Program, which features data-driven visuals from some of our favorite Creators around the world.

Markets

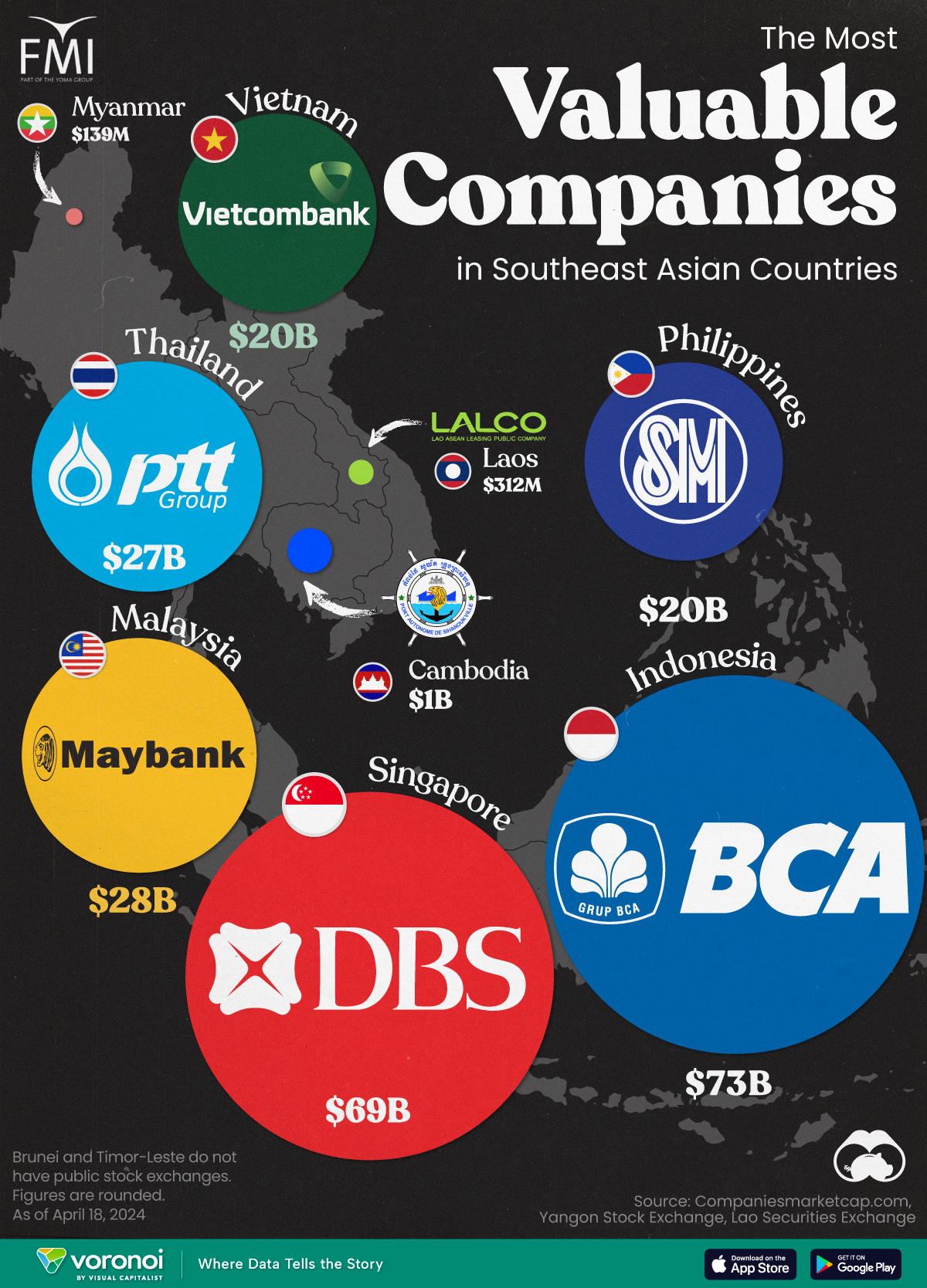

Mapped: The Most Valuable Company in Each Southeast Asian Country

Six businesses in the broader financial space are present on this list of the largest companies, by market cap, in each Southeast Asian country.

The Most Valuable Company in Each Southeast Asian Country

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Southeast Asia has been emerging as an economic powerhouse in the past decade. However, there are very noticeable disparities in the sizes of the largest publicly-traded corporations in countries within the region.

In this visualization, we map the most valuable company in each Southeast Asian country, by their market capitalization in current U.S. dollars as of April 18th, 2024.

Data for this visualization and article is sourced from Companiesmarketcap.com, and the Laos and Yangon stock exchanges.

Southeast Asia’s Biggest Companies are Banks

The most valuable companies in Indonesia and Singapore, Bank Central Asia and DBS Group, are each worth more than $60 billion, and both are banks.

In the quartet of Malaysia, Thailand, Vietnam, and the Philippines, the largest companies by market cap are all worth around $20 billion. Out of the four, two are banks.

| Country | Company | Market Cap |

|---|---|---|

| 🇮🇩 Indonesia | 🏦 Bank Central Asia | $73B |

| 🇸🇬 Singapore | 🏦 DBS Group | $69B |

| 🇲🇾 Malaysia | 🏦 Maybank | $28B |

| 🇹🇭 Thailand | ⛽ PTT PCL | $27B |

| 🇻🇳 Vietnam | 🏦 Vietcombank | $20B |

| 🇵🇭 Philippines | 📈 SM Investments Corporation | $20B |

| 🇰🇭 Cambodia | 🚢 Sihanoukville Autonomous Port | $1B |

| 🇱🇦 Laos | 🏭 LALCO | $312M |

| 🇲🇲 Myanmar | 📈 First Myanmar Investment | $139M |

Note: Figures are rounded, and current as of April 18th, 2024.

Cambodia stands by itself, with its most valuable publicly listed company, Sihanoukville Autonomous Port, worth $1 billion.

Meanwhile, LALCO in Laos is a credit leasing company worth $312 million and Myanmar’s biggest company, First Myanmar Investment, is worth $139 million.

Finally, Brunei and Timor-Leste do not have public stock exchanges, but for different reasons.

Most of Brunei’s economy relies on the state-owned oil sector, which also helps make its sultan the world’s second-richest monarch. However, in Timor-Leste, a small population combined with limited access to credit and liquidity has led to limited opportunities for the creation of publicly-listed companies or an exchange.

-

Economy7 days ago

Economy7 days agoRanked: The Top 20 Countries in Debt to China

-

Demographics2 weeks ago

Demographics2 weeks agoThe Countries That Have Become Sadder Since 2010

-

Money2 weeks ago

Money2 weeks agoCharted: Who Has Savings in This Economy?

-

AI2 weeks ago

AI2 weeks agoVisualizing AI Patents by Country

-

Economy2 weeks ago

Economy2 weeks agoEconomic Growth Forecasts for G7 and BRICS Countries in 2024

-

Wealth2 weeks ago

Wealth2 weeks agoCharted: Which City Has the Most Billionaires in 2024?

-

Technology1 week ago

Technology1 week agoAll of the Grants Given by the U.S. CHIPS Act

-

Green1 week ago

Green1 week agoThe Carbon Footprint of Major Travel Methods