Automotive

Interactive: Comparing Carmaker Revenue vs. Country GDP

Comparing Carmaker Revenue vs. Country GDP

As of July 2022, the global car and manufacturing market was worth about $2.9 trillion.

What companies are currently dominating this massive industry, and how much revenue do they generate on a yearly basis compared to the economic output of countries?

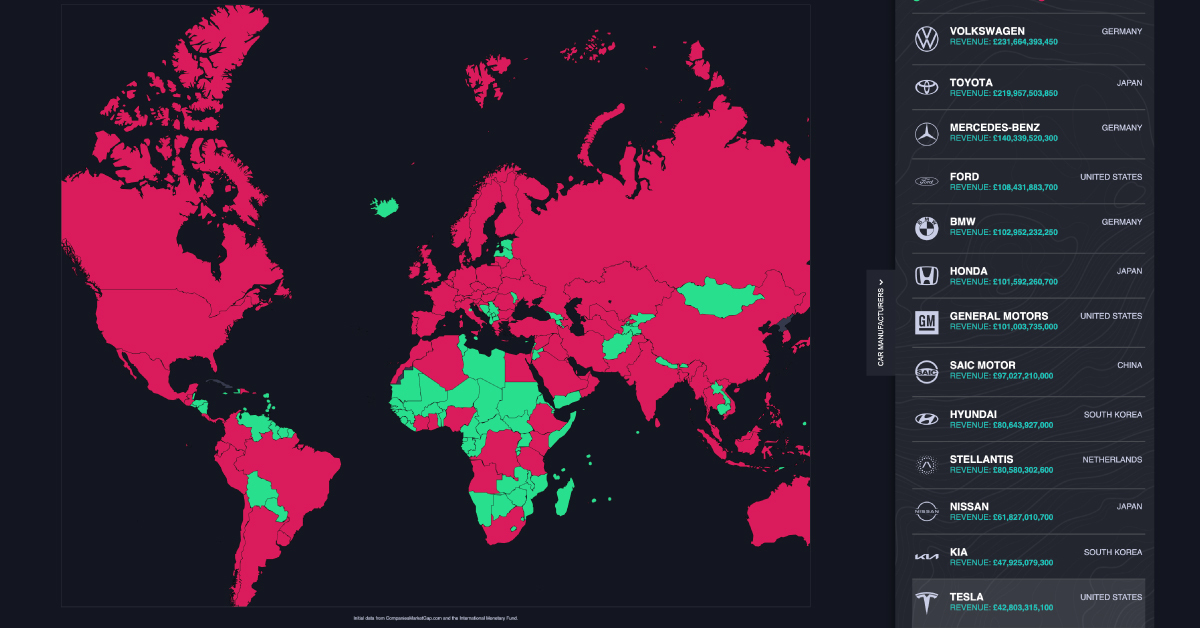

To help put things into perspective, this graphic by Vanarama looks at the revenue of the world’s top carmakers, and compares each company’s revenue to the gross domestic product (GDP) of 196 countries worldwide.

The World’s Largest Carmakers by Revenue

Based on data from CompaniesMarketCap.com, here’s a look at some of the biggest carmakers in the world, and how much revenue they brought in from Q1 2021 to Q1 2022:

| Rank | Carmaker | Revenue (Q1 2021 to Q1 2022) | Country of origin |

|---|---|---|---|

| 1 | Volkswagen | $291 billion | 🇩🇪 Germany |

| 2 | Toyota | $276 billion | 🇯🇵 Japan |

| 3 | Mercedes-Benz | $176 billion | 🇩🇪 Germany |

| 4 | Ford | $136 billion | 🇺🇸 United States |

| 5 | BMW | $129 billion | 🇩🇪 Germany |

| 6 | Honda | $127 billion | 🇯🇵 Japan |

| 7 | General Motors | $127 billion | 🇺🇸 United States |

| 8 | SAIC Motor | $122 billion | 🇨🇳 China |

| 9 | Hyundai | $101 billion | 🇰🇷 South Korea |

| 10 | Stellantis | $101 billion | 🇳🇱 Netherlands |

| 11 | Nissan | $77 billion | 🇯🇵 Japan |

| 12 | Kia | $60 billion | 🇰🇷 South Korea |

| 13 | Tesla | $53 billion | 🇺🇸 United States |

| 14 | Renault | $52 billion | 🇫🇷 France |

| 15 | BYD | $33 billion | 🇨🇳 China |

| 16 | Suzuki Motor | $31 billion | 🇯🇵 Japan |

| 17 | Volvo Car | $31 billion | 🇸🇪Sweden |

| 18 | Mazda | $27 billion | 🇯🇵 Japan |

| 19 | Subaru | $24 billion | 🇯🇵 Japan |

| 20 | Isuzu | $21 billion | 🇯🇵 Japan |

In first place was German car manufacturer Volkswagen, which generated about $291 billion in revenue between Q1 2022 and Q1 2022—that’s more spending power than 76% of the countries included in the dataset.

In 2021, Volkswagen’s best-selling vehicles were the Tiguan, a mid-size SUV, and the Polo, a compact hatchback. In addition to the Volkswagen brand, the company itself owns a handful of luxury car brands including Audi, Bentley, and Porsche.

Toyota came in second place, with a total of $276 billion in revenue from Q1 2021 to Q1 2022. While the Japanese manufacturer is popular in its country of origin, America is actually its largest market—in 2021, more than 2.3 million Toyota vehicles were sold in the United States, nearly double the amount sold in Japan.

How Important are These Brands to Their Countries’ GDPs?

As this graphic illustrates, these car manufacturers generate billions in revenue each year. Their financial power is so significant, they’ve become big parts of their home countries’ national economies.

But just how important are these brands to their countries of origin? Here’s a look at 20 different carmakers, as a percentage of their country of origin’s GDP:

One carmaker is nearly in the double digits—the revenue from Dutch automobile manufacturer Stellantis is equivalent to approximately 9.95% of the Netherland’s GDP.

Founded in 2021, Stellantis is comprised of 16 different international car brands, including well-known Europeans brands like Vauxhall and Citroen, as well as some American manufacturers like Dodge and Chrysler.

Other countries also have a large combined output from automakers, including Japan (11.91%) and Germany (13.97%).

But it’s important to note that each company’s revenue is not wholly contained in their home country’s GDP. Many major automakers have international subsidiaries for localized production, with revenue falling under those countries’ GDPs.

This article was published as a part of Visual Capitalist's Creator Program, which features data-driven visuals from some of our favorite Creators around the world.

Lithium

Ranked: The Top 10 EV Battery Manufacturers in 2023

Asia dominates this ranking of the world’s largest EV battery manufacturers in 2023.

The Top 10 EV Battery Manufacturers in 2023

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Despite efforts from the U.S. and EU to secure local domestic supply, all major EV battery manufacturers remain based in Asia.

In this graphic we rank the top 10 EV battery manufacturers by total battery deployment (measured in megawatt-hours) in 2023. The data is from EV Volumes.

Chinese Dominance

Contemporary Amperex Technology Co. Limited (CATL) has swiftly risen in less than a decade to claim the title of the largest global battery group.

The Chinese company now has a 34% share of the market and supplies batteries to a range of made-in-China vehicles, including the Tesla Model Y, SAIC’s MG4/Mulan, and various Li Auto models.

| Company | Country | 2023 Production (megawatt-hour) | Share of Total Production |

|---|---|---|---|

| CATL | 🇨🇳 China | 242,700 | 34% |

| BYD | 🇨🇳 China | 115,917 | 16% |

| LG Energy Solution | 🇰🇷 Korea | 108,487 | 15% |

| Panasonic | 🇯🇵 Japan | 56,560 | 8% |

| SK On | 🇰🇷 Korea | 40,711 | 6% |

| Samsung SDI | 🇰🇷 Korea | 35,703 | 5% |

| CALB | 🇨🇳 China | 23,493 | 3% |

| Farasis Energy | 🇨🇳 China | 16,527 | 2% |

| Envision AESC | 🇨🇳 China | 8,342 | 1% |

| Sunwoda | 🇨🇳 China | 6,979 | 1% |

| Other | - | 56,040 | 8% |

In 2023, BYD surpassed LG Energy Solution to claim second place. This was driven by demand from its own models and growth in third-party deals, including providing batteries for the made-in-Germany Tesla Model Y, Toyota bZ3, Changan UNI-V, Venucia V-Online, as well as several Haval and FAW models.

The top three battery makers (CATL, BYD, LG) collectively account for two-thirds (66%) of total battery deployment.

Once a leader in the EV battery business, Panasonic now holds the fourth position with an 8% market share, down from 9% last year. With its main client, Tesla, now sourcing batteries from multiple suppliers, the Japanese battery maker seems to be losing its competitive edge in the industry.

Overall, the global EV battery market size is projected to grow from $49 billion in 2022 to $98 billion by 2029, according to Fortune Business Insights.

-

Lithium6 days ago

Lithium6 days agoRanked: The Top 10 EV Battery Manufacturers in 2023

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023

-

Green2 weeks ago

Green2 weeks agoRanking the Top 15 Countries by Carbon Tax Revenue

-

Markets2 weeks ago

Markets2 weeks agoU.S. Debt Interest Payments Reach $1 Trillion

-

Mining2 weeks ago

Mining2 weeks agoGold vs. S&P 500: Which Has Grown More Over Five Years?