Technology

Chart: The Coin Universe Keeps Expanding

Chart: The Coin Universe Keeps Expanding

Bitcoin’s record year is just a part of the big story

Note: This post was updated June 27th, 2017 with current values for all cryptocurrencies.

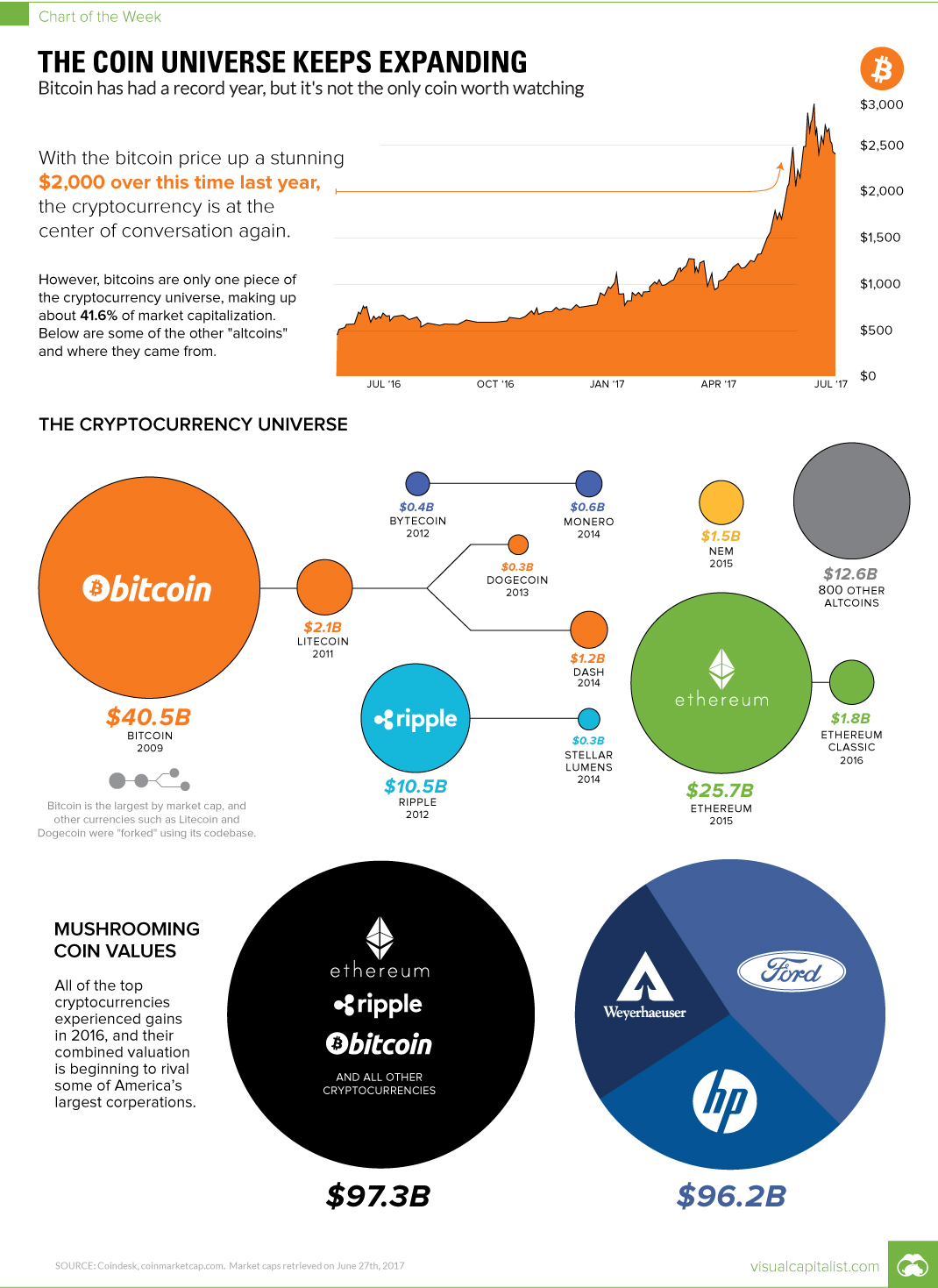

Bitcoin is the original cryptocurrency, and its meteoric rise has made it a mainstay of conversation for investors, media, and technologists alike.

In fact, the innovation of the blockchain is changing entire markets, while causing ripples with central banks and the financial industry. At time of publication, the bitcoin price now hovers near US$2,400, a massive increase from this time last year.

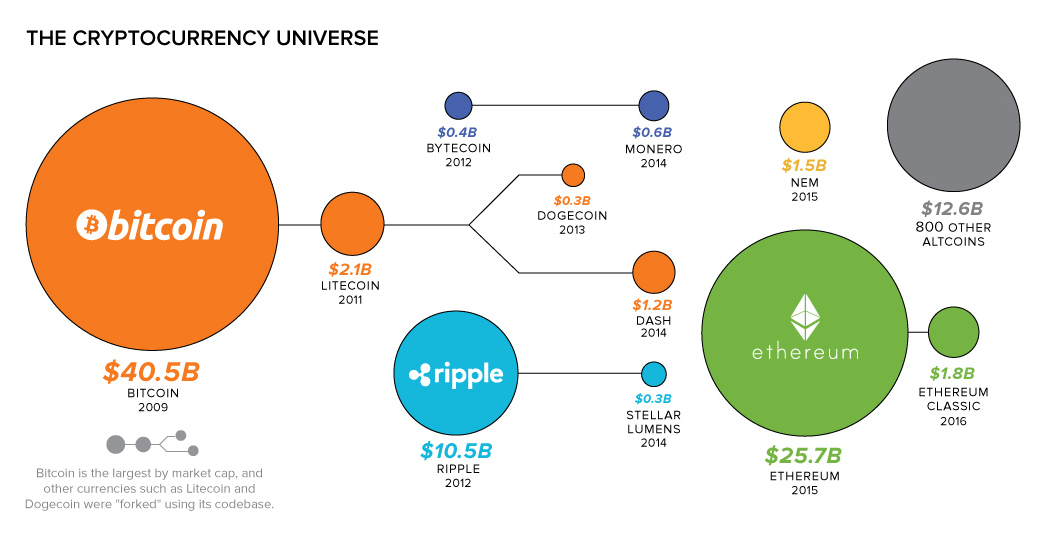

But the true impact of Bitcoin is actually far more reaching than this – it’s actually helped to birth new markets for over 800 other cryptocurrencies and assets that are available for online trading. And while the market for bitcoins is worth $40 billion itself, the rest of these cryptocurrencies are actually worth even more in combination.

The Altcoin Universe

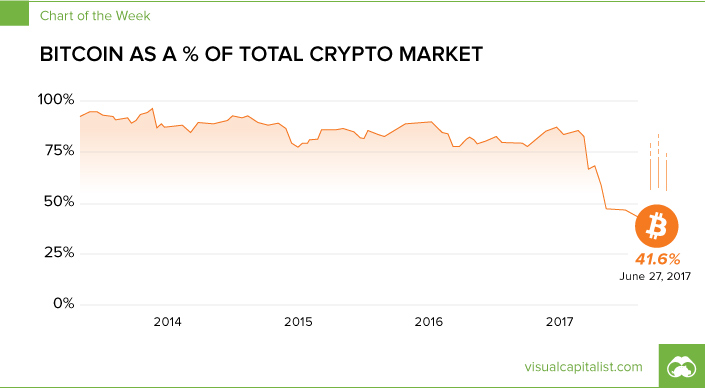

For the first time since Bitcoin was founded, it now makes up the minority of the entire cryptocurrency market at about 41.6% of all coins and assets.

So what are the other altcoins that make up the rest of this universe, and where did they come from?

Litecoin

Litecoin is one of the first altcoins, and it is nearly identical to Bitcoin after being “forked” in 2011. Litecoin aims to process blocks 4x faster than Bitcoin to speed up transaction confirmation time, though this creates several other challenges as well. At time of writing, Litecoin’s market capitalization is worth $2.1 billion.

Ethereum

Ethereum, launched in 2015, is the largest coin by market capitalization aside from Bitcoin. However, it is also quite different. While Bitcoin is designed to be a payments protocol first, Ethereum enables developers to build and deploy decentralized applications, while also enabling smart contracts. The tokens used to power the network are called Ether, but they can also be traded online. At time of writing, Ethereum’s market capitalization is $25.7 billion.

Also interesting: the Ethereum network actually split into two in 2016. It’s a complicated situation, but read about it here. There is now a separate Ethereum, based on the original Ethereum blockchain, trading as “Ethereum Classic” with its own market capitalization of $1.8 billion.

Ripple

Ripple (XRP) is the native currency of the Ripple Protocol – a broader catch-all for an open-source, global exchange. It’s already being used by banks such as Santander, Bank of America Merrill Lynch, UBS, and RBC. It solves a different problem than Bitcoin, allowing for settling payments between different currencies and even different payment systems. Today, Ripple’s native coin (XRP) has a market cap of $10.5 billion.

Learn More

With over 800+ altcoins or assets out there, there’s plenty of information to absorb.

Here’s a short 20-minute course on the history of altcoins that might provide useful context, as well as in-depth explanations of Ethereum and Ripple that may help you learn about the important parts of a rapidly growing altcoin universe.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees