AI

AI vs. Humans: Which Performs Certain Skills Better?

AI vs. Humans: Which Performs Certain Skills Better?

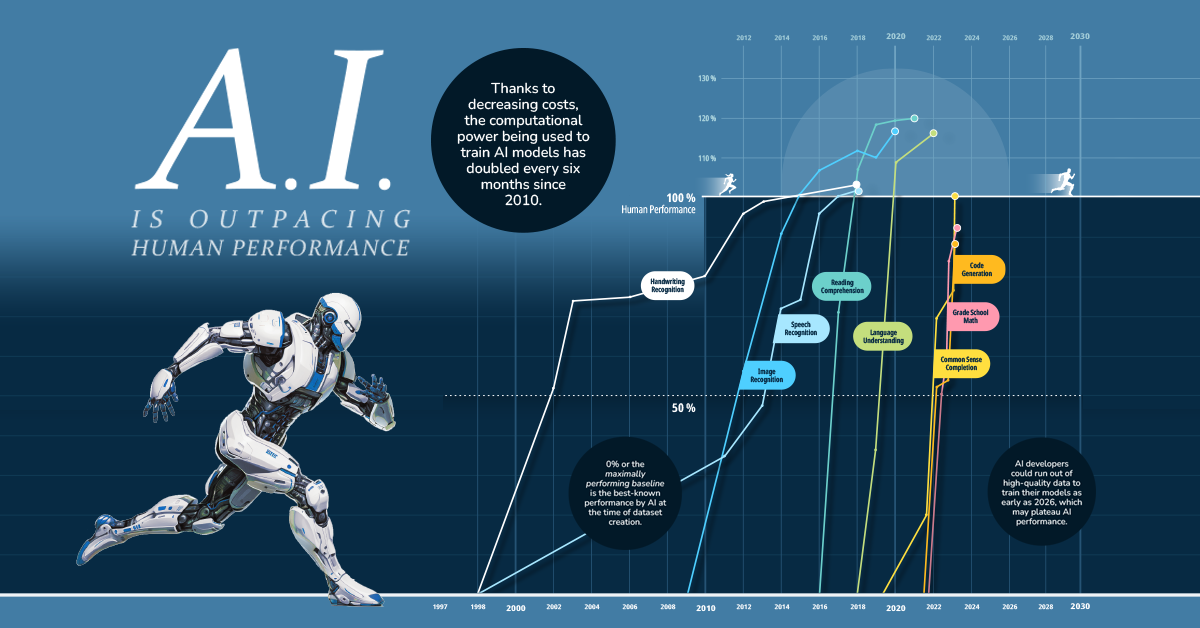

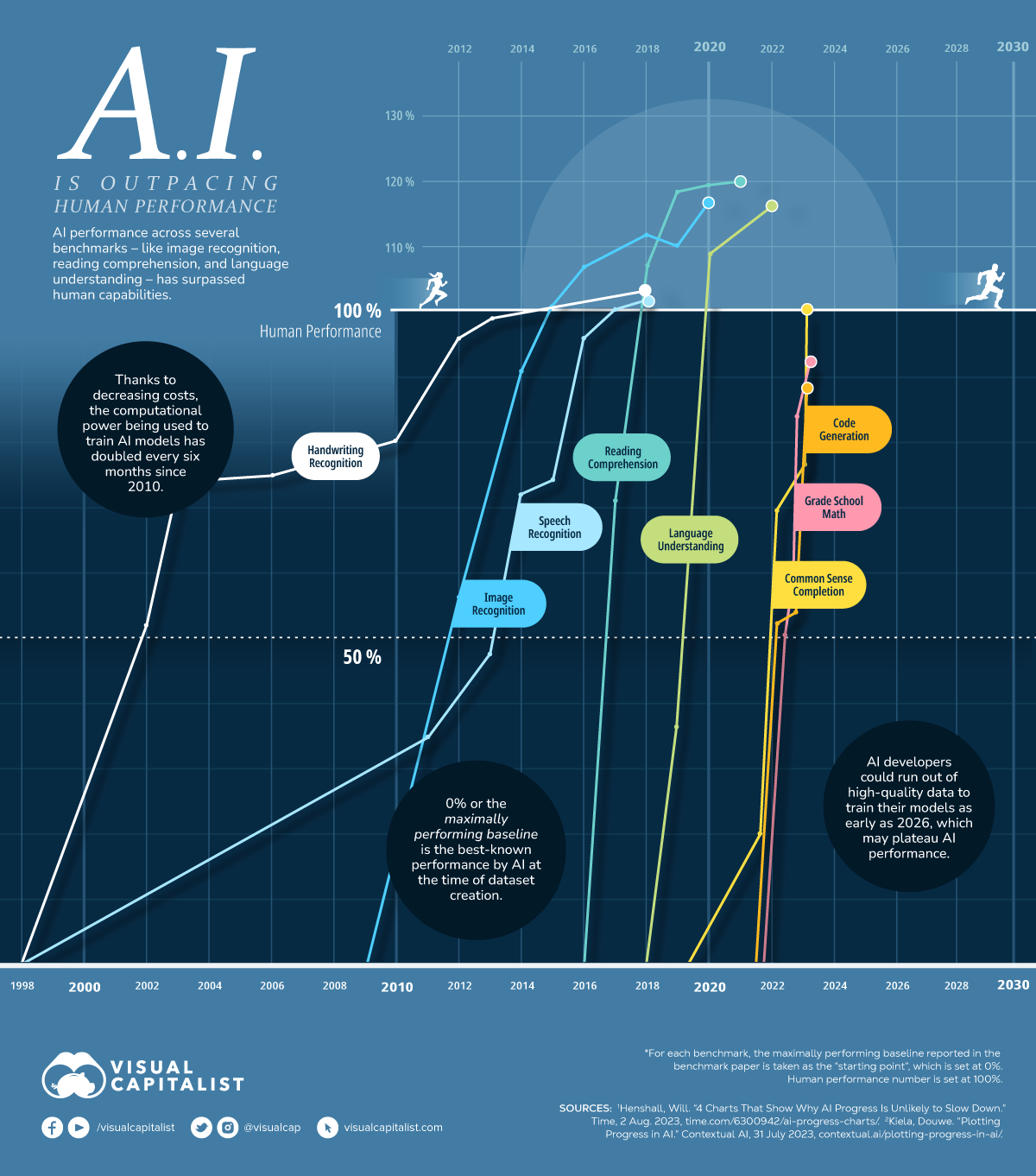

With ChatGPT’s explosive rise, AI has been making its presence felt for the masses, especially in traditional bastions of human capabilities—reading comprehension, speech recognition and image identification.

In fact, in the chart above it’s clear that AI has surpassed human performance in quite a few areas, and looks set to overtake humans elsewhere.

How Performance Gets Tested

Using data from Contextual AI, we visualize how quickly AI models have started to beat database benchmarks, as well as whether or not they’ve yet reached human levels of skill.

Each database is devised around a certain skill, like handwriting recognition, language understanding, or reading comprehension, while each percentage score contrasts with the following benchmarks:

- 0% or “maximally performing baseline”

This is equal to the best-known performance by AI at the time of dataset creation. - 100%

This mark is equal to human performance on the dataset.

By creating a scale between these two points, the progress of AI models on each dataset could be tracked. Each point on a line signifies a best result and as the line trends upwards, AI models get closer and closer to matching human performance.

Below is a table of when AI started matching human performance across all eight skills:

| Skill | Matched Human Performance | Database Used |

|---|---|---|

| Handwriting Recognition | 2018 | MNIST |

| Speech Recognition | 2017 | Switchboard |

| Image Recognition | 2015 | ImageNet |

| Reading Comprehension | 2018 | SQuAD 1.1, 2.0 |

| Language Understanding | 2020 | GLUE |

| Common Sense Completion | 2023 | HellaSwag |

| Grade School Math | N/A | GSK8k |

| Code Generation | N/A | HumanEval |

A key observation from the chart is how much progress has been made since 2010. In fact many of these databases—like SQuAD, GLUE, and HellaSwag—didn’t exist before 2015.

In response to benchmarks being rendered obsolete, some of the newer databases are constantly being updated with new and relevant data points. This is why AI models technically haven’t matched human performance in some areas (grade school math and code generation) yet—though they are well on their way.

What’s Led to AI Outperforming Humans?

But what has led to such speedy growth in AI’s abilities in the last few years?

Thanks to revolutions in computing power, data availability, and better algorithms, AI models are faster, have bigger datasets to learn from, and are optimized for efficiency compared to even a decade ago.

This is why headlines routinely talk about AI language models matching or beating human performance on standardized tests. In fact, a key problem for AI developers is that their models keep beating benchmark databases devised to test them, but still somehow fail real world tests.

Since further computing and algorithmic gains are expected in the next few years, this rapid progress is likely to continue. However, the next potential bottleneck to AI’s progress might not be AI itself, but a lack of data for models to train on.

Technology

Visualizing AI Patents by Country

See which countries have been granted the most AI patents each year, from 2012 to 2022.

Visualizing AI Patents by Country

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This infographic shows the number of AI-related patents granted each year from 2010 to 2022 (latest data available). These figures come from the Center for Security and Emerging Technology (CSET), accessed via Stanford University’s 2024 AI Index Report.

From this data, we can see that China first overtook the U.S. in 2013. Since then, the country has seen enormous growth in the number of AI patents granted each year.

| Year | China | EU and UK | U.S. | RoW | Global Total |

|---|---|---|---|---|---|

| 2010 | 307 | 137 | 984 | 571 | 1,999 |

| 2011 | 516 | 129 | 980 | 581 | 2,206 |

| 2012 | 926 | 112 | 950 | 660 | 2,648 |

| 2013 | 1,035 | 91 | 970 | 627 | 2,723 |

| 2014 | 1,278 | 97 | 1,078 | 667 | 3,120 |

| 2015 | 1,721 | 110 | 1,135 | 539 | 3,505 |

| 2016 | 1,621 | 128 | 1,298 | 714 | 3,761 |

| 2017 | 2,428 | 144 | 1,489 | 1,075 | 5,136 |

| 2018 | 4,741 | 155 | 1,674 | 1,574 | 8,144 |

| 2019 | 9,530 | 322 | 3,211 | 2,720 | 15,783 |

| 2020 | 13,071 | 406 | 5,441 | 4,455 | 23,373 |

| 2021 | 21,907 | 623 | 8,219 | 7,519 | 38,268 |

| 2022 | 35,315 | 1,173 | 12,077 | 13,699 | 62,264 |

In 2022, China was granted more patents than every other country combined.

While this suggests that the country is very active in researching the field of artificial intelligence, it doesn’t necessarily mean that China is the farthest in terms of capability.

Key Facts About AI Patents

According to CSET, AI patents relate to mathematical relationships and algorithms, which are considered abstract ideas under patent law. They can also have different meaning, depending on where they are filed.

In the U.S., AI patenting is concentrated amongst large companies including IBM, Microsoft, and Google. On the other hand, AI patenting in China is more distributed across government organizations, universities, and tech firms (e.g. Tencent).

In terms of focus area, China’s patents are typically related to computer vision, a field of AI that enables computers and systems to interpret visual data and inputs. Meanwhile America’s efforts are more evenly distributed across research fields.

Learn More About AI From Visual Capitalist

If you want to see more data visualizations on artificial intelligence, check out this graphic that shows which job departments will be impacted by AI the most.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)