Technology

Visualizing Google’s Search Engine Market Share

Visualizing Google’s Search Engine Dominance

Google is ubiquitous in the daily lives of billions of people around the world, with leading positions in online search, maps, and other services.

In fact, Google’s dominance is so far-reaching, it has led the U.S. Justice Department to launch a civil antitrust lawsuit for what it believes are examples of anticompetitive and exclusionary conduct.

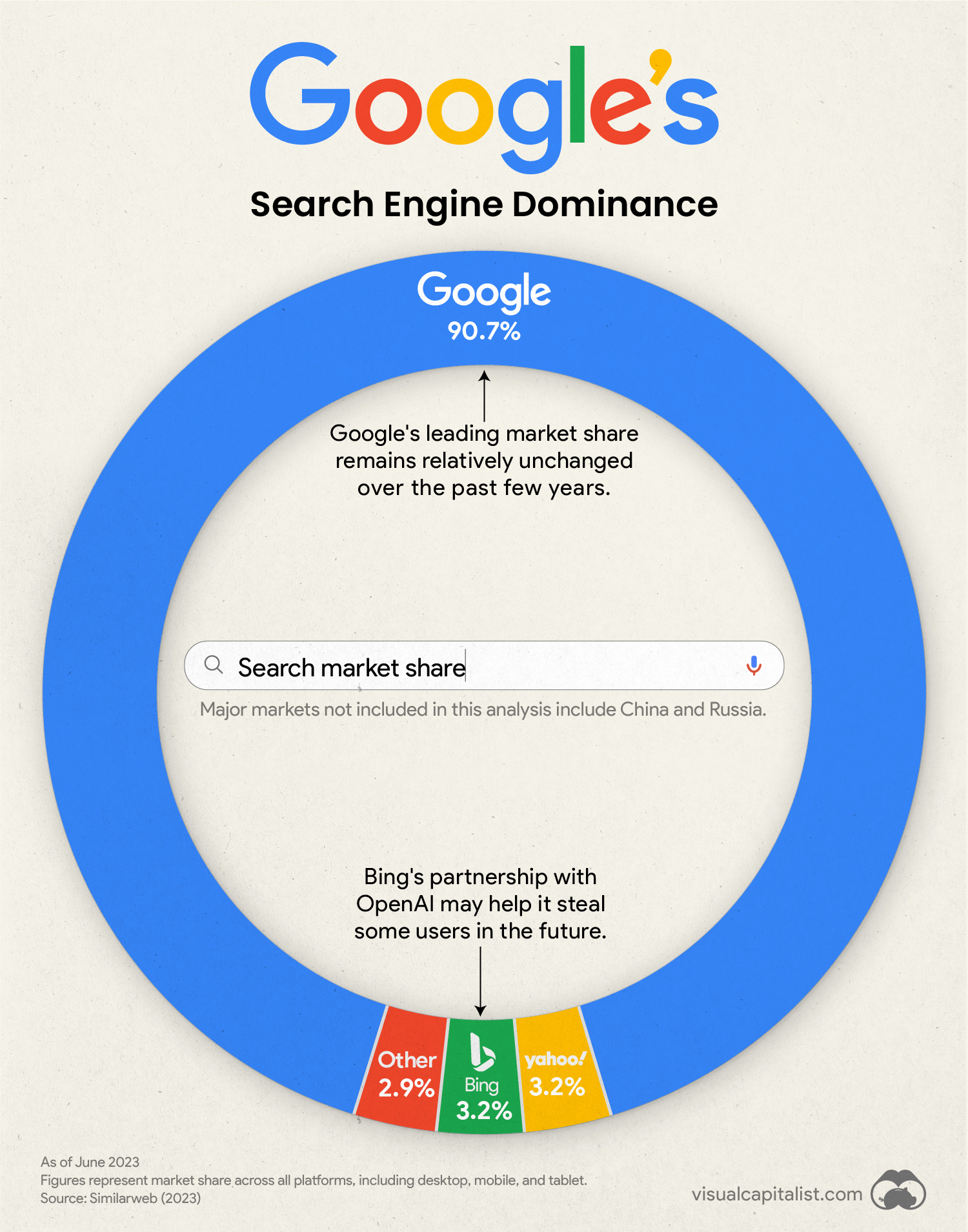

This graphic, which uses data from Similarweb, shows the scale of Google’s lead over major search engine competitors like Bing and Yahoo.

Global Search Engine Market Share

The data we used to create this graphic is provided in the table below. It is global search engine market share as of June 2023, across all platforms (desktop, mobile, and tablet).

Note that this analysis does not include China, where Google and other American tech firms are currently banned, or Russia, where Google has ceased operations.

| Search Engine | Global Market Share (%) |

|---|---|

| 90.7% | |

| Bing | 3.2% |

| Yahoo | 3.2% |

| Other | 2.9% |

The largest player included in “Other” is South Korea’s Naver (0.48% global market share), which is similar to Google in that it offers a plethora of online services like search, video, and mobile payments.

Google Prepares for its U.S. Lawsuit

In January 2023, the U.S. Justice Department announced a civil antitrust lawsuit against Google for monopolizing digital advertising technologies.

Today’s complaint alleges that Google has used anticompetitive, exclusionary, and unlawful conduct to eliminate or severely diminish any threat to its dominance over digital advertising technologies

Merrick B. Garland, Attorney General

The Justice Department originally made several antitrust arguments. Potential actions that were deemed red flags include setting Google as a default mobile browser on Android phones, designing search results to disadvantage competitors, and the company’s ongoing partnership with Apple for its Safari browser. That said, some of the less substantial claims have since been dismissed by Judge Amit Mehta.

Google’s court case will begin in mid-September, marking the biggest tech monopoly trial since United States v. Microsoft Corp in 2001. Google is expected to argue that it simply offers a superior product.

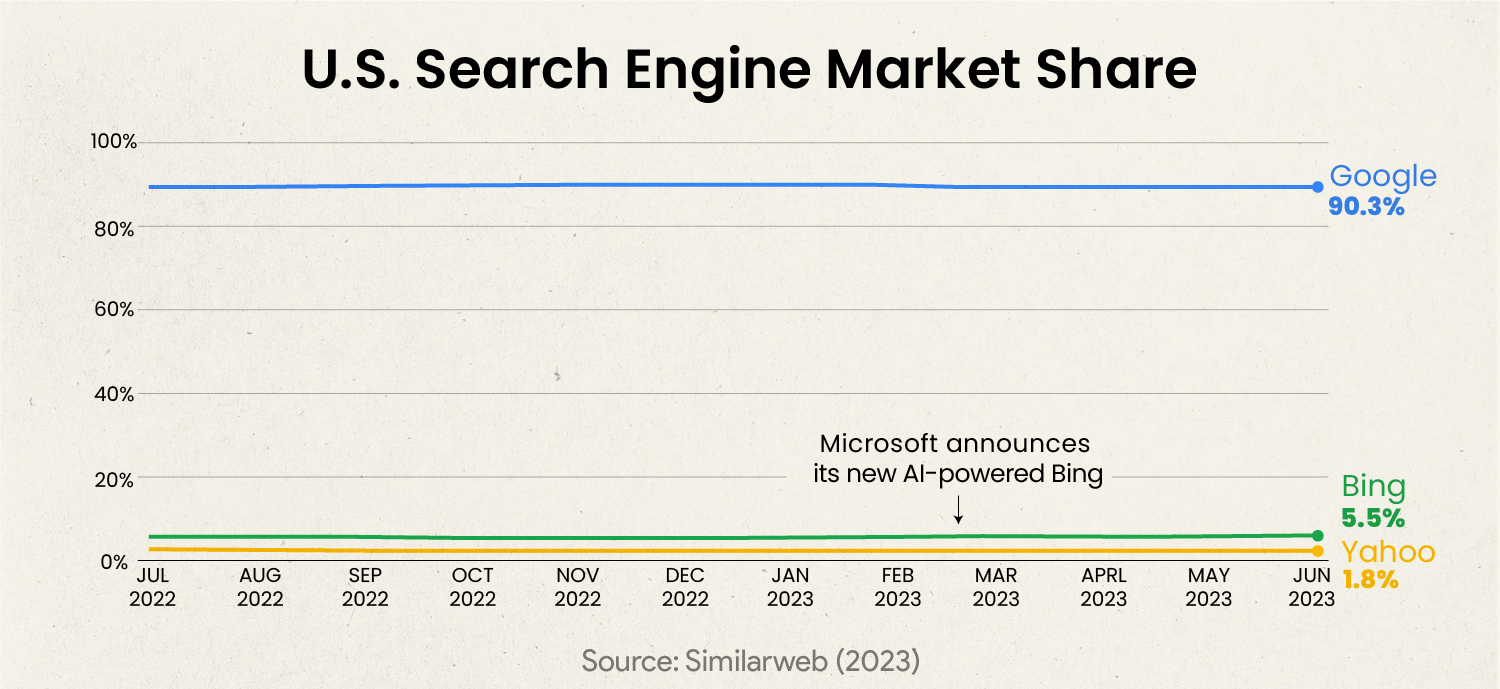

Can Bing Challenge Google on Home Turf?

To answer this question, let’s look at U.S. market share over the past 12 months ending June 2023.

From this chart we can see that Bing maintains a slightly higher 5.5% U.S. market share (versus 3.2% globally).

The biggest takeaway from this chart, though, is that Bing does not appear to have gained any traction in 2023, even after releasing its latest AI-powered version in February.

The new Bing is the result of Microsoft’s $10 billion investment into OpenAI at the beginning of 2023, which allows the tech giant to incorporate the immensely popular GPT-4 into its various products and services.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Science1 week ago

Science1 week agoVisualizing the Average Lifespans of Mammals

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023

-

Green2 weeks ago

Green2 weeks agoRanking the Top 15 Countries by Carbon Tax Revenue