Technology

5 Ways to Build a $100 Million Company

To build a successful and enduring company, you need more than just hype, publicity, or impressive fundraising skills.

Ultimately it all boils down to one simple principle: you must have a product that solves a pressing problem, and then the right amount of paying customers to make the math work.

Going Hunting

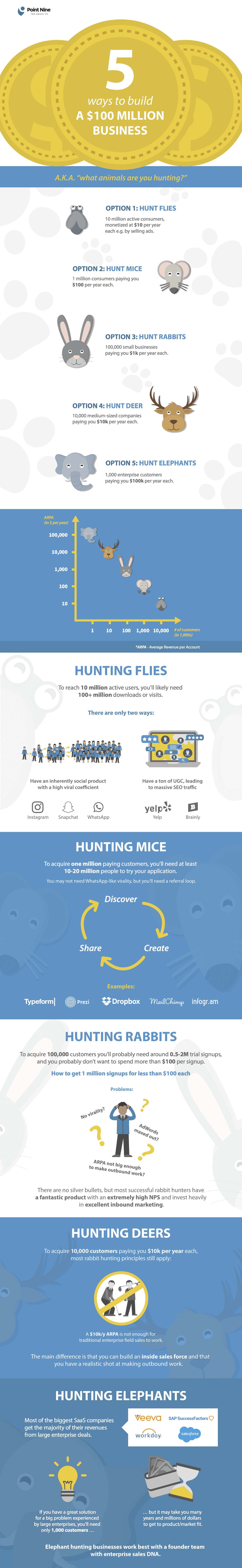

Today’s infographic comes to us from Point Nine Capital, and it highlights five basic revenue models that startups can use to achieve $100 million in annual revenue.

The take home message here is that to build a long-term business, a team must implement a realistic strategy that considers multiple factors including product-market fit, user acquisition, pricing, and revenue per user.

Are you hunting flies, or are you trying to hunt elephants?

Just like in real life, these things require very different strategies and tactics. To build a $100 million revenue per year company, you’ll need to have a clear vision of your product-market fit and the customers you’re going after.

Different Tools

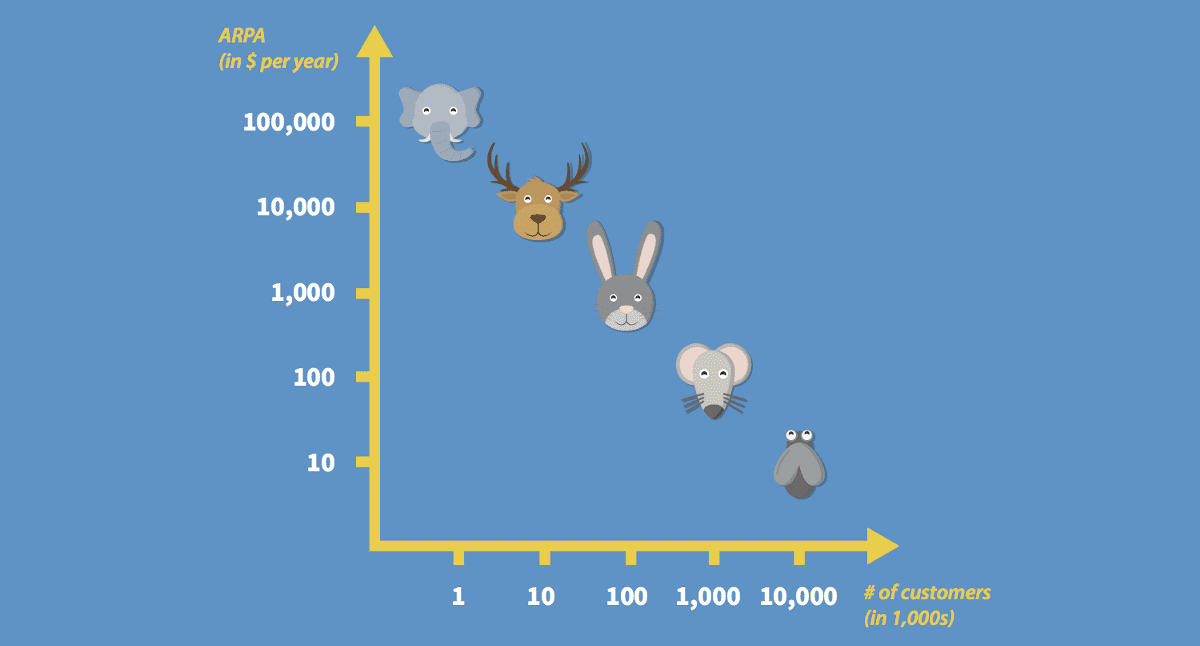

While the hunting analogy may be an oversimplification, it does help illustrate an undeniable truth to building large companies: how many users you will need depends on how much revenue you can earn per user.

This has implications.

If you are going to get $10 in annual ad revenue for each user, then you need a lot of users. If you’re going after Fortune 500 companies, you’ll need far fewer customers, but also a sophisticated and detailed sales strategy.

Flies – $10 per user x 10 million customers = $100 million in annual revenue

It takes a lot of flies to add up.

To build a big business with flies, you’ll need a product with a high viral coefficient (Instagram, WhatsApp, etc.) that spreads your brand quickly and inexpensively. Alternatively, you can build a platform that allows for the creation of massive amounts of user generated content (UGC) such as Yelp or Reddit.

Mice – $100 per user x 1 million customers = $100 million in annual revenue

Mice are still pretty small, but the expectations are higher than for flies. To get $100 per user, these customers will have to be directly paying for something, like a $10 monthly subscription. Music-streaming company Spotify is a good example of a startup hunting for mice.

Rabbits – $1k per user x 100k customers = $100 million in annual revenue

Once you hit rabbit territory, we are basically out of reach of B2C customers. That means to get 100k customers, they will likely have to be small businesses.

To do this, you’ll need a fantastic product, excellent inbound marketing, and an extremely high NPS (Net Promoter Score). The latter metric is used to measure the likelihood a customer would recommend you to their peers.

Deer – $10k per user x 10k customers = $100 million in annual revenue

We’re now getting up there in size – which makes it likely that deer have to be medium-sized businesses. These customers can afford to spend $10,000 per year, but expect a significant return on their investment.

While revenue per user is much higher than preceding levels, it is still not likely enough to warrant traditional enterprise field sales.

Elephants – $100k per user x 1k customers = $100 million in annual revenue

Going after elephants is a totally different world, and requires a skilled sales force, patience, and an enterprise-focused approach. You’ll need to educate Fortune 500 companies on why they should spend $100,000 with you each year – and you’ll need to be able to back that all up with a killer product.

Software as a Service (SaaS) companies like Workday or Salesforce often use this kind of strategy, and it allows them to key in on the features that their most important clients want to see. As we noted in a previous infographic, investors love the predictable revenue stemming from a well-positioned SaaS company.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Energy1 week ago

Energy1 week agoThe World’s Biggest Nuclear Energy Producers

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024