Entrepreneurship

11 Leadership Styles That Will Hurt Your Business

The starting place for developing an authentic leadership style is to make an extension of your best personality traits.

For example, if someone is a hard worker that likes to get in the trenches, this can be a key differentiator in how they run a particular organization. Likewise, abilities such as thinking big or being able to articulate a clear vision can also translate well in growing a successful team. Developing a leadership style this way is authentic and genuine, and it provides a helpful starting place for leading others.

However, good leaders know that they are not perfect, and that their own idiosyncrasies and insecurities also tend to shine through without them even recognizing it. In fact, often these shortcomings can even be amplified in unexpected ways within an organization, resulting in massive challenges and inefficiencies.

11 Ineffective Leadership Styles

A good leader knows that they must work hard to fix their own shortcomings, otherwise their team will never reach their full potential.

Today’s infographic comes to us from Colonial Life, and it shows 11 ineffective leadership styles that can have negative impacts on an organization’s productivity or culture.

Shortcomings aren’t always obvious, and it can take some serious self-reflection to see the weaknesses in one’s leadership style.

Styles to Recognize and Avoid

Here’s a summation of the 11 types of leadership styles to avoid:

1. Micro Managing

Helping employees is one thing, but it’s also important to know when to take a step back. Over-management leads to an unempowered team.

2. Anything Goes

The opposite of micro management is also problematic as well. By letting everything fly, there is no order and it can lead to missing deadlines or low expectations.

3. Autocratic

In many situations, having just one person making the decisions can lead to employees carrying out projects that they disagree with or do not think will work.

4. The Charge-Ahead General

Charging ahead on every new project usually comes with a key weakness: a lack of patience. If managers continually get impatient with employees, it affect trust and respect within the organization.

5. Complete Self-Reliance

If a manager can’t trust others, then the work will pile up for that manager until it becomes unbearable. Meanwhile, employees have a tough time becoming independent in their roles.

6. Dictatorial

If decisions cannot be questioned, it leads to employees feeling like they are incapable or that they have no input.

7. Excessive Consistency

A manager with this leadership style has inflexible boundaries, and tends to be over-strict with employees. This can create resentment and lower motivation.

8. Mushroom Management

Severe lack of communications between management and employees leads to misunderstandings, confusion, and limited responsibility.

9. The Morale Buster

Criticism is important, but too much of it can hurt employee morale.

10. The Screamer

Too much expression of authority, or expressing it in unprofessional ways, can lead to a lack of respect between employees and management. There are other ways to articulate authority and constructive criticisms.

11. Seagull Management

Managers only interact with employees when there is a problem – this means employees never get praise or encouragement when it is needed.

Markets

Why Do People Start Businesses in Every U.S. State?

Is it for greater flexibility, more income, or something else? These graphics answer the question, why do people start businesses?

Why Do People Start Businesses in Every U.S. State?

People have various motivations for starting their businesses.

Some seek higher income. Others are looking for a balance between family life and career. In some situations, entrepreneurship may be the only way to fight unemployment.

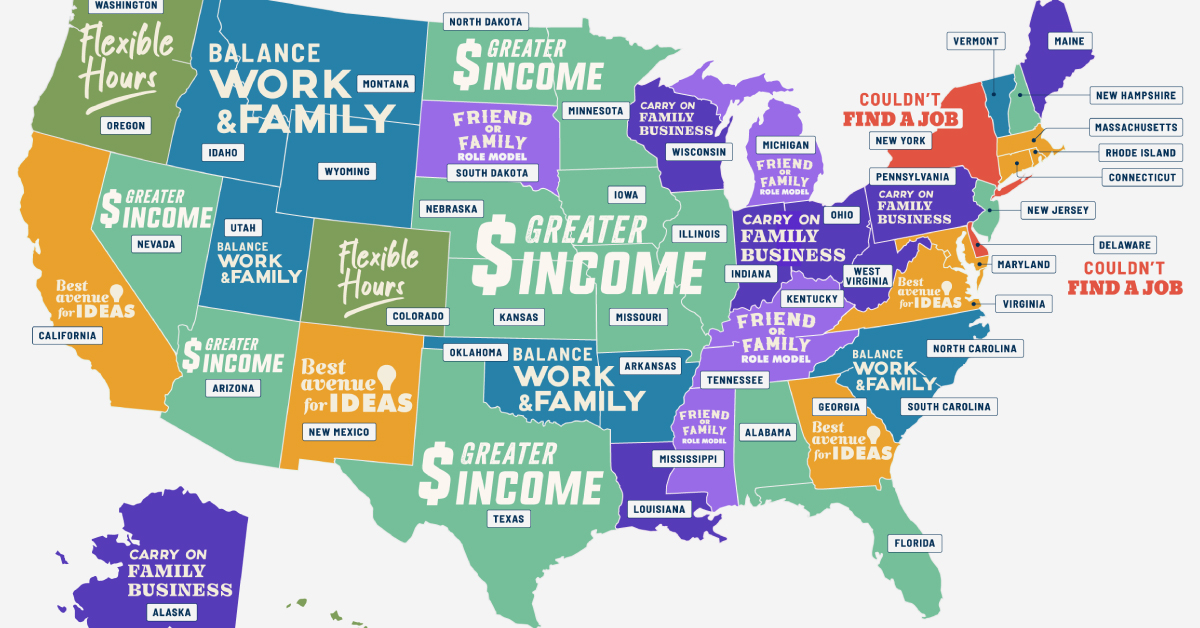

In this infographic, OnDeck uses data from the U.S. Census Bureau’s 2020 Annual Business Survey to highlight the most unique reasons for why people start businesses in each U.S. state.

Editor’s note: The map tracks the most popular unique reasons to start a business. In this case, “unique” is defined by how much a particular reason stands out from the U.S. average across all states. For example, in Delaware, more respondents said they started businesses because they “couldn’t find jobs” (11.6%) than in any other state (U.S. average: 7.3%). So, even though it’s not numerically the most popular reason overall, it is the unique reason that stands out the most for that state.

The Most Popular Unique Reasons to Start a Business

According to the Global Entrepreneurship Monitor, entrepreneurship rates in the U.S. have been trending upward over the past two decades.

In fact, despite multi-billion dollar companies getting the spotlight, 99.9% of businesses across the U.S. are small businesses, employing over 60 million people.

Wanting to make more income is the biggest unique factor in starting a business in 14 states, including some of the states with the highest unemployment rates, like New Hampshire, North Dakota, and Alabama.

In Utah, a higher percentage (65.4%) of entrepreneurs start businesses to achieve a work-life balance than in any other state. Notably, Utah is known for having the largest average family size, as reported by the U.S. Census Bureau, and has a strong religious presence.

On the other hand, in Florida, more business founders (69.2%) start their businesses to become their own bosses than anywhere else.

New York and California are states where entrepreneurs mentioned that they couldn’t find a job as a key unique reason to start a business. In fact, both states lead as the worst for job seekers, as shown in another Visual Capitalist graphic.

Small Businesses to Remain Vital

Despite all the different reasons to start a business, the fact is that entrepreneurship is still crucial for the U.S. economy.

Over the last 25 years, small businesses have added over 12.9 million jobs. For perspective, that’s about two-thirds of the jobs added to the economy.

In 2021, a record-breaking 5.4 million new business applications were filed in the U.S.

-

Energy1 week ago

Energy1 week agoThe World’s Biggest Nuclear Energy Producers

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

Creator Program

Creator Program