Energy

The Lithium Revolution

The Lithium Revolution

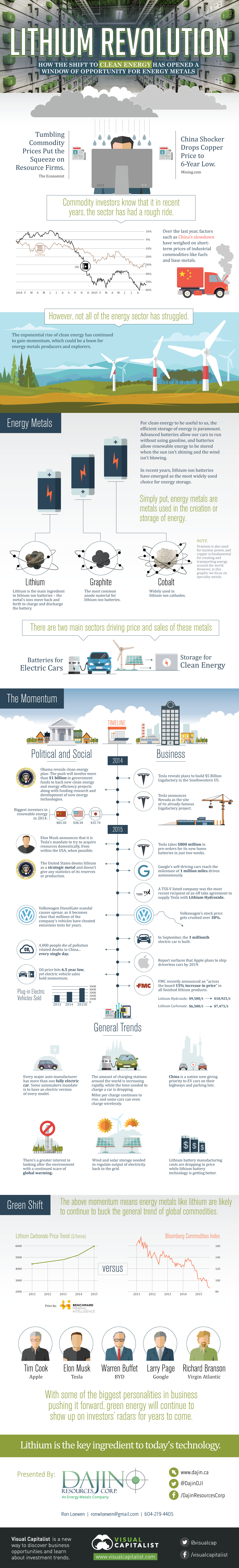

How the shift to clean energy has opened a window of opportunity for energy metals.

“The Lithium Revolution” infographic presented by: Dajin Resources

Commodity investors know that it in recent years, the sector has had a rough ride. Recently, factors such as China’s slowdown have weighed on short-term prices of industrial commodities like fuels and base metals.

However, not all of the energy sector has struggled. The rise of clean energy has continued to gain momentum, which could be a boon for energy metals producers and explorers.

Energy Metals

Simply put, energy metals are metals used in the creation or storage of energy. Here are some examples of energy metals needed to make lithium-ion batteries, which are the storage mechanism of choice for many green energy producers:

Lithium: Lithium is the main ingredient to lithium-ion batteries – the metal’s ions move back and forth to charge and discharge the battery.

Cobalt: Widely used in lithium-ion cathodes

Graphite: The most common anode material for lithium-ion batteries.

Note: Uranium is also used for nuclear power, and copper is fundamental for creating and transporting energy around the world. However, in this infographic we focus on specialty metals.

Electric cars and energy storage for renewable sources have been driving the increases in price and demand for these sectors. Let’s take a look at the specific momentum that has been growing since 2014.

The Momentum

Political and social:

2014

- Obama reveals clean energy plan: The push will involve more than $1 billion in government funds to back new clean energy and energy efficiency projects along with funding research and development of new energy technologies.

- Who were the biggest investors in renewable energy in 2014?

China ($83.3 billion), USA ($38.3 billion), and Japan ($35.7 billion)

2015

- Volkswagen DieselGate scandal causes uproar, as it becomes clear that millions of the company’s vehicles have cheated emissions tests for years

- Elon Musk announces a mandate for Tesla Motors to acquire raw materials from the USA when possible.

- 4,000 people die, each day, of pollution related deaths in China alone.

- The United States deems lithium as a strategic metal and doesn’t give any statistics of its reserves or production.

Business:

2014

- Tesla reveals plans to build $5 Billion Gigafactory in the Southwestern US.

- Tesla announces Nevada as the site of its already-famous Gigafactory project.

2015

- The 1 millionth electric car is built in September 2015.

- Report surfaces that Apple plans to ship driverless cars by 2019.

- Google’s self-driving cars reach the milestone of 1 million miles driven autonomously.

- Tesla takes $800 million in orders for its new home batteries in just two weeks.

- A TSX-V traded company was the most recent recipient of an off take agreement to supply Tesla with Lithium Hydroxide.

- Volkswagen’s stock price gets crushed over 30% in the aftermath of DieselGate.

- FMC recently announced an “across the board 15% increase in price” in all finished lithium products. Lithium Hydroxide rose from $9,500 per ton, up to $10,870. Lithium Carbonate from $6,500 per ton up to $7,475 USD.

General Trends:

- Charging stations have increased rapidly around the world.

- Every major auto manufacture has more than one fully electric car. Some automakers mandate is to have an electric version of every model.

- The oil price has hit a 6.5 year low, yet electric vehicle sales have held momentum.

- Lithium battery manufacturing costs are dropping in price while lithium battery technology is getting better.

- New technology is decreasing the charge time for electric cars. Meanwhile, “miles per charge” is rising, and some cars can even recharge wirelessly.

- There’s a greater interest in looking after the environment with a continued scare of global warming.

- Wind and solar storage needed to regulate output of electricity back to the grid.

- China is a nation now giving priority to EV cars on their highways and parking lots.

Green Shift

The above momentum means energy metals like lithium could continue to buck the general trend of global commodities. So far, the price of lithium has increased steadily since 2011.

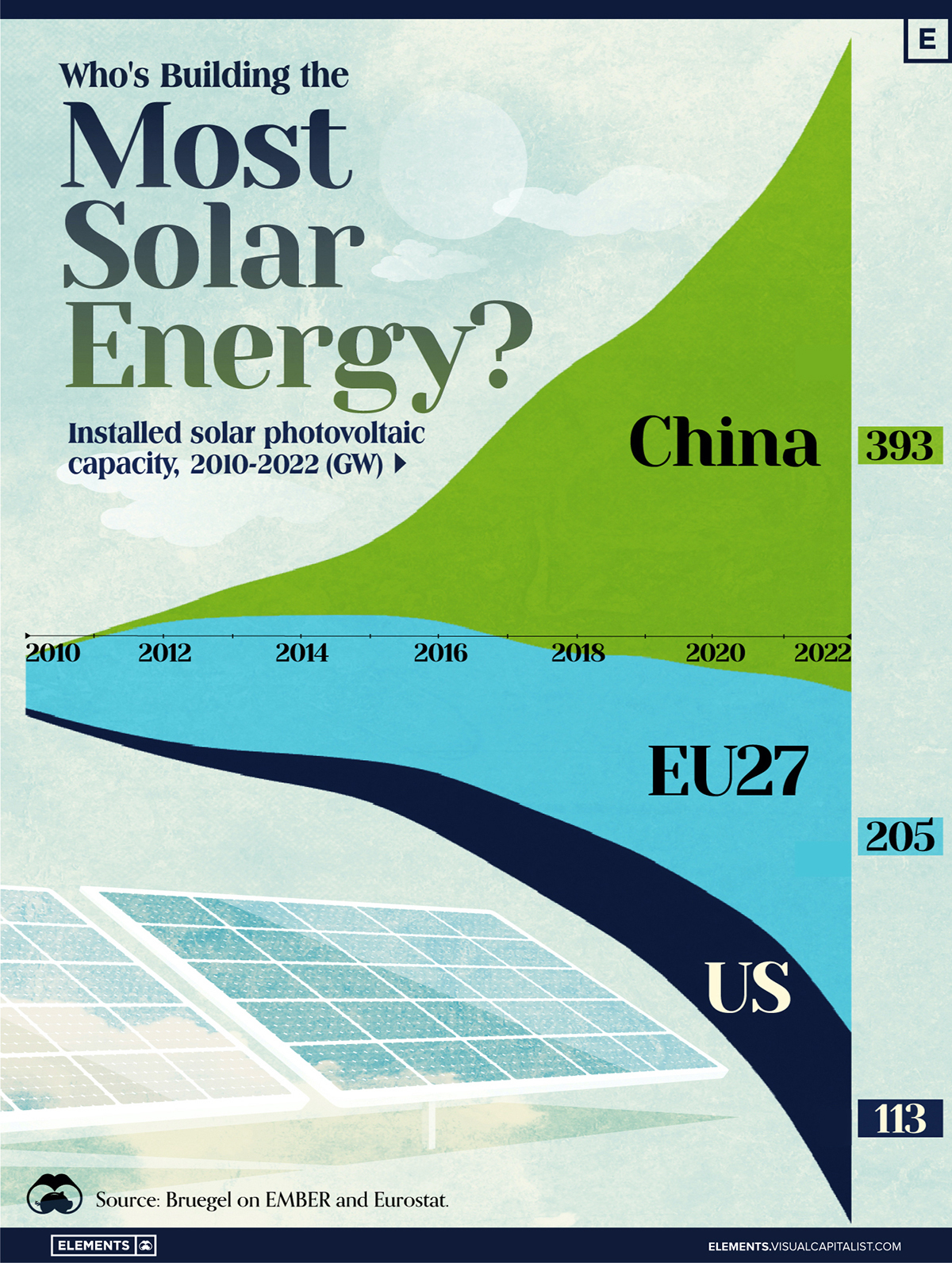

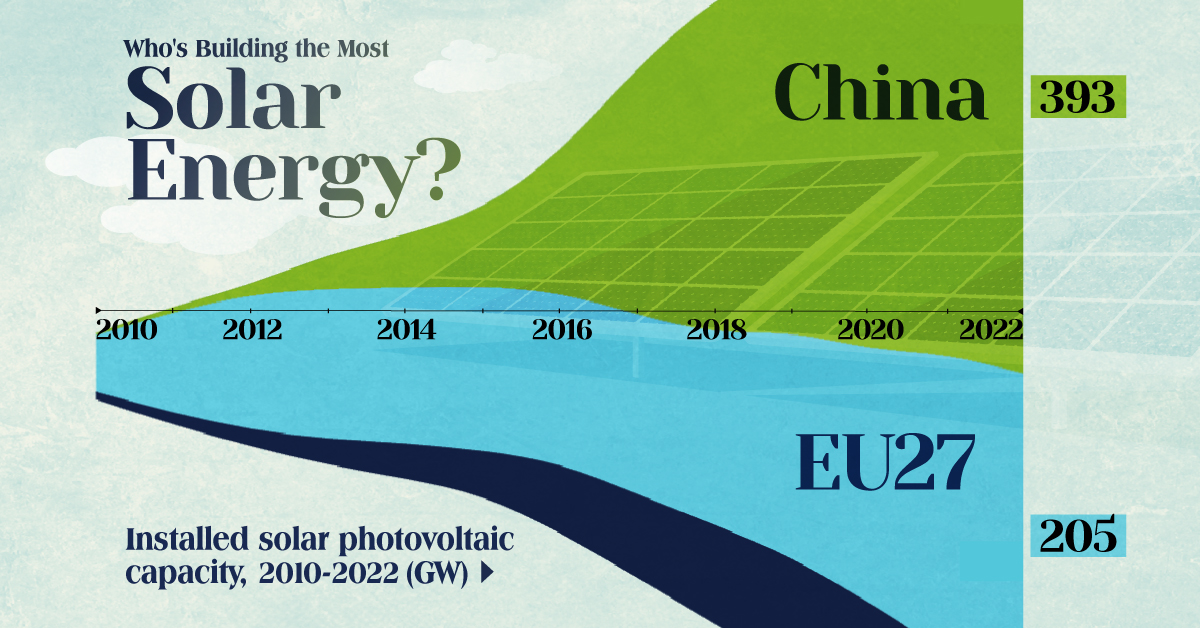

Who’s Building the Most Solar Energy?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

In 2023, solar energy accounted for three-quarters of renewable capacity additions worldwide. Most of this growth occurred in Asia, the EU, and the U.S., continuing a trend observed over the past decade.

In this graphic, we illustrate the rise in installed solar photovoltaic (PV) capacity in China, the EU, and the U.S. between 2010 and 2022, measured in gigawatts (GW). Bruegel compiled the data..

Chinese Dominance

As of 2022, China’s total installed capacity stands at 393 GW, nearly double that of the EU’s 205 GW and surpassing the USA’s total of 113 GW by more than threefold in absolute terms.

| Installed solar capacity (GW) | China | EU27 | U.S. |

|---|---|---|---|

| 2022 | 393.0 | 205.5 | 113.0 |

| 2021 | 307.0 | 162.7 | 95.4 |

| 2020 | 254.0 | 136.9 | 76.4 |

| 2019 | 205.0 | 120.1 | 61.6 |

| 2018 | 175.3 | 104.0 | 52.0 |

| 2017 | 130.8 | 96.2 | 43.8 |

| 2016 | 77.8 | 91.5 | 35.4 |

| 2015 | 43.6 | 87.7 | 24.2 |

| 2014 | 28.4 | 83.6 | 18.1 |

| 2013 | 17.8 | 79.7 | 13.3 |

| 2012 | 6.7 | 71.1 | 8.6 |

| 2011 | 3.1 | 53.3 | 5.6 |

| 2010 | 1.0 | 30.6 | 3.4 |

Since 2017, China has shown a compound annual growth rate (CAGR) of approximately 25% in installed PV capacity, while the USA has seen a CAGR of 21%, and the EU of 16%.

Additionally, China dominates the production of solar power components, currently controlling around 80% of the world’s solar panel supply chain.

In 2022, China’s solar industry employed 2.76 million individuals, with manufacturing roles representing approximately 1.8 million and the remaining 918,000 jobs in construction, installation, and operations and maintenance.

The EU industry employed 648,000 individuals, while the U.S. reached 264,000 jobs.

According to the IEA, China accounts for almost 60% of new renewable capacity expected to become operational globally by 2028.

Despite the phasing out of national subsidies in 2020 and 2021, deployment of solar PV in China is accelerating. The country is expected to reach its national 2030 target for wind and solar PV installations in 2024, six years ahead of schedule.

-

Markets6 days ago

Markets6 days agoVisualized: Interest Rate Forecasts for Advanced Economies

-

Markets2 weeks ago

Markets2 weeks agoEconomic Growth Forecasts for G7 and BRICS Countries in 2024

-

Wealth2 weeks ago

Wealth2 weeks agoCharted: Which City Has the Most Billionaires in 2024?

-

Technology2 weeks ago

Technology2 weeks agoAll of the Grants Given by the U.S. CHIPS Act

-

Green2 weeks ago

Green2 weeks agoThe Carbon Footprint of Major Travel Methods

-

United States1 week ago

United States1 week agoVisualizing the Most Common Pets in the U.S.

-

Culture1 week ago

Culture1 week agoThe World’s Top Media Franchises by All-Time Revenue

-

voronoi1 week ago

voronoi1 week agoBest Visualizations of April on the Voronoi App