Technology

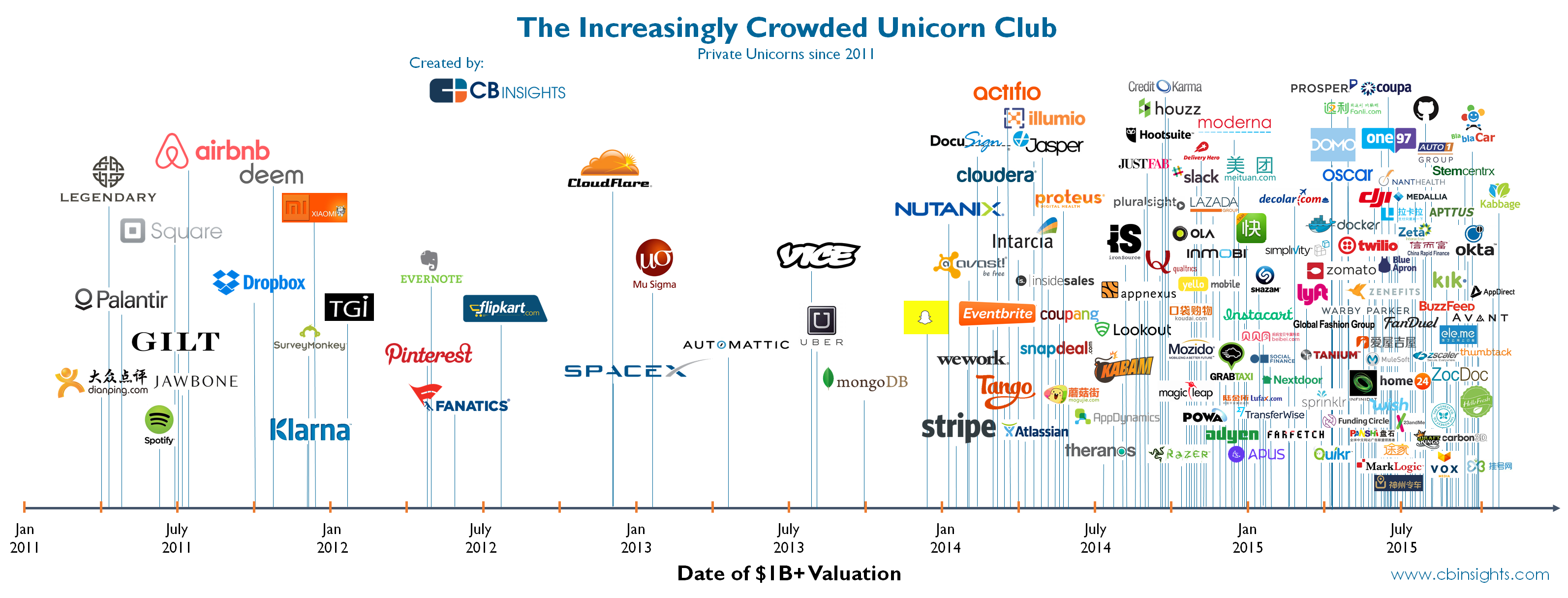

The Increasingly Crowded Unicorn Club

The Increasingly Crowded Unicorn Club

Unicorns, a moniker applied to private startups valued at over $1 billion or more, are supposed to be mythical in nature.

At best, there are supposed to be so few of them that venture capital firms would be absolutely elated to have a stake in any unicorn out there. (Or even their Canadian narwhal equivalents)

However, the truth is that unicorns are simply not rare or mythical anymore. According to the real-time list that CB Insights hosts, the number is now at 145 unicorns globally. In other words, the once exclusive Unicorn Club is becoming increasingly crowded.

That said, the odd member of the club does find the door.

Square, a prominent member of the club led by Twitter co-founder Jack Dorsey since mid-2011, finally IPO’d just a month ago with mixed results. It rose money from the public market at $9/share, which was a significant discount on the last private capital it raised at $15.46/share. Today it is trading closer to $12, which shows there is still optimism towards these kinds of technology companies.

Box’s IPO in January 2015 also sent mixed messages. It was privately valued at $2.4 billion, but then IPO’d at $1.7 billion. It soared on the first days of trading to $2.7 billion but then fell back down to a value below its IPO as lockups on insider traders expired during the summer.

Is the appetite for unicorns still frothy, or is it starting to sour?

We certainly agree that many of these companies have a great opportunity ahead of them. Many are growing at breakneck speed, and others are starting to find ways to monetize their offerings. However, is there really room for hundreds of them?

Today, the Australian software company Atlassian IPOs on the Nasdaq with a reported valuation of $4.4 billion. At time of publishing, it is up 33% on the day, and we will be continuing to watch the stock closely.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Brands6 days ago

Brands6 days agoHow Tech Logos Have Evolved Over Time

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023

-

Green2 weeks ago

Green2 weeks agoRanking the Top 15 Countries by Carbon Tax Revenue