Technology

33 Signs that Bitcoin Growth Isn’t Slowing in 2016

33 Signs that Bitcoin Growth Isn’t Slowing in 2016

It’s been a year of mixed results for cryptocurrency enthusiasts and speculators.

The biggest positive for Bitcoin is that it was actually the best performing currency this year, ahead of the US Dollar and the Israeli Shekel. Bitcoins have climbed a solid 21% in value over the course of the year in USD terms, and even more relative to other currencies. While the cryptocurrency hasn’t reached the heights it did in 2013, this is still a sign of positive strength.

On the other hand, mainstream news around Bitcoin over the course of 2015 has been distracting at best.

Ross Ulbricht, the man supposedly behind Silk Road, was sentenced to life imprisonment in May without the possibility of parole.

More recently, the Hunt for Satoshi has also heated up. Wired and Gizmodo subsequently both published reports that former Australian academic Craig Steven Wright was the creator of Bitcoin. Within hours, his house was raided by Australian police as part of an “unrelated” case. Days later, Wired rescinded its affirmation that Wright was the creator of the cryptocurrency, and instead asserted it was an elaborate hoax.

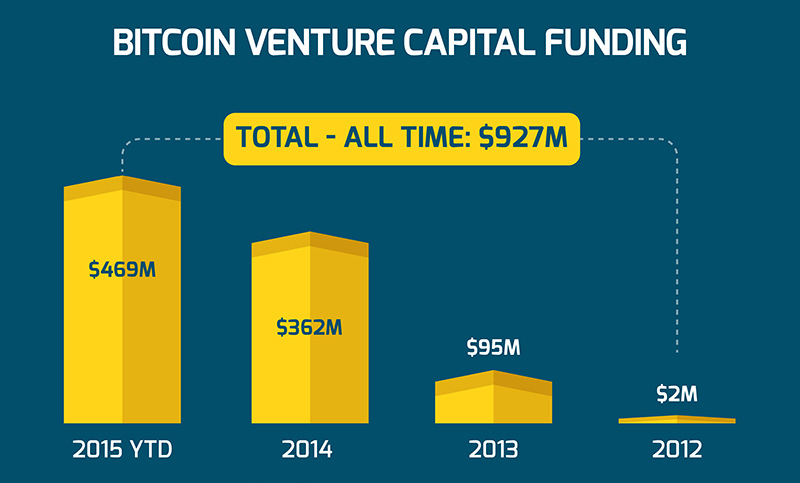

Lastly, despite close to $500 million in venture capital going into cryptocurrency-related pursuits, so far there hasn’t been any breakthroughs or apps that have captured the public’s eye. There has been progress and recognition around the merits of blockchain technology, but ultimately Bitcoin remains in the trough of disillusionment.

Bitcoin Growth in 2016

Today’s infographic highlights 33 signs that growth in Bitcoin will not slow down in 2016.

In our opinion, here are the most important reasons:

- The total amount of VC investment in Bitcoin since 2012 is $927 million. Over half of this investment has occurred in 2015 alone.

- World-class merchants now accept bitcoins for payment, including: Microsoft, Dell, Expedia, Dish, Overstock, TigerDirect, and Intuit.

- Transaction fees with bitcoins are extremely low: 0.0001 BTC per 1000 bytes.

- Daily transactions occurring with bitcoins amount to about $289 million per day. This is comparable to Paypal ($397 million), Square ($362 million), or Western Union ($216 million).

Original graphic by: BargainFox

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Lithium6 days ago

Lithium6 days agoRanked: The Top 10 EV Battery Manufacturers in 2023

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023

-

Green2 weeks ago

Green2 weeks agoRanking the Top 15 Countries by Carbon Tax Revenue

-

Markets2 weeks ago

Markets2 weeks agoU.S. Debt Interest Payments Reach $1 Trillion

-

Mining2 weeks ago

Mining2 weeks agoGold vs. S&P 500: Which Has Grown More Over Five Years?