Markets

Puerto Rico’s Debts Are “Not Payable” According to Governor

Puerto Rico’s Debts Are “Not Payable” According to Governor

The global economy has been walking a tightrope for some time. Zero interest-rate policies, slow economic growth, and mounting debt means zero room for error.

Puerto Rico is the latest jurisdiction to toss in the towel, with Governor Alejandro Garcia Padilla warning that the island is perilously close to falling into a “death spiral”.

“The debt is not payable… there is no other option. This is not politics, this is math,” Garcia Padilla told the New York Times. “But we have to make the economy grow. If not, we will be in a death spiral.”

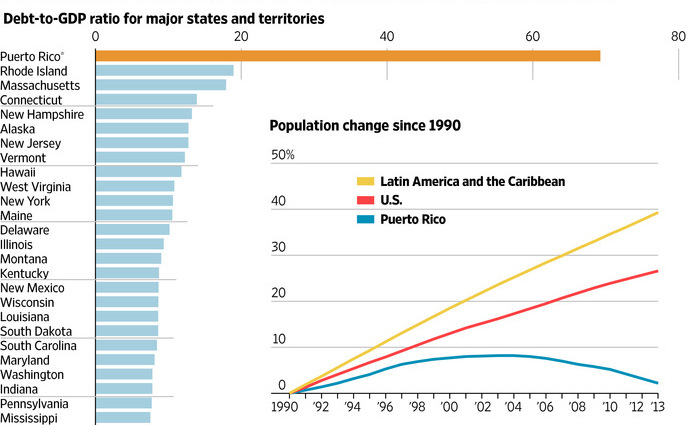

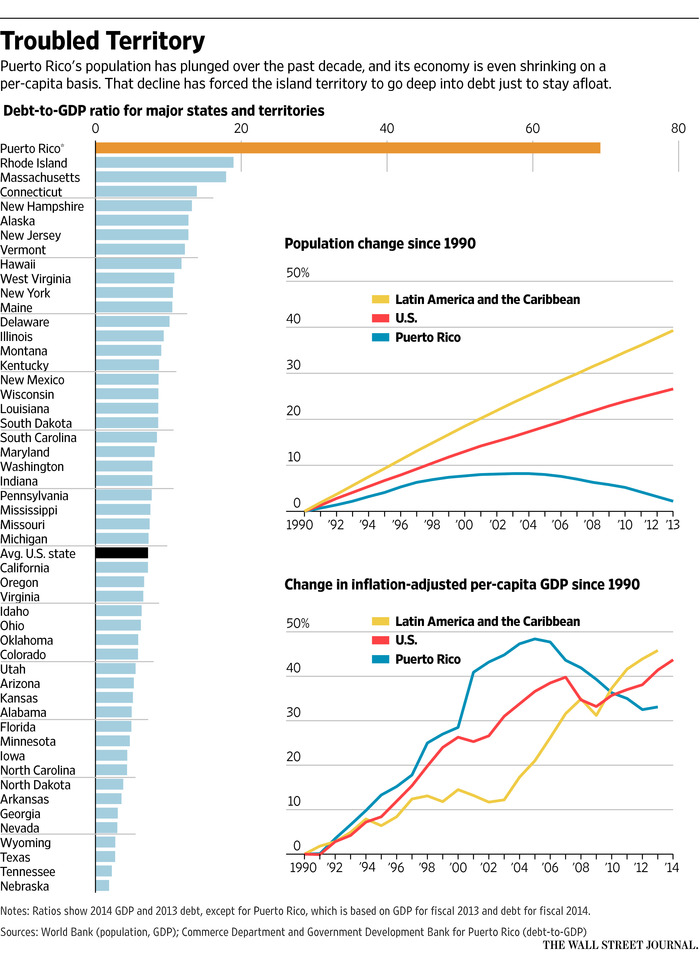

Puerto Rico, as you can see in the above chart published by the WSJ, has been in a tricky situation for some time. It’s $72 billion of debt for an island of roughly 3.5 million is equal to 70% of economic output. This is a ratio that is at least three times higher than the next highest state or territory in the United States.

The territory, which was ceded to the United States after the Spanish-American War, has been in trouble for awhile. The population growth rate has slowed, emigration is at record levels, and per-capita GDP has dropped over the last decade. Puerto Rico has relied on debt to try to grow the economy, and now credit-rating companies expect the first default to occur this week from the island’s electricity provider, which borrowed $9 billion. Further, the territory has been issuing new debt to pay old debt, and now the government is expected to run out of cash in July.

The Puerto Rico scenario encapsulates the current challenge that the rest of the world faces. Central Banks have pulled out all the stops to try to get growth: QE, increased borrowing, ZIRP, and ongoing currency wars. However, if that growth doesn’t come at the rate needed to get the ball rolling, it makes the debt harder to service. The more leverage, the higher the stakes are. Then all that is needed is one catalyst and things can get ugly fast.

Speaking of defaults: here’s what will happen if Greece defaults, and here is a breakdown of their debt.

Markets

Visualizing Global Inflation Forecasts (2024-2026)

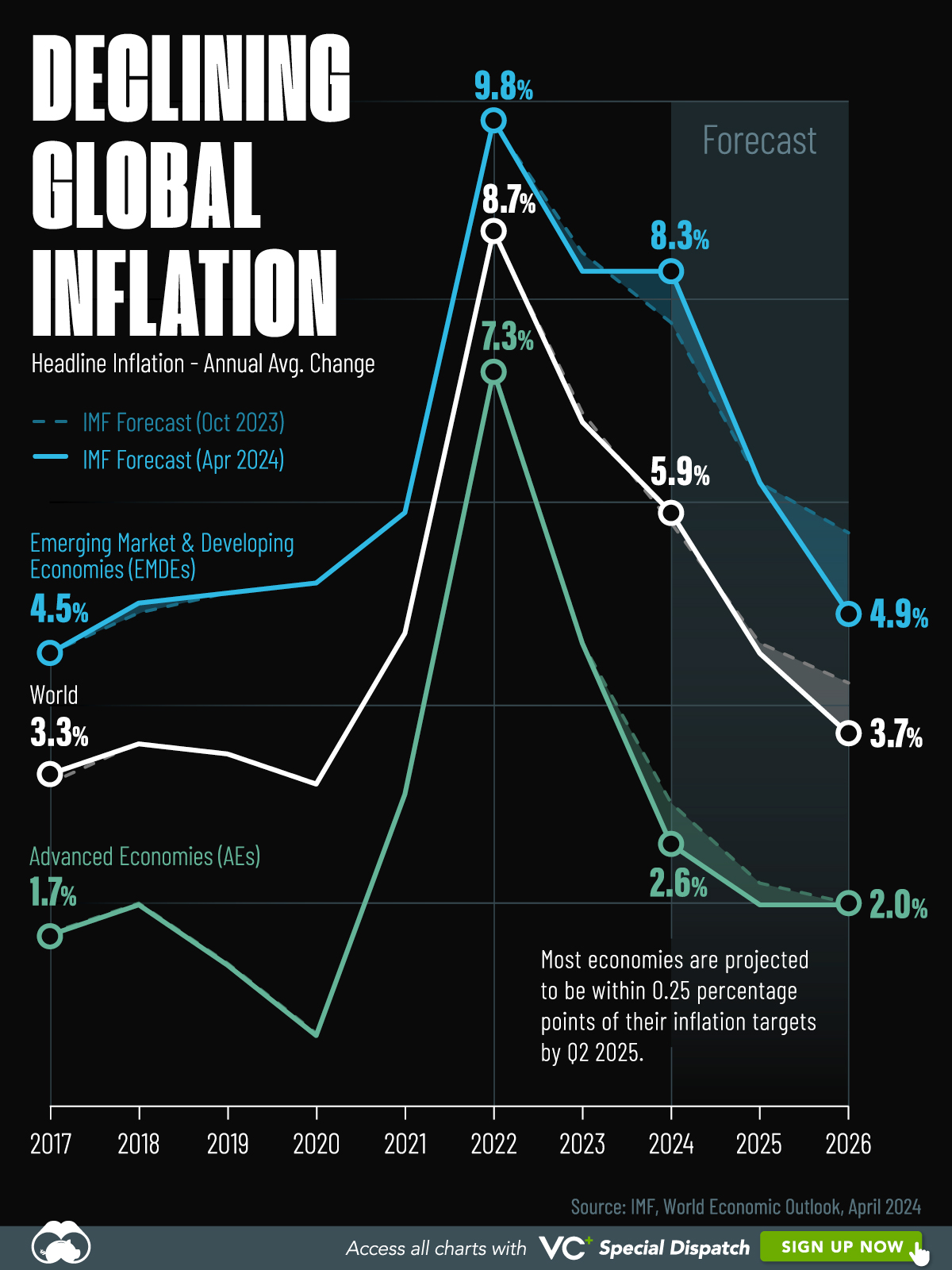

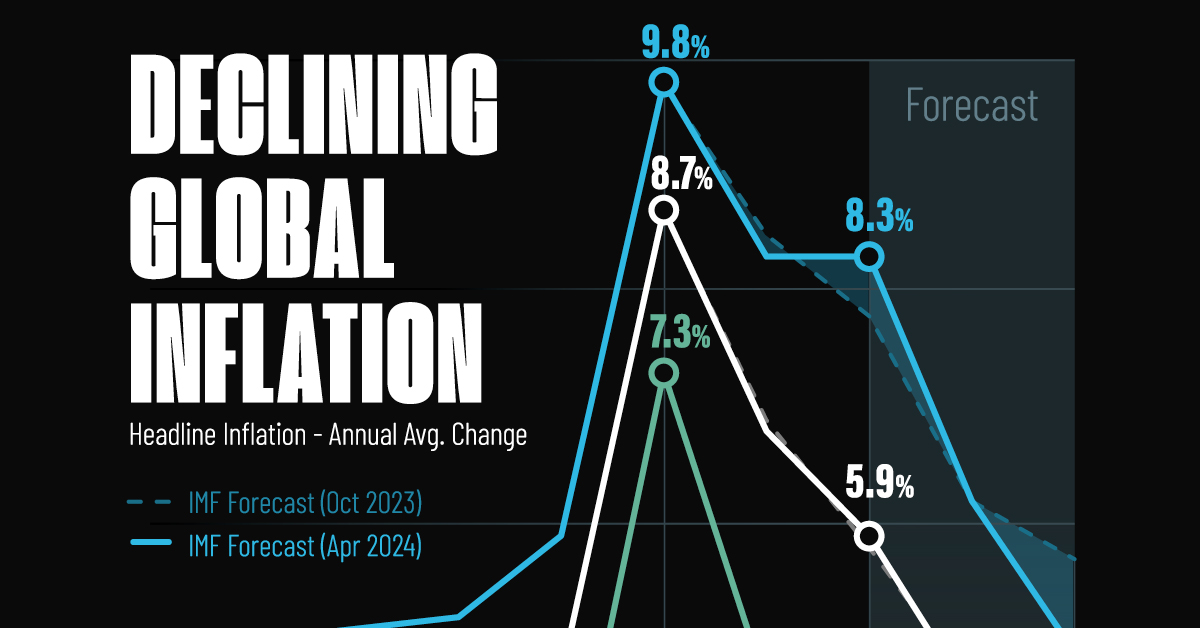

Here are IMF forecasts for global inflation rates up to 2026, highlighting a slow descent of price pressures amid resilient global growth.

Visualizing Global Inflation Forecasts (2024-2026)

Global inflation rates are gradually descending, but progress has been slow.

Today, the big question is if inflation will decline far enough to trigger easing monetary policy. So far, the Federal Reserve has held rates for nine months amid stronger than expected core inflation, which excludes volatile energy and food prices.

Yet looking further ahead, inflation forecasts from the International Monetary Fund (IMF) suggest that inflation will decline as price pressures ease, but the path of disinflation is not without its unknown risks.

This graphic shows global inflation forecasts, based on data from the April 2024 IMF World Economic Outlook.

Get the Key Insights of the IMF’s World Economic Outlook

Want a visual breakdown of the insights from the IMF’s 2024 World Economic Outlook report?

This visual is part of a special dispatch of the key takeaways exclusively for VC+ members.

Get the full dispatch of charts by signing up to VC+.

The IMF’s Inflation Outlook

Below, we show the IMF’s latest projections for global inflation rates through to 2026:

| Year | Global Inflation Rate (%) | Advanced Economies Inflation Rate (%) | Emerging Market and Developing Economies Inflation Rate (%) |

|---|---|---|---|

| 2019 | 3.5 | 1.4 | 5.1 |

| 2020 | 3.2 | 0.7 | 5.2 |

| 2021 | 4.7 | 3.1 | 5.9 |

| 2022 | 8.7 | 7.3 | 9.8 |

| 2023 | 6.8 | 4.6 | 8.3 |

| 2024 | 5.9 | 2.6 | 8.3 |

| 2025 | 4.5 | 2.0 | 6.2 |

| 2026 | 3.7 | 2.0 | 4.9 |

After hitting a peak of 8.7% in 2022, global inflation is projected to fall to 5.9% in 2024, reflecting promising inflation trends amid resilient global growth.

While inflation has largely declined due to falling energy and goods prices, persistently high services inflation poses challenges to mitigating price pressures. In addition, the IMF highlights the potential risk of an escalating conflict in the Middle East, which could lead to energy price shocks and higher shipping costs.

These developments could negatively affect inflation scenarios and prompt central banks to adopt tighter monetary policies. Overall, by 2026, global inflation is anticipated to decline to 3.7%—still notably above the 2% target set by several major economies.

Adding to this, we can see divergences in the path of inflation between advanced and emerging economies. While affluent nations are forecast to see inflation edge closer to the 2% target by 2026, emerging economies are projected to have inflation rates reach 4.9%—falling closer to their pre-pandemic averages.

Get the Full Analysis of the IMF’s Outlook on VC+

This visual is part of an exclusive special dispatch for VC+ members which breaks down the key takeaways from the IMF’s 2024 World Economic Outlook.

For the full set of charts and analysis, sign up for VC+.

-

Money6 days ago

Money6 days agoCharted: Which Country Has the Most Billionaires in 2024?

-

Energy2 weeks ago

Energy2 weeks agoRanked: The Top 10 EV Battery Manufacturers in 2023

-

Countries2 weeks ago

Countries2 weeks agoCountries With the Largest Happiness Gains Since 2010

-

Economy2 weeks ago

Economy2 weeks agoVC+: Get Our Key Takeaways From the IMF’s World Economic Outlook

-

Demographics2 weeks ago

Demographics2 weeks agoThe Countries That Have Become Sadder Since 2010

-

Money2 weeks ago

Money2 weeks agoCharted: Who Has Savings in This Economy?

-

Technology1 week ago

Technology1 week agoVisualizing AI Patents by Country

-

Economy1 week ago

Economy1 week agoEconomic Growth Forecasts for G7 and BRICS Countries in 2024