Technology

The Massive Impact of EVs on Commodities in One Chart

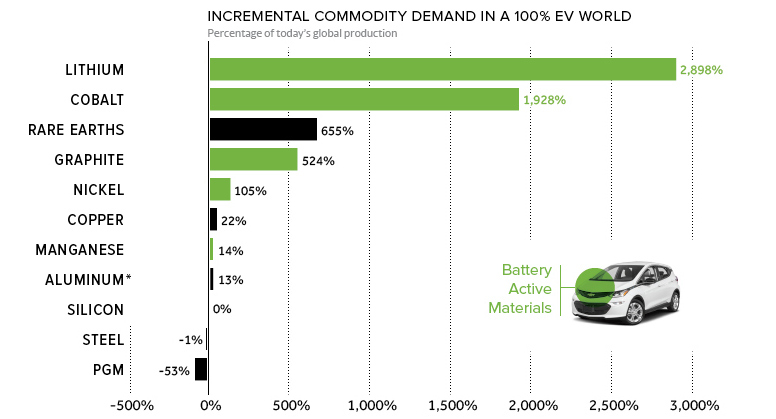

The Massive Impact of EVs on Commodities

How demand would change in a 100% EV world

The Chart of the Week is a weekly Visual Capitalist feature on Fridays.

What would happen if you flipped a switch, and suddenly every new car that came off assembly lines was electric?

It’s obviously a thought experiment, since right now EVs have close to just 1% market share worldwide. We’re still years away from EVs even hitting double-digit demand on a global basis, and the entire supply chain is built around the internal combustion engine, anyways.

At the same time, however, the scenario is interesting to consider. One recent projection, for example, put EVs at a 16% penetration by 2030 and then 51% by 2040. This could be conservative depending on the changing regulatory environment for manufacturers – after all, big markets like China, France, and the U.K. have recently announced that they plan on banning gas-powered vehicles in the near future.

The Thought Experiment

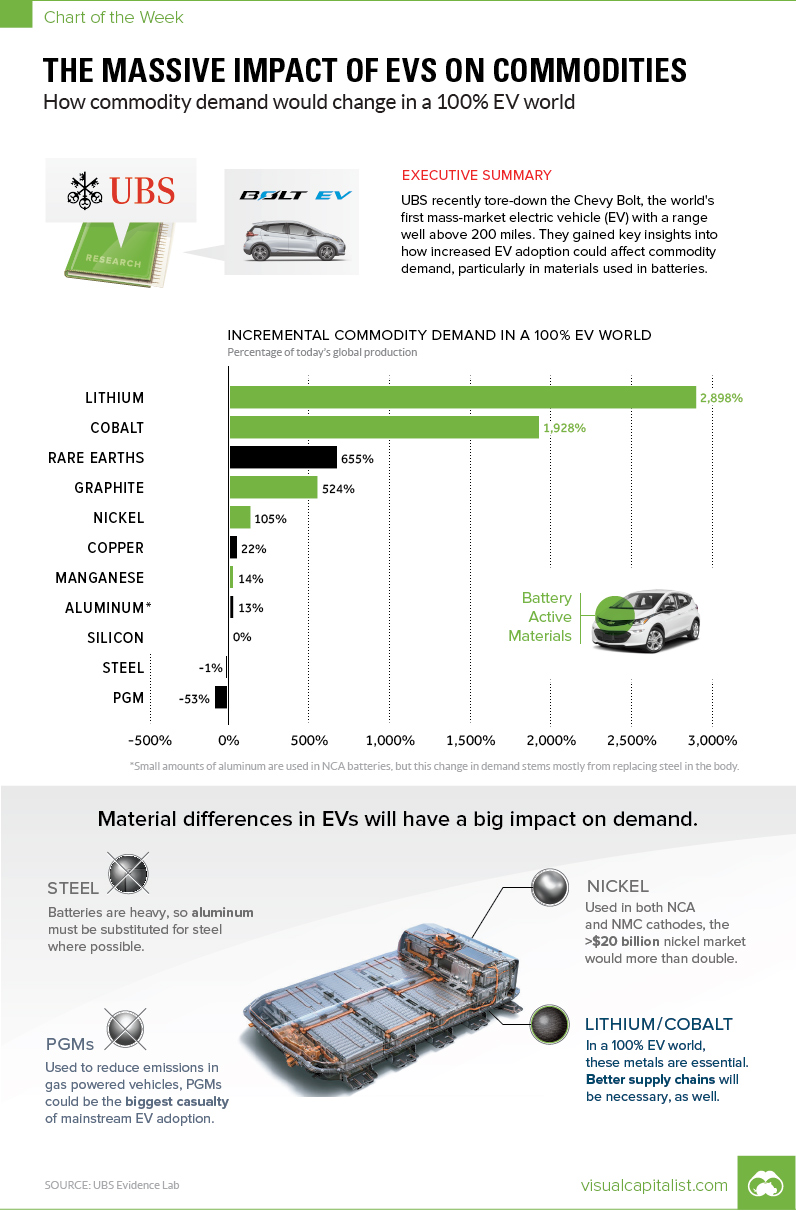

We discovered this “100% EV world” thought experiment in a UBS report that everyone should read. As a part of their UBS Evidence Lab initiative, they tore down a Chevy Bolt to see exactly what is inside, and then had 39 of the bank’s analysts weigh in on the results.

After breaking down the metals and other materials used in the vehicle, they noticed a considerable amount of variance from what gets used in a standard gas-powered car. It wasn’t just the battery pack that made a difference – it was also the body and the permanent-magnet synchronous motor that had big implications.

As a part of their analysis, they extrapolated the data for a potential scenario where 100% of the world’s auto demand came from Chevy Bolts, instead of the current auto mix.

The Implications

If global demand suddenly flipped in this fashion, here’s what would happen:

| Material | Demand increase | Notes |

|---|---|---|

| Lithium | 2,898% | Needed in all lithium-ion batteries |

| Cobalt | 1,928% | Used in the Bolt's NMC cathode |

| Rare Earths | 655% | Bolt uses neodymium in permanent magnet motor |

| Graphite | 524% | Used in the anode of lithium-ion batteries |

| Nickel | 105% | Used in the Bolt's NMC cathode |

| Copper | 22% | Used in permanent magnet motor and wiring |

| Manganese | 14% | Used in the Bolt's NMC cathode |

| Aluminum | 13% | Used to reduce weight of vehicle |

| Silicon | 0% | Bolt uses 6-10x more semiconductors |

| Steel | -1% | Uses 7% less steel, but fairly minimal impact on market |

| PGMs | -53% | Catalytic converters not needed in EVs |

Some caveats we think are worth noting:

The Bolt is not a Tesla

The Bolt uses an NMC cathode formulation (nickel, manganese, and cobalt in a 1:1:1 ratio), versus Tesla vehicles which use NCA cathodes (nickel, cobalt, and aluminum, in an estimated 16:3:1 ratio). Further, the Bolt uses an permanent-magnet synchronous motor, which is different from Tesla’s AC induction motor – the key difference there being rare earth usage.

Big Markets, small markets:

Lithium, cobalt, and graphite have tiny markets, and they will explode in size with any notable increase in EV demand. The nickel market, which is more than $20 billion per year, will also more than double in this scenario. It’s also worth noting that the Bolt uses low amounts of nickel in comparison to Tesla cathodes, which are 80% nickel.

Meanwhile, the 100% EV scenario barely impacts the steel market, which is monstrous to begin with. The same can be said for silicon, even though the Bolt uses 6-10x more semiconductors than a regular car. The market for PGMs like platinum and palladium, however, gets decimated in this hypothetical scenario – that’s because their use as catalysts in combustion engines are a primary source of demand.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees