Technology

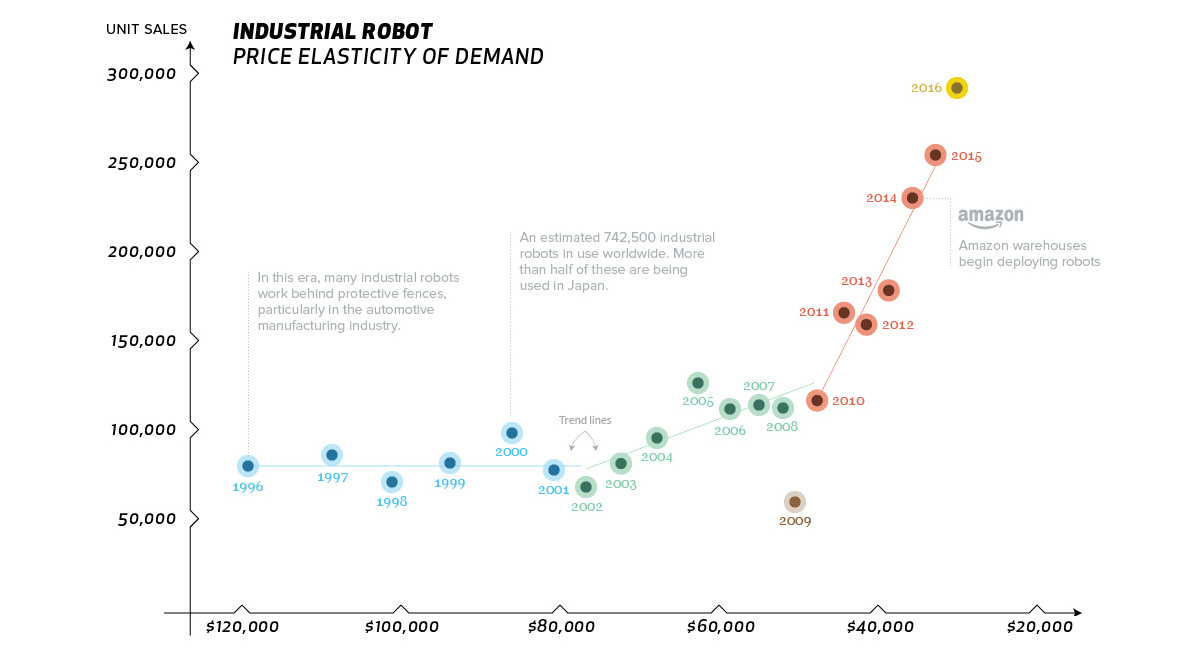

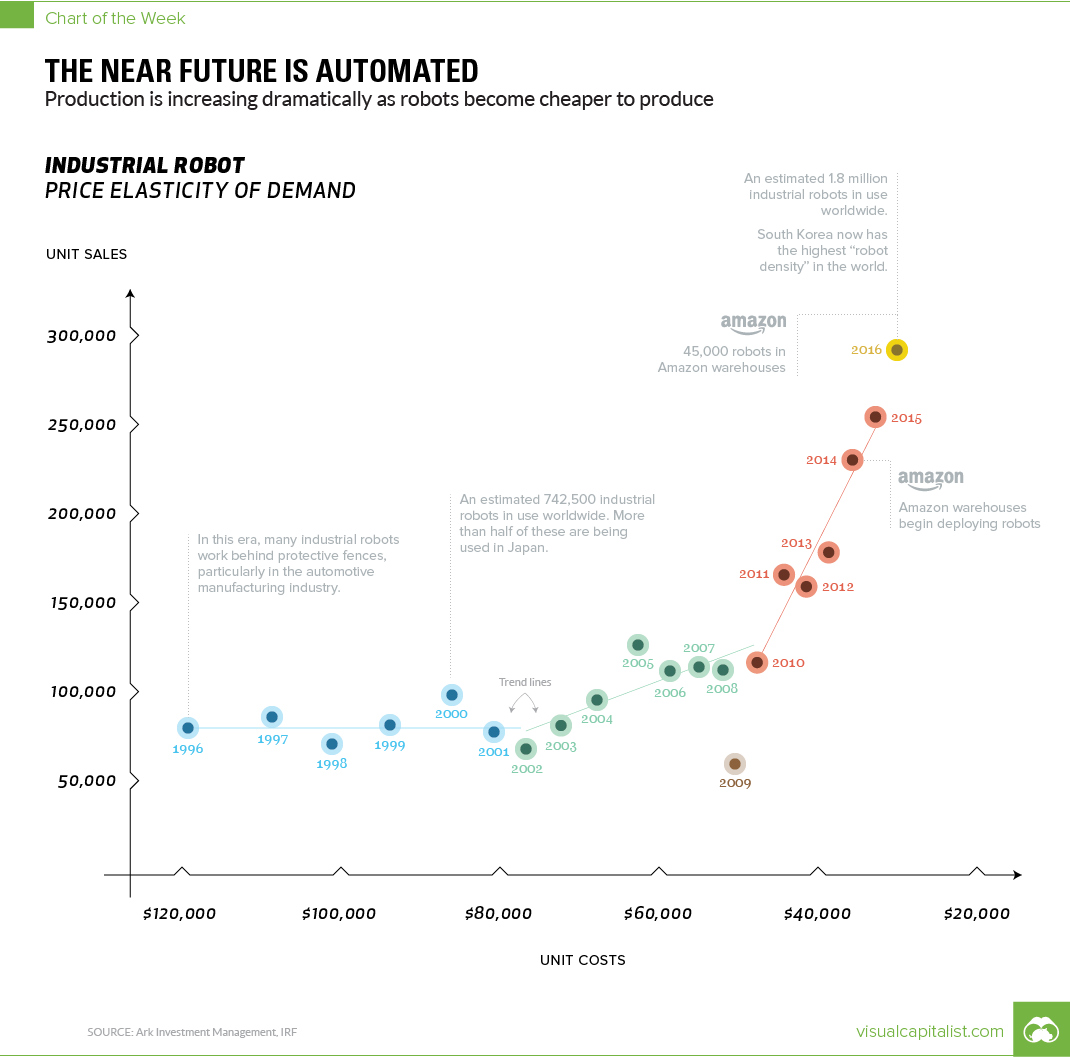

Chart: Why Industrial Robot Sales are Sky High

Chart: Why Industrial Robot Sales are Sky High

The Chart of the Week is a weekly Visual Capitalist feature on Fridays.

Industrial robots have come a long way since George Devol invented “Unimate” in 1961.

After pitching his idea to Joseph Engelberger at a cocktail party, the two soon saw their new creation become the first mass-produced robotic arm to be used in factory automation.

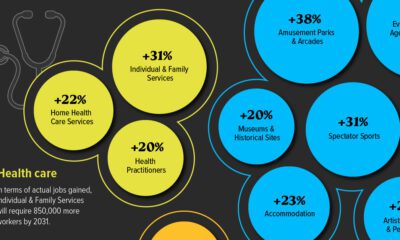

Today, this robot class is raising the bar of global manufacturing to new heights, striking a seamless mix of strength, speed, and precision. As a result, demand for industrial robots keeps growing at a robust 14% per year, setting the stage for 3.1 million industrial robots in operation globally by 2020.

Drivers of Robot Success

Why are industrial robots flying off the shelves at an unprecedented rate?

Significant factors include advancements in machine learning and computer vision, since the prospect of new functionality leads to more use cases and increased demand. In addition, the maturation of 3D printing technology and the soaring interest in collaborative robots also deserve some of the credit.

What’s interesting though, is that according to experts, the record demand for robots is actually largely in response to the notable decline in unit costs.

ARK Investment Management, a leading researcher in this market, says that industrial robot costs are expected to drop a solid 65% between 2015 and 2025. Impressively, the cost per robot will plunge from $31,000 to $11,000 over that decade of time.

A Sudden Cost Decline

Why are unit costs dropping so fast?

For ARK, such price shifts account for the workings of Wright’s Law, which states: “for every cumulative doubling in number of units produced, costs will decline by a consistent percentage”. In the field of robotics that cost decline, also known as the “learning rate”, has been around 50%.

As industrial robotic operations grow, especially in the automotive industry, the manufacturing sector continues to save millions. Meanwhile, working conditions improve as robots take mundane, repetitive, and dangerous task loads from human workers.

At present, the largest market share of industrial robots is held in the Asia-Pacific region – namely, China, Japan, Korea, and India. But as current trends suggest, these falling prices will only steer further global reach.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

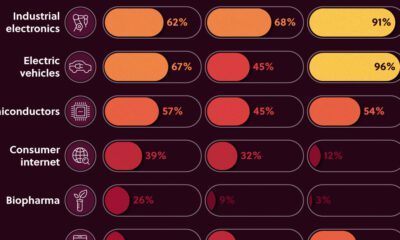

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees