Technology

What’s Hot (and Not) in Early Stage Tech

![What's Hot (and Not) in Early Stage Tech [Chart]](https://www.visualcapitalist.com/wp-content/uploads/2016/05/startup-trends-chart.png)

What’s Hot (and Not) in Early Stage Tech [Chart]

Using big data to discover what aspiring entrepreneurs are thinking

The Chart of the Week is a weekly Visual Capitalist feature on Fridays.

There are many ways to get a pulse on the startup scene to see what is trending. For example, one could look at the sub-sectors getting the most money from venture capitalists. The more deals and money hitting a sub-sector, the more it could be on its way up the ladder.

However, perhaps there is another angle that can tell us something, even if it’s simply confirming an already-held suspicion about trends in early stage tech. What are the entrepreneurs in the trenches doing? What are they focusing on, and how is that a change from previous time periods?

Big Data from Y Combinator

Y Combinator, arguably the most prominent startup accelerator on the planet, has indulged us on this hunch. Using the thousands of applications they get each year from aspiring entrepreneurs, they’ve had the foresight to methodically break them down by keyword to potentially show us trends within the pitches by startup founders.

For a wonderful post that breaks this all down, go to the company’s The Macro blog, which discusses many of these trends over the course of years in great detail.

That said, we decided to piggyback onto this interesting data set with a slightly different approach.

Method to the Madness

While the results of the keyword analysis of Y Combinator applications included many meaningful keywords, it also was cluttered with less meaningful pieces of noise. As an example, between 2015 and 2016 applications, there was a 204% increase in the use of the word “firms”. This doesn’t seem to tell us anything significant about the startup world, especially since it only went from 0.3% to 0.8% in actual usage within the scope of all applications.

To combat noise, we took the more subjective approach by identifying keywords that were more concretely associated with sub-sectors or trends. The mention of the term “IoT” in an application, for example, is more telling and suggests that an entrepreneur is pitching a startup idea related to the Internet of Things to the accelerator. More mentions of “IoT” in pitches means that ideas on the “IoT” are top of mind for aspiring entrepreneurs.

What’s Hot in Early Stage Tech?

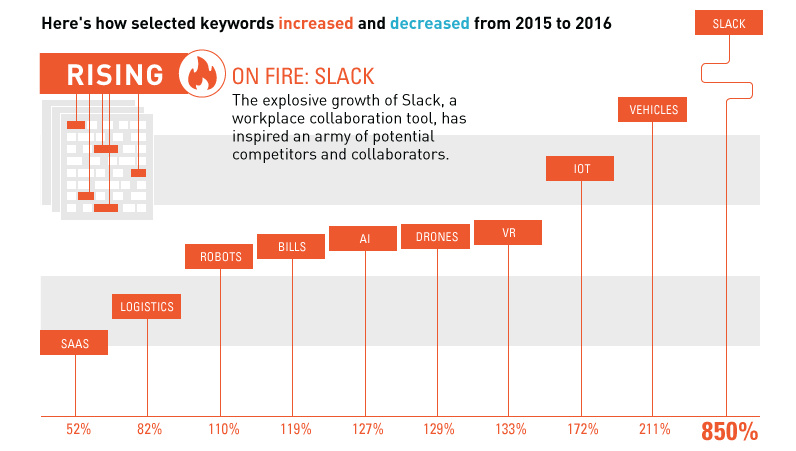

Using the above subjective methodology, here are the increases and decreases over the last year that stood out the most to us:

The word “Slack” was used 850% more often in 2016 applications, clearly related to the popular workplace collaboration tool of the same name. Slack’s explosive growth has rippled through to the startup world, likely inspiring an army of potential competitors and collaborators in the wake of their success.

Other emerging trends that picked up steam in recent applications: virtual reality (“VR”), artificial intelligence (“AI”), internet of things (“IoT”), and “drones”. The 119% increase in the usage of the word “bills” also points to the recent attention on the fintech space.

The mention of “SaaS” (Software as a Service) also increased 52%, as it has become a preferred business model by venture capitalists.

What’s Not

The largest decrease of all terms used was that of “Bitcoin”, which dropped 62% from one year to the next. The cryptocurrency has been a popular developer target for years, but the rush to take it mainstream may now be losing steam. The world’s top performing currency in 2015 has been called dead many times before, so it is certainly no stranger to adversity.

The word “nonprofit” was also used 29% less, which may point to the recent pressure for startups to offer a more foreseeable potential return on investment for investors. The ecosystem isn’t as frothy as it once was, and nonprofit ideas may have taken a temporary tumble as a result.

“Crowdfunding” has also dropped more off the radar, receiving 25% less mentions.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Science1 week ago

Science1 week agoVisualizing the Average Lifespans of Mammals

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023