Markets

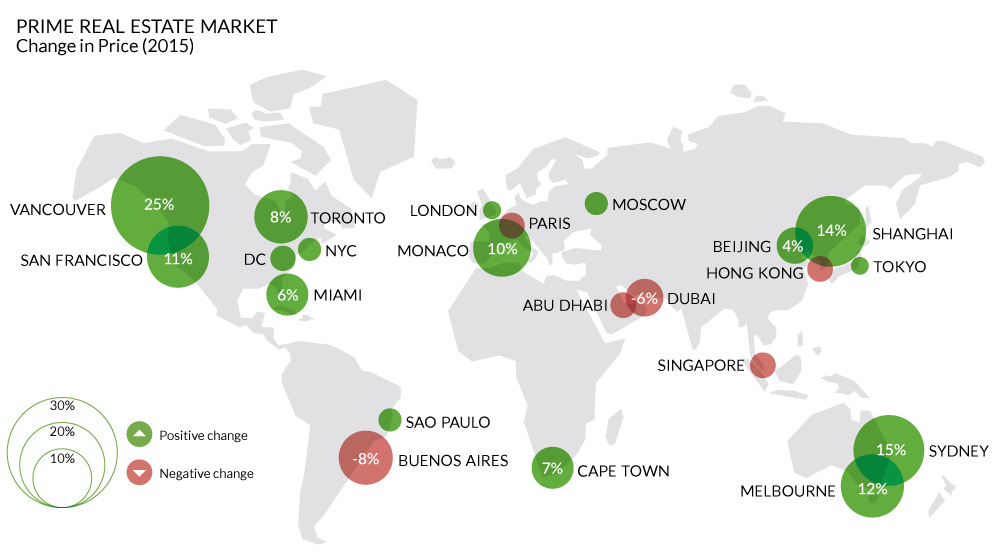

The Lopsided Market for Luxury Properties

![The Lopsided Market for Luxury Properties [Chart]](https://www.visualcapitalist.com/wp-content/uploads/2016/06/luxury-properties-chart.png)

The Lopsided Market for Luxury Properties [Chart]

Which world-class cities are the ultra rich scrambling to get into?

The Chart of the Week is a weekly Visual Capitalist feature on Fridays.

The global market for high-end luxury properties is a volatile one.

For example, during the tumultuous year of 2009, there was an astonishing 97 percentage point differential in the price changes of high-end real estate. Some markets may have been up 30%, but others were down over 60% – that’s a wild margin for multi-million dollar properties in some of the most world-class cities in the world.

This is according to the latest iteration of the Wealth Report, an annual publication by the global real estate consultancy Knight Frank that focuses on the world’s ultra-rich.

High-end Real Estate in 2015

The market for luxury properties last year was obviously less volatile than the aforementioned example, however the spread is still significant.

In Vancouver, which is currently engulfed in a real estate mania that we covered in-depth yesterday, luxury properties jumped up in price by 25% throughout 2015. This is not an exception to the trend. Royal Lepage, another realtor, covered Canadian luxury markets in more depth, finding that properties increased in price by a total of 125% from 2005 to 2015. That compares to 69% increases in Toronto over the same period, and 58% increases in Montreal.

The biggest decrease in the price of luxury real estate was in Lagos, Nigeria. The African metropolis of 16 million is the continent’s largest city, as well as the fastest growing city in the world. There, high-end properties divebombed by -20%.

In terms of more so-called “world-class” cities, the “Paris of South America” – Buenos Aires – saw the largest decline of -8.0%. Knight Frank notes this decline is based mainly because of currency and affordability issues. The market there could be an interesting one to watch for awhile, as new Argentinian president Mauricio Macri recently took the country’s reins in December 2015.

The North American Market

San Francisco was a distant second place from Vancouver, with an increase in high-end property values of 10.9%. Toronto was up 8.0%, while Los Angeles and New York both held modest gains of 4.7% and 2.4% respectively.

Chicago was the worst performing North American city in Knight Frank’s index with a 0.0% price change in luxury properties throughout 2015.

Markets

U.S. Debt Interest Payments Reach $1 Trillion

U.S. debt interest payments have surged past the $1 trillion dollar mark, amid high interest rates and an ever-expanding debt burden.

U.S. Debt Interest Payments Reach $1 Trillion

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

The cost of paying for America’s national debt crossed the $1 trillion dollar mark in 2023, driven by high interest rates and a record $34 trillion mountain of debt.

Over the last decade, U.S. debt interest payments have more than doubled amid vast government spending during the pandemic crisis. As debt payments continue to soar, the Congressional Budget Office (CBO) reported that debt servicing costs surpassed defense spending for the first time ever this year.

This graphic shows the sharp rise in U.S. debt payments, based on data from the Federal Reserve.

A $1 Trillion Interest Bill, and Growing

Below, we show how U.S. debt interest payments have risen at a faster pace than at another time in modern history:

| Date | Interest Payments | U.S. National Debt |

|---|---|---|

| 2023 | $1.0T | $34.0T |

| 2022 | $830B | $31.4T |

| 2021 | $612B | $29.6T |

| 2020 | $518B | $27.7T |

| 2019 | $564B | $23.2T |

| 2018 | $571B | $22.0T |

| 2017 | $493B | $20.5T |

| 2016 | $460B | $20.0T |

| 2015 | $435B | $18.9T |

| 2014 | $442B | $18.1T |

| 2013 | $425B | $17.2T |

| 2012 | $417B | $16.4T |

| 2011 | $433B | $15.2T |

| 2010 | $400B | $14.0T |

| 2009 | $354B | $12.3T |

| 2008 | $380B | $10.7T |

| 2007 | $414B | $9.2T |

| 2006 | $387B | $8.7T |

| 2005 | $355B | $8.2T |

| 2004 | $318B | $7.6T |

| 2003 | $294B | $7.0T |

| 2002 | $298B | $6.4T |

| 2001 | $318B | $5.9T |

| 2000 | $353B | $5.7T |

| 1999 | $353B | $5.8T |

| 1998 | $360B | $5.6T |

| 1997 | $368B | $5.5T |

| 1996 | $362B | $5.3T |

| 1995 | $357B | $5.0T |

| 1994 | $334B | $4.8T |

| 1993 | $311B | $4.5T |

| 1992 | $306B | $4.2T |

| 1991 | $308B | $3.8T |

| 1990 | $298B | $3.4T |

| 1989 | $275B | $3.0T |

| 1988 | $254B | $2.7T |

| 1987 | $240B | $2.4T |

| 1986 | $225B | $2.2T |

| 1985 | $219B | $1.9T |

| 1984 | $205B | $1.7T |

| 1983 | $176B | $1.4T |

| 1982 | $157B | $1.2T |

| 1981 | $142B | $1.0T |

| 1980 | $113B | $930.2B |

| 1979 | $96B | $845.1B |

| 1978 | $84B | $789.2B |

| 1977 | $69B | $718.9B |

| 1976 | $61B | $653.5B |

| 1975 | $55B | $576.6B |

| 1974 | $50B | $492.7B |

| 1973 | $45B | $469.1B |

| 1972 | $39B | $448.5B |

| 1971 | $36B | $424.1B |

| 1970 | $35B | $389.2B |

| 1969 | $30B | $368.2B |

| 1968 | $25B | $358.0B |

| 1967 | $23B | $344.7B |

| 1966 | $21B | $329.3B |

Interest payments represent seasonally adjusted annual rate at the end of Q4.

At current rates, the U.S. national debt is growing by a remarkable $1 trillion about every 100 days, equal to roughly $3.6 trillion per year.

As the national debt has ballooned, debt payments even exceeded Medicaid outlays in 2023—one of the government’s largest expenditures. On average, the U.S. spent more than $2 billion per day on interest costs last year. Going further, the U.S. government is projected to spend a historic $12.4 trillion on interest payments over the next decade, averaging about $37,100 per American.

Exacerbating matters is that the U.S. is running a steep deficit, which stood at $1.1 trillion for the first six months of fiscal 2024. This has accelerated due to the 43% increase in debt servicing costs along with a $31 billion dollar increase in defense spending from a year earlier. Additionally, a $30 billion increase in funding for the Federal Deposit Insurance Corporation in light of the regional banking crisis last year was a major contributor to the deficit increase.

Overall, the CBO forecasts that roughly 75% of the federal deficit’s increase will be due to interest costs by 2034.

-

Mining2 weeks ago

Mining2 weeks agoCharted: The Value Gap Between the Gold Price and Gold Miners

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Markets1 week ago

Markets1 week agoCharted: Big Four Market Share by S&P 500 Audits

-

AI1 week ago

AI1 week agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Automotive1 week ago

Automotive1 week agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Markets2 weeks ago

Markets2 weeks agoVisualizing America’s Shortage of Affordable Homes