Technology

The Future of Customer Rewards: Card Linked Offers

Every customer likes receiving a discount at the till.

Not surprisingly, businesses like customer rewards programs as well – they can be a way to drive loyalty, get repeat business, and ultimately increase customer retention.

But there’s one problem: creating a quality loyalty program has been traditionally quite expensive, especially for brick-and-mortar businesses. After all, most companies do not have the clout to market a proprietary rewards app like Starbucks, so how can customer rewards be tackled more cost effectively in the digital era?

Introducing Card Linked Offers

Today’s infographic comes from Mobi724 and it explains the concept of card linked offers (CLOs), as well as the benefits they confer to consumers, retailers, and even payment processors.

As brick-and-mortar businesses look to the potential of the smartphone economy to help retain customers and increase store traffic, card linked offers (CLOs) present an interesting opportunity.

Card linked offers are relevant, personalized, and easy to redeem. Further, they ultimately create a flawless and convenient experience that can help increase brand loyalty and customer satisfaction.

How Card Linked Offers Work

Card-linked offers (CLOs) are a card-linking technology enabling operators to link a special offer or coupon to a consumer’s debit or credit card.

- Retailers and/or banks target a consumer with relevant ads

- The closer the recommendations are to the consumer’s preferences and geolocation in real time, the higher the chances are for redemption

- Offers can be redeemed with usage of the linked payment card at point of sale (POS)

Combined with the effective use of proximity marketing, CLOs can help reach customers at the right place and at the right time. In return, operators see an increase card usage and spending at participating stores, while creating a unique opportunity to actively engage customers.

A Booming Market

In recent years, CLOs have become one of the most widely used online-to-offline (O2O) technologies.

Card linked offers are already a multi-billion dollar market, and a recent industry survey found that transactions are growing at a rapid pace. Impressively, 62% of CLO users that responded to the survey saw their transactions increase by 100% or more in the last year.

What else is driving growth in this expanding market?

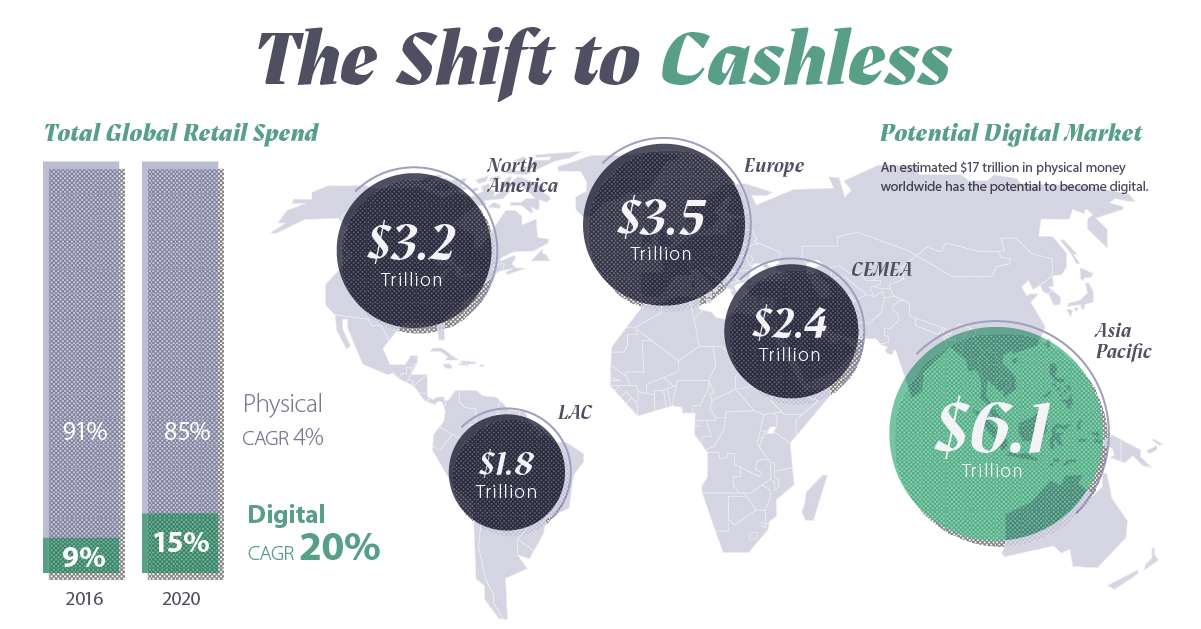

1. A Shift to Cashless

The world is embracing a cashless economy, as the popularity and convenience of using cards and mobile payment apps increases. CLOs are poised to benefit from more cashless retail transactions, which are growing at 20% per year.

2. Changing Consumer Behavior

Research shows that having an immediately gratifying rewards experience is more important to consumers than the monetary savings they get in the process. This creates a positive feedback loop with every experience.

Gauging Success

Truly successful card-linked offers must reach consumers where they are, provide personalized offers, and enable O2O – an online-to-offline redemption experience – for the customer.

If used correctly, card-linked offers can transform massive cost burdens and a lack of efficiency into new incremental revenue streams, providing a seamless user experience for all parties.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees