Markets

What are Top Investment Managers Holding in Their Portfolios?

The following is an complimentary excerpt from our Markets This Month dispatch from our premium newsletter called VC+. For more like this, get a VC+ annual membership for 25% off.

Analyzing the Funds of Five “Super Investors”

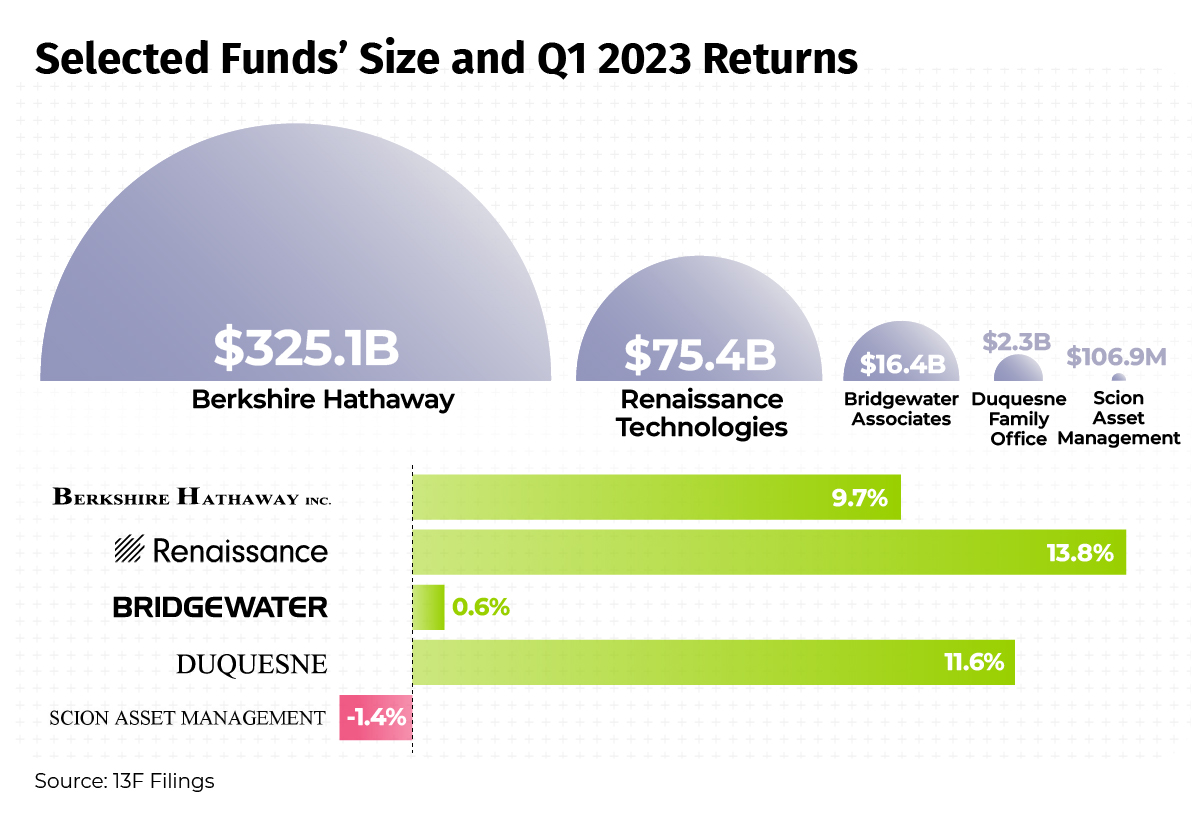

With the market usually taking a breather during the summer, it’s a great opportunity to analyze how top funds positioned their portfolios at the end of Q1 2023.

We selected five funds of various sizes, each one with a renowned investor at its helm that often has a unique outlook on the market and strategy towards building out their portfolio.

The differences in portfolio compositions underline the variety of investment strategies, showing how some of the top investors approach portfolio construction.

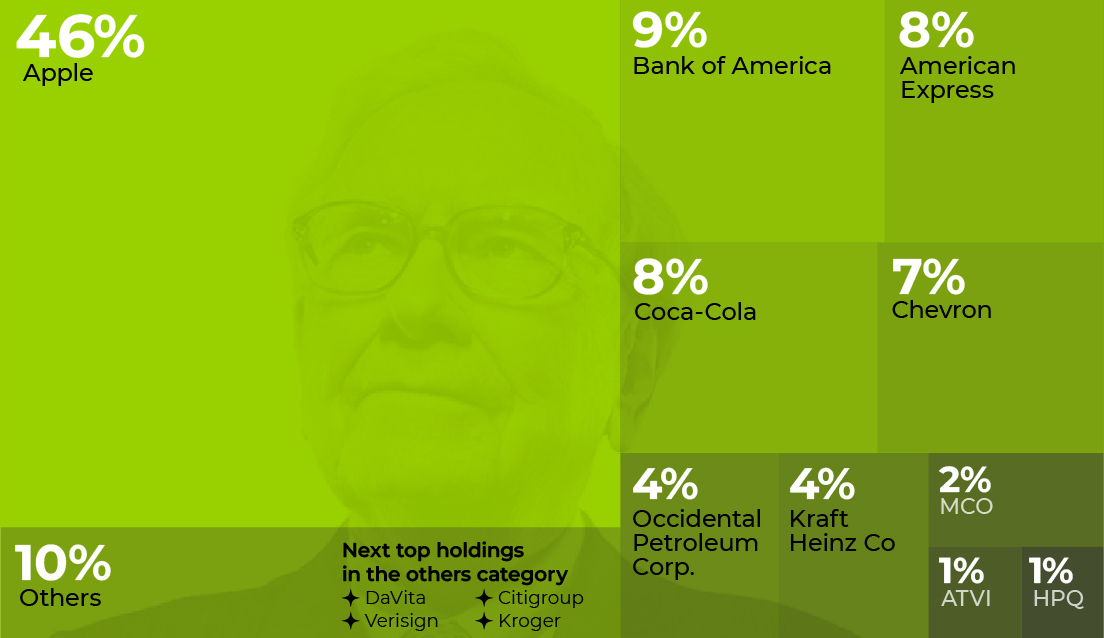

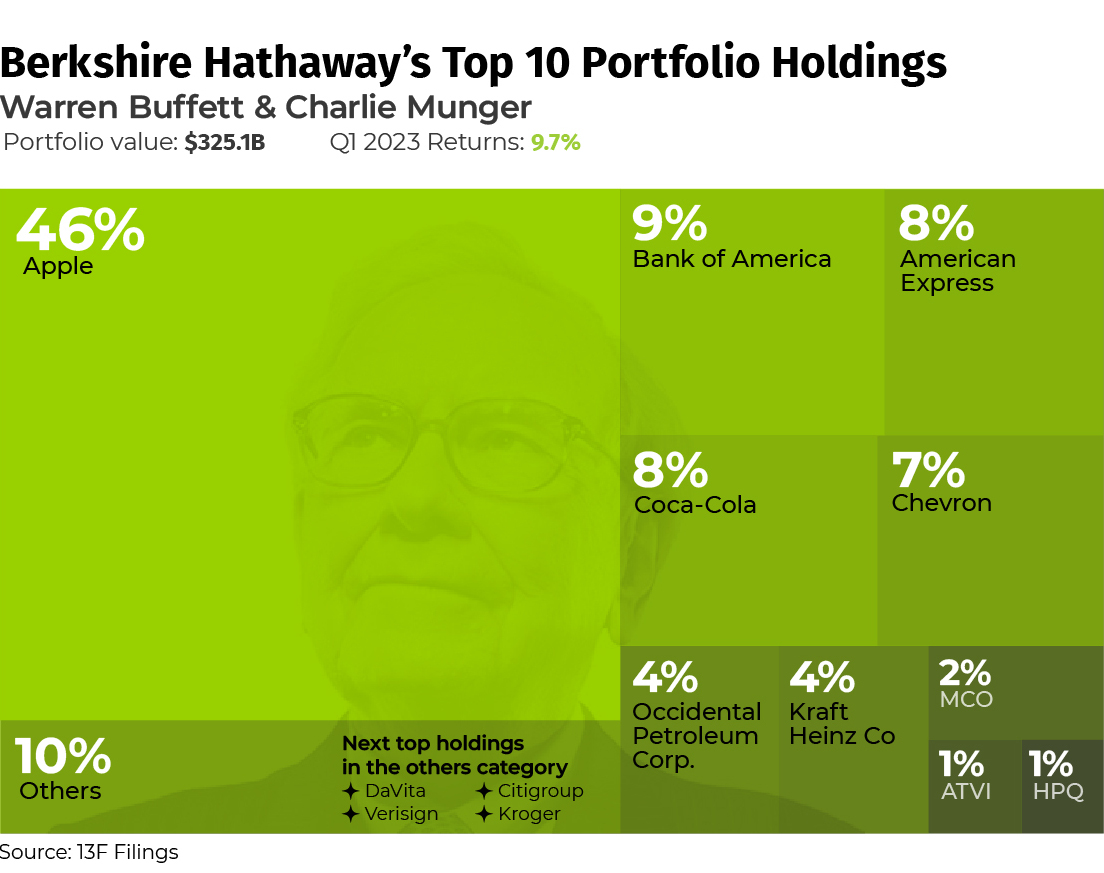

Berkshire Hathaway has one of the world’s best known and most successful portfolios, which has significantly outperformed the S&P 500 over the long term.

While the S&P 500 has returned 195% since 2013, Warren Buffett and Charlie Munger’s fund grew by 260% over the same time period.

Although Buffett is known for preaching diversification, almost half of Berkshire’s portfolio is all in the market’s most valuable company, Apple. The rest of the portfolio is fairly diversified with a mix of bank stocks, consumer staples like Coca-Cola and Kraft, along with oil and gas companies.

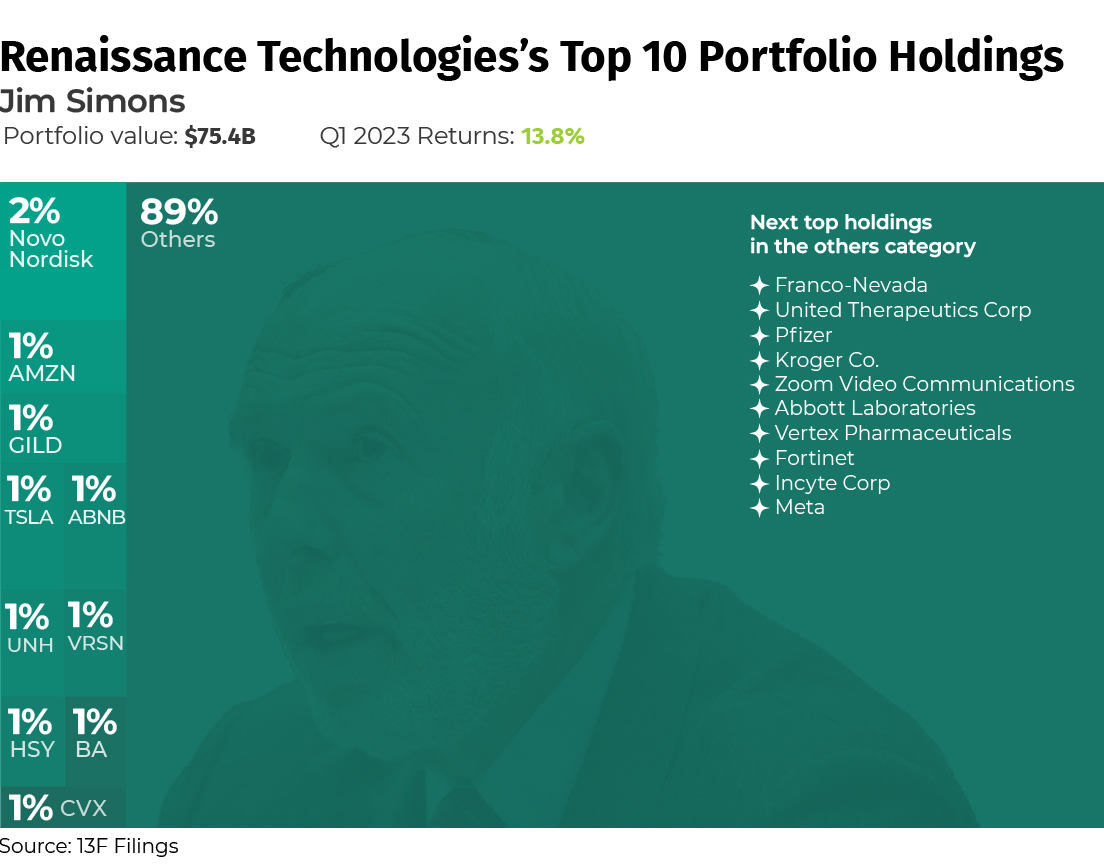

Jim Simons’ hedge fund, Renaissance Technologies, is best known for its groundbreaking use of complex mathematical models and algorithms which pioneered the practice of quantitative investing.

As a result, the hedge fund’s portfolio holdings showcase astounding diversification, with the fund’s largest holding being a 2% allocation to pharmaceutical giant Novo Nordisk.

The portfolio is split across more than 3,900 different positions, showcasing the fund’s strategy of squeezing out returns from a diverse collection of investments through its algorithm-driven, statistical arbitrage approach.

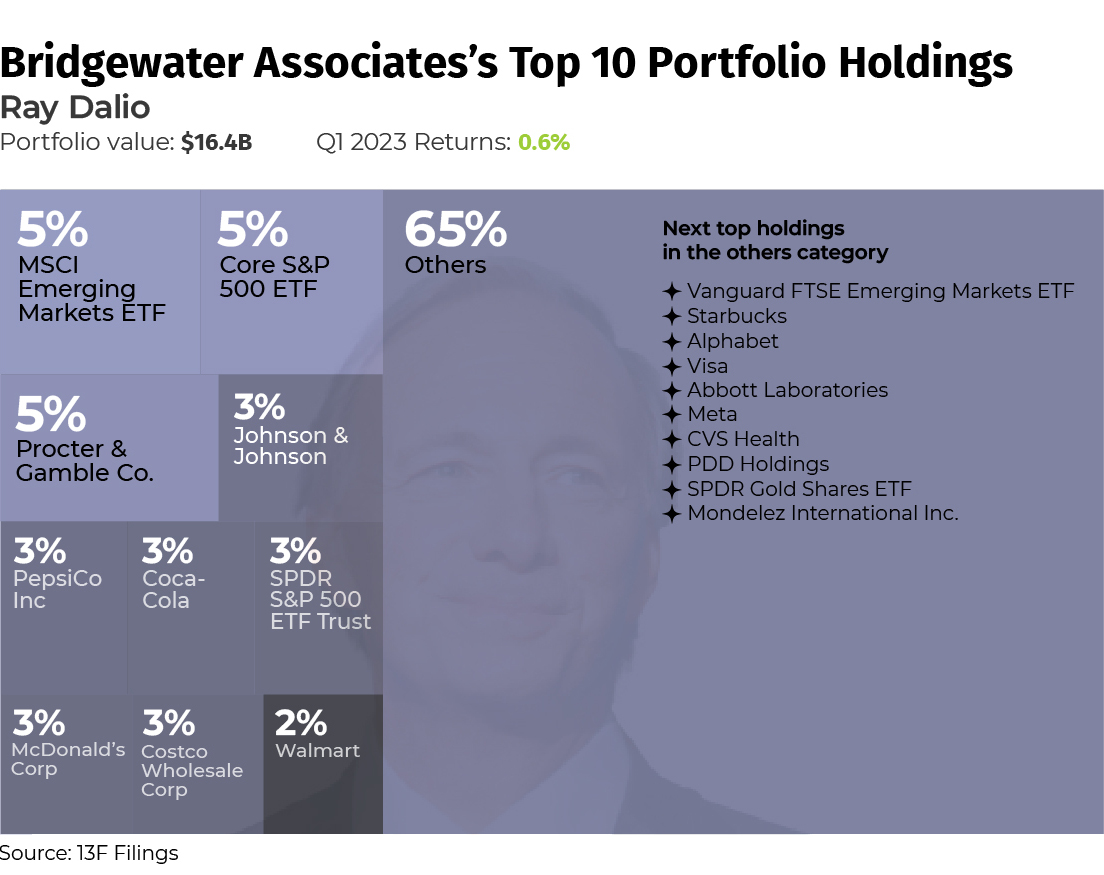

Ray Dalio’s Bridgewater Associates was one of the few hedge funds to predict and successfully navigate the 2008 financial crisis, largely thanks to its “all weather” strategy which looks to perform well in all economic environments through diversification and a risk-parity approach to asset allocation.

As a result, you see many parallels and “counterweights” in the fund’s holdings. Its largest holding of MSCI’s Emerging Markets ETF is balanced out by the Core S&P 500 ETF.

Bridgewater is also one of the few funds which holds shares in a gold ETF. While other funds we’ve looked at have investments in gold royalty companies or miners, which likely have strong balance sheets and businesses to support the investment, Dalio’s fund has preferred to invest directly in the precious metal.

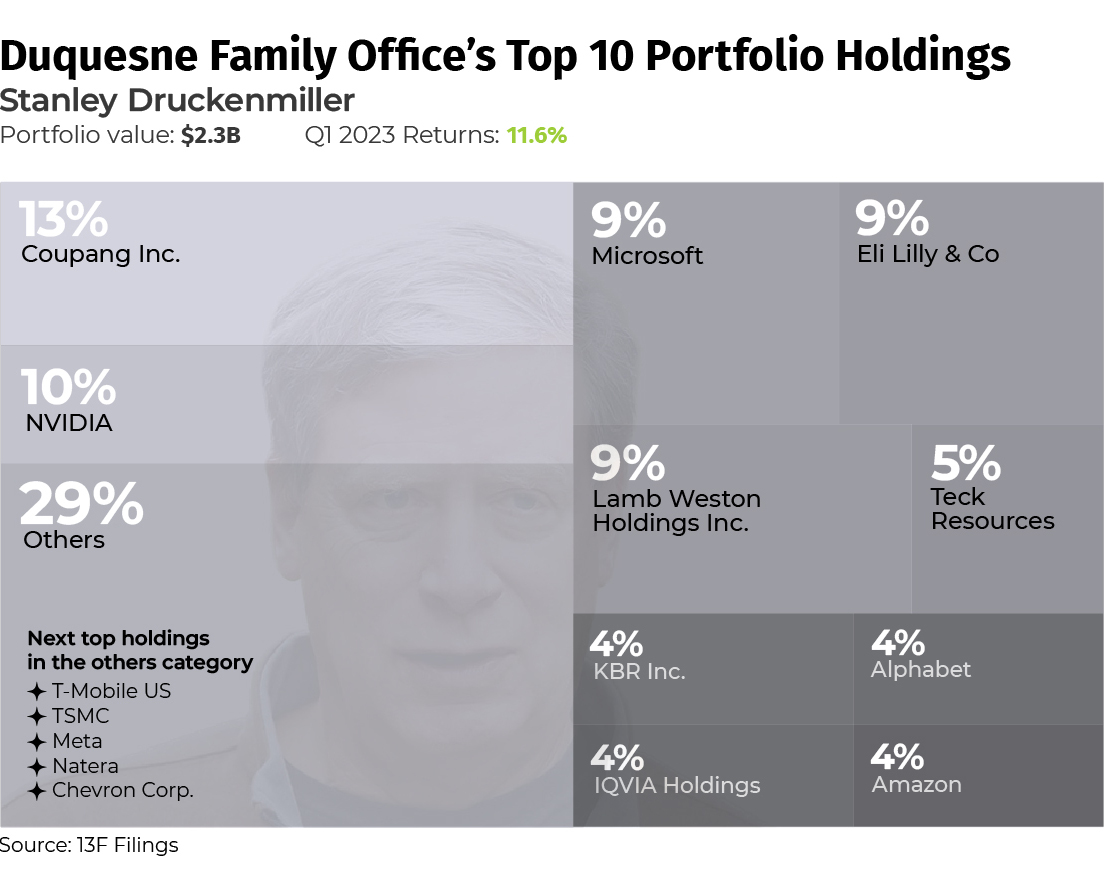

Stanley Druckenmiller is best known as having been a key strategist for George Soros’s Quantum Fund, along with his own consistent record of returns with Duquesne which average 30% annually.

Known for his macroeconomic approach to investing, Druckenmiller isn’t afraid to make unique and concentrated bets when he has high conviction.

Currently his highest conviction bet and largest holding in his portfolio is Coupang Inc., which is South Korea’s largest online marketplace. Along with Coupang, Druckenmiller positioned his fund to take advantage of this year’s AI boom, with significant holdings in companies like NVIDIA, Microsoft, and Alphabet.

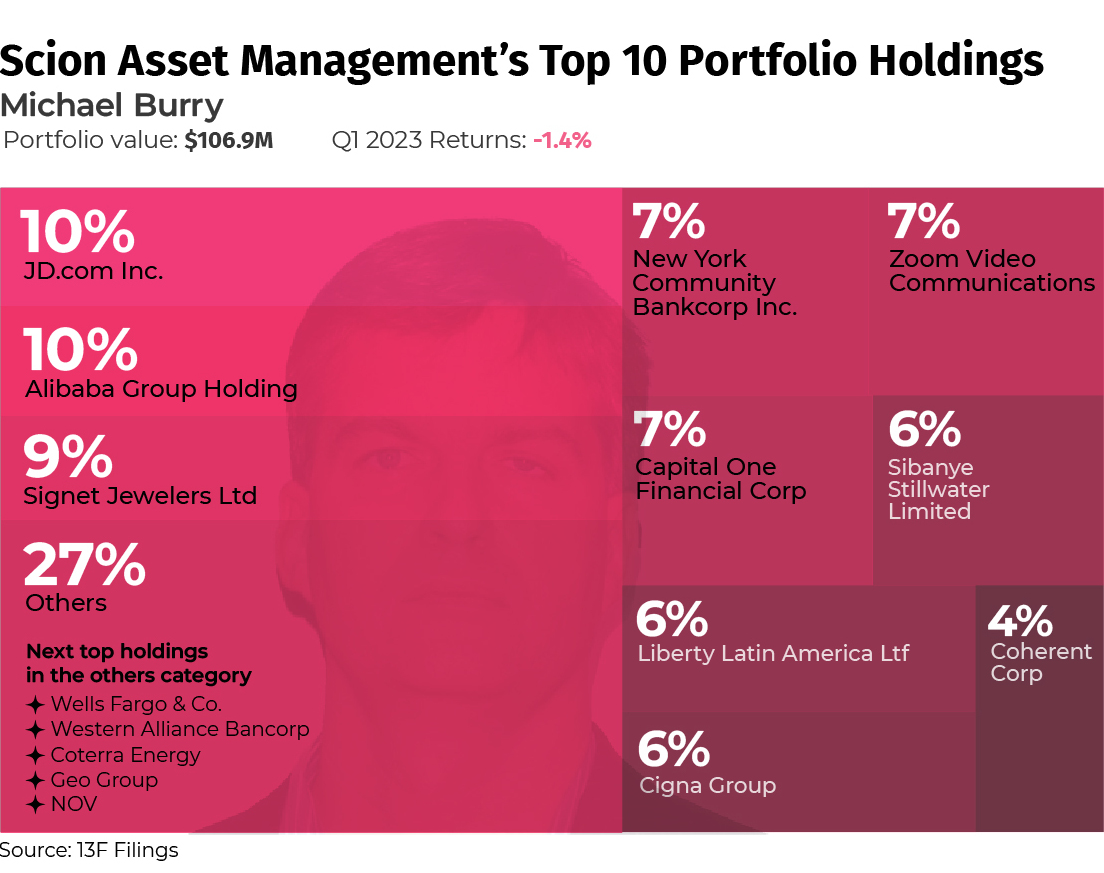

The smallest of all five funds we looked at, Michael Burry’s Scion Asset Management might be one of the best known for its role in predicting the 2008 financial crisis early on.

The protagonist of the film, The Big Short, Michael Burry is best known for his aggressive short bets and overall value investing approach especially in distressed assets.

Scion Asset Management’s portfolio reflects this as a good portion of its holdings at the end of Q1 this year were in various bank stocks which had declined significantly throughout the month of March.

Burry’s biggest bets however are in Chinese ecommerce companies JD.com and Alibaba, indicating Burry’s belief in a consumer driven economic reopening for China this year.

|

Markets This Month by VC+

We hope you enjoyed this excerpt by Niccolo Conte from Markets This Month, which hits VC+ subscribers’ inboxes every month. Get 25% off an annual subscription to VC+ by clicking here. |

Markets

The European Stock Market: Attractive Valuations Offer Opportunities

On average, the European stock market has valuations that are nearly 50% lower than U.S. valuations. But how can you access the market?

European Stock Market: Attractive Valuations Offer Opportunities

Europe is known for some established brands, from L’Oréal to Louis Vuitton. However, the European stock market offers additional opportunities that may be lesser known.

The above infographic, sponsored by STOXX, outlines why investors may want to consider European stocks.

Attractive Valuations

Compared to most North American and Asian markets, European stocks offer lower or comparable valuations.

| Index | Price-to-Earnings Ratio | Price-to-Book Ratio |

|---|---|---|

| EURO STOXX 50 | 14.9 | 2.2 |

| STOXX Europe 600 | 14.4 | 2 |

| U.S. | 25.9 | 4.7 |

| Canada | 16.1 | 1.8 |

| Japan | 15.4 | 1.6 |

| Asia Pacific ex. China | 17.1 | 1.8 |

Data as of February 29, 2024. See graphic for full index names. Ratios based on trailing 12 month financials. The price to earnings ratio excludes companies with negative earnings.

On average, European valuations are nearly 50% lower than U.S. valuations, potentially offering an affordable entry point for investors.

Research also shows that lower price ratios have historically led to higher long-term returns.

Market Movements Not Closely Connected

Over the last decade, the European stock market had low-to-moderate correlation with North American and Asian equities.

The below chart shows correlations from February 2014 to February 2024. A value closer to zero indicates low correlation, while a value of one would indicate that two regions are moving in perfect unison.

| EURO STOXX 50 | STOXX EUROPE 600 | U.S. | Canada | Japan | Asia Pacific ex. China |

|

|---|---|---|---|---|---|---|

| EURO STOXX 50 | 1.00 | 0.97 | 0.55 | 0.67 | 0.24 | 0.43 |

| STOXX EUROPE 600 | 1.00 | 0.56 | 0.71 | 0.28 | 0.48 | |

| U.S. | 1.00 | 0.73 | 0.12 | 0.25 | ||

| Canada | 1.00 | 0.22 | 0.40 | |||

| Japan | 1.00 | 0.88 | ||||

| Asia Pacific ex. China | 1.00 |

Data is based on daily USD returns.

European equities had relatively independent market movements from North American and Asian markets. One contributing factor could be the differing sector weights in each market. For instance, technology makes up a quarter of the U.S. market, but health care and industrials dominate the broader European market.

Ultimately, European equities can enhance portfolio diversification and have the potential to mitigate risk for investors.

Tracking the Market

For investors interested in European equities, STOXX offers a variety of flagship indices:

| Index | Description | Market Cap |

|---|---|---|

| STOXX Europe 600 | Pan-regional, broad market | €10.5T |

| STOXX Developed Europe | Pan-regional, broad-market | €9.9T |

| STOXX Europe 600 ESG-X | Pan-regional, broad market, sustainability focus | €9.7T |

| STOXX Europe 50 | Pan-regional, blue-chip | €5.1T |

| EURO STOXX 50 | Eurozone, blue-chip | €3.5T |

Data is as of February 29, 2024. Market cap is free float, which represents the shares that are readily available for public trading on stock exchanges.

The EURO STOXX 50 tracks the Eurozone’s biggest and most traded companies. It also underlies one of the world’s largest ranges of ETFs and mutual funds. As of November 2023, there were €27.3 billion in ETFs and €23.5B in mutual fund assets under management tracking the index.

“For the past 25 years, the EURO STOXX 50 has served as an accurate, reliable and tradable representation of the Eurozone equity market.”

— Axel Lomholt, General Manager at STOXX

Partnering with STOXX to Track the European Stock Market

Are you interested in European equities? STOXX can be a valuable partner:

- Comprehensive, liquid and investable ecosystem

- European heritage, global reach

- Highly sophisticated customization capabilities

- Open architecture approach to using data

- Close partnerships with clients

- Part of ISS STOXX and Deutsche Börse Group

With a full suite of indices, STOXX can help you benchmark against the European stock market.

Learn how STOXX’s European indices offer liquid and effective market access.

-

Economy4 days ago

Economy4 days agoEconomic Growth Forecasts for G7 and BRICS Countries in 2024

The IMF has released its economic growth forecasts for 2024. How do the G7 and BRICS countries compare?

-

Markets2 weeks ago

Markets2 weeks agoU.S. Debt Interest Payments Reach $1 Trillion

U.S. debt interest payments have surged past the $1 trillion dollar mark, amid high interest rates and an ever-expanding debt burden.

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

We visualized the top U.S. companies by employees, revealing the massive scale of retailers like Walmart, Target, and Home Depot.

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

This graphic shows the states with the highest real GDP growth rate in 2023, largely propelled by the oil and gas boom.

-

Markets3 weeks ago

Markets3 weeks agoRanked: The World’s Top Flight Routes, by Revenue

In this graphic, we show the highest earning flight routes globally as air travel continued to rebound in 2023.

-

Markets3 weeks ago

Markets3 weeks agoRanked: The Most Valuable Housing Markets in America

The U.S. residential real estate market is worth a staggering $47.5 trillion. Here are the most valuable housing markets in the country.

-

Science1 week ago

Science1 week agoVisualizing the Average Lifespans of Mammals

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023

-

Green2 weeks ago

Green2 weeks agoRanking the Top 15 Countries by Carbon Tax Revenue