Stocks

Three Stocks to Watch in the US Cannabis Market

Three Stocks to Watch in the U.S. Cannabis Market

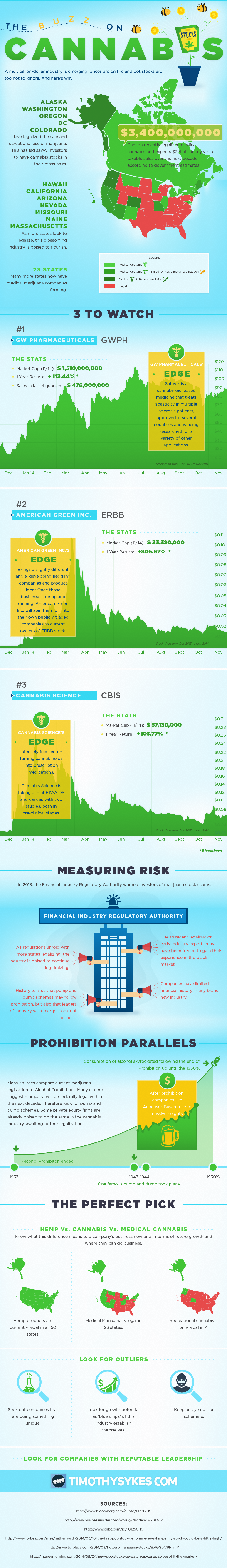

According to Timothy Sykes, now is the time to look closer at the opportunities in smallcap cannabis stocks. Alaska, Colorado, Washington, Oregon, and the District of Columbia have all legalized the sale of recreational marijuana, and many more jurisdictions are about to follow suit. Canada has also changed medical marijuana laws starting on April 1, 2014, creating a $3.4 billion opportunity.

With these aforementioned factors, Sykes sees big potential for investors.

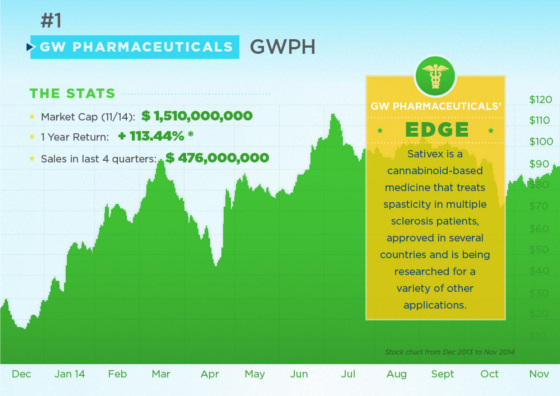

He cites three companies as being interesting to watch on the US cannabis market specifically: GW Pharmaceuticals (GWPH), American Green Inc. (ERBB), and Cannabis Science (CBIS). The market caps are $1.5 billion, $33 million, and $57 million respectively.

With more states legalizing recreational use and the new medical marijuana scheme in Canada, the industry is set to continue legitimizing, gaining more blue chip companies. However, in the interim, there are still some illegitimate companies on the horizon that are worth keeping a close eye on to avoid.

Original graphic from: Timothy Sykes

Markets

Visualizing the Biggest Companies on Major Stock Exchanges

With trillion dollar valuations becoming more common, we’ve compared the five biggest companies by stock exchange.

Comparing the Top Five Companies on Major Stock Exchanges

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

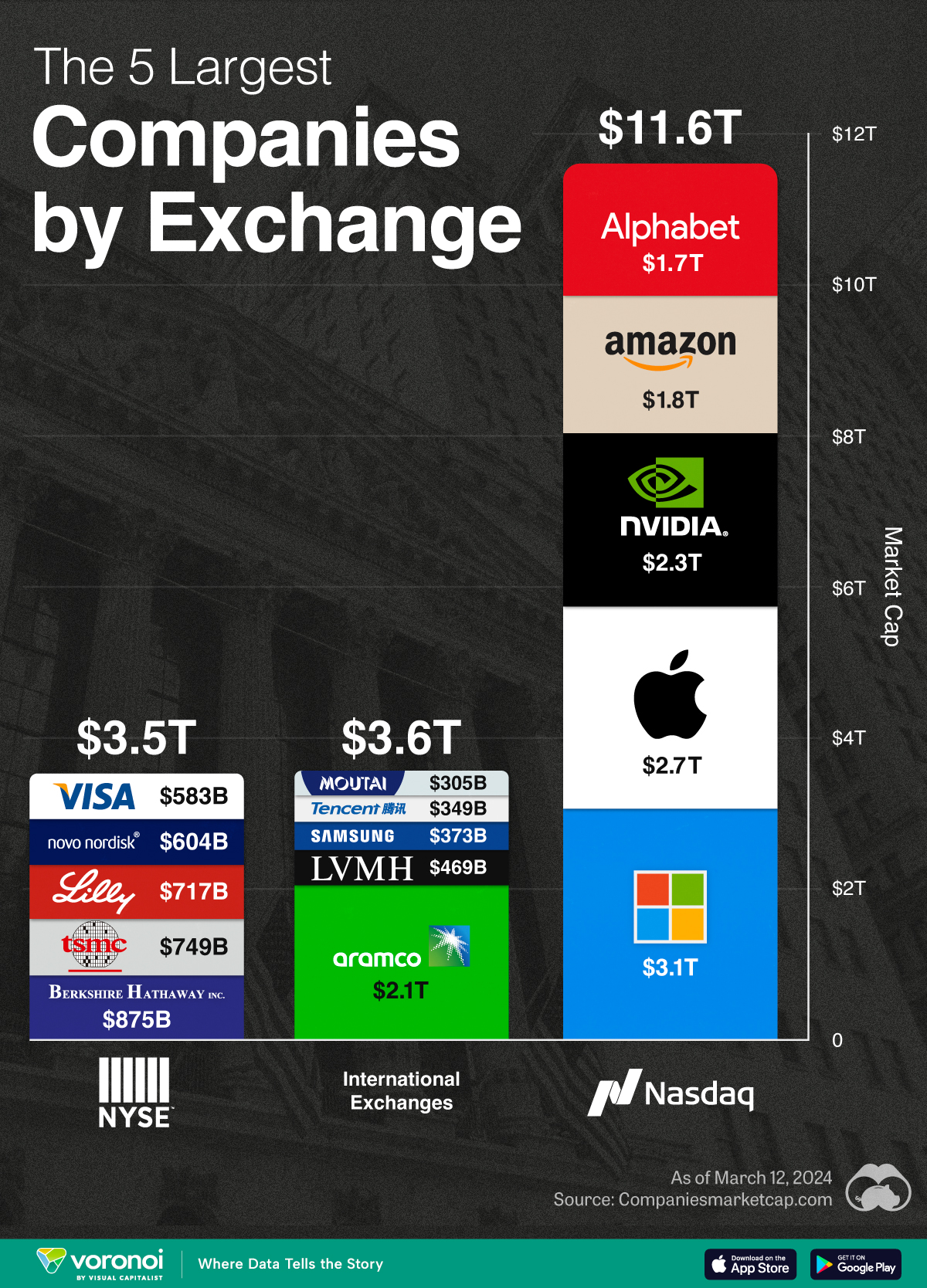

With many companies nearing or surpassing the $1 trillion market capitalization milestone, we’ve put together a graphic that visualizes the five largest companies trading on the Nasdaq, New York Stock Exchange (NYSE), and international exchanges.

These figures come from Companiesmarketcap.com, and are as of March 12, 2024.

Biggest Companies on the Nasdaq

The Nasdaq is largely dominated by the tech industry, with all of its top five companies belonging to the Magnificent Seven group of U.S. tech stocks.

| Company | Market Cap (USD) |

|---|---|

| 🇺🇸 Microsoft | $3.1T |

| 🇺🇸 Apple | $2.7T |

| 🇺🇸 Nvidia | $2.3T |

| 🇺🇸 Amazon | $1.8T |

| $1.7T |

Altogether, these five companies have a combined market capitalization of nearly $12 trillion. To put this figure into context, the entire U.S. equity market is worth around $53 trillion.

Biggest Companies on the NYSE

The NYSE’s largest companies are more diversified, with a combination of tech, financial services, and healthcare names present. Among this list, Warren Buffett’s Berkshire Hathaway is the closest to becoming the next trillion dollar company.

| Company | Market Cap (USD) |

|---|---|

| 🇺🇸 Berkshire Hathaway | $875B |

| 🇹🇼 TSMC | $749B |

| 🇺🇸 Eli Lilly | $717B |

| 🇩🇰 Novo Nordisk | $604B |

| 🇺🇸 Visa | $583B |

Biggest Companies on International Exchanges

Saudi Aramco is the largest public company listed outside of the U.S., with a mammoth $2.1 trillion valuation.

| Company | Market Cap (USD) |

|---|---|

| 🇸🇦 Saudi Aramco | $2.1T |

| 🇫🇷 LVMH | $469B |

| 🇰🇷 Samsung | $373B |

| 🇨🇳 Tencent | $349B |

| 🇨🇳 Kweichow Moutai | $305B |

It should be noted, however, that the Saudi government directly owns 90% of the company, while another 8% is held by the country’s sovereign wealth fund.

This means that only 2% of shares are actually available to the public, prompting one Bloomberg columnist to call the firm’s valuation an “illusion”.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees